-

Australian tennis star Purcell provisionally suspended for doping

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - December 23

-

Melrose Group Publicly Files Complaint to the Ontario Securities Commission

Melrose Group Publicly Files Complaint to the Ontario Securities Commission

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

-

Slovak PM Fico on surprise visit to Kremlin to talk gas deliveries

Slovak PM Fico on surprise visit to Kremlin to talk gas deliveries

-

Daniels throw five TDs as Commanders down Eagles

-

Atalanta fight back to take top spot in Serie A, Roma hit five

Atalanta fight back to take top spot in Serie A, Roma hit five

-

Mancini admits regrets over leaving Italy for Saudi Arabia

-

Run machine Ayub shines as Pakistan sweep South Africa

Run machine Ayub shines as Pakistan sweep South Africa

-

Slovak PM Fico on surprise visit to Kremlin

-

Gaza rescuers say Israeli strikes kill 35

Gaza rescuers say Israeli strikes kill 35

-

'Incredible' Liverpool must stay focused: Slot

-

Maresca 'absolutely happy' as title-chasing Chelsea drop points in Everton draw

Maresca 'absolutely happy' as title-chasing Chelsea drop points in Everton draw

-

Salah happy wherever career ends after inspiring Liverpool rout

-

Three and easy as Dortmund move into Bundesliga top six

Three and easy as Dortmund move into Bundesliga top six

-

Liverpool hit Spurs for six, Man Utd embarrassed by Bournemouth

-

Netanyahu vows to act with 'force, determination' against Yemen's Huthis

Netanyahu vows to act with 'force, determination' against Yemen's Huthis

-

Mbappe back from 'bottom' as Real Madrid down Sevilla

-

Ali hat-trick helps champions Ahly crush Belouizdad

Ali hat-trick helps champions Ahly crush Belouizdad

-

France kept on tenterhooks over new government

-

Salah stars as rampant Liverpool hit Spurs for six

Salah stars as rampant Liverpool hit Spurs for six

-

Syria's new leader says all weapons to come under 'state control'

-

'Sonic 3' zips to top of N.America box office

'Sonic 3' zips to top of N.America box office

-

Rome's Trevi Fountain reopens to limited crowds

-

Mbappe strikes as Real Madrid down Sevilla

Mbappe strikes as Real Madrid down Sevilla

-

'Nervous' Man Utd humiliated by Bournemouth

-

Pope again condemns 'cruelty' of Israeli strikes on Gaza

Pope again condemns 'cruelty' of Israeli strikes on Gaza

-

Lonely this Christmas: Vendee skippers in low-key celebrations on high seas

-

Troubled Man Utd humiliated by Bournemouth

Troubled Man Utd humiliated by Bournemouth

-

2 US pilots shot down over Red Sea in 'friendly fire' incident: military

-

Man Utd embarrassed by Bournemouth, Chelsea held at Everton

Man Utd embarrassed by Bournemouth, Chelsea held at Everton

-

France awaits fourth government of the year

-

Germany pledges security inquest into Christmas market attack

Germany pledges security inquest into Christmas market attack

-

Death toll in Brazil bus crash rises to 41

Cerrado Gold Announces Third Quarter Financial Results

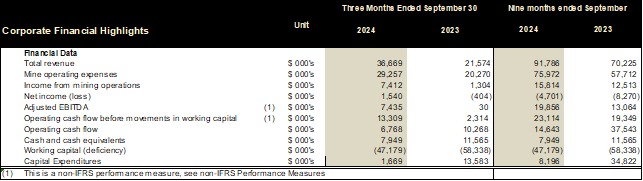

Gold equivalent production of 16,604 Gold Equivalent Ounces ("GEO") for Q3; On track for full year guidance of 50,000-60,000 GEO

Adjusted EBITDA of $7.4 million for Q3, 2024

Decrease in the working capital deficit by over US$20 million year to date

Gold equivalent production of 16,604 Gold Equivalent Ounces ("GEO") for Q3; On track for full year guidance of 50,000-60,000 GEO

