-

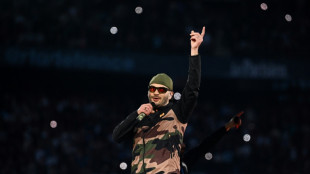

Miami's unbeaten MLS run ends after Dallas comeback

Miami's unbeaten MLS run ends after Dallas comeback

-

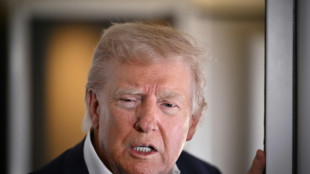

After 100 days in office, Trump voters still back US president

-

US anti-disinformation guardrails fall in Trump's first 100 days

US anti-disinformation guardrails fall in Trump's first 100 days

-

Dick Barnett, two-time NBA champ with Knicks, dies at 88

-

PSG hope to have Dembele firing for Arsenal Champions League showdown

PSG hope to have Dembele firing for Arsenal Champions League showdown

-

Arteta faces Champions League showdown with mentor Luis Enrique

-

Niemann wins LIV Mexico City to secure US Open berth

Niemann wins LIV Mexico City to secure US Open berth

-

Slot plots more Liverpool glory after Premier League triumph

-

Novak and Griffin win PGA pairs event for first tour titles

Novak and Griffin win PGA pairs event for first tour titles

-

Inter Miami unbeaten MLS run ends after Dallas comeback

-

T'Wolves rally late to beat Lakers, Knicks edge Pistons amid controversy

T'Wolves rally late to beat Lakers, Knicks edge Pistons amid controversy

-

Japan's Saigo wins playoff for LPGA Chevron title and first major win

-

Trump tells Putin to 'stop shooting' and make a deal

Trump tells Putin to 'stop shooting' and make a deal

-

US says it struck 800 targets in Yemen, killed 100s of Huthis since March 15

-

Conflicts spur 'unprecedented' rise in military spending

Conflicts spur 'unprecedented' rise in military spending

-

Gouiri hat-trick guides Marseille back to second in Ligue 1

-

Racing 92 thump Stade Francais to push rivals closer to relegation

Racing 92 thump Stade Francais to push rivals closer to relegation

-

Inter downed by Roma, McTominay fires Napoli to top of Serie A

-

Usyk's unification bout against Dubois confirmed for July 19

Usyk's unification bout against Dubois confirmed for July 19

-

Knicks edge Pistons for 3-1 NBA playoff series lead

-

Slot praises Klopp after Liverpool seal Premier League title

Slot praises Klopp after Liverpool seal Premier League title

-

FA Cup glory won't salvage Man City's troubled season: Guardiola

-

Bumrah, Krunal Pandya star as Mumbai and Bengaluru win in IPL

Bumrah, Krunal Pandya star as Mumbai and Bengaluru win in IPL

-

Amorim says 'everything can change' as Liverpool equal Man Utd title record

-

Iran's Khamenei orders probe into port blast that killed 40

Iran's Khamenei orders probe into port blast that killed 40

-

Salah revels in Liverpool's 'way better' title party

-

Arsenal stun Lyon to reach Women's Champions League final

Arsenal stun Lyon to reach Women's Champions League final

-

Slot 'incredibly proud' as Liverpool celebrate record-equalling title

-

Israel strikes south Beirut, prompting Lebanese appeal to ceasefire guarantors

Israel strikes south Beirut, prompting Lebanese appeal to ceasefire guarantors

-

Smart Slot reaps rewards of quiet revolution at Liverpool

-

Krunal Pandya leads Bengaluru to top of IPL table

Krunal Pandya leads Bengaluru to top of IPL table

-

Can Trump-Zelensky Vatican talks bring Ukraine peace?

-

Van Dijk hails Liverpool's 'special' title triumph

Van Dijk hails Liverpool's 'special' title triumph

-

Five games that won Liverpool the Premier League

-

'Sinners' tops N.America box office for second week

'Sinners' tops N.America box office for second week

-

Imperious Liverpool smash Tottenham to win Premier League title

-

Man City sink Forest to reach third successive FA Cup final

Man City sink Forest to reach third successive FA Cup final

-

Toll from Iran port blast hits 40 as fire blazes

-

Canada car attack suspect had mental health issues, 11 dead

Canada car attack suspect had mental health issues, 11 dead

-

Crowds flock to tomb of Pope Francis, as eyes turn to conclave

-

Inter downed by Roma, AC Milan bounce back with victory in Venice

Inter downed by Roma, AC Milan bounce back with victory in Venice

-

Religious hate has no place in France, says Macron after Muslim killed in mosque

-

Last day of Canada election campaign jolted by Vancouver attack

Last day of Canada election campaign jolted by Vancouver attack

-

Barcelona crush Chelsea to reach women's Champions League final

-

Nine killed as driver plows into Filipino festival in Canada

Nine killed as driver plows into Filipino festival in Canada

-

Germany marks liberation of Bergen-Belsen Nazi camp

-

Hojlund strikes at the death to rescue Man Utd in Bournemouth draw

Hojlund strikes at the death to rescue Man Utd in Bournemouth draw

-

Zelensky says Ukraine not kicked out of Russia's Kursk

-

Zverev, Sabalenka battle through in Madrid Open, Rublev defence over

Zverev, Sabalenka battle through in Madrid Open, Rublev defence over

-

Ruthless Pogacar wins Liege-Bastogne-Liege for third time

Focus Impact BH3 Stockholders Vote to Approve Business Combination with XCF Global Capital, Inc.

