-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

-

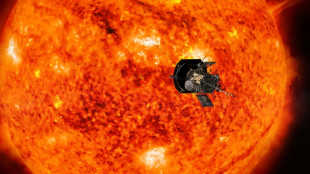

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

| CMSC | 0.33% | 23.939 | $ | |

| BCC | -0.39% | 122.275 | $ | |

| JRI | -0.08% | 12.05 | $ | |

| SCS | -1.03% | 11.62 | $ | |

| RIO | 0.66% | 59.03 | $ | |

| CMSD | -0.04% | 23.551 | $ | |

| RBGPF | 0% | 60.5 | $ | |

| RYCEF | -0.69% | 7.22 | $ | |

| NGG | 0.7% | 58.91 | $ | |

| AZN | 1.59% | 66.405 | $ | |

| GSK | 1.11% | 33.976 | $ | |

| VOD | -0.6% | 8.34 | $ | |

| RELX | 0.15% | 45.54 | $ | |

| BTI | -0.32% | 36.125 | $ | |

| BCE | -1.76% | 22.76 | $ | |

| BP | 0.33% | 28.695 | $ |

November, 2024 Letter to Shareholders

Building The Only Rare Earth and Critical Mineral Refining Platform From the Depths of a Metallurgical Carbon Business – A True Energy Transformation Play

Building The Only Rare Earth and Critical Mineral Refining Platform From the Depths of a Metallurgical Carbon Business – A True Energy Transformation Play

American Resources Corporation (Nasdaq:AREC)

To our shareholders:

First, I want to extend my heartfelt thanks to all our shareholders. Recently, I reconnected with a mentor, friend, and someone I consider family - a person of great wisdom who has overcome immense challenges and always emerged stronger. He shared many insights, but one stood out: the importance of expressing empathy and acknowledging the struggles of our shareholders in challenging markets. This resonates deeply with me and our team. We understand the frustration and pain that can come with declines in stock prices. We recognize that people invest in our company for its potential, and it is our responsibility to deliver. Our focus as a team has been to stay committed, work harder, push ourselves, and dig deeper to drive business success, which we believe will ultimately be reflected in market value. While some of these efforts may not be visible externally or currently be shared, I want to assure you that we are fully committed. We feel the same drive and urgency, and we're dedicated to achieving the fundamental value that our shareholders deserve. Our team is ready to go the distance to make that a reality.

Historically, our shareholder base predominately consisted of management and over 25,000 retail shareholders. Since management founded and initially funded the company, we have not traditionally had a large institutional shareholder presence. Fortunately, as the business has expanded, we have attracted attention from larger investors, and we believe that support from institutional shareholders is beginning to grow.

As both shareholders and management, we share the frustration over our current market valuation. We are fully committed to fighting for our shareholders, to building fundamental value, and to ensuring that our stock reflects that value for everyone - from those with ten million shares to those with ten. While we acknowledge that we haven't always met our goals, due to factors both within and beyond our control, we believe strongly in our exceptional portfolio of assets, which are strategically positioned to create substantial value. We are proud of the steps and progress we've made to reach this point and are committed to working tirelessly toward success so that all shareholders benefit.

The Business Lines Discussion

Our operating teams have demonstrated remarkable innovation and adaptability, and I'm proud to report significant progress across ReElement Technologies, American Metals, American Infrastructure, as well as our holdings in Royalty Management Holding Corporation and Novusterra Inc. These achievements showcase our dedication not only to our business goals but also to our core values of community and responsibility.

ReElement Technologies Corporation

As we look to the highest value denominator of our business, I'd like to provide some background on ReElement Technologies. ReElement was born out of our efforts to address the environmental cleanup of legacy mining operations associated with our carbon assets. When we acquired eight companies (five through bankruptcies), we inherited significant environmental liabilities from previous operators. Unlike many mining companies that defer these issues, we took a proactive approach to address and clean up the environmental impact, challenging industry norms and facing resistance for doing things differently. Through this process, we remediated over 7,000 acres of land and secured more than $20 million in environmental bond releases. Most importantly, we laid the foundation for ReElement Technologies, prioritizing innovation and technology over dumping chemical into waterways, and transforming our approach to environmental stewardship.

ReElement was initially founded to focus on the separation and purification of metals extracted from acid mine drainage sites and mine waste. At that time, China dominated 95% of the refining market for rare earth and critical minerals, creating a challenging single-source economy. We faced a choice: either send our concentrates to China at a loss or innovate to create a viable domestic solution. Our team spent years evaluating technologies for potential application in the U.S. market and quickly realized that traditional solvent-based or hydrometallurgical extraction methods were neither economically nor environmentally sustainable for domestic use. These methods are capital-intensive, have high operational costs, are environmentally harmful, and lack versatility for varying feedstocks - whether recycled or naturally sourced. Furthermore, we recognized that competing against China's low labor costs and relaxed environmental standards using similar processes would not be viable for the rest of the world.

ReElement prioritized innovation and partnered with Purdue University who was well ahead of the development of the electrified economy. Today, we have developed a versatile, multi-mineral, multi-feedstock platform technology capable of separating and purifying high-value critical minerals, including lithium, cobalt, nickel, dysprosium, terbium, neodymium, praseodymium, niobium, high-purity aluminum, silica, and copper. Not only can we separate and purify these elements, but we can do so at a cost that is competitive with, or even lower than, China's. ReElement is disrupting their monopoly by delivering higher-quality products at a lower cost, establishing a natural hedge in the market.

