-

Win or bust in Europa League for Amorim's Man Utd

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

-

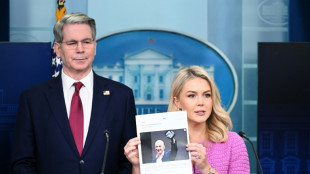

Trump fires ex first gentleman Emhoff from Holocaust board

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Trossard starts for Arsenal in Champions League semi against PSG

-

Sweden shooting kills three: police

-

Real Madrid's Rudiger, Mendy out injured until end of season

Real Madrid's Rudiger, Mendy out injured until end of season

-

Dubois' trainer accuses Usyk of 'conning boxing world'

-

Femke Bol targets fast return after draining 2024

Femke Bol targets fast return after draining 2024

-

Asterix, Obelix and Netflix: US streamer embraces Gallic heroes

-

Watson wins Tour de Romandie prologue, Evenepoel eighth

Watson wins Tour de Romandie prologue, Evenepoel eighth

-

Amazon says never decided to show tariff costs, after White House backlash

-

India gives army 'operational freedom' to respond to Kashmir attack

India gives army 'operational freedom' to respond to Kashmir attack

-

Stocks advance as investors weigh earnings, car tariff hopes

-

Canadian firm makes first bid for international seabed mining license

Canadian firm makes first bid for international seabed mining license

-

Kardashian robbery suspect says heist was one 'too many'

Guardian Metal Resources PLC Announces Option to Acquire Tempiute Tungsten Project Signed

Option to Acquire Former Producing Tempiute Tungsten Project Signed

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2025 / Guardian Metal Resources plc (LON:GMET)(OTCQX:GMTLF), a strategic development and mineral exploration company focused in Nevada, USA, is pleased to announce that it has completed the required due diligence and now signed the Definitive Exploration Lease and Option to Purchase Agreement ("Definitive" or the "Agreement") with Hinkinite Resources LLC ("Hinkinite" or the "Optionor") for the Tempiute Tungsten Project ("Tempiute" or the "Project"). Tempiute, also formerly known as the Emerson Tungsten Mine, is located in south-central Nevada less than 240 km north of Las Vegas in Lincoln County.

Highlights:

Signing of the Agreement marks a significant step forward for Guardian Metal in its mission to lead reshoring efforts for critical metals in the U.S., specifically tungsten, aligning with U.S. president Donald Trump's plan of 'Unleashing American Energy'.

Tempiute, a historical tungsten producer as recently as the late 1980s, boasts extensive in-place infrastructure and lies almost entirely within patented (private) mining claims, providing a robust foundation for rapid redevelopment.

The Company's Chairman, CEO, select advisers and members of Guardian Metal's engineering team will be completing a site visit to Tempiute in the second week of February with a goal of immediately aligning on next key steps to advance the Project with groundwork expected to commence shortly thereafter.

Oliver Friesen, CEO of Guardian Metal, commented:

"We are very pleased to have finalised the Agreement allowing for a 100% acquisition of the former producing Tempiute/Emerson Tungsten Project. Importantly, this asset, along with our Pilot Mountain tungsten project, represents a significant holding of U.S.-domiciled tungsten projects located in the mining friendly state of Nevada. We are positioned as a leader in U.S. tungsten at a critical time following the declaration of a 'National Energy Emergency 'as well as the 'Unleashing American Energy' Executive Order signed by President Donald Trump; both of which point to the U.S. urgency to reshore its mined supply chains of critical metals including tungsten.

"Tempiute has been a domestic U.S. tungsten producer during multiple periods over the last 100 years, and we strongly believe, given the significant tailwinds across the U.S. critical metals space, that it can under Guardian's guidance once again supply U.S. consumers with tungsten that has been mined in America."

Further Details:

Hinkinite is a privately owned and operated Utah-based company focused on the prospecting and development of precious, base-metal and industrial material deposits as well as on revitalising historic mining operations located throughout the western United States.

A Letter of Intent to acquire the Project was signed on 31 October 2024 the details of which are outlined in the below:

Following this, a due diligence update was provided on 18 December 2024 the details of which are outlined in the below:

Commercial Terms:

As the definitive agreement (the "Definitive" or "Definitive Agreement") to acquire the Option has now been signed, a cash payment of US$50,000 will be made to Hinkinite along with the issue to Hinkinite of 150,000 ordinary shares in Guardian Metal ("Consideration Shares") within the coming days.

