-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

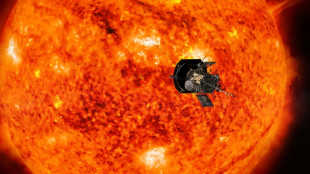

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

Sokoman Minerals Corp. to Seek Shareholders Approval to Spin-out Shares of Vinland Lithium Inc

Sokoman Minerals Corp. ("Sokoman" or the "Company") (TSXV:SIC) announces that it has filed Management Proxy Materials under its profile on sedarplus.ca for its annual and special general meeting of shareholders (the "Meeting"). The meeting is currently set to be held on January 8, 2025, in Vancouver, BC, although the actual date is likely to change as a result of the Canadian postal strike. At the Meeting, Sokoman shareholders will be asked to approve a special resolution (two-thirds of votes cast) to reorganize Sokoman's share capital to facilitate a spin-out to shareholders of approximately 2 million of Sokoman's 4 million shares of Vinland Lithium Inc. ("Vinland"). Vinland holds the Killick Lithium Project and is currently owned by Sokoman (40%), Benton Resources Inc. ("Benton") (40%) and Piedmont Lithium Newfoundland Holdings LLC ("Piedmont"), a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc. (20%). Benton will concurrently seek the approval of its shareholders for a similar 2 million share spin-out. Subject to the two spin-outs being completed, the TSX Venture Exchange has conditionally agreed to list the approximately 10 million issued shares of Vinland, of which approximately 40% will be in the hands of Sokoman and Benton shareholders.

The spin-outs will be substantially pro rata to Sokoman and Benton shareholders; however, the exact ratio of Vinland share per Sokoman share will be determined prior to completion in January 2025. The exchange ratio is dependent on the number of Sokoman shares issued at the time of completion. The ratio is expected to be approximately 50 Vinland shares per 8,000 Sokoman shares. Accounts holding less than 8,000 Sokoman shares (having an approximate $320 market value) will not receive Vinland shares as the immediate and ongoing administration and compliance costs for very small odd-lot Vinland shareholders would be prohibitive.

Some of the key points for shareholders are as follows:

The Killick Lithium Project holds excellent discovery potential in a newly discovered lithium belt

Piedmont, a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc., completed a 2023 financing in Vinland of CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont Lithium Inc. is one of North America's leading lithium companies

Newfoundland is ranked as one of the top jurisdictions to explore and develop mineral potential

Piedmont Lithium Inc. has vast technical and geological knowledge in similar geology to that of the Kraken pegmatites

Vinland holds indirectly, through its subsidiary Killick Lithium Inc., a 100% interest in the Killick Lithium Project

Piedmont will have the option to earn up to a 62.5% direct interest in Killick Lithium Inc. by spending CAD$12.0M in exploration and development during the period of the option

Upon Piedmont completing all earn-in options, Piedmont/Piedmont Lithium Inc. will have paid Sokoman and Benton a total of CAD$10.0M in Piedmont Lithium Inc. shares in addition to having funded all the Vinland exploration and development costs

Sokoman and Benton to collectively retain a 2% NSR on the Killick Lithium Project

In addition to the spin-out resolution, Sokoman shareholders who attend the Meeting will attend to annual matters, including consideration of Sokoman's June 30, 2024, audited financial statements, the election of directors, appointment of auditors, and approval of Sokoman's stock option plan.

Full details of the spin-out and the other annual matters are contained in a management information circular dated November 18, 2024, and filed under the Company's profile on sedarplus.ca. This circular contains detailed information on Vinland as a stand-alone company and will be mailed to registered shareholders once the postal strike is over. It will contain details of the final Meeting date, as that appears likely to change as of the date of this news release.

About Sokoman Minerals Corp.

Sokoman Minerals Corp., based in Newfoundland and Labrador, Canada, focuses primarily on its gold projects, including the wholly owned Moosehead, Crippleback Lake, and the extensive Fleur de Lys project near Baie Verte. This latter project aims to discover Dalradian-type orogenic gold mineralization like the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company has also partnered with Benton Resources Inc. on three large-scale joint ventures: Grey River, Killick Lithium, formerly Golden Hope, and Kepenkeck, positioning Sokoman as one of the largest landholders in Canada's emerging gold districts.

In October 2023, Sokoman and Benton entered into an agreement with Piedmont Lithium Inc. to advance the Killick Lithium Project. Under this deal, Piedmont can acquire up to 62.5% of the project by investing up to $12 million in exploration and issuing $10 million shares over three phases. The project, previously known as Golden Hope, is now part of Killick Lithium Inc., a subsidiary of Vinland Lithium Inc., in which Piedmont has acquired a 19.9% stake for $2 million. Sokoman and Benton maintain operational control during the earn-in phases and retain a 2% NSR royalty on future production. Additionally, Piedmont holds exclusive marketing and first-refusal rights on the lithium concentrates for the life of the mine.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E:[email protected]

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E:[email protected]

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

M.Fischer--AMWN