-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

-

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Hochul Signs Step Therapy Reform Measures Into Law

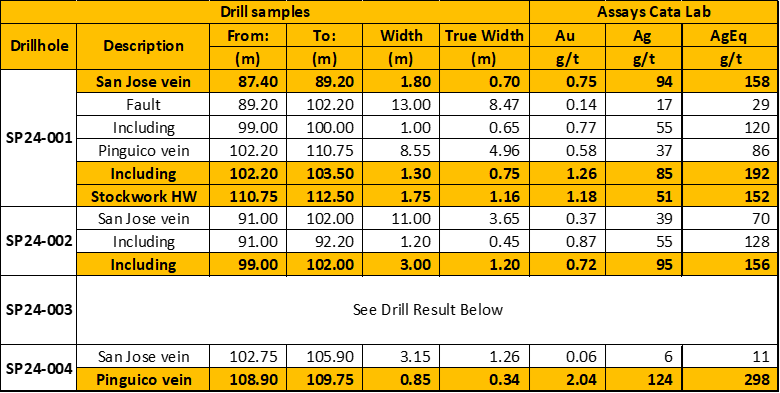

Guanajuato Silver Provides Pinguico Project Development Update

Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF), a growing Mexican-based precious metals producer,is pleased to provide an update on the 2024 drilling program and other exploration and development initiatives at the Company's wholly owned Pinguico Project ("Pinguico") located in Guanajuato, Mexico.

Highlights

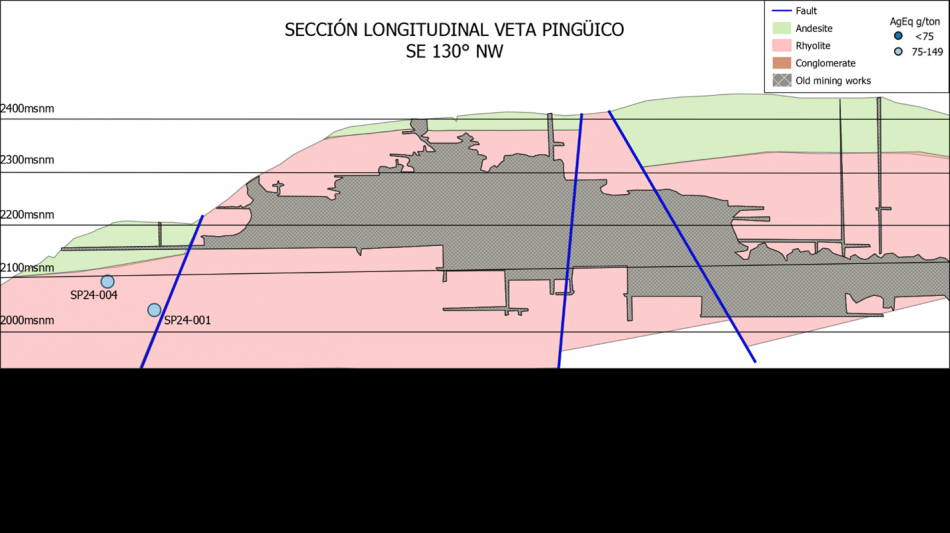

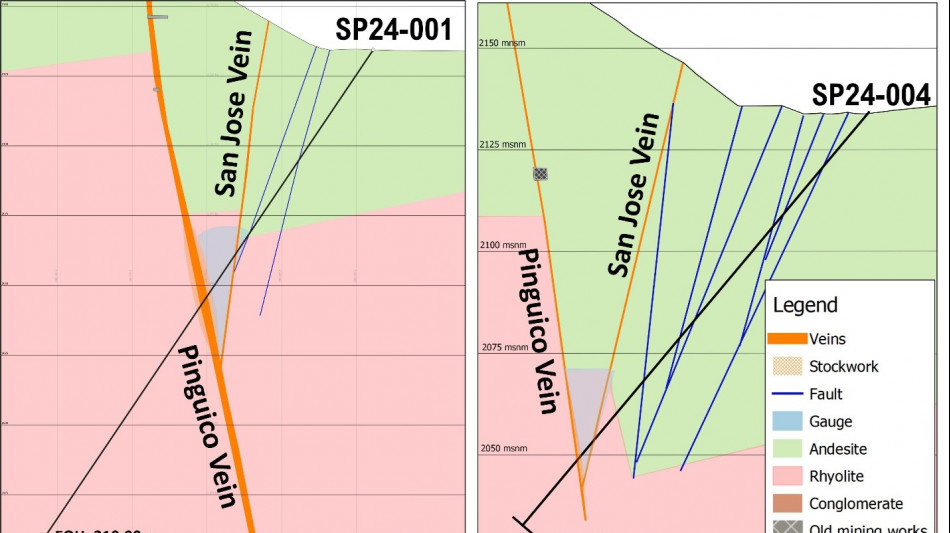

Drilling of the southern portion of the property targeting the Pinguico and San Jose veins returned several high-grade intercepts that continue to expand the total resource potential of what was historically one of the Guanajuato district's highest grade mining operations. The Company is targeting a resource estimate for Pinguico in late 2025.

