-

France mourns Mayotte victims amid uncertainy over government

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Tortoise Capital Completes Merger of Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE: TPZ), Tortoise Pipeline & Energy Fund, Inc. (NYSE: TTP), and Tortoise Energy Independence Fund, Inc. (NYSE: NDP) and Conversion to Actively Managed ETF

-

Tortoise Capital Completes Merger of Tortoise Energy Infrastructure Corp. (NYSE: TYG) and Tortoise Midstream Energy Fund, Inc. (NYSE: NTG)

Tortoise Capital Completes Merger of Tortoise Energy Infrastructure Corp. (NYSE: TYG) and Tortoise Midstream Energy Fund, Inc. (NYSE: NTG)

-

Telomir Pharmaceuticals Confirms Copper Binding Capabilities of Telomir-1 and Expands Pipeline Into Wilson's Disease

-

Datametrex Cancels RSUS

Datametrex Cancels RSUS

-

South Star Battery Metals Announces Upsize of Non-Brokered Private Placement to Raise Up to US$3.20M, Extends Closing and Amended and Restated Stream Agreement

-

Brightline Interactive Successfully Delivers A Scalable Immersive Simulation To A Global Government Service Integrator, Positioning Itself As A Leading Operating System For Processing And Visualizing Complex Information In 3D Space

Brightline Interactive Successfully Delivers A Scalable Immersive Simulation To A Global Government Service Integrator, Positioning Itself As A Leading Operating System For Processing And Visualizing Complex Information In 3D Space

-

Urb NM is Named "Fastest Growing" Marijuana Brand in New Mexico

-

Alset AI Broadens Investment Policy to Embrace Decentralized AI, Quantum AI, Quantum Computing, and Cryptocurrency Opportunities

Alset AI Broadens Investment Policy to Embrace Decentralized AI, Quantum AI, Quantum Computing, and Cryptocurrency Opportunities

-

Strawberry Fields REIT Enters Into Agreement for Six Healthcare Facilities Located in Kansas

-

NanoViricides is in a Great Position to Fight Potential Bird Flu Pandemic with a Drug that the Mercurial H5N1 Influenza A Virus is Unlikely to Escape

NanoViricides is in a Great Position to Fight Potential Bird Flu Pandemic with a Drug that the Mercurial H5N1 Influenza A Virus is Unlikely to Escape

-

Zomedica Launches Two New Quantitative Assays on the TRUFORMA(R) Platform: Canine NT-proBNP and Progesterone

