-

Prosecutors make case against Harvey Weinstein at rape retrial

Prosecutors make case against Harvey Weinstein at rape retrial

-

IAEA chief voices interest in UN secretary-general post

-

Magnificent Pogacar soars to Fleche Wallonne triumph

Magnificent Pogacar soars to Fleche Wallonne triumph

-

Asked to predict the next pope, AI bots hedge bets

-

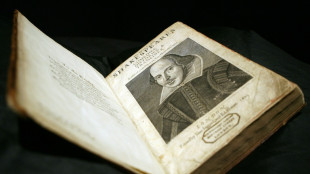

Set of Shakespeare folios to be sold in rare London auction

Set of Shakespeare folios to be sold in rare London auction

-

200 French media groups sue Meta over 'unlawful' advertising: lawyers

-

Boeing says China not accepting planes over US tariffs

Boeing says China not accepting planes over US tariffs

-

Olazabal to return as European Ryder Cup vice-captain

-

French president announces economic deals with Madagascar

French president announces economic deals with Madagascar

-

Tens of thousands bid farewell to Pope Francis lying in state

-

IMF warns of 'intensified' risks to public finances amid US trade war

IMF warns of 'intensified' risks to public finances amid US trade war

-

Sabalenka expecting 'big chance' to win on Madrid clay

-

IMF warns of 'intensified' risks to outlook for public finances

IMF warns of 'intensified' risks to outlook for public finances

-

Zelensky calls for 'unconditional ceasefire' after Russian attack kills nine

-

Muzarabani takes nine as Zimbabwe celebrate Bangladesh first Test win

Muzarabani takes nine as Zimbabwe celebrate Bangladesh first Test win

-

Powerful 6.2-magnitude quake hits off Istanbul coast

-

East Timor faithful, ex-rebels see hope after Pope Francis

East Timor faithful, ex-rebels see hope after Pope Francis

-

I.Coast's barred opposition leader says is party's only presidential candidate

-

India vows 'loud and clear' response to Kashmir attack

India vows 'loud and clear' response to Kashmir attack

-

Champions League spot would be 'Premier League trophy' for Man City: Nunes

-

Abbas urges Hamas to free Gaza hostages as Israeli strikes kill 18

Abbas urges Hamas to free Gaza hostages as Israeli strikes kill 18

-

Stocks rally as Trump soothes fears over China trade, Fed

-

French PM's daughter says priest beat her as a teenager

French PM's daughter says priest beat her as a teenager

-

Tens of thousands say goodbye to Pope Francis lying in state

-

EU slaps fines on Apple and Meta, risking Trump fury

EU slaps fines on Apple and Meta, risking Trump fury

-

Gaza rescuers recover charred bodies as Israeli strikes kill 17

-

Tourists flee India-administered Kashmir after deadly attack

Tourists flee India-administered Kashmir after deadly attack

-

China says 'door open' to trade talks after Trump signals tariffs will fall

-

WEF confirms investigation into claims against founder Schwab

WEF confirms investigation into claims against founder Schwab

-

Pilgrims flock to pay tribute to pope lying in state

-

Stocks rally as Trump comments ease Fed, China trade fears

Stocks rally as Trump comments ease Fed, China trade fears

-

Muzarabani takes six as Bangladesh set Zimbabwe 174 to win

-

PM faces first test as Singapore election campaign kicks off

PM faces first test as Singapore election campaign kicks off

-

Patients with leprosy face lasting stigma in Ethiopia

-

Still reeling a year on, Brazil's Porto Alegre fears next flood

Still reeling a year on, Brazil's Porto Alegre fears next flood

-

Lakers level NBA playoff series, Pacers and Thunder win again

-

At night, crime and fear stalk DR Congo's M23-run areas

At night, crime and fear stalk DR Congo's M23-run areas

-

Embalming and make-up: Pope's body prepared for lying-in-state

-

Prosecutors to make case against Harvey Weinstein at retrial

Prosecutors to make case against Harvey Weinstein at retrial

-

Coral reefs pushed to brink as bleaching crisis worsens

-

Vietnam village starts over with climate defences after landslide

Vietnam village starts over with climate defences after landslide

-

'Happiness, love' at Moonie mass wedding after Japanese court blow

-

Veteran Chinese astronaut to lead fresh crew to space station

Veteran Chinese astronaut to lead fresh crew to space station

-

Pilgrims gather as Pope Francis begins lying in state

-

Asian markets rally as Trump comments ease Fed, China trade fears

Asian markets rally as Trump comments ease Fed, China trade fears

-

Saudi 'city of roses' offers fragrant reminder of desert's beauty

-

Trump says won't fire Fed chief, signals China tariffs will come down

Trump says won't fire Fed chief, signals China tariffs will come down

-

India hunts gunmen who massacred 26 in Kashmir tourist hotspot

-

