-

Most stock markets rise despite China data, eyes on US reports

Most stock markets rise despite China data, eyes on US reports

-

TotalEnergies profits drop as prices slide

-

Volkswagen says tariffs will dampen business as profit plunges

Volkswagen says tariffs will dampen business as profit plunges

-

Jeep owner Stellantis suspends 2025 earnings forecast over tariffs

-

China's Shenzhou-19 astronauts return to Earth

China's Shenzhou-19 astronauts return to Earth

-

French economy returns to thin growth in first quarter

-

Ex-Premier League star Li Tie loses appeal in 20-year bribery sentence

Ex-Premier League star Li Tie loses appeal in 20-year bribery sentence

-

Belgium's green light for red light workers

-

Haliburton leads comeback as Pacers advance, Celtics clinch

Haliburton leads comeback as Pacers advance, Celtics clinch

-

Rahm out to break 2025 win drought ahead of US PGA Championship

-

Japan tariff envoy departs for round two of US talks

Japan tariff envoy departs for round two of US talks

-

Djurgarden eyeing Chelsea upset in historic Conference League semi-final

-

Haliburton leads comeback as Pacers advance, Pistons stay alive

Haliburton leads comeback as Pacers advance, Pistons stay alive

-

Bunker-cafe on Korean border paints image of peace

-

Tunics & turbans: Afghan students don Taliban-imposed uniforms

Tunics & turbans: Afghan students don Taliban-imposed uniforms

-

Asian markets struggle as trade war hits China factory activity

-

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

-

Spurs attempt to grasp Europa League lifeline to save dismal season

-

Thawing permafrost dots Siberia with rash of mounds

Thawing permafrost dots Siberia with rash of mounds

-

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Helium One Global Ltd Announces Jackson-27 Flow Test Results & Gas Analysis Update

-

Argo Blockchain PLC Announces Financial Update and Listing Suspension Request

Argo Blockchain PLC Announces Financial Update and Listing Suspension Request

-

Guardian Metal Resources PLC Announces Tempiute Mine Project - Geological Update

-

Agronomics Limited Announces BlueNalu Expands Partnership with Nomad Foods

Agronomics Limited Announces BlueNalu Expands Partnership with Nomad Foods

-

Helium One Global Ltd Announces Jackson-2 Spud at Galactica Project

-

Global Industry Leaders to Address Critical Trade Changes at Licensing Expo 2025

Global Industry Leaders to Address Critical Trade Changes at Licensing Expo 2025

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

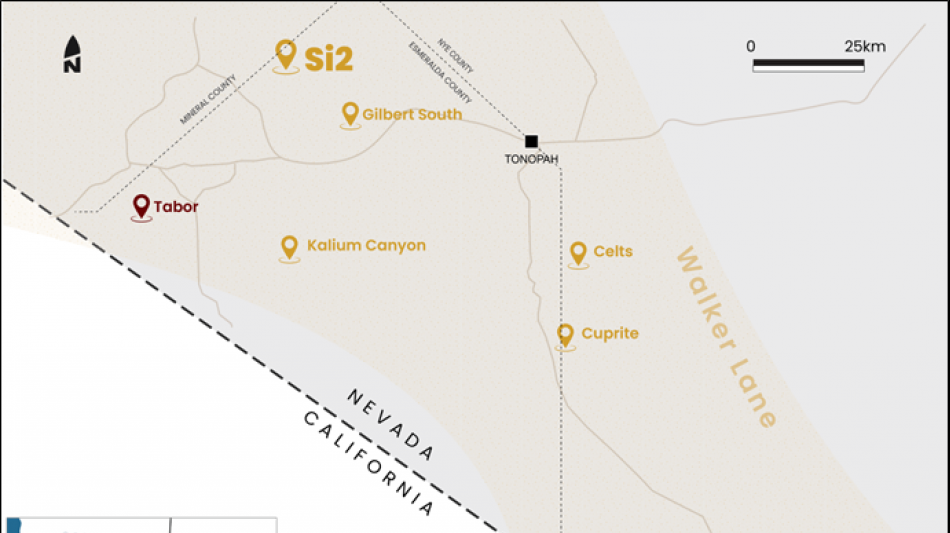

Orogen Royalties Creates a New Royalty on the Si2 Gold Project

VANCOUVER, BC / ACCESS Newswire / January 16, 2025 / Orogen Royalties Inc. (TSXV:OGN)(OTCQX:OGNRF) ("Orogen" or the "Company") is pleased to announce that the Company has signed a purchase and sale agreement (the "Agreement") with K2 Gold Corporation ("K2") (TSXV:KTO) whereby K2 has acquired the Si2 gold project ("Si2" or the "Project"), located in Nevada, USA. The Agreement replaces the option agreement ("Option Agreement") previously signed between Orogen and K2 on January 19, 2022.1

To acquire a 100% interest in Si2, K2 will pay C$250,000 in cash or common shares of K2, at the discretion of K2. Orogen will also retain a 2% net smelter return ("NSR") royalty. The Agreement follows on from the now terminated Option Agreement between Orogen and K2 whereby K2 made cash payments to Orogen totaling US$200,000 and incurred over C$2.3 million in exploration expenditures.

The common shares issued pursuant to the Agreement are subject to the regulatory approval of the TSX Venture Exchange.

"K2's initial efforts indicate the Si2 gold project shares many similarities with the multi-million ounce Expanded Silicon Project in the Beatty district, where Orogen holds a 1% NSR royalty2," commented Orogen CEO Paddy Nicol. "By purchasing the Project outright, K2 will be able to advance Si2 methodically within the constraints of the challenging equity market for junior exploration companies. We are excited to see K2's exploration team advance another asset in Nevada's prolific Walker Lane Trend."

About the Si2 Gold Project

The Si2 project is located approximately 50 kilometres northwest of Tonopah, Nevada and covers the northeast four square-kilometres of a large steam heated alteration cell hosted by a rhyolite flow dome complex. Alteration at surface is dominated by pervasive alunite and chalcedony replacement of breccias associated with highly anomalous mercury. Breccias and altered domes define an annular zone cored by a large recessive area of shallow alluvium. Small, altered exposures in the central portion of the target include milled hydrothermal breccias with leached silica textures and cross-cutting chalcedonic silica veins.

In 2023, K2 completed a four-hole 1,777 metre drill program on the project designed to test fault structures thought to control the steam-heated alteration observed at surface. The holes intersected alteration consistent with an epithermal system including broad zones of silicification accompanied by disseminated pyrite, quartz-pyrite veinlets, as well as discrete intervals of black quartz-pyrite bearing breccias. Assay results returned broad anomalous gold intercepts (up to 185 metres). The results demonstrate the gold bearing potential of the system with hole SD-23-001 ending in 3.2 metres of 0.52 g/t gold.

Figure 1: Location Map of the Si2 Project

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (2% NSR royalty) being mined by First Majestic Silver Corp. and the Expanded Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti NA. The Company is well financed with several projects actively being explored under joint ventures.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

[email protected]

https://orogenroyalties.com/news-releases/orogen-options-the-si2-gold-project-to-k2-gold/

https://www.anglogoldashanti.com/portfolio/reserves-resources/

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire

C.Garcia--AMWN