-

Once-dying Mexican river delta slowly nursed back to life

Once-dying Mexican river delta slowly nursed back to life

-

NATO chief says China military expansion 'staggering'

-

South Korea sets new presidential election for June 3

South Korea sets new presidential election for June 3

-

Indonesia stocks plunge on Trump tariffs after weeklong break

-

Two Nepalis swept away by Annapurna avalanche

Two Nepalis swept away by Annapurna avalanche

-

Vietnam says to buy more US goods as it seeks tariff delay

-

Why is the NBA eyeing Europe?

Why is the NBA eyeing Europe?

-

Mexico mourns photographers killed in music festival mishap

-

Nose job boom in Iran where procedure can boost social status

Nose job boom in Iran where procedure can boost social status

-

Clean streets vs business woes: pollution charge divides Londoners

-

Mexico mourns photographers killed in music festical mishap

Mexico mourns photographers killed in music festical mishap

-

Asian markets stage mild rebound but Trump tariff uncertainty reigns

-

Spain PM heads to China, Vietnam as US tariff blitz bites

Spain PM heads to China, Vietnam as US tariff blitz bites

-

Hong Kong firm did not uphold Panama Canal ports contract: Panama audit

-

Prince Harry mounts new court challenge over UK security downgrade

Prince Harry mounts new court challenge over UK security downgrade

-

South Korea sets presidential election for June 3: acting president

-

France have 'great chance' against New Zealand despite weakened side: ex-All Black Cruden

France have 'great chance' against New Zealand despite weakened side: ex-All Black Cruden

-

Australia's concussion-blighted Pucovski retires from cricket at 27

-

Global temperatures at near historic highs in March: EU monitor

Global temperatures at near historic highs in March: EU monitor

-

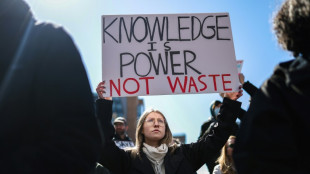

'Major brain drain': Researchers eye exit from Trump's America

-

Samsung forecast beats market expectations for first quarter

Samsung forecast beats market expectations for first quarter

-

US Supreme Court lifts order barring deportations using wartime law

-

The scholar who helped Bad Bunny deal a Puerto Rican history lesson

The scholar who helped Bad Bunny deal a Puerto Rican history lesson

-

Nippon Steel shares soar as Trump reviews US Steel takeover

-

Villa's Rashford targets PSG hat-trick as Asensio returns in Champions League

Villa's Rashford targets PSG hat-trick as Asensio returns in Champions League

-

De Jong revival helping Barca dream as Dortmund visit

-

US giant to buy stake in cash-short Australian casino group

US giant to buy stake in cash-short Australian casino group

-

US Supreme Court lifts order barring deportations under wartime law

-

200 firefighters battle major Paris inferno

200 firefighters battle major Paris inferno

-

Pulsar Helium Announces Execution of US$4 Million Project Finance Facility Line of Credit Note

-

How to Sell Your Small Business For Maximum Profit (2025 Guide Released)

How to Sell Your Small Business For Maximum Profit (2025 Guide Released)