Adjusted EBITDA of $7.4 million for Q3, 2024

Decrease in the working capital deficit by over US$20 million year to date

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces its operational and financial results for the third quarter ("Q3/24") including its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and its Mont Sorcier High Quality Iron Project in Quebec. The Company's Q3/24 financial results continue to consolidate the expenses, assets, and liabilities related to the Monte Do Carmo gold project ("MDC") as the sale of MDC (the "Transaction") to Amarillo Mineração do Brasil Ltda. ("Amarillo"), a wholly-owned subsidiary of Hochschild Mining PLC ("Hochschild), was completed subsequent to quarter end. The sale was in connection with the exercise of Amarillo's option pursuant to an option agreement dated March 5, 2024 (the "Option Agreement").

In connection with the Transaction, Cerrado received closing cash payments totaling US$30 million from Amarillo on November 6, 2024, in addition to the US$15 million that was previously received in connection with granting the Option. A further two payments totaling US$15 million in aggregate are expected to be received within the next 28 months bringing the total consideration of the sale to US$60 million (approximately C$83 million).

Production results for MDN were previously released on October 16, 2024. The Company's financial results are reported and available on SEDAR+ (www.sedarplus.com) and the Company's website (www.cerradogold.com).

Q3/24 MDN Operating Highlights

Q3/24 production of 16,604 GEO

Q3/24 Adjusted EBITDA of $7.4 million

AISC of $1,678 during Q3; focus on cost reduction initiatives has begun

Recent 43-101 Mineral Resource Update and Preliminary Economic Assessment Completed for MDN showing an NPV5% of $111MM at $2,100 oz gold price over a 5 year mine life

Focus remains on delivering cashflow and strengthening the balance sheet with significant progress made towards debt reduction during the quarter

Operational results for Q3 2024 demonstrated a slight increase in production over the previous quarter, highlighting greater stability in operations. Ore from the Calandrias Norte high-grade open pit was exhausted late in the quarter and is now being replaced by additional high-grade feed from two additional pits. The CIL plant is now expected to continue production until early 2025 as operations continue to transition to solely heap leach production. The ramp up of heap leach operations continued to improve as crushing capacity continued to climb with record production of 1,664 GEO in August before a slight decline in September as some adjustments were put in place to support the overall expansion of the facilities. The performance of the heap leach continues to depend on the output of the crushing circuit. The installation of the secondary crusher is expected to reduce fleet and operating costs. The new circuit is expected to be fully operational by the end of the 4th quarter, at which time the mobile crushers will be placed on standby. Recovery rates are in line with expectations given ore on the pad to date.

Mark Brennan, CEO and Chairman commented, "The results from this quarter further confirm we have entered into a more stable period of operations. We expect this to continue for the remainder of the year as the heap leach operation continues to ramp up to its expanded capacity. The cashflow from operations, combined with funds received from the sale of the MDC project, have had a significant positive impact on our working capital position, and we are now positioned to deploy capital in a strategic and fiscally prudent manner to ramp up exploration efforts at MDN, complete a bankable feasibility study at our high grade Mont Sorcier iron project and fund our recently announced normal course issuer bid."