RENO, NV / ACCESS Newswire / March 4, 2025 / Focus Impact BH3 Acquisition Company (OTC PINK:BHAC) ("Focus Impact BH3"), a special purpose acquisition company, and XCF Global Capital, Inc. ("XCF"), a key player in decarbonizing the aviation industry through Sustainable Aviation Fuel ("SAF"), today announced that Focus Impact BH3 stockholders have voted to approve the previously announced business combination ("Business Combination") with XCF at a special meeting held on February 27, 2025.

Subject to the satisfaction or waiver of certain closing conditions, the Business Combination is expected to close in March 2025.

Following the closing of the Business Combination, the combined company, that will operate under the name "XCF Global, Inc.," expects to have its Class A common stock traded on The Nasdaq Capital Market under the ticker symbol "SAFX," subject to final listing approval.

Advisors

Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC, acted as exclusive financial advisor and joint capital markets advisor to XCF. Height Capital Markets served as joint capital markets advisor to XCF. BTIG, LLC acted as capital markets advisor to Focus Impact BH3. Stradley Ronon Stevens & Young, LLP and Kirkland & Ellis LLP served as legal counsel to XCF and Focus Impact BH3, respectively. Alliance Advisors Investor Relations served as investor relations and public relations advisor for the transaction.

About Focus Impact BH3 Acquisition Co.

Focus Impact BH3 Acquisition Co. is a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. Focus Impact BH3 is sponsored by Focus Impact Partners, LLC, a private investment firm dedicated to bringing capital and expertise to socially forward companies and helping those companies realize their growth and development objectives. To learn more, visit www.bh3ac.com.

About XCF Global Capital, Inc.

XCF Global Capital, Inc. is a pioneering sustainable aviation fuel company dedicated to accelerating the aviation industry's transition to net-zero emissions. The Company is developing and operating state-of-the-art clean fuel SAF production facilities engineered to the highest levels of compliance, reliability, and quality. The Company is actively building partnerships across the energy and transportation sectors to accelerate the adoption of SAF on a global scale. To learn more, visit www.xcf.global.

Forward Looking Statements

This Press Release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "intend", "will", "estimate", "anticipate", "believe", "predict", "potential" or "continue", or the negatives of these terms or variations of them or similar terminology. These forward-looking statements, including, without limitation, Focus Impact BH3's and XCF's expectations with respect to future performance and anticipated financial impacts of the Business Combination and the acquisitions of New Rise Renewables, LLC and New Rise SAF Renewables Limited Liability Company (collectively, "New Rise"), estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share, the satisfaction of the closing conditions to the Business Combination and the timing of the consummation of the Business Combination, are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Focus Impact BH3 and its management, and XCF and its management, as the case may be, are inherently uncertain and subject to material change. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) changes in domestic and foreign business, market, financial, political, and legal conditions; (2) the amount of redemptions by Focus Impact BH3's public stockholders in connection with the Business Combination; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any agreements with respect to the Business Combination or with regard to the Company's offtake arrangements; (4) the outcome of any legal proceedings that may be instituted against Focus Impact BH3, XCF, NewCo or others; (5) the inability of the parties to successfully or timely close the Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect NewCo or the expected benefits of the Business Combination or that the approval of stockholders is not obtained; (6) changes to the proposed structure of the proposed transactions that may be required or appropriate as a result of applicable laws or regulations; (7) the ability to meet stock exchange listing standards following the consummation of the Business Combination; (8) the ability of XCF to integrate the operations of New Rise and implement its business plan on its anticipated timeline, including the inability to launch commercial operations in the New Rise plant in Reno, Nevada in the near future; (9) the risk that the proposed transactions disrupt current plans and operations of Focus Impact BH3 or XCF as a result of the announcement and consummation of the proposed transactions; (10) the ability to recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, competition, the ability of NewCo to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (11) costs related to the proposed transactions; (12) changes in applicable laws or regulations; (13) risks related to extensive regulation, compliance obligations and rigorous enforcement by federal, state, and non-U.S. governmental authorities; (14) the possibility that Focus Impact BH3, XCF or NewCo may be adversely affected by other economic, business, and/or competitive factors; (15) the availability of tax credits and other federal, state or local government support; (16) risks relating to XCF's and New Rise's key intellectual property rights; and (17) various factors beyond management's control, including general economic conditions and other risks, uncertainties and factors set forth in the section entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in the final prospectus relating to the initial public offering of Focus Impact BH3, dated October 4, 2021, and other filings with the Securities and Exchange Commission ("SEC") from time to time, including the registration statement on Form S-4, as amended, initially filed with the SEC by Focus Impact BH3 NewCo, Inc. ("NewCo") and XCF on July 31, 2024. If any of the risks actually occur, either alone or in combination with other events or circumstances, or Focus Impact BH3's or XCF's assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Focus Impact BH3 or XCF does not presently know or that it currently believes are not material that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Focus Impact BH3's or XCF's expectations, plans or forecasts of future events and views as of the date of this Press Release. These forward-looking statements should not be relied upon as representing Focus Impact BH3's or XCF's assessments as of any date subsequent to the date of this Press Release. Accordingly, undue reliance should not be placed upon the forward-looking statements. While Focus Impact BH3 or XCF may elect to update these forward-looking statements at some point in the future, Focus Impact BH3 and XCF specifically disclaim any obligation to do so.

Contacts

XCF Global Capital, Inc.:

Chris Santa Cruz

[email protected]

For Media:

Fatema Bhabrawala

[email protected]

SOURCE: XCF Global Capital Inc.

View the original press release on ACCESS Newswire

A.Malone--AMWN