The Company drilled a single deep hole of over 650 meters that has successfully intersected the Veta Madre vein on the El Pinguico property. Drill hole #SP24-003 confirmed the potential for an important confluence of the Pinguico mineralized system with the prolific Veta Madre regional fault structure.

The Company continues to advance underground mining activities with the goal of reaching a sizeable underground stockpile located approximately 600 meters from the Level 4 adit entrance. This advance is following known mineralization and is generating revenue from silver and gold production that is offsetting the costs of drifting. The Company expects to reach the stockpile in Q2, 2025.

James Anderson, Chairman & CEO, said, "We value our Pinguico gold and silver project for its near-term organic growth potential within Guanajuato Silver's growing portfolio of mining assets. Over the past two-years, our focus has been on processing Pinguico's low grade above ground historical stockpiles; preparing to expand the Level 4 access corridor and drive toward the historical underground stockpile; drilling the near surface San Jose and El Pinguico vein structures; and drilling towards the conceptual target of the probable intersection of the regional Veta Madre structure and the historically high-grade El Pinguico vein."

Pinguico Extensional Drilling

In 2024, drilling was conducted on the southern portion of the property with the objective of exploring the El Pinguico and San Jose veins along strike to the south. A total of 446 metres were drilled in three drill holes with the following results. Unless otherwise noted, all references in this news release to silver equivalent or AgEq have been calculated using 85:1 gold/silver (Ag/Au):

Pinguico Diamond Drill Results

Long Section El Pinguico Vein

Pinguico Diamond Drilling Cross Sections for SP24-001 and SP24-004

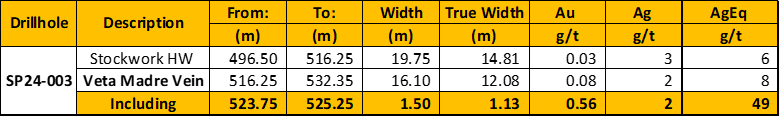

Pinguico Drillhole SP24-003 - Drilling into the Veta Madre

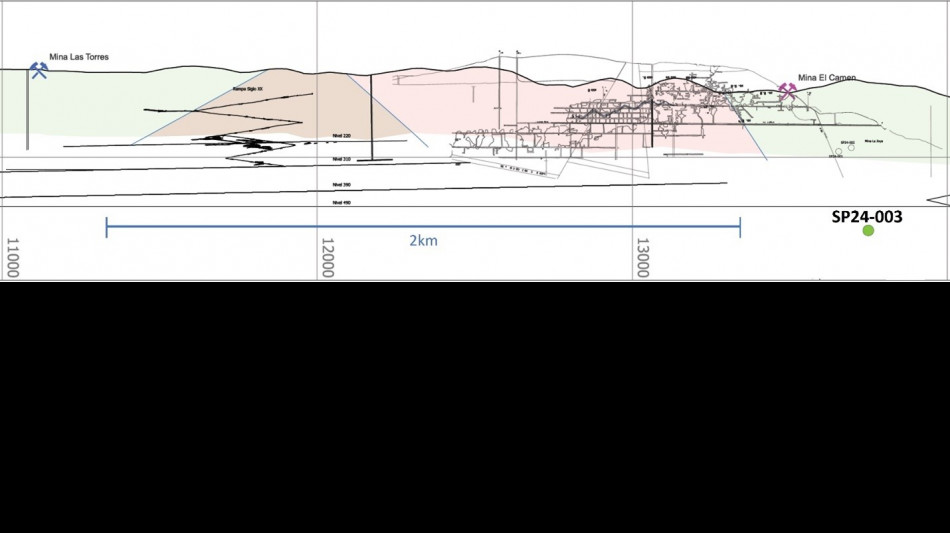

Veta Madre Longitudinal Section

Pinguico Deep Drilling

In 2024, a single deep drill hole - SP24-003 - was drilled to a 659m core length to advance the Company's understanding of the relationship between Veta Madre and the El Pinguico vein structure at depth. This drill hole successfully intersected a broad (approximately 60m in core length), highly altered, deformation zone associated with the Veta Madre fault zone - the first time Veta Madre proper has been intersected on the Pinguico property. Within this zone, which is located within the highly productive Guanajuato Conglomerate Unit, the drill hole encountered an interval of stockwork with 0.56 gpt gold over an estimated true width of 1.13m.