-

Teotihuacan altar found at Guatemala Maya site

-

Stead quits as New Zealand white-ball cricket coach

Stead quits as New Zealand white-ball cricket coach

-

Trump announces direct nuclear talks with Iran

-

Tai 'honored' to be first Singaporean to play in the Masters

Tai 'honored' to be first Singaporean to play in the Masters

-

Newcastle step up Champions League chase as dismal Leicester slump again

-

Napoli give Serie A leaders Inter reprieve with Bologna draw

Napoli give Serie A leaders Inter reprieve with Bologna draw

-

Bittersweet: Two-time champ Langer to make Masters farewell

-

Newcastle step up Champions League chase with Leicester win

Newcastle step up Champions League chase with Leicester win

-

Napoli give Serie A leaders Inter a let-off with Bologna draw

-

'Taxi Driver' writer accused of sexual harassment and assault

'Taxi Driver' writer accused of sexual harassment and assault

-

US Supreme Court pauses order for return of Salvadoran deported in error

-

Scheffler and McIlroy chase history at Masters

Scheffler and McIlroy chase history at Masters

-

No.3 Schauffele likes chance of third win in four majors

-

Trump announces direct Iran talks, at meeting with Netanyahu

Trump announces direct Iran talks, at meeting with Netanyahu

-

Indigenous leaders want same clout as world leaders at UN climate talks

-

Palestinians in West Bank strike to demand end to Gaza war

Palestinians in West Bank strike to demand end to Gaza war

-

Woods teams with Augusta National on course design, school project

-

Real Madrid goalkeeper Courtois fit to face Arsenal in Champions League

Real Madrid goalkeeper Courtois fit to face Arsenal in Champions League

-

Masters halts practice for the day and evacuates spectators

| CMSC | -0.54% | 22.17 | $ | |

| BCC | -3.86% | 91.89 | $ | |

| RBGPF | 100% | 60.27 | $ | |

| RIO | -0.2% | 54.56 | $ | |

| NGG | -4.82% | 62.9 | $ | |

| GSK | -4.85% | 34.84 | $ | |

| SCS | -3.73% | 10.2 | $ | |

| BCE | -2.85% | 22.08 | $ | |

| CMSD | -1.56% | 22.48 | $ | |

| RYCEF | -0.98% | 8.15 | $ | |

| BTI | -1.09% | 39.43 | $ | |

| JRI | -6.22% | 11.26 | $ | |

| RELX | -5.78% | 45.53 | $ | |

| AZN | -4.06% | 65.79 | $ | |

| VOD | -1.8% | 8.35 | $ | |

| BP | -4.45% | 27.17 | $ |

Electric Metals Announces Private Placement Offering

Not for distribution to U.S. news wire services or dissemination in the United States.

TORONTO, ON / ACCESS Newswire / April 7, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce its intention to complete a non-brokered private placement (the "Offering") of up to 25,000,000 units (the "Units") at a price of CAN$0.12 per Unit for gross proceeds of up to CAN$3,000,000. Each Unit will consist of one common share in the capital of the Company (a "Share") and one-half of one non-transferable common share purchase warrant (a "Warrant"). Each whole Warrant will be exercisable to acquire one Share at an exercise price of CAN$0.20 per Share for a period of 18 months from the date of issuance. The Shares issued under the Offering may be subject to hold periods in accordance with applicable laws and stock exchange policies.

EML intends to allocate the Offering proceeds to advance key initiatives, including a preliminary economic assessment of the Emily manganese mine, various studies related to our HPMSM plant, environmental baseline work, other critical research at our Emily Manganese Project, and general working capital purposes.

The Company may engage one or more agents or finders in connection with the Offering and may pay such parties fees as may be agreed between the Company and such parties.

The securities of the Company have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there by any sale of the securities referenced in this press release, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Certain insiders of the Company may acquire Shares in the Offering. Any participation by insiders in the Offering would constitute a "related party transaction" as defined under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). However, the Company expects such participation would be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value subscribed for by the insiders under the Offering, nor the consideration for the Shares paid by such insiders, will exceed 25% of the Company's market capitalization.

A material change report including details with respect to the related party transaction is not expected to be able to be filed less than 21 days prior to the closing of the Offering as the Company has not received confirmation of the participation of insiders in the Offering and the Company deems it reasonable in the circumstances so as to be able to avail itself of potential financing opportunities and complete the Offering in an expeditious manner.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV:EML)(OTCQB:EMUSF) is a US-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. The Company's principal asset is the Emily Manganese Project in Minnesota, the highest-grade manganese deposit in North America, which has been the subject of considerable technical studies, including National Instrument 43-101 Technical Reports - Resource Estimates. The Company's mission in Minnesota is to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets. With manganese playing a critical and prominent role in lithium-ion battery formulations, and with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, the State of Minnesota and for the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

or

Valerie Kimball

Director Investor Relations

720-933-1150

[email protected]

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the ability of the Company to complete the Offering; the size, terms and timing of the Offering; participation in the Offering by insiders of the Company; the timing and receipt of TSXV and other approvals required in connection with the Offering; the intended use of proceeds of the Offering; the Company's mission to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical and prominent role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

These statements address future events and conditions and so involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, the failure to obtain all necessary stock exchange and regulatory approvals; investor interest in participating in the Offering; and risks related to the exploration and other plans of the Company. Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Electric Metals (USA) Limited

View the original press release on ACCESS Newswire

F.Dubois--AMWN