-

Pacquiao 'hungry' for comeback after four-year layoff

Pacquiao 'hungry' for comeback after four-year layoff

-

'Job done': Sundowns coach proud despite Club World Cup exit

-

RFK Jr vaccine panel targets childhood vaccinations in first meeting

RFK Jr vaccine panel targets childhood vaccinations in first meeting

-

Tech giants' net zero goals verging on fantasy: researchers

-

Australia quicks hit back after strong West Indies bowling effort

Australia quicks hit back after strong West Indies bowling effort

-

Dortmund through to Club World Cup last 16, Fluminense deny Sundowns

-

Judge orders Trump admin to release billions in EV charging funds

Judge orders Trump admin to release billions in EV charging funds

-

Sale of NBA's $10 bn Lakers expected to close this year

-

US Fed proposes easing key banking rule

US Fed proposes easing key banking rule

-

Nvidia hits fresh record while global stocks are mixed

-

Elliott-inspired England to play Germany in Under-21 Euros final

Elliott-inspired England to play Germany in Under-21 Euros final

-

Gunmen kill 11 in crime-hit Mexican city

-

Mbappe absent from Real Madrid squad for Salzburg Club World Cup clash

Mbappe absent from Real Madrid squad for Salzburg Club World Cup clash

-

Sainz opts out of race for FIA presidency

-

Shamar Joseph rips through Australia top order in first Test

Shamar Joseph rips through Australia top order in first Test

-

Court rejects EDF complaint over Czech nuclear tender

-

Mbappe returns to Real Madrid training at Club World Cup

Mbappe returns to Real Madrid training at Club World Cup

-

Kenya anniversary protests turn violent, 8 dead

-

Elliott double fires England into Under-21 Euros final

Elliott double fires England into Under-21 Euros final

-

Trans campaigners descend on UK parliament to protest 'bathroom ban'

-

New York mayoral vote floors Democratic establishment

New York mayoral vote floors Democratic establishment

-

Trump claims 'win' as NATO agrees massive spending hike

-

EU probes Mars takeover of Pringles maker Kellanova

EU probes Mars takeover of Pringles maker Kellanova

-

Sidelined Zelensky still gets Trump face time at NATO summit

-

Mexico president threatens to sue over SpaceX rocket debris

Mexico president threatens to sue over SpaceX rocket debris

-

Amazon tycoon Bezos arrives in Venice for lavish wedding

-

Shamar Joseph gives West Indies strong start against Australia

Shamar Joseph gives West Indies strong start against Australia

-

Raducanu's Wimbledon build-up hit by Eastbourne exit

-

RFK Jr.'s vaccine panel opens amid backlash over fabricated study

RFK Jr.'s vaccine panel opens amid backlash over fabricated study

-

'You try not to bump into things:' blind sailing in Rio

-

Trump says 'three or four' candidates in mind for Fed chief

Trump says 'three or four' candidates in mind for Fed chief

-

Trump teases Iran talks next week, says nuclear programme set back 'decades'

-

Turkey tussles with Australia to host 2026 UN climate talks

Turkey tussles with Australia to host 2026 UN climate talks

-

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

-

James Webb telescope discovers its first exoplanet

James Webb telescope discovers its first exoplanet

-

Kenya's Kipyegon seeks history with four minute mile attempt

-

Gunmen kill 10 in crime-hit Mexican city

Gunmen kill 10 in crime-hit Mexican city

-

Olympic surfing venue battling erosion threat

-

Relief, joy as Israel reopens after Iran war ceasefire

Relief, joy as Israel reopens after Iran war ceasefire

-

Spain upholds fine against Rubiales for Hermoso forced kiss

-

Iran hangs three more accused of spying as fears grow for Swede

Iran hangs three more accused of spying as fears grow for Swede

-

Australia choose to bat first in first Test against West Indies

-

Gambhir backs India bowlers to 'deliver' despite first Test misery

Gambhir backs India bowlers to 'deliver' despite first Test misery

-

Trump reassures allies as NATO agrees 'historic' spending hike

-

England's Duckett says mindset change behind Test success

England's Duckett says mindset change behind Test success

-

Trump sees 'progress' on Gaza, raising hopes for ceasefire

-

UK's Glastonbury Festival opens gates amid Kneecap controversy

UK's Glastonbury Festival opens gates amid Kneecap controversy

-

Oil rebounds as markets track Iran-Israel ceasefire

-

Cable theft in north France disrupts Eurostar traffic

Cable theft in north France disrupts Eurostar traffic

-

Cambodians at quiet Thai border plead for peace

Orogen Royalties Announces 34% Increase in Gold Resources at the Merlin Deposit

VANCOUVER, BC / ACCESS Newswire / February 20, 2025 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce an update to the Expanded Silicon project in Nevada, USA. Project owner AngloGold Ashanti NA ("AngloGold") has announced an updated Inferred Resource of 12.1 million ounces gold at the Merlin deposit1. The new resource at Merlin is separate from the 4.22 million ounce gold resource at the Silicon deposit1, located approximately 270 metres to the northwest.

