-

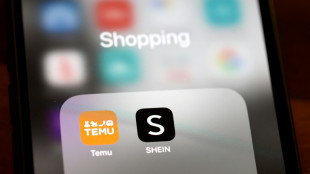

France targets cheap Chinese goods with fee on packages

France targets cheap Chinese goods with fee on packages

-

Amnesty accuses Israel of 'live-streamed genocide' in Gaza

-

Japan, Philippines leaders vow to deepen security ties

Japan, Philippines leaders vow to deepen security ties

-

AstraZeneca moves some production to US amid tariff threat

-

Shadman's ton gives Bangladesh lead in 2nd Zimbabwe Test

Shadman's ton gives Bangladesh lead in 2nd Zimbabwe Test

-

Barca's Yamal: I admire Messi but don't compare myself to him

-

Pfizer profits dip on lower Paxlovid sales

Pfizer profits dip on lower Paxlovid sales

-

French right-wing TV host fans talk of presidential bid

-

Two men in court charged with 'moronic' felling of famed UK tree

Two men in court charged with 'moronic' felling of famed UK tree

-

Amnesty accuses Israel of 'live-streamed genocide' against Gazans

-

Spotify posts record profit in first quarter

Spotify posts record profit in first quarter

-

Sciver-Brunt named as England women's cricket captain

-

GM profits top estimates, but automaker reviewing outlook due to tariffs

GM profits top estimates, but automaker reviewing outlook due to tariffs

-

Stock markets edge up as Trump softens tariff pain for auto firms

-

Pricier trainers? Adidas warns on US tariff impact

Pricier trainers? Adidas warns on US tariff impact

-

Spain, Portugal rule out cyberattack for massive blackout

-

Suryavanshi, 14, dubbed India's next superstar after shattering records

Suryavanshi, 14, dubbed India's next superstar after shattering records

-

Power back in Spain, Portugal after massive blackout

-

Pakistan says it shot down Indian drone along Kashmir border

Pakistan says it shot down Indian drone along Kashmir border

-

Cardinals run the media gauntlet ahead of conclave

-

BP profit drops 70% amid pivot back to oil and gas

BP profit drops 70% amid pivot back to oil and gas

-

Iran says fire contained after deadly blast at key port

-

Irish rappers Kneecap deny support for Hamas, Hezbollah

Irish rappers Kneecap deny support for Hamas, Hezbollah

-

Blackout plunges Spain into chaotic night of darkness

-

Convicted cardinal confirms he will sit out conclave

Convicted cardinal confirms he will sit out conclave

-

Kashmiris fortify bunkers anticipating India-Pakistan crossfire

-

Adidas warns US tariffs to push up prices

Adidas warns US tariffs to push up prices

-

Markets boosted as Trump softens tariff pain for auto firms

-

Suryavanshi, 14, dubbed 'next superstar' after batting records tumble

Suryavanshi, 14, dubbed 'next superstar' after batting records tumble

-

Australian doubles player Purcell accepts 18-month doping ban

-

Kashmir attack unites political foes in India, Pakistan

Kashmir attack unites political foes in India, Pakistan

-

Croatia hotel toasts dizzying century of stars, sovereigns and champagne

-

Kenya's desperate need for more snake antivenom

Kenya's desperate need for more snake antivenom

-

Les Kiss in frame with Wallabies set to name new coach

-

Cavaliers scorch Heat, Warriors down Rockets in thriller

Cavaliers scorch Heat, Warriors down Rockets in thriller

-

Opposition wins Trinidad and Tobago election, returning Persad-Bissessar as PM

-

Study sheds light on origin of Australia's odd echidna

Study sheds light on origin of Australia's odd echidna

-

France tries Syrian Islamist rebel ex-spokesman on war crime charges

-

Trump boasts of 'fun' 100 days, but Americans disenchanted

Trump boasts of 'fun' 100 days, but Americans disenchanted

-

Elitist no more, caviar is turning casual

-

Amnesty accuses Israel of 'live-streamed genocide' against Gaza Palestinians

Amnesty accuses Israel of 'live-streamed genocide' against Gaza Palestinians

-

Inter slump puts season at risk ahead of daunting Barca trip

-

Power returns to most of Spain, Portugal after massive blackout

Power returns to most of Spain, Portugal after massive blackout

-

'I have hope': Vietnam Babylift survivor's search for birth mother

-

US climate assessment thrown into doubt as Trump dismisses authors

US climate assessment thrown into doubt as Trump dismisses authors

-

Venezuelan president slams US over little girl's 'abduction'

-

Hard-right upstarts eye big gains in local UK polls

Hard-right upstarts eye big gains in local UK polls

-

Skulls, smoke and spirits: Thai ceremony for the unclaimed dead

-

Canada's Carney: political newcomer who says he's best in a crisis

Canada's Carney: political newcomer who says he's best in a crisis

-

Cavaliers scorch Heat to seal series sweep

Sokoman Minerals Corp. Closes Non-Brokered Flow-Through and Non-Flow-Through Private Placement Financing

ST JOHN'S, NL / ACCESS Newswire / February 3, 2025 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF)("Sokoman" or the "Company") is pleased to announce that, further to its December 4, 2024, December 17, 2024, and December 31, 2024 news releases the Company has closed its non-brokered flow-through and non-flow-through private placement financing (the "Financing") for aggregate gross proceeds of $1,706,250.

The Company has issued 36,412,500 $0.04 flow-through shares, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada), for $1,456,500.

The Company has also issued 7,135,714 $0.035 non-flow-through common shares for $249,750.

The FT Financing has been affected with one (1) insider subscribing for $10,000 or 250,000 FT Shares, that portion of the FT Financing a "related party transaction" as such term is defined under MI 61-101 - Protection of Minority Security Holders in Special Transactions. The Company is relying on exemptions from the formal valuation requirement of MI-61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company's market capitalization.

In connection with the Financing, the Company has paid cash finders' fees totaling CAD$57,200, issued 1,458,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year, and issued 1,200,000 common shares to four finders, as permitted by the policies of the Exchange.

All securities issued pursuant to the Financing are subject to a four-month and one-day hold period.

Final approval of the Financing is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement, please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: [email protected]

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: [email protected]

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

View the original press release on ACCESS Newswire

A.Malone--AMWN