'No one else will': Sudan's journalists risk all to report the war

'No one else will': Sudan's journalists risk all to report the war

-

UK hosts new round of Ukraine talks

Alta Copper Announces Option Agreement on Arikepay Project

VANCOUVER, BC / ACCESS Newswire / April 23, 2025 / Alta Copper Corp. (TSX:ATCU)(OTCQX:ATCUF)(BVL:ATCU) ("Alta Copper" or the "Company") is very pleased to announce it has entered into a Definitive Option Agreement (the "Option Agreement") with the newly formed Precore Gold Corp. ("Precore Gold") to explore and develop the 100% owned Arikepay copper-gold project ("Arikepay Project"), comprised of three mineral concessions totaling 1,800 hectares and located about 110 km south of the city of Arequipa in southern Perú.

Under the Definitive Option Agreement, Precore Gold will have the option and right to acquire up to a 100% beneficial interest in the Arikepay Project. A summary of the terms based on 100% acquisition which is contingent upon the successful staged development of the Arikepay Project is outlined below:

Total Share Consideration of 3,500,000 common shares of Precore Gold

1.5% Net Smelter Royality

Total Cash Payments of Cdn$375,000

Milestone Payments totaling Cdn$7,000,000 comprised of:

$1,000,000 contingent on defining a mineral resource estimate of 1 million equivalent ounces;

$1,000,000 on defining a mineral resource estimate of 2 million equivalent ounces;

$2,000,000 on completion of a Preliminary Economic Assessment; and,

$3,000,000 on completion of a Feasibility Study.

Exploration Commitment of Cdn$1,500,000 between Year 1 to 3, Cdn$4,000,000 between Year 4 to 5 and a further $3,500,000 in year 6 to 10.

Cdn$1,000,000 in cash or the equivalent value in common shares of Precore Gold on the acquisition of the final 20% interest.

Giulio T. Bonifacio, Executive Chair and CEO, commented: "We are very pleased to have entered into an option agreement on our Arikepay gold-copper project, originally acquired by Alta Copper in 2006. Arikepay is a highly prospective asset with significant upside, as demonstrated by past drilling. Given Alta's primary focus on advancing the Cañariaco copper project, more fully described below, this option agreement represents a strategic move to maximize shareholder value on what is a very prospective project. We are very pleased to see Precore Gold take the lead in advancing Arikepay which is backed by top-tier mining professionals with a strong track record of success."

Detailed Summary of Option Terms:

First 51% Interest

Precore Gold would have the option to acquire an initial indirect 51% beneficial interest in the Arikepay Project by:

Issuance of 1,500,000 common shares of Precore Gold (the "Initial Shares") upon receiving Canadian Stock Exchange approval of the Option Agreement followed by the issuance of a further 1,000,000 common shares within four months of the issuance of the Initial Shares;

Incurring the following minimum expenditures:

Cdn$1,500,000 within the first 3 years; and

Cdn$4,000,000 in total during year 4 and year 5.

All expenditures may be accelerated at the option of Precore Gold (dependent on required permitting).

Second 24% Interest

Precore Gold would have the option to acquire an additional indirect 24% beneficial interest in the Arikepay Project by:

Issuance of 1,000,000 common shares of Precore Gold;

Incurring a minimum of Cdn$3,500,000 in expenditures; and

Making consecutive cash payments from year 6 to 10 in the amount of Cdn$75,000 per year.

Third 5% Interest

Precore Gold would have the option to acquire an additional indirect 5% beneficial interest in the Arikepay Project by:

Having identified an inferred mineral resource estimate (Maiden Resource Estimate ("MRE") prepared in accordance with the requirements set out in National Instrument 43-101.

Remaining 20% Interest

Precore Gold would have the option to acquire the remaining indirect 20% beneficial interest in the Arikepay Project by:

Paying an additional Cdn$1M in cash or the equivalent value in common shares of Precore Gold; and

Granting 1.5% net smelter returns royalty in respect of the Arikepay Project.

Milestone Payments:

Precore Gold would have further milestone payment obligations as follow:

Identifying an MRE of 1M oz AuEq = Payment of Cdn$1M in cash or the equivalent value in common shares of Precore Gold;

Identifying an MRE of 2M oz AuEq = Additional payment of Cdn$1M in cash or the equivalent value in common shares of Precore Gold;

Preliminary Economic Assessment = Cdn$2M in cash or the equivalent value in common shares of Precore Gold; and

Feasibility Study = $3M in cash or the equivalent value in common shares of Precore Gold.

