-

NFL's Raiders fire head coach Pierce

NFL's Raiders fire head coach Pierce

-

Deschamps to step down as France coach after 2026 World Cup: team source

-

Newcastle win at Arsenal to put one foot in League Cup final

Newcastle win at Arsenal to put one foot in League Cup final

-

Race begins to replace Canadian PM Trudeau

-

Wildfire sparks panicked evacuations in Los Angeles suburb

Wildfire sparks panicked evacuations in Los Angeles suburb

-

NASA eyes SpaceX, Blue Origin to cut Mars rock retrieval costs

-

Eyeing green legacy, Biden declares new US national monuments

Eyeing green legacy, Biden declares new US national monuments

-

Venezuela's Gonzalez Urrutia says son-in-law detained in new clampdown

-

Invisible man: German startup bets on remote driver

Invisible man: German startup bets on remote driver

-

Turkey threatens military operation against Syrian Kurdish fighters

-

Second accused in Liam Payne drug death surrenders: Argentine police

Second accused in Liam Payne drug death surrenders: Argentine police

-

Disinformation experts slam Meta decision to end US fact-checking

-

Freewheeling Trump sets out US territorial ambitions

Freewheeling Trump sets out US territorial ambitions

-

'Snowball's chance in hell' Canada will merge with US: Trudeau

-

Daglo, feared Darfuri general accused by US of genocide

Daglo, feared Darfuri general accused by US of genocide

-

Trump Jr. in Greenland on 'tourist' trip as father eyes territory

-

Chat leaves Racing by 'mutual consent' after Christmas party incident

Chat leaves Racing by 'mutual consent' after Christmas party incident

-

TVs get smarter as makers cater to AI lifestyles

-

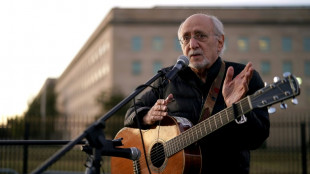

Peter Yarrow of Peter, Paul and Mary dead at 86

Peter Yarrow of Peter, Paul and Mary dead at 86

-

Dyche accepts Everton job under scrutiny from new owners

-

US urged to do more to fight bird flu after first death

US urged to do more to fight bird flu after first death

-

Trump says NATO members should raise defense spending to 5% of GDP

-

X's 'Community Notes': a model for Meta?

X's 'Community Notes': a model for Meta?

-

Freewheeling Trump sets out territorial ambitions

-

England skipper Stokes undergoes hamstring operation

England skipper Stokes undergoes hamstring operation

-

Inflation concerns pull rug out from Wall Street rally

-

Ban for Wolves striker Cunha cut after offer to buy new glasses for security guard

Ban for Wolves striker Cunha cut after offer to buy new glasses for security guard

-

Olmo situation could affect future signings: Barca's Raphinha

-

US sanctions top Hungary minister over 'corruption'

US sanctions top Hungary minister over 'corruption'

-

Frigid temps hit US behind major winter storm

-

Former Cambodian opposition MP shot dead in Bangkok: Thai media

Former Cambodian opposition MP shot dead in Bangkok: Thai media

-

US says Sudan's RSF committed 'genocide' in Darfur

-

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

-

Barca's Olmo absence 'better' for us: Athletic coach Valverde

-

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

-

Spurs boss Postecoglou not in favour of VAR stadium announcements

-

Meta abruptly ends US fact-checks ahead of Trump term

Meta abruptly ends US fact-checks ahead of Trump term

-

Quake in China's Tibet kills 126 with tremors felt in Nepal, India

-

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

-

Postecoglou wants trophy for Son as Spurs extend contract

-

Loeb limps home as teenager wins Dakar stage

Loeb limps home as teenager wins Dakar stage

-

US trade deficit widens in November on imports jump

-

Macron irks allies, left with Africa 'forgot to say thank you' jibe

Macron irks allies, left with Africa 'forgot to say thank you' jibe

-

Key dates in the rise of the French far right

-

Meta announces ending fact-checking program in the US

Meta announces ending fact-checking program in the US

-

Liverpool's Slot says contract issues not affecting Alexander-Arnold's form

-

Ghana's John Mahama sworn in after presidential comeback

Ghana's John Mahama sworn in after presidential comeback

-

Hundreds of young workers sue McDonald's UK alleging harassment

-

Jabeur beats Collins to step up comeback ahead of Melbourne

Jabeur beats Collins to step up comeback ahead of Melbourne

-

Eurozone inflation rises, likely forcing slower ECB rate cuts

| RBGPF | -4.54% | 59.31 | $ | |

| CMSC | -1.12% | 23.23 | $ | |

| RELX | 0.72% | 45.98 | $ | |

| GSK | 0.38% | 34.09 | $ | |

| NGG | -0.46% | 58.6 | $ | |

| AZN | -0.3% | 66.64 | $ | |

| BP | 2.54% | 31.83 | $ | |

| SCS | -2.14% | 11.2 | $ | |

| RIO | -0.33% | 58.19 | $ | |

| BTI | -0.52% | 36.78 | $ | |

| RYCEF | 1.53% | 7.2 | $ | |

| JRI | -1.88% | 12.22 | $ | |

| BCC | -1.69% | 118.22 | $ | |

| CMSD | -1.15% | 23.46 | $ | |

| BCE | -0.34% | 23.86 | $ | |

| VOD | -0.71% | 8.41 | $ |

American Resources Corporation's American Infrastructure Corporation to Become Publicly Listed Through Merger with CGrowth Capital, Inc.

