-

'Cruel measure': Dominican crackdown on Haitian hospitals

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

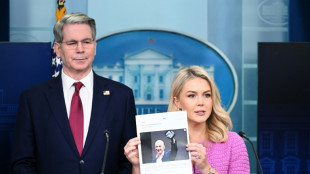

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Trossard starts for Arsenal in Champions League semi against PSG

-

Sweden shooting kills three: police

-

Real Madrid's Rudiger, Mendy out injured until end of season

Real Madrid's Rudiger, Mendy out injured until end of season

-

Dubois' trainer accuses Usyk of 'conning boxing world'

-

Femke Bol targets fast return after draining 2024

Femke Bol targets fast return after draining 2024

-

Asterix, Obelix and Netflix: US streamer embraces Gallic heroes

-

Watson wins Tour de Romandie prologue, Evenepoel eighth

Watson wins Tour de Romandie prologue, Evenepoel eighth

-

Amazon says never decided to show tariff costs, after White House backlash

-

India gives army 'operational freedom' to respond to Kashmir attack

India gives army 'operational freedom' to respond to Kashmir attack

-

Stocks advance as investors weigh earnings, car tariff hopes

-

Canadian firm makes first bid for international seabed mining license

Canadian firm makes first bid for international seabed mining license

-

Kardashian robbery suspect says heist was one 'too many'

-

'Chilled' Swiatek scrapes into Madrid Open last eight

'Chilled' Swiatek scrapes into Madrid Open last eight

-

Interconnectivity: the cornerstone of the European electricity network

-

France accuses Russian military intelligence of cyberattacks

France accuses Russian military intelligence of cyberattacks

-

Multiple challenges await Canada's Carney

-

US consumer confidence hits lowest level since onset of pandemic

US consumer confidence hits lowest level since onset of pandemic

-

How climate change turned Sao Paulo's drizzle into a storm

-

Video game rides conclave excitement with cardinal fantasy team

Video game rides conclave excitement with cardinal fantasy team

-

Candles and radios in demand in Spain as blackout lessons sink in

-

Boca Juniors sack coach Gago ahead of Club World Cup

Boca Juniors sack coach Gago ahead of Club World Cup

-

Trump celebrates tumultuous 100 days in office as support slips

-

Forest face 'biggest games of careers' in Champions League chase: Nuno

Forest face 'biggest games of careers' in Champions League chase: Nuno

-

Stocks waver as investors weigh earnings, car tariff hopes

-

US climate assessment in doubt as Trump dismisses authors

US climate assessment in doubt as Trump dismisses authors

-

W. House slams Amazon over 'hostile' plan to display tariff effect on prices

-

What we know ahead of conclave to elect new pope

What we know ahead of conclave to elect new pope

-

EU top court rules 'golden passport' schemes are illegal

Wolfden Closes Sale of a Timberland Parcel for $2.1 Million in Non-Dilutive Financing

TORONTO, ON / ACCESS Newswire / January 30, 2025 / Wolfden Resources Corporation (TSXV:WLF) ("Wolfden"or the"Company")is pleased to announce that it has closed the sale of a 3,770 acre parcel (the "Severed Land") from its 6,862 acre timberland property in Maine for gross proceeds of $2.1 million (US$1.5 million) as per its announcement of January 20, 2025. The Severed Land is situated north of its wholly owned Pickett Project where Wolfden has retained 3,082 acres (the "Retained Land") that is host to a high grade polymetallic critical mineral deposit along with all mineral resources and known exploration upside.

As per the terms of the property sale agreement dated January 16, 2025, in respect of the Severed Land, Wolfden retains exclusive rights to explore and buy-back the mineral rights of the Severed Land for a period of five years.

In addition, Altius Royalty Corporation ("Altius"), who had purchased in 2022, an increase in its timber rights and carbon credits from 20% to 30%, along with the right to received the next US$1.5 million in timber proceeds from the 6,862 acre property in consideration for US$1.0 million, has amended its royalty agreement with the Company whereby Altius has forfeited its timber and carbon rights on the Severed Land for the following terms: 1) Altius will retain all of its timber rights and carbon credits on Wolfden's Retained Land, and 2) Altius shall hold an option, that expires January 16, 2030 to convert US$1.0 million (less any future timber harvest proceeds paid to Altius since January 2025) into common shares of the Company at a conversion price that is the greater of C$0.30 per share or the 20-day VWAP of common shares of the Company at the time of conversion, subject to Altius not holding more than 19.9% of the issued and outstanding common shares of the Company or being issued more than 10% of the number of outstanding common shares of the Company, and 3) Should Wolfden sell the Retained Lands at arm's length to a third party, Altius shall receive up to US$1.0 million from the sale proceeds (less any timber harvest proceeds plus any value converted into shares of the Company that Altius received since January 16, 2025). Should either option 2) or 3) occur, Altius will have forfeited its timber rights and carbon credits to the Retained Land. Altius's previous option to convert all of its Pickett Project royalties including minerals, timber and carbon credits, into common shares of the Company and cash, was not exercised and expired on November 15, 2023.

The Severed Land sale transaction is arm's length in nature and was settled in cash and may include up to a 2% finder's fee commission. The amendment to the Altius royalty agreement is considered not to be at arm's length as Altius owns more than 10% of the outstanding shares of the Company. The amendment is considered to be a "related party transaction" for the purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") and is exempt from the formal valuation requirement pursuant to section 5.5(b) of MI 61-101 as the Company is not listed on a specified market within the meaning of MI 61-101 and furthermore, the amendment is exempt from the minority approval requirement pursuant to section 5.7(1)(a) of MI 61-101 on the basis that neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the amendment to the royalty agreement, insofar as it involves Altius, exceeds 25 per cent of the Issuer's market capitalization at the time of the amendment.

About Wolfden

Wolfden is a North American exploration and development company focused on high-margin metallic mineral deposits including precious, base, and strategic metals. It has two nickel sulphide deposits in Manitoba and one of the highest-grade polymetallic projects in the USA (Zn, Pb, Cu, Ag, Au) that represent significant development projects with the potential to be domestic sources of ethically produced base and critical metals in North America.

For further information please contact Ron Little, President & CEO at (807) 624-1136.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events, including closing of the sale of the Severed Land and the potential for projects to be domestic sources of ethically produced base and critical metals for the expansion of renewable energy in North America. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, metal price assumptions, cash flow forecasts, permitting, land transactions, timber harvesting, community and other regulatory approvals, and the timing and completion of exploration programs in the USA, Manitoba, New Brunswick and the respective drill results. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Wolfden Resources Corp.

View the original press release on ACCESS Newswire

L.Davis--AMWN