-

MainStreetChamber Holdings, Inc. Submits 15(c)211 Application

MainStreetChamber Holdings, Inc. Submits 15(c)211 Application

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - December 23

-

Melrose Group Publicly Files Complaint to the Ontario Securities Commission

Melrose Group Publicly Files Complaint to the Ontario Securities Commission

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

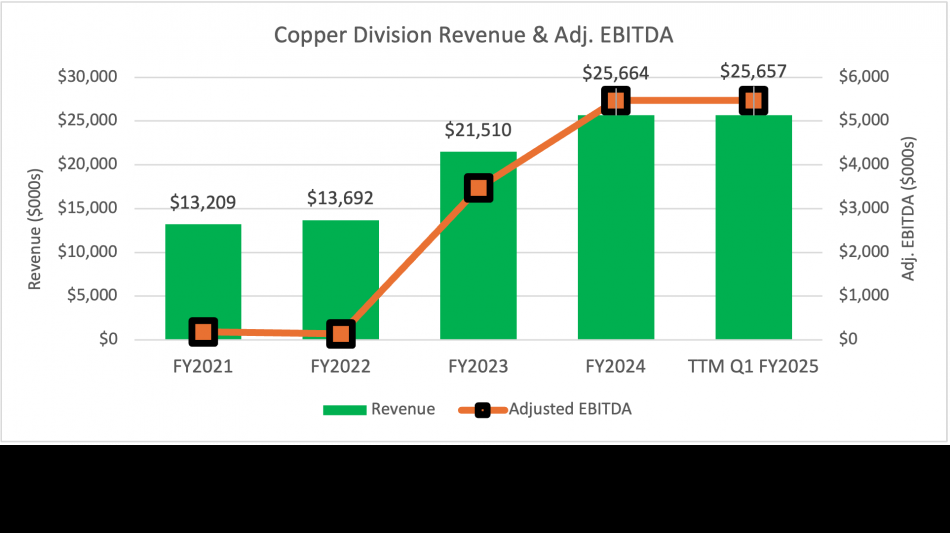

IBC Advanced Alloys' Reports Financial Results For Quarter Ended September 2024

Highlights of the Quarter Ended September 30, 2024

(Unless otherwise noted, all financial amounts in this news release are expressed in U.S. dollars)

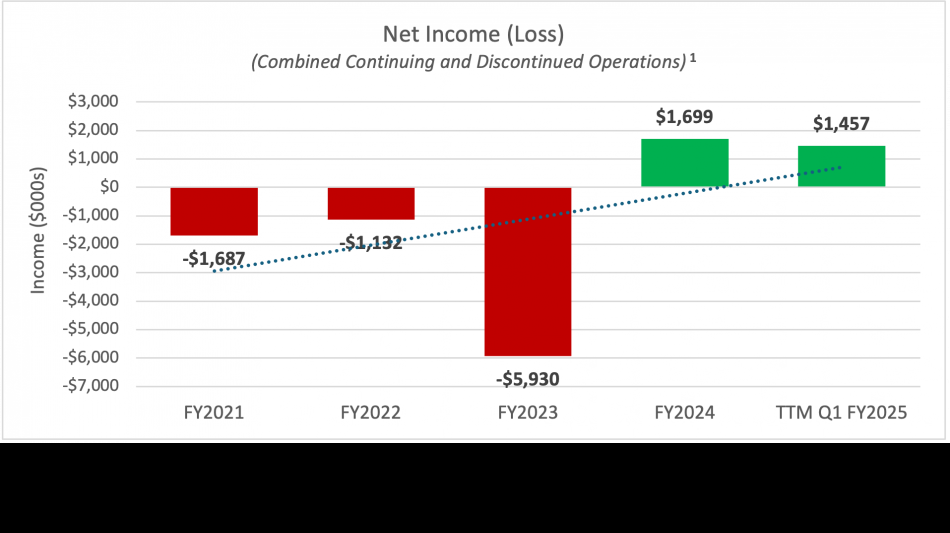

IBC is reporting the performance of "continuing operations" at its Copper Alloy division, "discontinued operations" at its Massachusetts facility, and a combination of continued and discontinued operations.1

Copper alloys division (continuing operations) sales remained steady at $4.9 million

Copper alloys division operations operating income1 dropped slightly to $322,000 from $338,000 in the prior-year period.

Copper Alloys gross margin remained largely unchanged quarter-over-quarter ("Q/Q").

IBC's consolidated net loss of $1.2 million ($0.01 per share) was driven by continuing closing costs at the EM division discontinued operations, by higher-than-normal corporate SG&A costs (largely due to the EM division closure), and by debt service payments.

The Company will host a live investor webcast to discuss these results on Friday, November 29 at 12 Noon Eastern.

IBC Advanced Alloys Corp. ("IBC" or the "Company") (TSXV:IB)(OTCQB:IAALF) announces its financial results for the quarter ended September 30, 2024. The Company will host a live investor webcast to discuss these results on Friday, November 29 at 12 Noon Eastern. To register, please go here: https://events.gov.teams.microsoft.us/event/8c3611f7-e3f7-4d3b-8809-d6f7e9e21916@a7c6e2dc-c188-46da-80af-dd3453bd7361

Sales at IBC's continuing operations1 (its Copper Alloys Division) totaled $4.898 million, largely unchanged from sales of $4.906 million in the quarter ended September 30, 2023. The division's gross profit of $857,000 and gross margin of 17.5% largely equaled its performance in the prior-year period ($865,000 and 17.6%, respectively), as did its Adjusted EBITDA of $479,000 ($479,000 in the prior-year period).

