-

Asian markets edge up but uncertainty rules ahead of Trump tariffs

Asian markets edge up but uncertainty rules ahead of Trump tariffs

-

Nintendo's megahit Switch console: what to know

-

Nintendo to unveil upgrade to best-selling Switch console

Nintendo to unveil upgrade to best-selling Switch console

-

China practises hitting key ports, energy sites in Taiwan drills

-

Oil, sand and speed: Saudi gearheads take on towering dunes

Oil, sand and speed: Saudi gearheads take on towering dunes

-

All eyes on Tsunoda at Japan GP after ruthless Red Bull move

-

'Image whisperers' bring vision to the blind at Red Cross museum

'Image whisperers' bring vision to the blind at Red Cross museum

-

Hay shines as New Zealand make 292-8 in Pakistan ODI

-

Other governments 'weaponising' Trump language to attack NGOs: rights groups

Other governments 'weaponising' Trump language to attack NGOs: rights groups

-

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

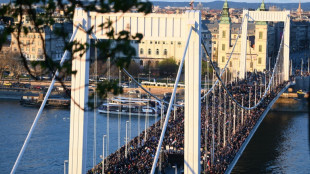

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Highlander Silver Closes $32 Million Bought Deal Private Placement

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

TORONTO, ON / ACCESS Newswire / March 11, 2025 / Highlander Silver Corp. (CSE:HSLV)("Highlander Silver" or the "Company") is pleased to announce that it has closed its previously announced bought deal private placement, pursuant to which the Company sold 23,000,000 common shares of the Company (the "Shares") at a price of $1.40 per Share for aggregate gross proceeds of $32,200,000, which includes the full exercise of the underwriters' option (the "Offering"). The Offering was conducted by a syndicate of underwriters led by Ventum Financial Corp. (the "Lead Underwriter"), as lead underwriter and sole bookrunner, and including BMO Nesbitt Burns Inc., Haywood Securities Inc., National Bank Financial Inc., Canaccord Genuity Corp., Stifel Nicolaus Canada Inc. and TD Securities Inc. (collectively, the "Underwriters").

Daniel Earle, President and CEO, commented, "We are deeply grateful to close our oversubscribed, upsized offering, with the continued support and investment of the Lundin family. I was delighted to be able to participate in the offering alongside my colleagues and all members of the Board, led by Richard Warke and Jerrold Annett. The strength of this financing supports expanding our community hiring and development plans as we prepare to ramp-up exploration activities at San Luis after the rainy season ends in Central Peru."

The Company intends to use the net proceeds from the Offering to fund the advancement of exploration activities at the Company's San Luis gold-silver project in Peru, as well as for working capital and general corporate purposes. The Shares are subject to a statutory hold period of four months and one day under applicable Canadian securities laws and the Company has entered into a customary lock-up pursuant to which it has agreed not to issue common shares for 120 days without the consent of the Lead Underwriter, subject to limited ordinary-course exceptions. In connection with the Offering, the Underwriters received a cash fee in an amount representing 6.0% of the gross proceeds of the Offering.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

All currency references herein are to Canadian dollar unless otherwise stated.

About Highlander Silver

Highlander Silver is advancing a portfolio of silver exploration and development assets in the Americas, including the bonanza grade San Luis gold-silver project that is located adjacent to the Pierina mine in Central Peru. Highlander Silver is backed by the Augusta Group, which boasts an exceptional track record of value creation totaling over $4.5B in exit transactions, and supported by strategic shareholders, the Lundin family and Eric Sprott. The Company is listed on the Canadian Securities Exchange ("CSE") under the ticker symbol HSLV. Additional information about Highlander Silver and its mineral projects can be viewed on the Company's SEDAR+ profile at (www.sedarplus.ca) and its website at www.highlandersilver.com.

Neither the CSE nor the Canadian Investment Regulatory Organization accepts responsibility for the adequacy or accuracy of this news release.

For further information, please contact:

Arun Lamba, Vice President Corporate Development

Email: [email protected]

Cautionary Notes and Forward-looking Statements

Certain information contained in this news release constitutes "forward-looking information" under Canadian securities legislation. This includes, but is not limited to, information or statements with respect to the Offering, including statements with respect to the completion of the Offering and the anticipated use of the net proceeds therefrom; the future exploration plans of the Company, timing of future exploration, anticipated results of exploration and potential mineralization of the Company's mineral projects. Such forward looking information or statements can be identified by the use of words such as "believes", "plans", "suggests", "targets" or "prospects" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "will" be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, the actual results of current exploration activities, changes in project parameters as plans continue to be refined, future prices of precious and base metals, accident, labour disputes and other risks of the mining industry, and delays in obtaining governmental approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on ACCESS Newswire

A.Rodriguezv--AMWN