The platform will focus on expansion through organic growth and strategic acquisitions of additional infrastructure-related assets

Following the audit of the combined entity, the company will pursue an uplisting to a senior national exchange

American Resources Corporation's (NASDAQ:AREC) ("American Resources" or the "Company") subsidiary American Infrastructure Corporation ("AIC"), a raw material supplier to the infrastructure marketplace with a focus on iron ore, titanium and metallurgical carbon, has entered into a binding term sheet to merge with CGrowth Capital, Inc. (OTC PINK:CGRA) ("CGrowth Capital" or "CGRA") as part of its spin out from American Resources Corporation. In conjunction with the merger with CGRA, the company has developed a structure to support future financing for both organic and acquisition growth within the infrastructure marketplace, aligning with its overall business strategy.

Mark Jensen, Executive Chairman of American Infrastructure Corporation, commented, "We believe this merger with CGrowth Capital represents a significant milestone for American Infrastructure and its shareholders, advancing our goal of achieving a senior exchange listing and providing a pathway for capital to support growth initiatives, both organic and through strategic acquisitions. As one of the last remaining metallurgical carbon growth platforms, we are confident in the strength of our asset base, which we believe is among the lowest cost in the industry. Over the next four years, we are well positioned to drive production and cash flow for our investors with relatively minimal capital expenditure required. We also believe this is an opportune time to be a pure-play infrastructure company, especially with the increasing focus on domestic infrastructure initiatives in the United States. Our strategy remains centered on leveraging our royalty and leasehold production model, which allows us to generate cash flow by partnering with experienced local operators who have a proven track record of success in the region. We are optimistic about the opportunities ahead in 2025 as we continue to grow the business. We also want to extend our gratitude to Nick Link and his team for their efforts establishing a strong platform like CGrowth Capital".

Under the terms of the Share Exchange Agreement, American Infrastructure Corporation will become a wholly owned subsidiary of CGrowth Capital, Inc., which will change its name to American Infrastructure Holding Corporation. The American Infrastructure team will assume management of CGRA and nominate new board members, with Nick Link, the former Chief Executive Officer of CGRA, remaining on the board of the combined entity. The existing operations and assets of CGRA will be spun-out of that entity concurrent with this transaction, leaving the operations of American Infrastructure Corporation as the primary operations of the combined entity.

American Resources has received multiple LOI's for structured transactions over the last year ranging from $150 million to $280 million in total value to American Infrastructure. The structured nature of such previous transactions where not acceptable to the board. The merger with CGRA is structured to reflect the growth opportunities and achieve such value for the combined entity with additional growth capital to unlock additional value in the future.

The transaction was structured as a tax-free exchange of American Infrastructure Corporation shares for shares of CGrowth Capital, Inc.. Common shareholders of American Infrastructure, as consideration for the merger, will receive a Series A Preferred Stock, which can be converted into common shares of the post-merger combined company, American Infrastructure Holding Corporation, at the holder's discretion. The Series A Preferred Stock will automatically convert into common stock twelve months after the merger. Additionally, the Series A Preferred Stock includes an anti-dilution provision, ensuring that any Series A Preferred shares not converted into common stock of the combined entity by the twelve-month anniversary of the merger will automatically convert into common stock of the combined entity, representing 92% ownership of the common stock outstanding in American Infrastructure Holding Corporation (formerly CGRA) at that time.

About American Infrastructure Corporation

American Infrastructure Corporation is a raw material supplier to the infrastructure marketplace with a focus on metallurgical carbon, iron ore and titanium. Current operations are primarily focused on the extraction, processing, transportation, and distribution of coal for a variety of industries, with a primary focus on metallurgical quality coal to the steel industry. We have six coal mining and processing operating subsidiaries in the metallurgical carbon industry located in Eastern Kentucky and West Virginia along with a substantial iron ore and titanium asset base in the mining region of Jamaica. For more information visit americaninfracorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

About American Resources Corporation

American Resources Corporation (NASDAQ: AREC) is a next-generation, environmentally and socially responsible supplier of high-quality raw materials to the new infrastructure market. The Company is focused on the extraction and processing of metallurgical carbon, an essential ingredient used in steelmaking, critical and rare earth minerals for the electrification market, and reprocessed metal to be recycled. American Resources has a growing portfolio of operations located in the Central Appalachian basin of eastern Kentucky and southern West Virginia where premium quality metallurgical carbon and rare earth mineral deposits are concentrated.

American Resources has established a nimble, low-cost business model centered on growth, which provides a significant opportunity to scale its portfolio of assets to meet the growing global infrastructure and electrification markets while also continuing to acquire operations and significantly reduce their legacy industry risks. Its streamlined and efficient operations are able to maximize margins while reducing costs. For more information visit americanresourcescorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

About CGrowth Capital Inc.

CGrowth Capital Inc. (OTC: CGRA) is a public holding company for alternative and undervalued assets. The company is sector and industry agnostic and currently consists of two divisions including Mining and Sports Technology. The company is focused on investing in growth-oriented opportunities where the company's capital, expertise, and capabilities can help create significant added value for shareholders. For more information visit https://cgrowthcapital.com.

Special Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause the Company's actual results, performance, or achievements or industry results to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. These statements are subject to a number of risks and uncertainties, many of which are beyond American Resources Corporation's control. The words "believes", "may", "will", "should", "would", "could", "continue", "seeks", "anticipates", "plans", "expects", "intends", "estimates", or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Any forward-looking statements included in this press release are made only as of the date of this release. The Company does not undertake any obligation to update or supplement any forward-looking statements to reflect subsequent events or circumstances. The Company cannot assure you that the projected results or events will be achieved.

Investor Contact:

JTC Team, LLC

Jenene Thomas

833-475-8247

[email protected]

Company Contact:

Mark LaVerghetta

317-855-9926 ext. 0

[email protected]

CGrowth Capital Inc. Contact

[email protected]

SOURCE: American Resources Corporation

S.F.Warren--AMWN