-

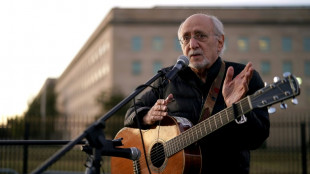

Peter Yarrow of Peter, Paul and Mary dead at 86

Peter Yarrow of Peter, Paul and Mary dead at 86

-

Dyche accepts Everton job under scrutiny from new owners

-

US urged to do more to fight bird flu after first death

US urged to do more to fight bird flu after first death

-

Trump says NATO members should raise defense spending to 5% of GDP

-

X's 'Community Notes': a model for Meta?

X's 'Community Notes': a model for Meta?

-

Freewheeling Trump sets out territorial ambitions

-

England skipper Stokes undergoes hamstring operation

England skipper Stokes undergoes hamstring operation

-

Inflation concerns pull rug out from Wall Street rally

-

Ban for Wolves striker Cunha cut after offer to buy new glasses for security guard

Ban for Wolves striker Cunha cut after offer to buy new glasses for security guard

-

Olmo situation could affect future signings: Barca's Raphinha

-

US sanctions top Hungary minister over 'corruption'

US sanctions top Hungary minister over 'corruption'

-

Frigid temps hit US behind major winter storm

-

Former Cambodian opposition MP shot dead in Bangkok: Thai media

Former Cambodian opposition MP shot dead in Bangkok: Thai media

-

US says Sudan's RSF committed 'genocide' in Darfur

-

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

-

Barca's Olmo absence 'better' for us: Athletic coach Valverde

-

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

-

Spurs boss Postecoglou not in favour of VAR stadium announcements

-

Meta abruptly ends US fact-checks ahead of Trump term

Meta abruptly ends US fact-checks ahead of Trump term

-

Quake in China's Tibet kills 126 with tremors felt in Nepal, India

-

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

-

Postecoglou wants trophy for Son as Spurs extend contract

-

Loeb limps home as teenager wins Dakar stage

Loeb limps home as teenager wins Dakar stage

-

US trade deficit widens in November on imports jump

-

Macron irks allies, left with Africa 'forgot to say thank you' jibe

Macron irks allies, left with Africa 'forgot to say thank you' jibe

-

Key dates in the rise of the French far right

-

Meta announces ending fact-checking program in the US

Meta announces ending fact-checking program in the US

-

Liverpool's Slot says contract issues not affecting Alexander-Arnold's form

-

Ghana's John Mahama sworn in after presidential comeback

Ghana's John Mahama sworn in after presidential comeback

-

Hundreds of young workers sue McDonald's UK alleging harassment

-

Jabeur beats Collins to step up comeback ahead of Melbourne

Jabeur beats Collins to step up comeback ahead of Melbourne

-

Eurozone inflation rises, likely forcing slower ECB rate cuts

-

France remembers Charlie Hebdo attacks 10 years on

France remembers Charlie Hebdo attacks 10 years on

-

Microsoft announces $3 bn AI investment in India

-

French far-right figurehead Jean-Marie Le Pen dies at 96

French far-right figurehead Jean-Marie Le Pen dies at 96

-

South Korea investigators get new warrant to arrest President Yoon

-

French far-right figurehead Jean-Marie Le Pen dies

French far-right figurehead Jean-Marie Le Pen dies

-

South Sudan says will resume oil production from Jan 8

-

Pope names Sister Brambilla to head major Vatican office

Pope names Sister Brambilla to head major Vatican office

-

Stock markets mostly rise on US optimism

-

Olmo's Barcelona registration battle puts Laporta under pressure

Olmo's Barcelona registration battle puts Laporta under pressure

-

Taste of 2034 World Cup as Saudi Asian Cup stadiums named

-

Eurozone inflation picks up in December

Eurozone inflation picks up in December

-

France flanker Ollivon out for season, to miss Six Nations

-

S. Korea investigators get new warrant to arrest President Yoon

S. Korea investigators get new warrant to arrest President Yoon

-

Tottenham trigger Son contract extension

-

China's most successful team kicked out of professional football

China's most successful team kicked out of professional football

-

Eyeing green legacy, Biden declares new national monuments

-

South Korea rival parties form plane crash task force

South Korea rival parties form plane crash task force

-

Georgians hold anti-government protest on Orthodox Christmas

| RIO | -0.27% | 58.224 | $ | |

