-

Huthis claim new attack on American warships, report new US strikes

Huthis claim new attack on American warships, report new US strikes

-

Asian markets track Wall St gains as tech inspires Hong Kong

-

Japan victims voice fears 30 years after sarin subway attack

Japan victims voice fears 30 years after sarin subway attack

-

Bach's successor needs cool head to guide Olympics through stormy seas: experts

-

What happens to the human body in deep space?

What happens to the human body in deep space?

-

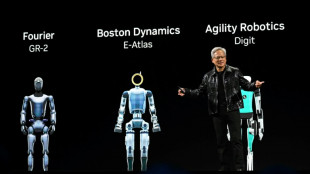

Nvidia showcases AI chips as it shrugs off DeepSeek

-

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

-

Fired US federal worker in need of releasing steam? Try the internet

-

'No going back': Serbia protests heap pressure on government

'No going back': Serbia protests heap pressure on government

-

Trump touts control over famed arts venue

-

Trump taps Michelle Bowman to be US Fed vice chair for supervision

Trump taps Michelle Bowman to be US Fed vice chair for supervision

-

Jury deliberates US pipeline case with free speech implications

-

European star-gazing agency says Chile green power plant will ruin its view

European star-gazing agency says Chile green power plant will ruin its view

-

Carney says Canada 'too reliant on US' on UK, France trip

-

Starbucks ordered to pay $50m for hot tea spill

Starbucks ordered to pay $50m for hot tea spill

-

Talks on divisive deep-sea mining resume in Jamaica

-

Astronauts finally to return after unexpected 9-month ISS stay

Astronauts finally to return after unexpected 9-month ISS stay

-

Trump veers towards courts clash over migrant flights

-

Donors pledge 5.8 bn euros for Syria, down on last year

Donors pledge 5.8 bn euros for Syria, down on last year

-

M23 shuns DR Congo peace talks at 11th hour after sanctions

-

Man Utd defy fan groups with five percent season ticket rise

Man Utd defy fan groups with five percent season ticket rise

-

Huthis report new US strikes after major rallies in rebel-held Yemen

-

UN chief meets rival Cyprus leaders ahead of talks

UN chief meets rival Cyprus leaders ahead of talks

-

Messi out injured as Argentina seek to seal World Cup place

-

New blow to German auto sector as Audi announces job cuts

New blow to German auto sector as Audi announces job cuts

-

New Canada PM meets King Charles and Macron after Trump threats

-

Conan O'Brien tapped to host Oscars again

Conan O'Brien tapped to host Oscars again

-

China stimulus hopes help stock markets rise

-

Hong Kong property tycoon Lee Shau-kee dies aged 97

Hong Kong property tycoon Lee Shau-kee dies aged 97

-

EU vows 2.5 bn euros to help Syrians after Assad ouster

-

'Anti-American'? US questions UN agencies, international aid groups

'Anti-American'? US questions UN agencies, international aid groups

-

Trump claims Biden pardons of his opponents are void

-

N.Macedonia mourns 59 killed in nightclub blaze

N.Macedonia mourns 59 killed in nightclub blaze

-

West Ham's Antonio '100 percent' sure he will play again after car crash

-

Major rallies in rebel-held Yemen after deadly US strikes

Major rallies in rebel-held Yemen after deadly US strikes

-

Webb telescope directly observes exoplanet CO2 for first time

-

Trump to visit top US arts venue after takeover

Trump to visit top US arts venue after takeover

-

McIlroy wins second Players Championship title in playoff

-

Stench of death as Sudan army, paramilitaries battle for capital

Stench of death as Sudan army, paramilitaries battle for capital

-

Trump and Zelensky's stormy ties: From impeachment to truce proposal

-

McIlroy wins Players Championship title in playoff

McIlroy wins Players Championship title in playoff

-

'More and faster': UN calls to shrink buildings' carbon footprint

-

Plastic pellets spotted in water after North Sea ship crash

Plastic pellets spotted in water after North Sea ship crash

-

US retail sales weaker than expected as consumer health under scrutiny

-

After ending Man Utd goal drought, Hojlund admits struggles

After ending Man Utd goal drought, Hojlund admits struggles

-

African players in Europe: Brilliant Marmoush strikes for City

-

Liverpool face uncertain future even as Premier League glory beckons

Liverpool face uncertain future even as Premier League glory beckons

-

Court upholds £3 bn lifeline for UK's top water supplier

-

New Canada PM seeks 'reliable' Europe allies after Trump threats

New Canada PM seeks 'reliable' Europe allies after Trump threats

-

Putin, Trump to discuss Ukraine Tuesday

Heramba Electric plc Announces Receipt of Notice from Nasdaq Regarding the Minimum Bid Price Requirement

