-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

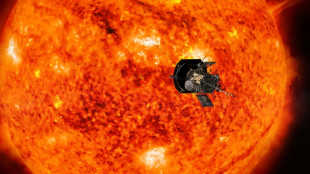

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

Jaguar Mining Announces Normal Course Issuer Bid

announced that the Toronto Stock Exchange (the "TSX") has accepted Jaguar's notice to make a normal course issuer bid (the "Bid") to purchase for cancellation up to 3,965,404 common shares in the capital of the Company ("Common Shares") in total, being 5%of the issued and outstanding Common Shares as of the day immediately preceding Jaguar's notice to the TSX, to be transacted through the facilities of the TSX or through a Canadian alternative trading system, at prevailing market prices or as otherwise permitted. The actual number of Common Shares that may be purchased pursuant to the Bid will be determined by Management of the Company ("Management"). The Bid will commence on November 27, 2024 and will terminate on November 26, 2025, or such earlier time as the Bid is completed or terminated at the option of Jaguar.

Purchases pursuant to the Bid will be made by Pollitt & Co. Inc. on behalf of the Company. Decisions regarding the timing of purchases under the Bid will be determined by Management based on market conditions, share price and other factors. Management may elect to suspend or discontinue the Bid at any time. Any purchases pursuant to the Bid will be financed from the Company's working capital.

In accordance with the rules of the TSX governing normal course issuer bids, the total number of Common Shares the Company is permitted to purchase is subject to a daily purchase limit of 19,073 Common Shares, representing 25% of the average daily trading volume of Common Shares on the TSX calculated for the six-month period ended October 31, 2024, being approximately 76,292 Common Shares. However, the Company may make one block purchase per calendar week which exceeds the daily repurchase restriction. The price that Jaguar will pay for any Common Shares under the Bid will be the prevailing market price on the TSX at the time of such purchase. Outside of pre-determined blackout periods, Common Shares may be purchased under the Bid based on Management's discretion, in compliance with TSX rules and applicable securities laws.

The Board of Directors of Jaguar believes that the underlying value of the Company may not be accurately reflected at times in the market price of the Common Shares. Accordingly, the purpose of the Bid is to enhance long-term shareholder value through the purchase and cancellation of Common Shares at a discount to the underlying value of the Company. Furthermore, the purchases by Jaguar will help mitigate the dilutive effects of any future potential issuances of additional Common Shares as consideration for capital raises, joint ventures or asset acquisitions.

A copy of the Form 12 (Notice of Intention to Make a Normal Course Issuer Bid) filed with the TSX in connection with the Bid can be obtained from the Company upon request without charge.

As of the close of business on November 14, 2024 (being the day immediately preceding Jaguar's aforementioned notice to the TSX regarding the Bid), the Company had 79,308,085 Common Shares issued and outstanding.

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with over 41,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL Mining Complex (Turmalina mine and plant) and Caeté Mining Complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência Mining Complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is planned to restart in early 2025. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

[email protected]

416-847-1854

Alfred Colas

Chief Financial Officer

Jaguar Mining Inc.

[email protected]

416-847-1848

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about Management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the number of Common Shares to be purchased pursuant to the Bid and the anticipated benefits of the Bid, including the enhancement of long term shareholder value. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions set forth in the Company's annual information form dated March 25, 2024 for the year ended December 31, 2023 and the Company's most recent Management's discussion and analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.ca. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

The forward-looking information set forth herein reflects the Company's reasonable expectations as of the day immediately preceding Jaguar's notice to the TSX and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the United States Securities Act of 1933, as amended, and applicable state securities laws.

SOURCE: Jaguar Mining, Inc.

S.Gregor--AMWN