Q3 Financial Performance

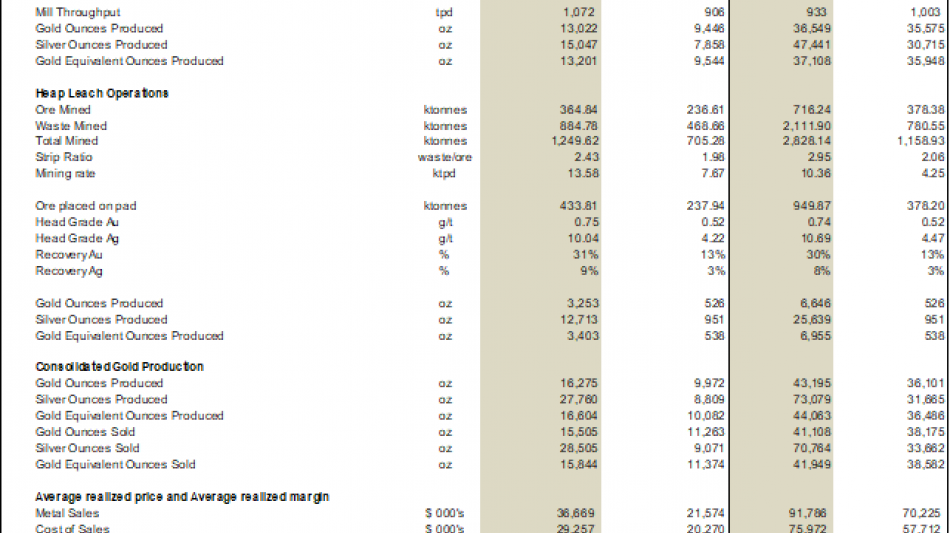

Table 1. Q3 2024 Operational and Financial Performance

The Company produced 16,604 GEO during the third quarter ended September 30, 2024, as compared to 10,082 GEO for the third quarter ended September 30, 2023. Production is higher in the three months ended September 30, 2024, due to 44% higher gold head grade and 18% higher throughput.

The Company generated revenue of $36.7 million for the third quarter ended September 30, 2024, from the sale of 15,505 ounces of gold and 28,505 ounces of silver at an average realized price per gold ounce sold of $2,329. For the third quarter ended September 30, 2023, the Company generated revenue of $21.6 million from the sale of 11,263 ounces of gold and 9,071 ounces of silver at an average realized price per gold ounce sold of $1,897. Revenue and sales of gold for the current period are higher than the quarter ended September 30, 2023, due to higher ounces sold and higher average realized gold price.

Cost of sales for the third quarter ended September 30, 2024, were $29.3 million as compared to $20.3 million for the quarter ended September 30, 2023. The Company incurred $5.6 million higher production costs for the third quarter ended September 30, 2024, due primarily to higher labour costs.

Total cash costs (including royalties) per ounce sold were $1,617 per ounce in the third quarter ended September 30, 2024, as compared to $1,689 per ounce for the third quarter ended September 30, 2023, a $72 per ounce decrease (refer to reconciliation of Non-IFRS performance metrics). The decrease is a result of higher ounces sold in 2024 as compared to 2023.

Net income for the third quarter ended September 30, 2024, was $1.5 million as compared to a $0.4 million net loss for the third quarter ended September 30, 2023. The decrease in net loss is primarily a result of an increase in revenue offset by higher other expenses.

The Company incurred general and administrative expenses of $2.9 million for the third quarter ended September 30, 2024, as compared to $3.3 million of general and administrative expenses incurred during the third quarter ended September 30, 2023. For the three months ended September 30, 2024, there was a decrease in share based payments expense of $0.4 million and office expense of $0.3 million offset by an increase in professional fees of $0.3 million.

Other expense of $2.1 million during the third quarter ended September 30, 2024, includes finance expense of $1.6 million, foreign exchange gain of $6.4 million, loss on fair value remeasurement of MDN stream obligation of $2.4 million and loss on fair value remeasurement of MDC secured note and stream obligation of $3.1 million.

Normal Course Issuer Bid

As previously announced on November 13, 2024, the Company announced TSX Venture Exchange approval for the Company's notice to implement a normal course issuer bid (the "NCIB") permitting the Company to repurchase, for cancellation, up to 5,170,903 common shares ("Common Shares") of the Company, representing 5% of the issued and outstanding Common Shares.

Share Incentive Issuances

The Company also announces it has issued 200,000 share purchase options at an exercise price of C$0.365 for a period of 2 years to a third party consultant of the Company.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing its 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of sustainable development goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

[email protected]

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, receipt of funds due from Amarillo within 28 months, stabilizing operations at MDN, ramp up of the heap leach operation and assumptions set out in the PEA. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

A.Mahlangu--AMWN