Discontinued operations at the IBC's Engineered Materials ("EM") division had no sales, as all contracts were completed in June 2024, but continued to incur closing costs. IBC expects these to wind down in the coming months, potentially putting the company on a substantially stronger footing.

On a consolidated basis, IBC booked a loss of $1.2 million, or $0.01 per share, driven largely by the lack of revenue and ongoing closing costs at its discontinued EM division, by higher-than-normal corporate SG&A costs (largely due to the EM division closure), and by debt service payments.

IBC expects to incur a charge to operations in respect to the discontinuation of the Engineered Materials division's operations and is negotiating with the building landlord to minimize such costs.

"In spite of slightly softer quarterly demand in copper alloy markets, our Copper Alloys division continued to drive healthy sales revenue and maintained its gross profit, gross margin, and adjusted earnings as compared to the prior-year period," said Mark A. Smith, Chairman and CEO of IBC. "As closing costs at our discontinued EM division wind down over the coming months, I see IBC moving to a substantially stronger footing with significant opportunity for growth in the Copper Alloys division. On a parallel path, as we continue to pay down debt and strengthen our balance sheet through organic growth, I see a great deal of upside for the Company going forward."

Selected Results

Except as noted, all financial amounts are determined in accordance with IFRS.1

SELECTED RESULTS: Combined Continuing and Discontinued Operations ($000s)1 | ||||||

Quarter Ended 9-30-2024 | Quarter Ended 9-30-2023 | |||||

Continuing Operations 1 | ||||||

Revenue | $ | 4,899 | $ | 4,905 | ||

Operating loss | $ | (226 | ) | $ | (179 | ) |

Net Loss | $ | (652 | ) | $ | (629 | ) |

Adjusted EBITDA | $ | 15 | $ | 57 | ||

Gross Profit | $ | 858 | $ | 864 | ||

Gross Margin | 18 | % | 18 | % | ||

DISCONTINUED OPERATIONS | ||||||

Revenue | $ | - | $ | 1,762 | ||

Operating loss | $ | (476 | ) | $ | (155 | ) |

Net Loss | $ | (563 | ) | $ | (305 | ) |

Adjusted EBITDA | $ | (463 | ) | $ | 62 | |

CONSOLIDATED OPERATIONS | ||||||

Revenue | $ | 4,898 | $ | 6,667 | ||

Operating loss | $ | (702 | ) | $ | (334 | ) |

Net Loss | $ | (1,215 | ) | $ | (934 | ) |

Adjusted EBITDA | $ | (448 | ) | $ | 119 | |

Full results can be seen in the Company's financial statements and management's discussion and analysis ("MD&A"), available at sedarplus.ca and on the Company's website at https://ibcadvancedalloys.com/investors-center/.

INVESTOR WEBCAST SCHEDULED FOR FRIDAY, NOVEMBER 29, 2024 at 12 NOON EASTERN

IBC will host a live investor webcast on Friday, November 29, 2024 at 12 noon Eastern featuring Mark A. Smith, CEO and Board Chairman, who will discuss the Company's financial results for the quarter. Participants can register to participate by going here: https://events.gov.teams.microsoft.us/event/8c3611f7-e3f7-4d3b-8809-d6f7e9e21916@a7c6e2dc-c188-46da-80af-dd3453bd7361

NON-IFRS MEASURES

To supplement its consolidated financial statements, which are prepared and presented in accordance with IFRS, IBC uses "Adjusted EBITDA," which a non-IFRS financial measure. IBC believes that Adjusted EBITDA is a useful indicator for cash flow generated by the business that is independent of IBC's capital structure.

Operating income (loss) and Adjusted EBITDA should not be considered in isolation or construed as an alternative to loss for the period or any other measure of performance or as an indicator of our operating performance. Operating income (loss) and Adjusted EBITDA presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to IBC's data.

