-

US judge sets June 23 trial date over Boeing crashes

US judge sets June 23 trial date over Boeing crashes

-

S. Africa take big World Cup lead, but may lose points over Mokoena

-

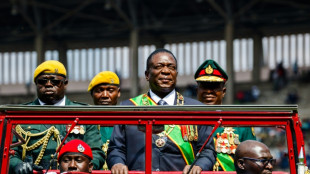

Zimbabwe moves army chief to sports docket

Zimbabwe moves army chief to sports docket

-

Stocks edge out gains as fears ease over next Trump tariffs

-

'In my heart' - Malinin defends figure skating world title in wake of tragedy

'In my heart' - Malinin defends figure skating world title in wake of tragedy

-

Trump downplays firestorm over leaked Yemen air strike chat

-

Turkey protesters fill streets, defying crackdown

Turkey protesters fill streets, defying crackdown

-

Roma's Dybala undergoes surgery on thigh injury

-

US VP to visit Greenland as Trump ups pressure

US VP to visit Greenland as Trump ups pressure

-

What is Signal and is it secure?

-

Political football as Iran reach World Cup while Australia, Saudis stay alive

Political football as Iran reach World Cup while Australia, Saudis stay alive

-

Brignone claims World Cup giant slalom title as Gut-Behrami wins finale

-

UK artist Grayson Perry indulges playful side in new show

UK artist Grayson Perry indulges playful side in new show

-

Swiatek gets extra security after harassment

-

Tuchel says Maguire 'will always be in contention' for England

Tuchel says Maguire 'will always be in contention' for England

-

Iran book World Cup spot as Australia, Saudis keep hopes alive

-

Iran qualify for 2026 World Cup

Iran qualify for 2026 World Cup

-

Big bucks Iyer leads Punjab to win over Gujarat in IPL

-

'Spider-Man,' 'Harry Potter' producers hired for new 007 film

'Spider-Man,' 'Harry Potter' producers hired for new 007 film

-

Trump, intel chiefs dismiss chat breach

-

Boko Haram fighters kill 20 Cameroonian troops: sources

Boko Haram fighters kill 20 Cameroonian troops: sources

-

Bolsonaro headed 'criminal organization' to stay in power, court told

-

Istanbul court jails 7 journalists as protesters fill streets

Istanbul court jails 7 journalists as protesters fill streets

-

Vernon takes Tour of Catalonia sprint as teen Brennan keeps lead

-

Stocks meander as fears ease over next Trump tariffs

Stocks meander as fears ease over next Trump tariffs

-

Ex-Man City player Barton gets suspended jail term for assaulting wife

-

UK judge slams Paddington Bear statue vandals

UK judge slams Paddington Bear statue vandals

-

Back in the pink: Senegal salt lake gets its colour back

-

Robinson crashes out of World Cup giant slalom, Brignone eyes season title

Robinson crashes out of World Cup giant slalom, Brignone eyes season title

-

French art expert on trial over forged furniture at Versailles

-

'An Italian miracle': Controversial Winter Olympics track slides into action

'An Italian miracle': Controversial Winter Olympics track slides into action

-

On US visit, Estonia warns of Putin 'upper hand' through talks

-

Australia, Saudis keep World Cup hopes alive as S. Korea stutter again

Australia, Saudis keep World Cup hopes alive as S. Korea stutter again

-

Temple burned, UNESCO village evacuated as South Korea wildfires spread

-

Lesotho's king warns nation will reel from Trump cuts

Lesotho's king warns nation will reel from Trump cuts

-

SpaceX rocket fuel makes stunning swirl in European sky

-

US says Russia, Ukraine agree to end Black Sea military action

US says Russia, Ukraine agree to end Black Sea military action

-

EU unveils critical material projects to cut China dependence

-

UK watchdog concerned Oasis fans 'misled' into buying costly tickets

UK watchdog concerned Oasis fans 'misled' into buying costly tickets

-

Barcelona basilica narrows down search for artist to design facade

-

Brazil judges weigh whether to put Bolsonaro on trial for 'coup'

Brazil judges weigh whether to put Bolsonaro on trial for 'coup'

-

Faux gras? Scientists craft 'more ethical' version of French delicacy

-

Turkish court jails 7 journalists after anti-Erdogan protests

Turkish court jails 7 journalists after anti-Erdogan protests

-

Trump brushes off Yemen chat breach as a 'glitch'

-

Stocks up as fears ease over next Trump tariffs

Stocks up as fears ease over next Trump tariffs

-

Real Madrid making progress on Alexander-Arnold transfer: reports

-

Depardieu denies 'groping' women in France sex abuse trial

Depardieu denies 'groping' women in France sex abuse trial

-

Olympic champion Ingebrigtsen testifies against father in abuse trial

-

No Ukraine deal after US-Russia Saudi talks

No Ukraine deal after US-Russia Saudi talks

-

France to auction superyacht seized in money-laundering case

Torq Resources to Raise C$2 Million, Settle Debts and Extends Credit Facility

VANCOUVER, BC / ACCESS Newswire / March 24, 2025 / Torq Resources Inc. (TSXV:TORQ)(OTCQB:TRBMF) ("Torq" or the "Company") announces that it is undertaking a non-brokered private placement of 33.33 million equity units of the Company (the "Units") at an offering price of CAD$0.06 per Unit for gross proceeds to the Company of $2 million (the "Offering"). Each Unit will consist of one common share (a "Share") and one full common share purchase warrant (each, a "Warrant"). Each Warrant will entitle the holder to purchase one common share of the Company at a price of C$0.12 at any time on or before the date which is 24 months from the closing date of the Offering (the "Closing Date"). This financing supersedes the previous financing announced on October 2, 2024, and November 18, 2024 which did not complete and any funds which were advanced under the superseded placements will be applied to this Offering.

