-

UK imposes online entry permit on European visitors

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

Newsmax shares surge more than 2,000% in days after IPO

-

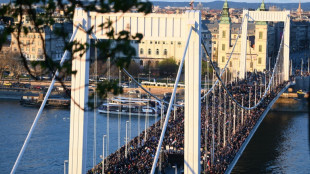

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

Southern Cross Gold Announces Inclusion in the S&P/ASX All Ordinaires Index

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / March 10, 2025 / Southern Cross Gold Consolidated Ltd . ("Southern Cross Gold" or the "Company") (TSXV:SXGC)(ASX:SX2)(OTC PINK:MWSNF)(Frankfurt:MV3.F) announces that the CHESS Depositary Interests ("CDI") of the Company will be added to the S&P/ASX All Ordinaries Index effective prior to Australian Securities Exchange ("ASX") market open on March 24, 2025.

Michael Hudson, Southern Cross Gold's President & CEO, commented , "We are delighted to be included in the All Ordinaries Index, which recognizes our team's hard work and the support of our shareholders in building Southern Cross Gold into a significant player in the Australian gold and critical metals sector. This inclusion will increase our visibility to a broader range of investors and potentially improve the liquidity of our shares, benefiting all stakeholders. We look forward to continuing to engage with investment analysts, institutional fund managers, and investors both in Australia and internationally as we continue to build one of the world's most significant gold-antimony assets at Sunday Creek."

The S&P/ASX All Ordinaries Index is Australia's oldest share market indicator and represents the 500 largest companies listed on the ASX by market capitalization. The index is widely regarded as the benchmark for measuring the performance of the Australian equity market.

Southern Cross Gold's inclusion in this index is expected to attract increased interest from institutional investors, index funds, and exchange-traded funds (ETFs) that track the All Ordinaries, potentially enhancing the Company's visibility and trading liquidity.

Southern Cross Gold's CDIs commenced trading on the ASX under the ticker symbol SX2 on January 15, 2025. Each CDI represents one fully paid share of common stock of Southern Cross Gold Consolidated Ltd.

Southern Cross Gold also announces the granting of an aggregate of 700,000 stock options (the "Options") to Canadian officers and a consultant in Australia to acquire an aggregate of 700,000 common shares of the Company for a period of three years and vest immediately from the date of grant. The Options are exercisable at C$3.38. The granting of the Options is part of the long-term compensation, alignment and employee retention incentives program provided by the Company.

About Southern Cross Gold Consolidated Ltd.

Southern Cross Gold Consolidated Ltd is now dual listed on the TSXV: SXGC and ASX: SX2

Southern Cross Gold Consolidated Ltd. (TSXV:SXGC)(ASX:SX2) controls the Sunday Creek Gold-Antimony Project located 60 km north of Melbourne, Australia. Sunday Creek has emerged as one of the Western world's most significant gold and antimony discoveries, with exceptional drilling results including 60 intersections exceeding 100 g/t AuEq x m from just 73.3 km of drilling. The mineralization follows a "Golden Ladder" structure over 12 km of strike length, with confirmed continuity from surface to 1,100 m depth.

Sunday Creek's strategic value is enhanced by its dual-metal profile, with antimony contributing 20% of the in-situ value alongside gold. This has gained increased significance following China's export restrictions on antimony, a critical metal for defense and semiconductor applications. Southern Cross' inclusion in the US Defense Industrial Base Consortium (DIBC) and Australia's AUKUS-related legislative changes position it as a potential key Western antimony supplier. Importantly, Sunday Creek can be developed primarily based on gold economics, which reduces antimony-related risks while maintaining strategic supply potential.

Technical fundamentals further strengthen the investment case, with preliminary metallurgical work showing non-refractory mineralization suitable for conventional processing and gold recoveries of 93-98% through gravity and flotation.

With A$18M in cash, over 1,000 Ha of strategic freehold land ownership, and an aggressive 60 km drill program planned through Q3 2025, SXGC is well-positioned to advance this globally significant gold-antimony discovery in a tier-one jurisdiction.

- Ends -

This announcement has been approved for release by the Board of Southern Cross Gold Consolidated Ltd.

For further information, please contact:

Mariana Bermudez - Corporate Secretary (Canada)

[email protected] or +1 604 685 9316

Executive Office: 1305 - 1090 West Georgia Street Vancouver, BC, V6E 3V7, Canada

Nicholas Mead - Corporate Development

[email protected] or +61 415 153 122

Justin Mouchacca - Company Secretary (Australia)

[email protected] or +61 3 8630 3321

Subsidiary Office: Level 21, 459 Collins Street, Melbourne, VIC, 3000, Australia

Forward-Looking Statement

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements including without limitation applicable court, regulatory authorities and applicable stock exchanges. Forward-looking statements include words or expressions such as "proposed", "will", "subject to", "near future", "in the event", "would", "expect", "prepared to" and other similar words or expressions. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include general business, economic, competitive, political, social uncertainties; the state of capital markets, unforeseen events, developments, or factors causing any of the expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and other risks described in SXGC's documents filed with Canadian or Australian securities regulatory authorities (under code SX2). You can find further information with respect to these and other risks in filings made by SXGC with the securities regulatory authorities in Canada or Australia (under code SX2), as applicable, and available for SXGC in Canada at www.sedarplus.ca or in Australia at www.asx.com.au under code SX2. Documents are also available at www.southerncrossgold.com We disclaim any obligation to update or revise these forward-looking statements, except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) or the Australian Securities Exchange accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Southern Cross Gold Consolidated Ltd.

View the original press release on ACCESS Newswire

J.Williams--AMWN