-

US Fed Chair warns of 'tension' between employment, inflation goals

US Fed Chair warns of 'tension' between employment, inflation goals

-

Trump touts trade talks, China calls out tariff 'blackmail'

-

US judge says 'probable cause' to hold govt in contempt over deportations

US judge says 'probable cause' to hold govt in contempt over deportations

-

US eliminates unit countering foreign disinformation

-

Germany sees 'worrying' record dry spell in early 2025

Germany sees 'worrying' record dry spell in early 2025

-

Israel says 30 percent of Gaza turned into buffer zone

-

TikTok tests letting users add informative 'Footnotes'

TikTok tests letting users add informative 'Footnotes'

-

Global uncertainty will 'certainly' hit growth: World Bank president

-

EU lists seven 'safe' countries of origin, tightening asylum rules

EU lists seven 'safe' countries of origin, tightening asylum rules

-

Chelsea fans must 'trust' the process despite blip, says Maresca

-

Rebel rival government in Sudan 'not the answer': UK

Rebel rival government in Sudan 'not the answer': UK

-

Prague zoo breeds near-extinct Brazilian mergansers

-

Macron to meet Rubio, Witkoff amid transatlantic tensions

Macron to meet Rubio, Witkoff amid transatlantic tensions

-

WTO chief says 'very concerned' as tariffs cut into global trade

-

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

-

Zverev joins Shelton in Munich ATP quarters

-

The Trump adviser who wants to rewrite the global financial system

The Trump adviser who wants to rewrite the global financial system

-

US senator travels to El Salvador over wrongly deported migrant

-

UN watchdog chief says Iran 'not far' from nuclear bomb

UN watchdog chief says Iran 'not far' from nuclear bomb

-

Trump says 'joke' Harvard should be stripped of funds

-

Macron vows punishment for French prison attackers

Macron vows punishment for French prison attackers

-

Canada central bank holds interest rate steady amid tariffs chaos

-

Rubio headed to Paris for Ukraine war talks

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

-

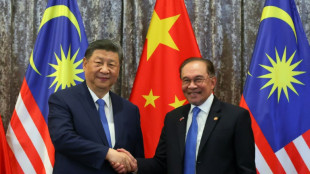

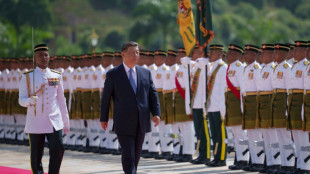

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

-

PSG keep Champions League bid alive, despite old ghosts reappearing

PSG keep Champions League bid alive, despite old ghosts reappearing

-

Stocks retreat as US hits Nvidia chip export to China

-

China's Xi meets Malaysian leaders in diplomatic charm offensive

China's Xi meets Malaysian leaders in diplomatic charm offensive

-

Israel says no humanitarian aid will enter Gaza

-

Anxiety clouds Easter for West Bank Christians

Anxiety clouds Easter for West Bank Christians

-

Pocket watch found on Titanic victim to go on sale in UK

-

UK top court rules definition of 'a woman' based on sex at birth

UK top court rules definition of 'a woman' based on sex at birth

-

All Black Ioane to join Leinster on six-month 'sabbatical'

-

Barca suffer morale blow in Dortmund amid quadruple hunt

Barca suffer morale blow in Dortmund amid quadruple hunt

-

China tells Trump to 'stop threatening and blackmailing'

-

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

-

Automakers hold their breath on Trump's erratic US tariffs

-

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

-

Troubled Red Bull search for path back to fast lane

-

China's forecast-beating growth belies storm clouds ahead: analysts

China's forecast-beating growth belies storm clouds ahead: analysts

-

ASML CEO sees growing economic 'uncertainty' from tariffs

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

The Queen: From Churchill to Yeltsin and Tito to Trudeau

Queen Elizabeth II dies aged 96

Ukraine: Kherson, nuclear inspectors and Russian army

Why Lithuania didn't join the tributes to Gorbachev

Germany: River Rhine water levels could fall to critical low