The Company also announces that it has reached an agreement with the lender, dated March 23, 2025, to extend its Credit Facility in the amount of $2.8 million from July 11, 2025 to July 11, 2026. In consideration the Lender will receive, subject to TSX Venture Exchange ("TSXV") acceptance of the extension agreement, 46,666,667 share purchase warrants ("Lender's Warrants"), with each Lender's Warrant exercisable for one common share at the price of $0.06 per common share until July 11, 2026. The interest rate on the Credit Facility will reset for the last year to 12% and the lender will receive a $30,000 payment in consideration of a recent security priority waiver and a default waiver. The Lender's Warrants are subject to a contractual blocker term that will prohibit exercise if the number of shares that would result on exercise combined with the Lender's other Torq shares would exceed 9.99% of issued Torq shares.

The Company has also reached agreements in principle with arms-length creditors, with dates varying this quarter, to settle approximately $1.15 million in Units identical to those in the Offering.

The Company is also seeking to renegotiate the option terms pertaining to its Margarita project which requires a balloon option payment and work funded by August 2025. If the Company is unable to renegotiate the option terms it may need to elect to relinquish its rights to a substantive portion of this project although it will retain some important adjoining concessions which it previously purchased outright.

The Offering Warrants are subject to an accelerated expiry if, anytime following the date that is four months after the Closing Date, the closing price of the common shares of the Company on the TSXV, or such other market as the common shares may trade from time to time, is or exceeds $0.30 for any 10 consecutive trading days, in which event the holder of the Warrants may, at the Company's election, be given notice and the Company will issue a press release announcing that the financing Warrants will expire 30 days following the date of such press release. The Offering Warrants may be exercised by the holder of the Warrant during the 30-day period after the date of the press release announcing the accelerated expiry date.

The proposed use of proceeds from the Offering is to finance general working capital.

In accordance with applicable securities laws, the securities issued under the Offering will be subject to a four-month-and-one-day hold period from the Closing Date in Canada. Although the Offering is non-brokered, the Company may pay a cash finder's fee equal to 6.0% of the gross proceeds and issue finder's warrants equal to 6.0% of the number of Units sold under the Offering to eligible persons who refer participating investors to the Company, where permitted by applicable law and in accordance with the policies of the TSXV. Each finder's warrant will entitle the holder thereof to purchase one common share of the Company at the exercise price of C$0.06 for a period of 12 months from the Closing Date. Each finder's warrant is also subject to the accelerated expiry as described above.

Closing of the Offering is anticipated to occur on or about April 15, 2025, subject to the receipt of investor and creditor documentation, funds and TSXV approval. There is no minimum upon which the closing of the Offering is conditional, and any upsize will be announced in the context of the market. All securities referred to herein will be subject to a 4 month resale restricted period in Canada from completion of the transactions.

It is possible that insiders of the company may participate in the Offering and the Company will be relying on the exemption from the formal valuation and minority shareholder approval requirements pursuant to sections 5.5(a) and 5.7(1)(a) of Canadian Multilateral Instrument 61-101 - Protection of Minority Shareholders in Related Party Transactions, as neither the fair market value of any securities issued to nor the consideration paid by such person could exceed 25% of the Company's market capitalization.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such an offer, solicitation or sale would be unlawful.

ON BEHALF OF THE BOARD,

Shawn Wallace

CEO & Chair

For further information on Torq Resources, please visit www.torqresources.com or contact the company at (778) 729-0500 or [email protected].

About Torq Resources

Torq is a Vancouver-based copper and gold exploration company with a portfolio of premium holdings in Chile. The Company is establishing itself as a leader of new exploration in prominent mining belts, guided by responsible, respectful and sustainable practices. The Company was built by a management team with prior success in monetizing exploration assets and its specialized technical team is recognized for their extensive experience working with major mining companies, supported by robust safety standards and technical proficiency. The technical team includes Chile-based geologists with invaluable local expertise and a noteworthy track record for major discovery in the country. Torq is committed to operating at the highest standards of applicable environmental, social and governance practices in the pursuit of a landmark discovery. For more information, visit www.torqresources.com.

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements". Forward-looking information in this release includes statements that relate to closing of the Offering, the use of proceeds, receipt of regulatory approval, closing of the Credit Facility and renegotiation of option on the Margarita project. These statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by some of the principal forward-looking statements. See Torq's Annual Information Form filed April 29, 2024, at www.sedarplus.ca for disclosure of the risks and uncertainties faced in this business.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Torq Resources Inc.

View the original press release on ACCESS Newswire

S.Gregor--AMWN