-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

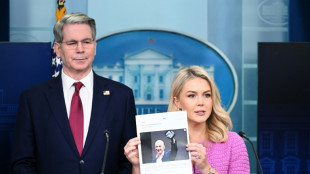

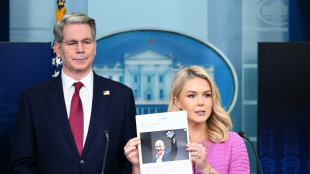

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Electric Metals (USA) Limited Closes $3.0 Million Non-Brokered Private Placement Led by Eric Sprott and Crescat Capital

TORONTO, ON / ACCESS Newswire / April 29, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce the closing of its previously announced non-brokered private placement, raising gross proceeds of approximately C$3.0 million. The financing, led by Eric Sprott and Crescat Capital, will advance the Company's Emily Manganese Project in Minnesota, supporting a critical U.S. domestic supply of high-purity manganese products, including high-purity manganese sulfate monohydrate (HPMSM), for the U.S. electric vehicle battery sector.

Under the Offering, the Company issued 25,000,331 units (the "Units") at a price of C$0.12 per Unit. Each Unit consists of one common share of the Company (a "Share") and one-half of one non-transferable common share purchase warrant (each whole warrant, a "Warrant"). Each Warrant entitles the holder to acquire one additional Share at an exercise price of C$0.20 for a period of 18 months. The Shares and any Shares issued upon exercise of the Warrants are subject to applicable hold periods in accordance with securities laws and exchange policies.

Eric Sprott and Crescat Capital participated as the cornerstone investors, reinforcing the Company's long-term strategy and strengthening its shareholder base. The Offering also attracted additional institutional and accredited investors, both new and returning, demonstrating broad confidence in the Company's growth prospects.

Kevin Smith, CFA, Founder and CEO of Crescat Capital, commented: "High-purity manganese sulfate monohydrate (HPMSM) demand is expected to increase 29x by 2050 because it's critical for electric vehicle batteries. 96% of HPMSM is produced in China. This creates a US national security issue. Electric Metals has the highest-grade manganese deposit in North America and is deeply undervalued in our analysis. Because this deposit is right here in the US, we believe it has the strong potential of being fast-tracked under the new administration, and we are happy to contribute capital to advance this project."

"This financing puts Electric Metals in a strong position to advance the Emily Manganese Project in Minnesota and support the development of a secure, U.S. domestic supply of high-purity manganese products," said Brian Savage, CEO of Electric Metals. "We're especially pleased to have the support of Eric Sprott, Crescat Capital, and other respected institutional and accredited investors."

Net proceeds will be used to advance key initiatives, including the preliminary economic assessment of the Emily Manganese Project, technical and environmental studies, studies related to the planned high-purity manganese sulfate monohydrate (HPMSM) facility, and for general working capital purposes.

This financing aligns with recent U.S. policy initiatives aimed at strengthening domestic critical mineral supply chains. The Emily Manganese Project is uniquely positioned to support these national objectives by reducing reliance on foreign sources of manganese and reinforcing U.S. economic and energy security.

In connection with the the Offering, the Company paid certain finders who introduced subscribers to the Offering including: Canaccord Genuity Corp. and Cormark Securities Inc. a cash commission totaling $37,220, being up to 3% of the gross proceeds raised under the Offering from investors introduced to the Company from such finders,and 310,170 non-transferable common share purchase warrants of the Company ("Finders' Warrants"), being up to 3% of the Units sold under the Offering from investors introduced to the Company from such finders. Each Finder's Warrant entitles the holder to purchase one Common Share at a price of $0.20 for a period of 18 months.

Under the Offering, directors of the Corporation have subscribed for a total of 333,333 Shares for a total consideration of C$40,000, which constitutes a "related party transaction" within the meaning of Regulation 61-101 respecting Protection of Minority Security Holders in Special Transactions ("Regulation 61-101") and TSXV Policy 5.9 - Protection of Minority Security Holders in Special Transactions. However, the directors of the Corporation who voted in favor of the Offering have determined that the exemptions from formal valuation and minority approval requirements provided for respectively under subsections 5.5(a) and 5.7(1)(a) of Regulation 61-101 can be relied on as neither the fair market value of the Shares issued to this insider, nor the fair market value of the consideration paid exceeded 25% of the Corporation's market capitalization. None of the Corporation's directors have expressed any contrary views or disagreements with respect to the foregoing. A material change report in respect of this related party transaction will be filed by the Corporation but could not be filed earlier than 21 days prior to the closing of the Offering, due to the fact that the terms of the participation of each of the non-related parties and the related parties of the Offering were not confirmed.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV:EML)(OTCQB:EMUSF) is a US-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. The Company's principal asset is the Emily Manganese Project in Minnesota, the highest-grade manganese deposit in North America, which has been the subject of considerable technical studies, including National Instrument 43-101 Technical Reports - Resource Estimates. The Company's mission in Minnesota is to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets. With manganese playing a critical and prominent role in lithium-ion battery formulations, and with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, the State of Minnesota and for the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

or

Valerie Kimball

Director Investor Relations

720-933-1150

[email protected]

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the Company's mission to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical and prominent role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

These statements address future events and conditions and so involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, the failure to obtain all necessary stock exchange and regulatory approvals; investor interest in participating in the Offering; and risks related to the exploration and other plans of the Company. Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Electric Metals (USA) Limited

View the original press release on ACCESS Newswire

A.Jones--AMWN