Joint Venture Agreement and subsequent expenditures and funding:

After Precore Gold has:

earned the First Interest, and Precore Gold has waived or abandoned its right to acquire the Second Interest;

earned the Second Interest, and Precore Gold has waived or abandoned its right to acquire the Third Interest; or

earned the Third Interest, Precore Gold (or a subsidiary thereof) and Alta Copper (or a subsidiary thereof) would enter into a joint venture agreement (the "JV Agreement") for the Arikepay Project that would contain market standard joint venture terms.

Each party would then contribute on a pro rata basis to the further development of the Arikepay Project as may be determined and proposed by a management committee established in accordance with the terms of the JV Agreement which would contemplate at the minimum, a party's representation on the management committee in proportion to its interest in the Arikepay Project.

Should either party decide not to contribute any part of its pro rata portion of any further work then its interest would be diluted on a pro rata basis using a formula based on the total expenditures on the Arikepay Project. Precore Gold shall have the right of first refusal to acquire Alta Copper's interest in the Arikepay Project.

During the term of the Option Agreement, Precore Gold shall be the operator of the project and shall have the final approval authority for exploration and development programs and expenditure budgets.

The issuance of common shares pursuant to the Option Agreement is subject to approval by the Canadian Securities Exchange. Any common shares issued pursuant to the Option Agreement will be subject to a statutory four month and one day hold period commencing on the date of issuance of such common shares pursuant to applicable Canadian securities laws.

Don Gregorio Project

Alta Copper has terminated its Joint Venture Option Agreement and Assignment Agreement with Forte Minerals Corp. These agreements were related to the Don Gregorio copper-gold porphyry project, which is 100% owned by Alta Copper. The project comprises a single mineral concession covering 900 hectares, located roughly 140 km north-northeast of Chiclayo and about 40 km north of Alta Copper's Cañariaco Norte project, within the Cajamarca department of northern Perú.

Following the termination of the agreements, Alta Copper plans to advance the Don Gregorio project either independently or through a new option agreement with what are expected to be improved terms. The company is currently in discussions with several interested parties which further emphasizes Don Gregorio's geological potential.

About Alta Copper

Alta Copper is focused on the development of its 100% owned Cañariaco advanced staged copper project. Cañariaco comprises 91 square km of highly prospective land located 102 km northeast of the City of Chiclayo, Peru, which includes the Cañariaco Norte deposit, the Cañariaco Sur deposit and the Quebrada Verde prospect, all within a 4 km NE-SW trend in northern Peru's prolific mining district. Cañariaco is one of the largest copper deposits in the Americas not held by a major.

The Company's Preliminary Economic Assessment ("PEA"), filed on June 10, 2024 highlights that the Cañariaco Norte deposit has a measured and indicated resource containing 9.3 billion pounds of copper; 2.1 million ounces of gold and 60.4 million ounces of silver within 1.1 billion tonnes with a copper equivalent grade of 0.42% and a further 2.4 billion pounds of copper; 520,000 ounces of gold and 16.9 million ounces of silver within 416 tonnes with a copper equivalent grade of 0.29%. The PEA also highlights that the Cañariaco Sur deposit has an inferred resource containing 2.5 billion pounds of copper; 1.3 million ounces gold; 17.6 million ounces of silver and 24 million pounds of Moly within 474 million tonnes with a copper equivalent grade of 0.29%.

Please refer to the technical report dated June 10, 2024 and titled "NI 43-101 Technical Report on Preliminary Economic Assessment," prepared by Ausenco Engineering Canada ULC available on the Company's website and on SEDAR+ at www.sedarplus.ca under the Company's profile.

Cautionary Note Regarding Forward Looking Statements

This press release contains forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements, including, but not limited to, statements with respect to the timeline, resources expansions and impact on PEA economics. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

On behalf of the Board of Alta Copper Corp.

"Giulio T. Bonifacio" Executive Chair & CEO

For further information please contact:

Giulio T. Bonifacio

[email protected]

+1 604 318 6760

Email: [email protected]

Website: www.altacopper.com

X: https://X.com/Alta_Copper

LinkedIn: https://www.linkedin.com/company/altacopper/

Facebook: https://www.facebook.com/AltaCopperCorp

Instagram: https://www.instagram.com/altacopper/

YouTube: https://www.youtube.com/@AltaCopper

SOURCE: Alta Copper Corp.

View the original press release on ACCESS Newswire

S.Gregor--AMWN