-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

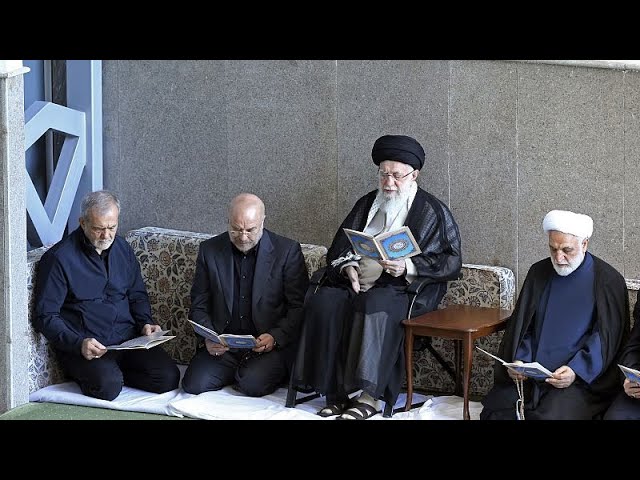

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

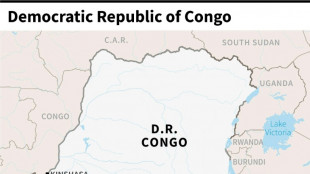

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

Polish PM and the danger of asylum seekers

Ukraine: Recruiters searched Kyiv venues

EU: Austrian elections shake Establishment

Terrorist state Iran: ‘We are ready to attack Israel again’

EU: Greenpeace warns of dying farms

EU: Tariffs on all Chinese electric Cars

Zelenskyy: ‘What worked in Israel work also in Ukraine’

Electric car crisis: Future of a Audi plant?

Vladimir Putin, War criminal and Dictator of Russia

EU vs. Hungary: Lawsuit over ‘national sovereignty’ law

Ukraine: Zelenskyy appeals for international aid