Until such time as the Option is exercised or the Definitive Agreement is terminated, Guardian Metal will pay Hinkinite a cash payment of US$25,000 at the end of each six-month period following the date of the Definitive Agreement.

In order to exercise the Option, Guardian Metal will be required, (i) within three (3) years of the date of the Definitive Agreement, to establish on the Property a "mineral resource" of tungsten trioxide (WO3) with a minimum cut off grade of 0.4%, prepared in accordance with either the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended, or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the "Maiden Resource"), and (ii) within five (5) business days of the announcement of the Maiden Resource to pay Hinkinite a bonus of US$100,000 for each 3,100 tons (WO3 metal) of such Maiden Resource (the "Bonus Payment"), equal to US$1,000,000 for a 31,000 ton (WO3 metal) Maiden Resource, up to a maximum Bonus Payment of US$2,000,000. Guardian Metal may, in its sole discretion, satisfy up to 50% of the Bonus Payment by issuing to Hinkinite ordinary shares in Guardian Metal at a deemed price per share equal to the volume weighted average trading price of Guardian Metal's ordinary shares on the London Stock Exchange for the last ten (10) trading days ("10-day VWAP") calculated as of the date of the announcement of the Maiden Resource, converted from pounds sterling to United States dollars using the Bank of England daily spot exchange rate as of the date of the announcement. In the event that Guardian Metal does not establish a Maiden Resource and make the Bonus Payment within three (3) years of the date of the Definitive Agreement, the Definitive Agreement will terminate and Hinkinite will retain a 100% interest in the Property.

Upon Guardian Metal having established a Maiden Resource and payment of the Bonus Payment, Guardian Metal will be deemed to have acquired a 100% interest in the Project. Hinkinite will retain a limited license to explore for and mine industrial minerals, such as sand, gravel and limestone, on the Property at its own cost and risk, subject to Guardian Metal's prior and superior right to explore for, develop and mine other minerals on the Project.

Upon exercise of the Option, Guardian Metal will grant Hinkinite a production royalty equal to 1.5% of the net smelter returns from all mineral production from the Project (the "NSR Royalty"). Guardian Metal may, at any time after the grant of the NSR Royalty, repurchase 50% of the NSR Royalty for a one time payment of US$1,000,000 by Guardian Metal to Hinkinite, payable at the option of Guardian Metal in cash or in Guardian Metal ordinary shares at a deemed price per share equal to the 10-Day VWAP converted from pounds sterling to United States dollars using the Bank of England daily spot exchange rate calculated as of the date that Guardian Metal provides notice to Hinkinite of its election to repurchase. The balance of the NSR Royalty after repurchase will be 0.75% of the net smelter returns from all mineral production on the Project.

Media

Application will be made for the 150,000 Consideration Shares to be admitted to trading on AIM which is expected to occur on or around 30 January 2025 ("Admission"). The Consideration Shares will rank pari passu in all respects with the ordinary shares of the Company currently traded on AIM.

Following Admission of the Consideration Shares and of the 931,873 Warrant Shares issued and announced on 24 January 2025, the Company's issued share capital will comprise 126,422,687 ordinary shares of 1p each. This number will represent the total voting rights in the Company and may be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in, the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of Article 7 of EU Regulation 596/2014 (which forms part of domestic UK law pursuant to the European Union (Withdrawal) Act 2018). The Directors of the Company are responsible for the contents of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to execute and implement future plans, and the occurrence of unexpected events.

Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

For further information visit www.Guardianmetalresources.com or contact the following:

Guardian Metal Resources plc Oliver Friesen (CEO) | Tel:+44 (0) 20 7583 8304 |

Cairn Financial Advisers LLP Nominated Adviser Sandy Jamieson/Jo Turner/Louise O'Driscoll | Tel: +44 20 7213 0880 |

Shard Capital Partners LLP Lead Broker Damon Heath/Erik Woolgar | Tel: +44 (0) 20 7186 9000 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

View the original press release on ACCESS Newswire

D.Sawyer--AMWN