DUSSELDORF, GERMANY AND ATLANTA, GA / ACCESS Newswire / March 17, 2025 / As previously disclosed, and pursuant to the terms and conditions set forth in the Share Purchase Agreement, dated as of July 25 and 26, 2023, by and among Heramba GmbH ("Heramba"), Heramba Holdings, Inc. ("Heramba Holdings"), Knorr-Bremse Systeme für Schienenfahrzeuge GmbH ("KB GmbH") and Knorr-Brake Holding Corporation ("KB US"), as amended pursuant to the Amendment Agreement to Share Purchase Agreement, dated as of January 31, 2024, on February 6, 2024, (i) KB GmbH, as sole shareholder of Kiepe Electric GmbH, sold and transferred 85% of the equity interests in Kiepe GmbH, as well as certain receivables and shareholder loans, to Heramba, and (ii) KB US, as the sole member of Kiepe Electric LLC ("Kiepe US" and together with Kiepe GmbH, "Kiepe"), sold and transferred all ownership interests in Kiepe US, as well as certain receivables, to Heramba Holdings.

As previously disclosed, and pursuant to the terms and conditions set forth in the Business Combination Agreement, dated as of October 2, 2023, by and among Project Energy Reimagined Acquisition Corp., Heramba Electric plc, Heramba Merger Corp., Heramba Limited and Heramba, effective as of July 26, 2024, the business combination contemplated by the Business Combination Agreement was consummated resulting in, among other matters, each of Heramba, Heramba Holdings, Kiepe GmbH and Kiepe US becoming direct or indirect subsidiaries of the Company.

As previously disclosed, on January 9, 2025, Heramba received letters (the "Demand Letters") from KB GmbH demanding payment of certain funds allegedly owed under the Share Purchase Agreement, totaling approximately EUR 24,855,000 in the aggregate plus applicable default interest (collectively, the "Demanded Amounts"). Heramba and the Company subsequently delivered response letters to the Demand Letters to contest the Demanded Amounts and propose further discussions among the relevant parties to resolve such matters; however, no resolution was reached.

As previously disclosed, on January 30, 2025, as a consequence of the outstanding Demanded Amounts and in accordance with certain obligations under applicable German insolvency law, the managing director of Heramba has determined that Heramba is currently unable to pay its existing liabilities due and may also be overindebted. Following such determination and upon authorization by the Company as sole shareholder of Heramba, on January 30, 2025, the managing director of Heramba filed for the opening of ordinary insolvency proceedings over the assets of Heramba (the "Insolvency Filing") with the local court of Düsseldorf in Germany (the "Court").

Heramba Electric plc (NASDAQ:PITA) ("Heramba Electric" or the "Company"), today announced that on March 11, 2025, it received a delinquency notification letter (the "Notice") from the Listing Qualifications Department of The Nasdaq Stock Market LLC ("Nasdaq"), indicating that the Company is not currently in compliance with the minimum bid price requirement set forth in Nasdaq's Listing Rules for continued listing on the Nasdaq Capital Market as the closing bid price for the Company's ordinary shares was below $1.00 per share for 30 consecutive business days. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. The Notice provides that the Company has a period of 180 calendar days from the date of the Notice, or until September 8, 2025, to regain compliance with the minimum bid price requirement.

The receipt of the Notice has no immediate effect on the Company's business operations or the listing of the Company's ordinary shares, which will continue to trade uninterrupted on the Nasdaq under the ticker "PITA" during the 180-day Notice period. If at any time before September 8, 2025, the bid price of the Company's ordinary shares closes at or above $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide written confirmation of compliance to the Company.

In the event that the Company does not regain compliance by September 8, 2025, the Company may be eligible for additional time to regain compliance. If the Company cannot demonstrate compliance by the allotted compliance period(s), Nasdaq's staff will notify the Company that its ordinary shares are subject to delisting.

CONTACT:

Michele

[email protected]

SOURCE: Heramba Electric plc

View the original press release on ACCESS Newswire

Y.Kobayashi--AMWN