We achieved this using our own capital, with a focus on creating a platform that can catalyze and synthesize a robust critical mineral supply chain outside of China. Although we have been approached with funding offers from Chinese nationals, we have consistently declined, choosing instead to protect the long-term value for our shareholders.

Today, we are producing rare earth elements and battery materials for customers at our Customer Qualification Plant in Noblesville, Indiana. We are also in the process of ordering equipment for our Marion Advanced Technology Center in Marion, Indiana, which spans 400,000 square feet on a 42-acre campus. We are confident that this facility will become the largest producer of separated and purified rare earth oxides - including dysprosium, terbium, neodymium, and praseodymium - outside of China. Additionally, it is poised to be a major, if not the largest, producer of lithium carbonate equivalent (LCE) in the United States.

We have also begun dismantling our Knott County Coal processing plant, which we acquired from Arch Coal. The facility was previously owned and operated by Wilbur Ross' International Coal Group. Our plan is to repurpose this site for a lithium refinery, sourcing ores both domestically and internationally. We take pride in this genuine energy transition project, which leverages American ingenuity and builds on the region's rich history in commodity processing in eastern Kentucky.

We continue to make daily progress on our goals, all while being mindful of minimizing shareholder dilution by grinding forward every day, and when the right opportunities arise, we act decisively to capture them. In this regard, we utilize alternative and flexible capital strategies, such as bond offerings and incentives, to drive our growth. We are proud of the work we're accomplishing behind the scenes and look forward to sharing more positive developments as our domestic supply chain evolves and our partners permit us to announce them.

As a team of individuals with direct military service or with family members who have served, I can confidently say that we are 100% committed to fulfilling our mission to establish a critical rare earth element supply chain. Our goal is to catalyze the reshoring of our defense industrial base to strengthen national security for the U.S. and our allied nations. We are the solution that can provide ultra-pure rare earth elements for F-35 fighter jets, nuclear submarines, drones, and lithium for military communication units. This challenge cannot, and will not, be solved by traditional hydromet or solvent-based refining methods - a fact that is being proven today and will be evident over the next five years. Our path forward is driven by innovation and entrepreneurship, not legacy practices. We firmly believe that ReElement's refining solution is leading the market, and any alternative spending will ultimately prove to be wasted capital.

We are also excited that we have recently completed our initial closing of our financing at the ReElement level and announced the record and distribution dates for ReElement's separation into a standalone company.

American Infrastructure Corporation

Formerly known as American Carbon Corporation, this business line focuses on metallurgical carbon and iron ore. Through its growth, the company has consolidated valuable assets that can be restructured to focus solely on high-margin, high-value products. As we expanded, we built an independent team capable of driving value for the business and our shareholders as a separate entity.

American Metals LLC

American Metals has advanced as a business and is now developing innovative strategies to pre-process rare earth and critical minerals. The legacy business leveraged reclamation from previously acquired coal mining operations, primarily scrapping and recovering ferrous metals, and through its affiliation with ReElement, has garnered knowledge and knowhow of optimal and efficient processing methods to produce products that can be efficiently refined back to ultra-pure critical minerals. Recently, the company partnered with LOHUM Cleantech, India's leading battery recycling and reuse company, to pre-process batteries, creating materials that can serve as feedstock for ReElement Technologies in a cost-effective and environmentally conscious way. We are also making progress on our merger with AI Transportation Acquisition Corp. The company has received comments from the SEC on its S-4 registration statement, which we believe can be addressed with minimal effort.

Royalty Management Holding Corporation (NASDAQ: RMCO)

Royalty Management is an innovative royalty and streaming company with a highly attractive portfolio of holdings. At the time of the de-SPAC merger, as with most SPACs, the majority of capital was not retained by the company. SPACs have largely become a mechanism for hedge funds to temporarily park money and retain warrants, with little intent from initial investors to remain in the transaction. Due to these redemptions, the company now has a significantly smaller float and less capital to deploy than initially anticipated.

Nonetheless, the company has an exciting business model focused on creating value, increasing cash flow, and growing equity stakes in its holdings. Since the merger, it has made several notable investments and has repurchased its stock, retiring those shares. We believe the company is currently undervalued, but as it expands its communications, we expect this value to be reflected in its market valuation.

Novusterra Inc.

We are excited about the progress of Novusterra, a company collaborating with Kenai Defense in partnership with the United States Air Force and Army to develop high-value applications for graphene and carbon nanostructures. The company recently had its selling shareholder S-1 approved by the SEC and will soon file a new issuance S-1, aiming to use an underwriter to raise capital and list on a national exchange. Novusterra plans to submit this S-1 in the near term, and we are enthusiastic about their continued progress.

In closing, we remain committed to keeping you informed and engaged as we navigate this journey together. Your feedback is invaluable, and I encourage you to share your thoughts and questions. Our relationship with you is fundamental to our success, and we are dedicated to ensuring your voice is heard and valued.

Thank you for your continued trust and partnership. Together, I am confident we can capitalize on these opportunities and build a brighter future for American Resources, ReElement Technologies, American Metals, American Infrastructure, Royalty Management Holding Corporation, and Novusterra, Inc.

Sincerely,

/s/ MARK JENSEN

Mark Jensen

Chairman and Chief Executive Officer

American Resources Corporation

SOURCE: American Resources Corporation

P.Silva--AMWN