-

Palestinian official tells ICJ Israel using aid blockage as 'weapon of war'

Palestinian official tells ICJ Israel using aid blockage as 'weapon of war'

-

France arrests 25 in police raids after prison attacks

-

Kim Kardashian's next star turn is in a Paris courtroom

Kim Kardashian's next star turn is in a Paris courtroom

-

Syria group says military chief arrested in UAE

-

Anger in Indian Kashmir at demolitions and detentions

Anger in Indian Kashmir at demolitions and detentions

-

Italy bank merger wave heats up as Mediobanca eyes Banca Generali

-

Putin critic Johann Wadephul, Germany's incoming foreign minister

Putin critic Johann Wadephul, Germany's incoming foreign minister

-

Cardinals expected to pick conclave date to elect new pope

-

French mosque murder suspect arrested in Italy

French mosque murder suspect arrested in Italy

-

China says on 'right side of history' in trade standoff with US

-

Stock markets mostly rise as investors eye trade talks

Stock markets mostly rise as investors eye trade talks

-

Fires rage 2 days after Iran port blast killed 40

-

Yemen's Huthi rebel media says 68 killed in US strikes on migrant centre

Yemen's Huthi rebel media says 68 killed in US strikes on migrant centre

-

Man rescued from Mount Fuji twice in one week: reports

-

Canada votes for new government to take on Trump

Canada votes for new government to take on Trump

-

Top UN court to open hearings on Israel's aid obligation to Palestinians

-

Philippines denies 'irresponsible' Chinese report on disputed reef

Philippines denies 'irresponsible' Chinese report on disputed reef

-

T'Wolves win to push Lakers to brink, Celtics, Knicks and Pacers win

-

Myanmar marks month of misery since historic quake

Myanmar marks month of misery since historic quake

-

South Korea's SK Telecom begins SIM card replacement after data breach

-

Women's flag football explodes in US as 2028 Olympics beckon

Women's flag football explodes in US as 2028 Olympics beckon

-

'Hunger breaks everything': desperate Gazans scramble for food

-

Suspect charged with murder in Canada car attack that killed 11

Suspect charged with murder in Canada car attack that killed 11

-

Lost to history: Myanmar heritage falls victim to quake

-

Romania far-right rides TikTok wave in election re-run

Romania far-right rides TikTok wave in election re-run

-

Trial begins in Paris over 2016 gunpoint robbery of Kim Kardashian

-

Trump thinks Zelensky ready to give up Crimea to Russia

Trump thinks Zelensky ready to give up Crimea to Russia

-

North Korea confirms troop deployment to Russia's Kursk

-

Romania presidential election re-run under Trump shadow

Romania presidential election re-run under Trump shadow

-

Asian markets mixed as investors eye trade talks

-

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

-

Suspect charged with murder in Canada car attack that left 11 dead

-

Smart driving new front in China car wars despite fatal crash

Smart driving new front in China car wars despite fatal crash

-

Cardinals set to pick conclave date to elect new pope

-

Miami's unbeaten MLS run ends after Dallas comeback

Miami's unbeaten MLS run ends after Dallas comeback

-

After 100 days in office, Trump voters still back US president

-

US anti-disinformation guardrails fall in Trump's first 100 days

US anti-disinformation guardrails fall in Trump's first 100 days

-

Dick Barnett, two-time NBA champ with Knicks, dies at 88

-

PSG hope to have Dembele firing for Arsenal Champions League showdown

PSG hope to have Dembele firing for Arsenal Champions League showdown

-

Arteta faces Champions League showdown with mentor Luis Enrique

-

Niemann wins LIV Mexico City to secure US Open berth

Niemann wins LIV Mexico City to secure US Open berth

-

Slot plots more Liverpool glory after Premier League triumph

-

Novak and Griffin win PGA pairs event for first tour titles

Novak and Griffin win PGA pairs event for first tour titles

-

Q2 Metals Extends Mineralized Zone Strike Length to 1.5 Kilometres and Concludes the 2025 Winter Program at the Cisco Lithium Project in Quebec, Canada

-

Empire Metals Limited - Extensive High-Grade Titanium Zones Confirmed

Empire Metals Limited - Extensive High-Grade Titanium Zones Confirmed

-

Hemogenyx Pharmaceuticals PLC Announces Final Results

-

Inter Miami unbeaten MLS run ends after Dallas comeback

Inter Miami unbeaten MLS run ends after Dallas comeback

-

T'Wolves rally late to beat Lakers, Knicks edge Pistons amid controversy

-

Japan's Saigo wins playoff for LPGA Chevron title and first major win

Japan's Saigo wins playoff for LPGA Chevron title and first major win

-

Trump tells Putin to 'stop shooting' and make a deal

Aston Bay Announces Initial Mineral Resource Estimate for Near-Surface Mineralization at the Storm Copper Project, Nunavut, Canada

