-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

-

Sweden shooting kills three: police

Sweden shooting kills three: police

-

Real Madrid's Rudiger, Mendy out injured until end of season

-

Dubois' trainer accuses Usyk of 'conning boxing world'

Dubois' trainer accuses Usyk of 'conning boxing world'

-

Femke Bol targets fast return after draining 2024

-

Asterix, Obelix and Netflix: US streamer embraces Gallic heroes

Asterix, Obelix and Netflix: US streamer embraces Gallic heroes

-

Watson wins Tour de Romandie prologue, Evenepoel eighth

-

Amazon says never decided to show tariff costs, after White House backlash

Amazon says never decided to show tariff costs, after White House backlash

-

India gives army 'operational freedom' to respond to Kashmir attack

-

Stocks advance as investors weigh earnings, car tariff hopes

Stocks advance as investors weigh earnings, car tariff hopes

-

Canadian firm makes first bid for international seabed mining license

-

Kardashian robbery suspect says heist was one 'too many'

Kardashian robbery suspect says heist was one 'too many'

-

'Chilled' Swiatek scrapes into Madrid Open last eight

-

Interconnectivity: the cornerstone of the European electricity network

Interconnectivity: the cornerstone of the European electricity network

-

France accuses Russian military intelligence of cyberattacks

-

Multiple challenges await Canada's Carney

Multiple challenges await Canada's Carney

-

US consumer confidence hits lowest level since onset of pandemic

-

How climate change turned Sao Paulo's drizzle into a storm

How climate change turned Sao Paulo's drizzle into a storm

-

Video game rides conclave excitement with cardinal fantasy team

-

Candles and radios in demand in Spain as blackout lessons sink in

Candles and radios in demand in Spain as blackout lessons sink in

-

Boca Juniors sack coach Gago ahead of Club World Cup

-

Trump celebrates tumultuous 100 days in office as support slips

Trump celebrates tumultuous 100 days in office as support slips

-

Forest face 'biggest games of careers' in Champions League chase: Nuno

-

Stocks waver as investors weigh earnings, car tariff hopes

Stocks waver as investors weigh earnings, car tariff hopes

-

US climate assessment in doubt as Trump dismisses authors

-

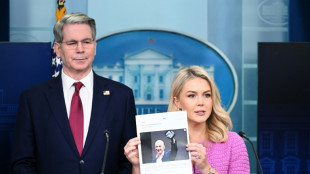

W. House slams Amazon over 'hostile' plan to display tariff effect on prices

W. House slams Amazon over 'hostile' plan to display tariff effect on prices

-

What we know ahead of conclave to elect new pope

-

EU top court rules 'golden passport' schemes are illegal

EU top court rules 'golden passport' schemes are illegal

-

Mounds of waste dumped near Athens's main river: NGO

American Resources Corporation's American Infrastructure Corporation Closes Merger with CGrowth Capital, Inc

The merger has been successfully completed based on the December 30th, 2024 binding contract announced on January 6th, 2025.

American Infrastructure Corporation is now publicly listed and a wholly owned division of CGrowth Capital, Inc, which will be renamed American Infrastructure Holding Corporation

The combined company plans to pursue an uplisting to a senior national exchange

FISHERS, IN / ACCESS Newswire / January 28, 2025 / American Resources Corporation (NASDAQ:AREC) ("American Resources" or the "Company") announced that its partially owned subsidiary, American Infrastructure Corporation ("AIC"), a supplier of raw material to the infrastructure marketplace with a focus on iron ore, titanium and metallurgical carbon, has successfully completed its merger with CGrowth Capital, Inc. (OTC:CGRA) ("CGrowth Capital" or "CGRA"). In conjunction with the merger with CGRA, the Company has established a framework to support future financing for both organic growth and acquisitions within the infrastructure sector, in alignment with its overall business strategy.

Mark Jensen, Executive Chairman of American Infrastructure Corporation, commented, "Closing the previously announced binding agreement with CGrowth Capital represents a significant milestone for American Infrastructure and its shareholders. As a standalone public company focused on expanding its presence in the mining and infrastructure marketplace, our goal of building high-value royalty structures presents a substantial opportunity for both our shareholders and those of CGRA. We believe that, given the new administration's emphasis on energy and infrastructure growth, we are well-positioned to capitalize on the undercapitalized and distressed assets within the infrastructure marketplace. This is an opportune time to be a pure-play infrastructure company, especially with the increasing focus on domestic infrastructure initiatives in the United States. Our strategy remains centered on leveraging our royalty and leasehold production model, which enables us to generate cash flow by partnering with experienced local operators with a proven track record of success in the region. We are optimistic about the opportunities ahead in 2025 as we continue to grow the business. We also want to extend our gratitude to Nick Link and his team for their efforts establishing a strong platform like CGrowth Capital."

