-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

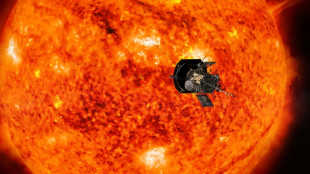

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

| CMSC | 0.33% | 23.939 | $ | |

| BCC | -0.39% | 122.275 | $ | |

| JRI | -0.08% | 12.05 | $ | |

| SCS | -1.03% | 11.62 | $ | |

| RIO | 0.66% | 59.03 | $ | |

| CMSD | -0.04% | 23.551 | $ | |

| RBGPF | 0% | 60.5 | $ | |

| RYCEF | -0.69% | 7.22 | $ | |

| NGG | 0.7% | 58.91 | $ | |

| AZN | 1.59% | 66.405 | $ | |

| GSK | 1.11% | 33.976 | $ | |

| VOD | -0.6% | 8.34 | $ | |

| RELX | 0.15% | 45.54 | $ | |

| BTI | -0.32% | 36.125 | $ | |

| BCE | -1.76% | 22.76 | $ | |

| BP | 0.33% | 28.695 | $ |

Lift Announces the Closing of Its Strategic $21.3 Million Private Placement

Li-FT Power Ltd. ("LIFT" or the "Company") (TSXV:LIFT)(OTCQX:LIFFF)(Frankfurt:WS0) has closed its previously announced (see press release dated October 23, 2024) non-brokered private placement consisting of (i) 2,694,895 common shares of the Company that qualify as "flow-through shares" (within the meaning of subsection 66(15) of the Income Tax Act (Canada)) (each, a "Flow-Through Share") at a price of $5.6575 and (ii) 1,645,105 common shares of the Company (each, a "Hard Dollar Share") which were issued to a single purchaser (the "Strategic Investor") at a price of $3.65 per Hard Dollar Share, for aggregate gross proceeds of approximately $21,251,002 (the "Offering").

Francis MacDonald, CEO and Director of LIFT, commented, "This is a pivotal moment for our Company, and we are very pleased to welcome the Strategic Investor as a meaningful shareholder of LIFT. We believe this investment supports the work completed to date by our team and the significant potential of our portfolio of hard rock lithium projects in Canada. The proceeds from the Offering will help to further de-risk our Yellowknife Lithium Project in the Northwest Territories for which we plan to complete a preliminary economic assessment in Q2 2025, as well as advance exploration on our Cali Project and our portfolio of highly prospective lithium properties in Quebec."

In connection with the Offering, the Company and the Strategic Investor entered into an investor rights agreement, pursuant to which the Strategic Investor is entitled to certain rights, provided the Strategic Investor maintains certain ownership thresholds in the Company, including: (a) the right to participate in equity financings and top-up its holdings in relation to dilutive issuances in order to maintain its pro rata ownership interest at the time of such financing or issuance or acquire up to a 9.99% ownership interest in the Company, on a partially-diluted basis; and (b) the right to nominate one person to the board of directors of the Company in the event that the Purchaser's ownership interest in the Company exceeds and remains at or above 10%, on a partially-diluted basis.

The gross proceeds from the issue of the Hard Dollar Shares will be used to advance the Company's Canadian assets as well as for general corporate purposes. The gross proceeds from the issue of the Flow-Through Shares will be used by the Company to incur eligible "Canadian exploration expenses" that will qualify as "flow-through critical mineral mining expenditures" as such terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") related to the Company's projects located in the Northwest Territories, Canada on or before December 31, 2025. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2024.

Canaccord Genuity acted as financial advisor to LIFT in connection with the Offering.

About LIFT

LIFT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada. The Company's flagship project is the Yellowknife Lithium Project located in Northwest Territories, Canada. LIFT also holds three early-stage exploration properties in Quebec, Canada with excellent potential for the discovery of buried lithium pegmatites, as well as the Cali Project in Northwest Territories within the Little Nahanni Pegmatite Group.

For further information, please contact:

Francis MacDonald | Daniel Gordon |

Chief Executive Officer | Investor Relations |

Tel: + 1.604.609.6185 | Tel: +1.604.609.6185 |

Email: [email protected] | Email: [email protected] |

Website: www.li-ft.com

Cautionary Statement Regarding Forward-Looking Information

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements relating to the closing of the Offering, the use of proceeds of the Offering, the timing of incurring the Qualifying Expenditures and the renunciation of the Qualifying Expenditures as well as the approval of the TSXV. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release.

Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors" in the Company's latest annual information form filed on March 27, 2024, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future. Forward-looking statements contained herein are made only as to the date of this press release and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Information

Francis MacDonald

CEO

[email protected]

1.604.609.6185

Daniel Gordon

Investor Relations Manager

[email protected]

1.604.609.6185

SOURCE: Li-FT Power Ltd.

P.Costa--AMWN