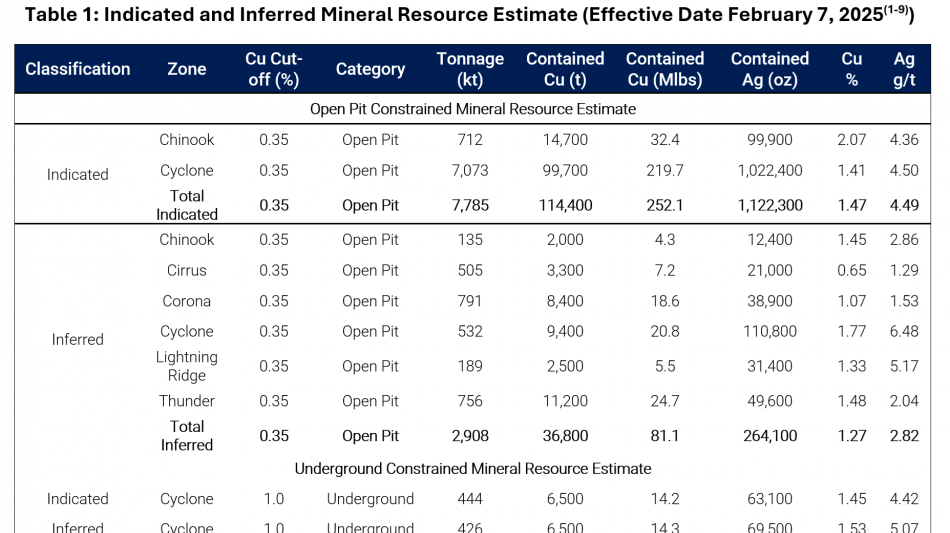

TORONTO, ON / ACCESS Newswire / March 3, 2025 / Aston Bay Holdings Ltd. (TSXV:BAY)(OTCQB:ATBHF) ("Aston Bay" or the "Company") is pleased to announce an Initial Mineral Resource Estimate ("MRE") for the near-surface mineralization (

The Storm Copper Project is a 20/80 unincorporated joint venture between Aston Bay and American West Metals Limited ("American West"), the Project operator. Aston Bay maintains a free carried interest until a decision to mine is made upon completion of a Feasibility Study. The MRE in this announcement was prepared by P&E Mining Consultants Inc. ("P&E") at the request of Aston Bay, independently of American West.

Storm Copper Initial Mineral Resource Estimate Key Highlights

Indicated Mineral Resources: 8.2 million tonnes at an average grade of 1.47% copper (Cu) and 4.5 grams per tonne (g/t) silver (Ag), containing 266.3 million pounds (Mlbs) (121,000 tonnes) of copper and 1.185 million ounces of silver (refer to Table 1 for MRE details).

Inferred Mineral Resources: 3.3 million tonnes at an average grade of 1.30% Cu and 3.1 g/t Ag, containing 95.4 Mlbs (43,000 tonnes) of copper and 333,600 ounces of silver (refer to Table 1 for MRE details).

Low-cost development potential:

Near-surface Mineral Resources accessed primarily with open-pit mining, accounting for over 90% of contained metal in the MRE.

100% of MRE consists of fresh, chalcocite-dominant copper sulphide with metallurgical testwork, which confirms excellent beneficiation potential, including sorting (see Aston Bay news releases dated August 13, 2024 and April 11, 2022).

Significant growth and expansion opportunities:

MRE deposits remain open - All six deposits remain open, offering strong potential for rapid expansion of the Mineral Resource inventory.

Cyclone Deeps discovery (2024) - Cyclone-style mineralization located immediately south and faulted down from the existing Cyclone Deposit (1.2% Cu over 10 m from 311 m down hole in drill hole ST24-01; see Aston Bay news release dated September 20, 2024).

New high-grade copper discoveries (2024) - The Gap (2.3% Cu over 20 m from 38 m down hole, including 5.3% Cu over 8 m in drill hole SR24-003; see Aston Bay news release dated July 2, 2024), Squall and Hailstorm are located near surface and ready for Mineral Resource definition drilling.

Belt-scale exploration opportunity - Tempest, Tornado, Blizzard and Seabreeze Prospects, where surface copper-zinc gossans have been identified.

Aston Bay's Storm MRE was prepared by P&E, with an effective date of February 7, 2025. The full Technical Report will be filed under the Company's SEDAR+ profile (www.sedarplus.ca) within 45 days of this news release, in accordance with NI 43-101 disclosure and reporting requirements.