ADJUSTED EBITDA

Adjusted EBITDA in the Company's continuing operations represents the income (loss) for the period, and year-to-date, before interest, income taxes, depreciation, amortization, and share-based compensation. A reconciliation of the quarter loss to Adjusted EBITDA in IBC's continuing operations follows:

Quarter ended Sept. 30 | 2024 | 2023 | ||

($000s) | ($000s) | |||

Loss for the period | (652 | ) | (629 | ) |

Income tax expense (recovery) | 1 | - | ||

Interest expense | 464 | 491 | ||

(Gain) loss on revaluation of derivative (non cash) | - | 1 | ||

Depreciation, amortization, and impairment | 172 | 158 | ||

Stock-based compensation expense (non-cash) | 29 | 36 | ||

Adjusted EBITDA | 14 | 57 | ||

For more information on IBC and its innovative alloy products, go here.

On Behalf of the Board of Directors:

"Mark A. Smith "

Mark A. Smith, CEO & Chairman of the Board

# # #

CONTACTS:

Mark A. Smith, Chairman of the Board

Jim Sims, Director of Investor and Public Relations

+1 (303) 503-6203

Email: [email protected]

Website: www.ibcadvancedalloys.com

ABOUT IBC ADVANCED ALLOYS CORP.

IBC is a leading advanced copper alloys manufacturer serving a variety of industries such as defense, aerospace, automotive , telecommunications, precision manufacturing, and others. At its vertically integrated production facility in Franklin, Indiana, IBC manufactures and distributes a variety of copper alloys as castings and forgings, including beryllium copper, chrome copper, and aluminum bronze. The Company's common shares are traded on the TSX Venture Exchange under the symbol "IB" and the OTCQB under the symbol "IAALF".

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained in this news release may be forward-looking information or forward-looking statements as defined under applicable securities laws. Forward-looking information and forward-looking statements are often, but not always identified by the use of words such as "expect", "anticipate", "believe", "foresee", "could", "estimate", "goal", "intend", "plan", "seek", "will", "may" and "should" and similar expressions or words suggesting future outcomes. This news release includes forward-looking information and statements pertaining to, among other things, the Company's expectation of further growth in revenue and market demand, and the ability of the Copper Alloy division to increase its production capacity, reduce unit costs of production, expand its product portfolio and expand into new markets, the closure of the Engineered Materials division and the expected charge to operations in connection therewith, and the completion of existing contracts by the Engineered Materials division. Forward-looking statements involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company's control including: the risk that the Company may not be able to make sufficient payments to retire its debt, the impact of general economic conditions in the areas in which the Company or its customers operate, including the semiconductor manufacturing and oil and gas industries, risks associated with manufacturing activities, changes in laws and regulations including the adoption of new environmental laws and regulations and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, limited availability of raw materials, fluctuations in commodity prices, foreign exchange or interest rates, stock market volatility and obtaining required approvals of regulatory authorities. As a result of these risks and uncertainties, the Company's future results, performance or achievements could differ materially from those expressed in these forward-looking statements. All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Please see "Risks Factors" in our Annual Information Form available under the Company's profile at www.sedarplus.ca, for information on the risks and uncertainties associated with our business. Readers should not place undue reliance on forward-looking information and statements, which speak only as of the date made. The forward-looking information and statements contained in this release represent our expectations as of the date of this release. We disclaim any intention or obligation or undertaking to update or revise any forward-looking information or statements whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

1 IBC reports non-IFRS measures such as "Adjusted EBITDA", "Operating Income," "Continuing Operations," "Discontinued Operations" and "'Combined Continuing and Discontinued Operations." Please see information on this and other non-IFRS measures in the "Non-IFRS Measures" section of this news release and in IBC's MD&A, available on sedarplus.ca.

SOURCE: IBC Advanced Alloys Corp.

P.M.Smith--AMWN