-

Asian markets edge up but uncertainty rules ahead of Trump tariffs

Asian markets edge up but uncertainty rules ahead of Trump tariffs

-

Nintendo's megahit Switch console: what to know

-

Nintendo to unveil upgrade to best-selling Switch console

Nintendo to unveil upgrade to best-selling Switch console

-

China practises hitting key ports, energy sites in Taiwan drills

-

Oil, sand and speed: Saudi gearheads take on towering dunes

Oil, sand and speed: Saudi gearheads take on towering dunes

-

All eyes on Tsunoda at Japan GP after ruthless Red Bull move

-

'Image whisperers' bring vision to the blind at Red Cross museum

'Image whisperers' bring vision to the blind at Red Cross museum

-

Hay shines as New Zealand make 292-8 in Pakistan ODI

-

Other governments 'weaponising' Trump language to attack NGOs: rights groups

Other governments 'weaponising' Trump language to attack NGOs: rights groups

-

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

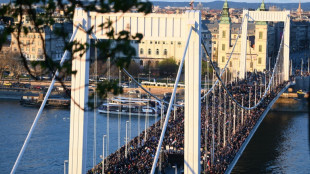

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

CORRECTION FROM SOURCE: Empire Metals Limited Announces Admission to Trading on OTCQB

The following amendment has been made to the 'Admission to Trading on OTCQB in the United States' announcement released on 14 March 2025 at 07:00.

The incorrect OTCQB ticker symbol was listed and should be EPMLF.

All other details remain unchanged.

The full amended text is shown below.

LONDON, UK / ACCESS Newswire / March 14, 2025 / Empire Metals Limited / LON: EEE / Sector: Natural Resources

14 March 2025

Empire Metals Limited

("Empire" or "the Company")

Admission to Trading on OTCQB in the United States

Empire Metals Limited (LON:EEE), the AIM-quoted resource exploration and development company,is pleased to announce that its Ordinary Shares have been approved to trade on the OTCQB Market ("OTCQB") in the United States of America (the "US") and will commence trading at the market open today under the ticker symbol "EPMLF".

The cross-trading of Empire Metals' ordinary shares on the OTCQB will provide significant benefits to investors, including enhanced access to trading for US-based investors and greater liquidity from a broader pool of potential investors globally. By trading on the OTCQB, Empire Metals will engage directly with US investors, providing them with the same level of information and disclosure available to shareholders in the United Kingdom, but through US-facing platforms and portals. Additionally, the OTCQB cross-trading facility will enable US investors to access Empire Metals' ordinary shares in US dollars, during US market hours.

Shaun Bunn, Managing Director, said: "Trading on OTCQB opens Empire Metals to a new and diverse pool of potential investors in the US, who are keen for exposure to strategic metals. Titanium is on the critical minerals list in many countries, including the United States. The growing global demand for titanium, particularly in industries like defence and aerospace, underpins our objective to accelerate development at our Pitfield Project, the world's largest known titanium discovery, towards commercialisation. Empire Metals is working to become an industry disruptor by producing high-value titanium pigments and/or titanium metal from a Tier 1 mining jurisdiction in Australia, which we believe will drive strategic interest internationally from investors and consumers alike.

"Trading on the OTCQB is an important component of this vision as we take Pitfield to the international stage, offering investors a significant and responsibly sourced pathway to gain exposure to this high-growth and strategically important commodity. The Company will be presenting to investors in the US next week, as well as presenting at the Critical Minerals North America conference on 20 March, and we are delighted to provide US investors with the opportunity to invest in Empire Metals."

About OTCQB

The ability to trade Empire Metals' existing ordinary shares on AIM will remain unaffected by the OTCQB listing, and no new shares will be issued. Empire Metals will continue to make announcements and disclosures to the London Stock Exchange via the Regulatory News Service and will not be subject to Sarbanes-Oxley or US Securities and Exchange Commission ("SEC") reporting requirements.

The OTCQB is recognised as an Established Public Market by the SEC. To be eligible for the OTCQB, companies must be current in their financial reporting, meet a minimum bid price test, and undergo annual company verification and management certification. As a verified market with efficient access to US investors, OTCQB supports companies as they seek to build shareholder value, enhance liquidity, and achieve fair valuation.

US investors can access real-time quotes, market information, and updates on Empire Metals via www.otcmarkets.com.

Empire Metals has not yet made, and does not expect to make, a determination as to whether it, or any of its subsidiaries, are Passive Foreign Investment Companies ("PFIC") for U.S. tax purposes for any taxable year.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

Empire Metals Ltd Shaun Bunn / Greg Kuenzel / Arabella Burwell | Tel: 020 4583 1440 |

S. P. Angel Corporate Finance LLP (Nomad & Broker) Ewan Leggat / Adam Cowl | Tel: 020 3470 0470 |

Shard Capital Partners LLP (Joint Broker) Damon Heath | Tel: 020 7186 9950 |

St Brides Partners Ltd (Financial PR) Susie Geliher / Charlotte Page | Tel: 020 7236 1177 |

About Empire Metals Limited

Empire Metals is an AIM-listed exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

A JORC Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Empire Metals Limited

View the original press release on ACCESS Newswire

L.Miller--AMWN