Thomas Ullrich, Chief Executive Officer of Aston Bay, commented:

"We are thrilled to announce our Initial Mineral Resource Estimate for the near-surface copper mineralization at the Storm Copper Project. This robust initial MRE, combined with obvious expansion targets and favorable metallurgical characteristics, reinforces our belief in the potential of Storm Copper to become a world-class asset."

"The near-surface nature of the deposits, combined with the excellent metallurgical characteristics of the chalcocite mineralization, strongly supports the potential for a low-cost, high-margin operation. In addition, the exceptional exploration upside potential along the broader Storm Copper Belt provides a clear path for continued growth. We look forward to advancing Storm with our partners at American West, as work continues toward unlocking its full potential."

This announcement and the Mineral Resource Estimate for the Storm Project contained in it have been prepared solely by Aston Bay based on relevant available information and have not been reviewed or approved by American West, Aston Bay's Storm joint venture partner. American West is the manager of the Storm Joint Venture and holds the majority 80% joint venture interest. Whilst the information in this announcement pertaining to the estimation and reporting of the Mineral Resources has been reviewed and approved by a Qualified Person and the Mineral Resource estimate has been independently reviewed, the Company considers that it is possible that in preparing any future Mineral Resource Estimate or Mineral Reserve Estimate for the Storm Project, American West may adopt different interpretations, assumptions, parameters or plans, or make different judgements, to those used or made by Aston Bay in the Mineral Resource Estimate contained in this announcement.

Notes:

The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

Yungang Wu, M.Sc., P.Geo. of P&E Mining Consultants Inc. is the Qualified Person responsible for the completion of the Mineral Resource Estimation, with an effective date of February 7, 2025.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The quantity and grade of the reported Inferred Resources are uncertain in nature and there has not been sufficient work to define these Inferred Resources as Indicated or Measured Resources. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

All figures are rounded to reflect the relative accuracy of the estimates. Tonnages have been rounded to the nearest 1,000 t. Contained metal values have been rounded to the nearest 100 copper tonnes or 100,000 copper pounds, and to the nearest 100 silver ounces, Totals may not sum due to rounding.

Bulk density was assigned based on geological formation. The following median bulk density value for each formation was used: 2.81 g/cm3 (ADMW), 2.78 g/cm3 (BPF), 2.76 g/cm3 (VSM), and 2.68 g/cm3 (Scs).

The Mineral Resource Estimation is limited to material contained within estimation domains modelled using a nominal 0.3% copper mineralized envelope. Open pit constrained Mineral Resources are reported within the constraining pit shells, applying a lower cut-off grade of 0.35% Cu. Underground constrained Mineral Resources report all material within the potentially mineable shapes, regardless of whether the estimated grades exceed the optimized cut-off grade.

The constraining pit optimization parameters included a mining cost of US$5.00/t for both mineralized and waste material, a processing cost of US$7.00/t processed, and a G&A cost of US$12.00/t processed, resulting in a total operating cost of US$24.00/t. The copper price was set at US$4.00/lb Cu, with process recoveries of 75% for Cu and pit slopes of 45°.

Underground Mineral Resources include blocks below the constraining pit shell within underground potentially mineable shapes. A mining cost of US$47/t, in addition to the economic assumptions above, results in an underground Cu cut-off of 1.0%. Potentially mineable shapes encapsulate material within domains with a minimum vertical mining height of 2.5 m. All "take all" material within the potentially mineable shapes is reported, regardless of whether the estimated grades are above the optimized cut-off grade.

The Project also includes the Seal Zinc Deposit, which is located 28 km northwest of the Storm Copper MRE deposits on the northern shore of Aston Bay. The Seal Zinc Deposit hosts current Inferred Mineral Resources of 1.006 million tonnes at an average grade of 10.24% zinc (Zn) and 46.5 g/t Ag, containing 103,000 tonnes of zinc and 1,505,000 ounces of silver. A cut-off of 4.0% zinc equivalent (ZnEq) was applied, using the formula ZnEq% = Zn% + (Ag g/t / 39). The Seal Zinc Deposit MRE was prepared by P&E, with an effective date of October 6, 2017. A supporting Technical Report titled, "Initial Mineral Resource Estimate and Technical Report for the Seal Zinc Deposit, Aston Bay Property, Somerset Island, Nunavut," was also prepared by P&E and is available under the Company's SEDAR+ profile (www.sedarplus.ca).

Storm Copper Mineral Resource Estimation and Classification Methodology

Ordinary Kriging with locally varying anisotropy was used to estimate copper and silver grades within a 5.0 m (X) by 5.0 m (Y) by 2.5 m (Z) block model. The grade estimation process considered capped drill hole composites to ensure appropriate representation of shorter high-grade assays.

Two distinct mineralization styles have been identified at the Storm Copper Project: horizontal, strata-bound mineralization and steeply dipping, structurally controlled mineralization. Certain zones within the project exhibit both styles.