| CMSC | -0.6% | 23.349 | $ | |

| BTI | -0.07% | 36.945 | $ | |

| BP | 2.7% | 31.88 | $ | |

| CMSD | -0.64% | 23.58 | $ | |

| SCS | -2.55% | 11.155 | $ | |

| GSK | 0.63% | 34.175 | $ | |

| BCC | -2.34% | 117.475 | $ | |

| JRI | -1.55% | 12.26 | $ | |

| NGG | -0.25% | 58.725 | $ | |

| RBGPF | -4.54% | 59.31 | $ | |

| RYCEF | 1.53% | 7.2 | $ | |

| AZN | 0.24% | 67 | $ | |

| VOD | -0.36% | 8.44 | $ | |

| BCE | 0.4% | 24.035 | $ | |

| RELX | 0.89% | 46.06 | $ |

Guardian Metal Resources PLC Announces £750,000 Placing with Institutional Investor

Guardian Metal Resources plc

('Guardian Metal' or the 'Company')

Placing with Single Institutional Investor to Raise £750,000

Guardian Metal Resources plc (LON:GMET)(OTCQB:GMTLF), a strategic mineral exploration and development company focused on tungsten in Nevada, USA, is pleased to announce that it has raised £750,000 in a placing with a single existing institutional investor at an issue price of £0.30 per share ("Placing"). The Placing represents a further step for the Company towards its goal of strengthening the U.S. supply chain for the essential metal, tungsten. There is growing global investor recognition of the critical importance of rapidly establishing domestic tungsten production in the U.S., given its dual applications in both military and broad industrial sectors.

Placing Highlights:

Guardian Metal has completed a strategic raise of £750,000 through the issue of 2,500,000 new ordinary shares of 1.0p each ("Placing Shares"), representing 2.00% of the enlarged issued share capital of the Company. No warrants are to be issued to the subscriber.

The entire Placing has been subscribed for by Premier Miton, a well-established UK asset management company; their relevant funds overseen by fund managers Gervais Williams and Martin Turner. Gervais Williams is president of the QCA and member of the AIM advisory panel at the London Stock Exchange.

The net proceeds of the Placing will be applied to the Company's working capital and is targeted for accelerated exploration and project development activities at Pilot Mountain as well as, subject to the signing of the definitive agreement, at Tempiute.

The Placing was arranged by the Company's broker and 120,000 broker warrants are being issued as part of the commission payable under the terms of the Placing ("Broker Warrants"). The Broker Warrants are exercisable at £0.375 per share with an expiry date of 24 months from the date of the Placing.

Oliver Friesen, CEO of Guardian Metal, commented:

"We are delighted that Premier Miton is adding to its existing holding in Guardian Metal. It is hugely encouraging that respected fund managers Gervais Williams and Martin Turner, along with the clients of Premier Miton, are demonstrating their confidence in the Company.

"We are very confident about the Company's direction as we head into 2025 and the additional financing allows us to accelerate and expand key exploration and development activities."

ADMISSION AND TOTAL VOTING RIGHTS

Application will be made for the 2,500,000 Placing Shares to be admitted to trading on AIM, which is expected to occur on or around 9 January 2025 ("Admission"). The Placing Shares will rank pari passu in all respects with the ordinary shares of the Company currently traded on AIM.

Following Admission, the Company's issued share capital will comprise 125,006,991 ordinary shares of 1p each. This number will represent the total voting rights in the Company and may be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in, the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of Article 7 of EU Regulation 596/2014 (which forms part of domestic UK law pursuant to the European Union (Withdrawal) Act 2018). The Directors of the Company are responsible for the contents of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to execute and implement future plans, and the occurrence of unexpected events.

Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

For further information visit www.guardianmetalresources.com or contact the following:

Guardian Metal Resources plc | Tel:+44 (0) 20 7583 8304 |

Cairn Financial Advisers LLP | Tel: +44 20 7213 0880 |

Shard Capital Partners LLP | Tel: +44 (0) 20 7186 9000 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

G.Stevens--AMWN