Pinguico Diamond Drill Results - SP24-003

After further studying the implications of this potentially important interval, the Company plans to drill a deeper hole toward the interpreted intersection of El Pinguico and Veta Madre in Q2, 2025.

Pinguico Diamond Drilling Cross Sections for SP24-003

Pinguico Underground Development

At Pinguico, underground mining activities resumed in mid-year, with the objective of continuing the advance at level 4 toward the historical underground backfill stockpile. Mine drifting has advanced over 75 meters to date with the development of a 4m x 4m fully serviceable crosscut. The Company expects to complete the advance in Q2, 2025. During the quarter, production from development contributed an estimated 2,562 tonnes with an average grade of 1.19 g/t gold, 102 g/t silver for 203 g/t silver equivalent (AgEq).

The underground stockpile ranges from 25 metres to 100 metres in thickness and has an indicated mineral resource of 25,600 tonnes grading 166 g/t silver and 1.67 g/t gold for contained metal of 136,600 ounces of silver and 1,375 ounces of gold. For additional information please refer to the technical report entitled: "Behre Dolbear Technical Report - El Cubo/El Pinguico Silver Gold Complex Project" dated April 17, 2024 and filed on SEDAR+ at www.sedarplus.ca.

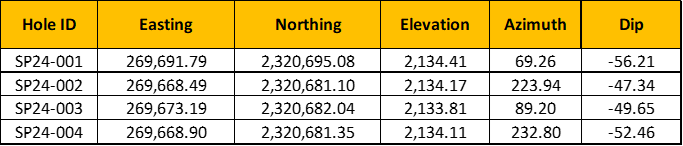

Drill Collar Information

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Sampling and quality assurance/quality control

Drill core was first reviewed by a Company geologist, who identified and marked intervals for sampling. The marked sample intervals were then cut in half with a diamond saw; half of the core was left in the core box and the other half was removed, placed in plastic bags, sealed and labeled. Intervals and unique sample numbers are recorded on the drill logs and the samples are sequenced with standards and blanks inserted according to a predefined QA/QC procedure. The samples are maintained under security on site until they are shipped to the analytical lab. The analytical work reported on herein was performed by Corporacion Quimica Platinum S.A de C.V., Silao, Guanajuato, Mexico which is independent of GSilver. To validate the Company's assay results and its preparation procedures, GSilver sends additional random samples representing approximately 20% of all analytical samples to Bureau Veritas in Hermosillo, Sonora, Mexico. Bureau Veritas is an ISO/IEC (International Organization for Standardization/International Electrotechnical Commission) geo-analytical laboratory and is independent of GSilver and its "qualified person". In order to further validate the Company's assay results and its preparation procedures GSilver sent additional random samples representing approximately 10% of all analytical samples to SGS Mexico, S.A de C.V, Durango, Mexico. SGS is also an ISO/IEC geo-analytical laboratory and is independent of GSilver and its "qualified person". Core samples were subject to crushing at a minimum of 70 per cent passing two millimeters, followed by pulverizing of a 250-gram split to 85 per cent passing 75 microns. Gold determination was via standard atomic absorption (AA) finish 30-gram fire assay (FA) analysis, in addition to silver and 34-element using fire assay and gravimetry termination. Following industry-standard procedures, blank and standard samples were inserted into the sample sequence and sent to the laboratory for analysis. Data verification of the analytical results included a statistical analysis of the standards and blanks that must pass certain parameters for acceptance to ensure accurate and verifiable results.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. Verified data underlying the disclosed information includes reviewing compiled assay data; QA/QC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: [email protected]

GSilver.com

Guanajuato Silver Bullion Store

Please visit our Bullion Store, where Guanajuato Silver coins and bars can be purchased.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, near term organic growth within the Company's growing portfolio of mining assets; plans to drill a deeper hole toward the interpreted intersection of El Pinguico and Veta Madre in Q2, 2025; at Pinguico, the objective of continuing the advance at level 4 toward the historical underground backfill stockpile and timeline for completion; and GSilver's status as one of the fasting growing silver mining companies in Mexico.

Such forward-looking statements and information reflect management's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the potential quantity, grade and metal content of the mineralized material at El Cubo and San Ignacio, the geotechnical and metallurgical characteristics of such material conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, currency rate fluctuations, high inflation and interest rates, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual grades and recoveries of silver, gold and other metals from the Company's existing mines including El Cubo, San Ignacio, VMC and Topia, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at El Cubo, San Ignacio, VMC and/or Topia to process mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, San Ignacio, VMC and Topia is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected grades of gold and silver at El Cubo and San Ignacio and the anticipated level of production therefrom will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about impact of any resurgence ofCOVID-19, the ongoing war in Ukraine and conflict in Gaza, elevated inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca including the Company's most recently filed annual information form . These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

C.Garcia--AMWN