Indicated Mineral Resource block grade interpolation requires data from at least three drill holes within a search ellipse of 75 m by 75 m by 10 m for stratigraphic and mixed mineralization zones, and 35 m by 25 m by 10 m for structural mineralization zones. Inferred Mineral Resource grade interpolation requires data from at least two drill holes within a search ellipse of 120 m by 120 m by 10 m for stratigraphic mineralization, 85 m by 60 m by 10 m for structural mineralization, and 90 m by 90 m by 10 m for mixed mineralization zones. Only composites within a given grade estimation domain were used within that domain.

Measured Mineral Resources have not yet been defined. Further drilling is recommended to improve geological understanding and refine mineralization controls at the Storm Copper Project. Additional metallurgical testing across multiple zones will also be essential to characterize the metallurgical properties of the different mineralized areas.

The Storm MRE tonnage constrained to conceptual open pits and undergrounds represents 56% of the mineralized block model. As potential prices of copper and/or the metallurgical, mining, processing or other costs change, the other 44% of the model not currently contained within the conceptual open pits or undergrounds represents a target for potential future resource definition.

Sampling and Quality Assurance/Quality Control

The analytical work reported herein was performed by ALS Global ("ALS"), Vancouver, Canada. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geoanalytical laboratory and is independent of Aston Bay Holdings Ltd., American West Metals Limited, and the QP.

Samples were subject to 33-element geochemistry by four-acid digestion and inductively coupled plasma-atomic emission spectroscopy (ICP-AES) to determine concentrations of copper, silver, lead, zinc, and many other elements (ALS Method ME-ICP61a). Overlimit analyses for copper were re-assayed using an ore-grade four-acid digestion with an ICP finish.

Aston Bay Holdings Ltd. and American West Metals Limited followed industry standard procedures for the work carried out on the Storm Project, incorporating a quality assurance/quality control (QA/QC) program. Blank, duplicate, and certified reference materials (CRM) were inserted into the sample sequence and sent to the laboratory for analysis. QA/QC samples represented approximately 13% of all analytical samples. CRMs and blanks were inserted at a rate of one QAQC sample per 10 samples, and duplicates were collected at a rate of three per 100 samples. No significant QA/QC issues were detected during the review of the data.

Aston Bay Holdings Ltd. and American West Metals Limited are not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

The Storm Copper Initial MRE was completed by Yungang Wu, M.Sc., P.Geo. of P&E Mining Consultants Inc. Mr. Wu is a Qualified Person as defined by the NI 43-101 Standards of Disclosure for Mineral Projects and is independent of the Company. Mr. Wu has reviewed and verified the technical data disclosed in this news release related to the MRE.

Michael Dufresne, M.Sc., P.Geol., P.Geo., is a Qualified Person as defined by the NI 43-101 Standards of Disclosure for Mineral Projects, and has reviewed and approved the scientific and technical information in this press release.

About Aston Bay Holdings

Aston Bay is a publicly traded mineral exploration company exploring for high-grade critical and precious metal deposits in Nunavut, Canada and Virginia, USA.

The Company is currently exploring the Storm Copper Property and Cu-Ag-Zn-Co Epworth Property in Nunavut, as well as the high-grade Buckingham Gold Vein in central Virginia. The Company is also in advanced stages of negotiation on other lands with high-grade critical metals potential in North America

The Company and its joint venture partners, American West Metals Limited and its wholly-owned subsidiary, Tornado Metals Ltd. (collectively, "American West"), have formed a 20/80 unincorporated joint venture in respect of the Storm Project property, which hosts the Storm Copper Project and the Seal Zinc Deposit. Under the unincorporated joint venture, Aston Bay shall have a free carried interest until American West has made a decision to mine upon completion of a bankable feasibility study, meaning American West will be solely responsible for funding the joint venture until such decision is made. After such decision is made, Aston Bay will be diluted in the event it does not elect to contribute its proportionate share and its interest in the Storm Project property will be converted into a 2% net smelter returns royalty if its interest is diluted to below 10%.

FORWARD-LOOKING STATEMENTS

Statements made in this news release, including those regarding entering into the joint venture and each party's interest in the Project pursuant to the agreement in respect of the joint venture, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute "forward-looking statement", which can be identified by the use of conditional or future tenses or by the use of such verbs as "believe", "expect", "may", "will", "should", "estimate", "anticipate", "project", "plan", and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay's expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by securities legislation.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For more information contact:

Thomas Ullrich, Chief Executive Officer

[email protected]

(416) 456-3516

Sofia Harquail, IR and Corporate Development

[email protected]

(647) 821-1337

SOURCE: Aston Bay Holdings Ltd.

View the original press release on ACCESS Newswire

Y.Kobayashi--AMWN