Orogen holds a 1% net smelter return royalty on the Expanded Silicon project that includes the Silicon and Merlin deposits with exposure to approximately 16.31 million ounces of gold (Table 1).

Table 1: Reported Mineral Resources at the Expanded Silicon Project1

Deposit | Category | Tonnes (millions) | Grade (g/t) | Contained Gold (million ounces) |

Silicon | Indicated | 121 | 0.87 | 3.40 |

Inferred | 36 | 0.70 | 0.81 | |

Total Silicon1 | 158 | 0.83 | 4.22* | |

Total Merlin2 | Inferred | 355 | 1.06 | 12.10 |

Total Expanded Silicon Project | 513 | 0.99 | 16.31* |

*Rounding of numbers may result in computational discrepancies in the Mineral Resource tabulations and are reported directly from AngloGold disclosure

1. The Silicon deposit mineral resource is based on a gold price of $1,750/oz

2. The Merlin deposit mineral resource is based on a gold price of $1,900/oz

Merlin Deposit Update Highlights

Pit constrained inferred resource at Merlin of 355 million tonnes grading 1.06 grams per tonne ("g/t") gold

Updated resource at Merlin represents a 25% increase in tonnes, a 34% increase in gold ounces, and a 7% increase in gold grade from the February 2024 announcement

Approximately 132 kilometres of drilling completed within the Merlin area in 2024

Exploration drilling east of Merlin appears to have encountered the fault offset extension of mineralization with results pending

Drilling at Merlin will continue into 2025 to support resource upgrades and conversion at the Merlin deposit with a pre-feasibility study expected H2-2025

"We are very pleased to see another 3.05 million ounces of gold have been added by AngloGold to the Merlin Resource, representing a significant increase in size and grade", commented Paddy Nicol, Orogen's CEO. "High-grade zones and mineralized stratigraphic units were refined, thereby improving the resource model leading to an increase in the declared inferred resource. We note from AngloGold Ashanti's presentation that next steps include additional infill and expansion drilling, resource upgrades, and engineering studies to support a pre-feasibility study toward the end of the year."

About the Expanded Silicon Project

Orogen holds a 74 square-kilometre 1% NSR royalty area of interest covering the Expanded Silicon project, which includes the Silicon and Merlin deposits (Figure 1). By the end of 2024, AngloGold completed over 430 kilometres of drilling on the project and announced resource updates on February 19, 2025. (Table 1).

Figure 1: Overview of AngloGold's Beatty Project, the Expanded Silicon Project and Orogen's royalty area of interest