Common shareholders of American Infrastructure, as consideration for the merger, will receive a Series A Preferred Stock in exchange for their common shares, which can be converted into common shares of the post-merger, combined company, American Infrastructure Holding Corporation, at the holder's discretion. Per the previously established record date, for the distribution of shares of American Infrastructure Corporation to the underlying shareholders of American Resources Corporation, those investors will now receive there prorate Series A Preferred Shares of CGrowth Capital, Inc. on February 14, 2025.

Under the terms of the Agreement, American Infrastructure Corporation is a wholly owned subsidiary of CGrowth Capital, Inc., which will change its name to American Infrastructure Holding Corporation. The American Infrastructure team will assume management of CGRA and nominate new board members, with Nick Link, the former Chief Executive Officer of CGRA, remaining on the board of the combined entity. The previously existing operations and assets of CGRA will be spun-out of that entity concurrent with this transaction, leaving the operations of American Infrastructure Corporation as the sole operations of the combined entity.

American Resources has received multiple term sheets and letters of interest for structured transactions over the last year for the American Infrastructure Corporation operations, ranging in value from $150 million to $280 million in total value to American Infrastructure. The structured nature of such previous transactions were not acceptable to the Board of Directors of American Infrasturure, and thus not enacted upon. The merger with CGRA is structured to reflect the growth opportunities and achieve such value for the combined entity, with the prospects of additional growth capital to unlock the company's value in the future.

About American Infrastructure Corporation

American Infrastructure Corporation is a raw material supplier to the infrastructure marketplace with a focus on metallurgical carbon, iron ore and titanium. Current operations are primarily focused on the extraction, processing, transportation, and distribution of coal for a variety of industries, with a primary focus on metallurgical quality coal to the steel industry. The company has six coal mining and processing operating subsidiaries in the metallurgical carbon industry located in Eastern Kentucky and West Virginia along with a substantial iron ore and titanium asset base in the mining region of Jamaica. For more information visit americaninfracorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

About American Resources Corporation

American Resources Corporation is a leader in the critical mineral supply chain, developing innovative solutions both upstream and downstream of the refining process. The company and its affiliates focus on the extraction and processing of metallurgical carbon and iron ore, essential ingredients in steelmaking, as well as critical and rare earth minerals for the electrification market and recycled metals.

Leveraging its affiliation and former parent status of ReElement Technologies Corporation, a leading provider of high-performance refining capacity for rare earth and critical battery elements, American Resources is investing in and developing efficient upstream and downstream critical mineral operations. These operations include mining interests in conventional and unconventional sources, recycling, and manufacturing.

American Resources has established a nimble, low-cost business model centered on growth, which provides a significant opportunity to scale its portfolio of assets to meet the growing global infrastructure and electrification markets while also continuing to acquire operations and significantly reduce their legacy industry risks. Its streamlined and efficient operations are able to maximize margins while reducing costs. For more information visit americanresourcescorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

About CGrowth Capital Inc.

CGrowth Capital Inc. (OTC PINK:CGRA) is a public holding company for alternative and undervalued assets. The company is sector and industry agnostic and currently consists of two divisions including Mining and Sports Technology. The company is focused on investing in growth-oriented opportunities where the company's capital, expertise, and capabilities can help create significant added value for shareholders. For more information visit https://cgrowthcapital.com.

Special Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause the Company's actual results, performance, or achievements or industry results to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. These statements are subject to a number of risks and uncertainties, many of which are beyond American Resources Corporation's control. The words "believes", "may", "will", "should", "would", "could", "continue", "seeks", "anticipates", "plans", "expects", "intends", "estimates", or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Any forward-looking statements included in this press release are made only as of the date of this release. The Company does not undertake any obligation to update or supplement any forward-looking statements to reflect subsequent events or circumstances. The Company cannot assure you that the projected results or events will be achieved.

Investor Contact:

JTC Team, LLC

Jenene Thomas

833-475-8247

[email protected]

Company Contact:

Mark LaVerghetta

317-855-9926 ext. 0

[email protected]

CGrowth Capital Inc. Contact

SOURCE: American Resources Corporation

View the original press release on ACCESS Newswire

C.Garcia--AMWN