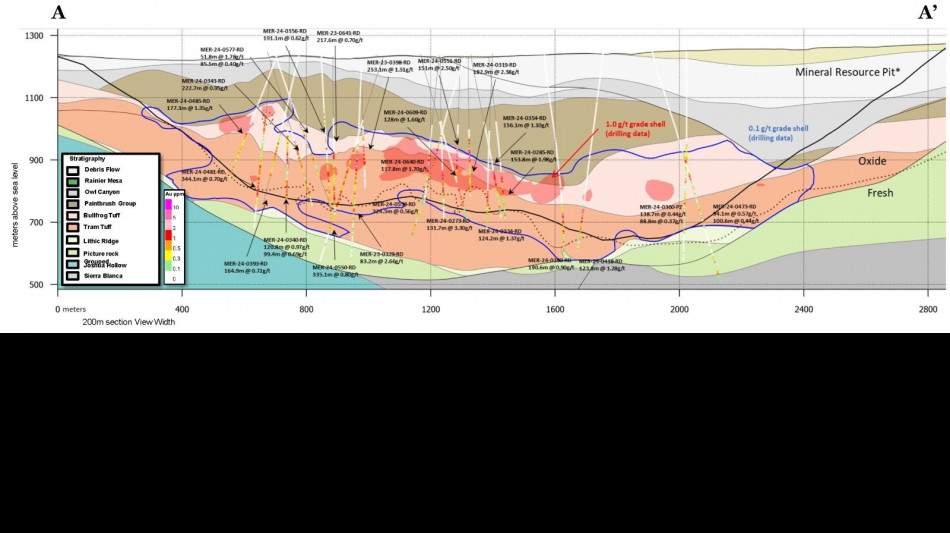

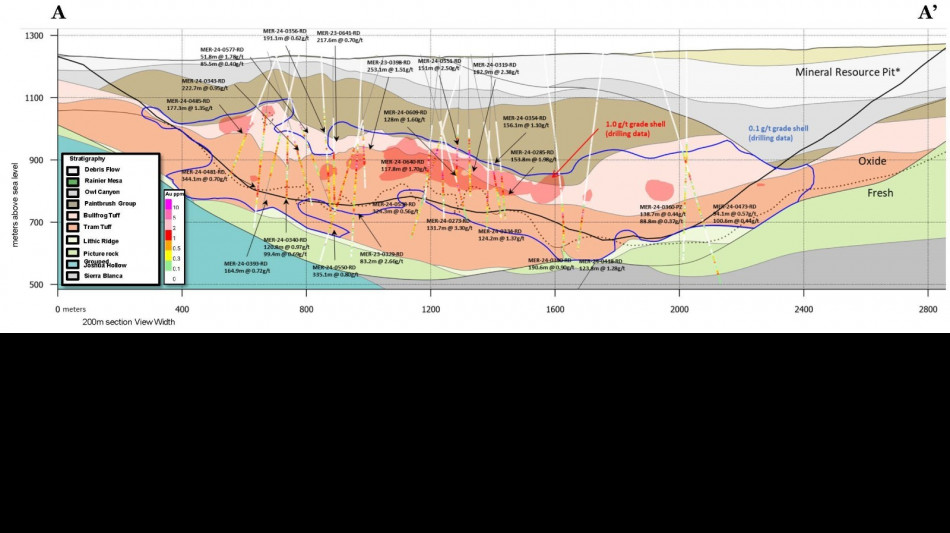

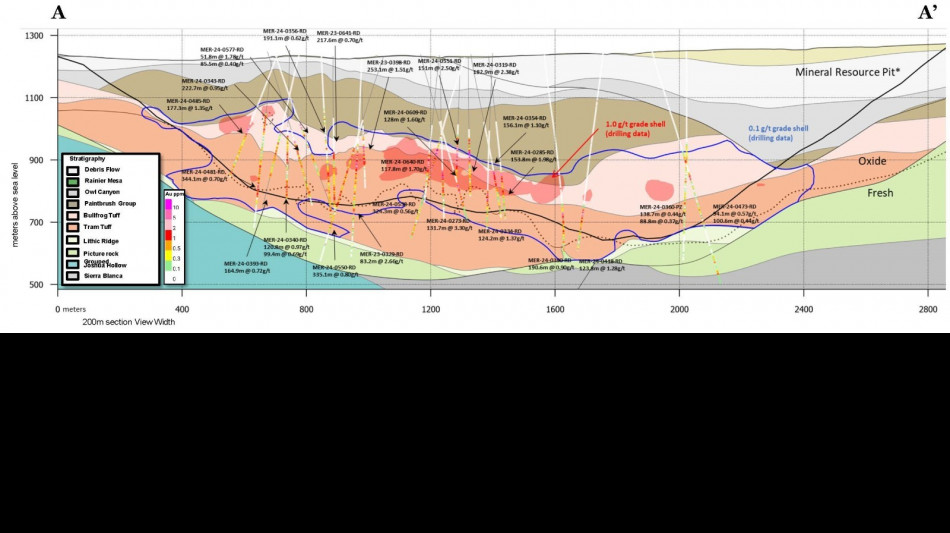

Merlin Geology, Mineralization and Exploration Potential

The Merlin deposit is interpreted as a low sulphidation epithermal gold system developed in an extensional setting between two strike slip faults. Mineralization is hosted within a stack of rhyolitic ignimbrite sheets cut by multiple normal faults, a subset of which appear to control the emplacement of the mineralization. Mineralization occurs as high-gold grade epithermal veins and stockworks and a low to moderate gold grade broad disseminated zone within silica-adularia altered tuffs. The deposit is oxidized to depths exceeding five hundred metres (Figure 3). The new pit design also increased 70% in size from 3.7 square kilometres in 2023 to 6.3 square kilometres to capture additional gold mineralization to the west of the main high-grade zone at Merlin (Figure 2).

The deposit remains open in multiple directions with drilling planned to define the limits of mineralization to the west of the current ore body and to better understand the mineralization and fault systems between Merlin and Silicon to the north (Figure 1). Additionally, the high-grade core at Merlin is offset by the Bare Mountain Fault to the southeast. A deeper drillhole completed towards the end of 2024 was positioned to test the hanging wall extension and encountered encouraging visual observations2. Assays from this hole are pending.

Figure 2: Plan view map of the 2024 Merlin Pit Design based on a gold price of US$1,900/oz Mineral resource. 3

Drill hole collars in blue.

Figure 3: Long section looking NW across the Merlin Deposit3 (Section location shown on Figure 2)

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Vice President of Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant company. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon Project (1.0% NSR royalty) in Nevada, U.S.A, being advanced by AngloGold Ashanti NA. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

https://thevault.exchange/?get_group_doc=143/1739954271-YearEnd2024EarningsRelease.pdf

https://thevault.exchange/?get_group_doc=143/1739961968-YearEnd2024ExplorationReport.pdf

https://thevault.exchange/?get_group_doc=143/1739957070-YearEnd2024Presentation.pdf

Neither TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire

F.Pedersen--AMWN