-

Lewandowski injury confirmed in blow to Barca quadruple bid

Lewandowski injury confirmed in blow to Barca quadruple bid

-

Russia and Ukraine accuse each other of breaching Easter truce

-

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

-

Ukrainians voice scepticism on Easter truce

-

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

-

Sri Lanka police probe photo of Buddha tooth relic

-

Home hero Wu wows Shanghai crowds by charging to China Open win

Home hero Wu wows Shanghai crowds by charging to China Open win

-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

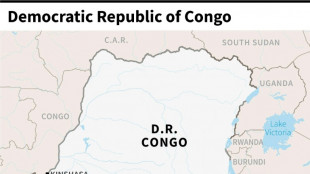

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Credit Suisse customers unruffled by stock slump

Credit Suisse customers in Geneva were not spooked by the bank's plunge on the stock exchange Wednesday, believing the Swiss government would ride to the rescue before it could ever collapse.

Emerging from the bank's headquarters branch, in a prime location on the Rhone riverside in the central shopping and business district, customers were largely unruffled by the bank's share price tumbling more than 30 percent during the day to 1.55 Swiss francs.

"It will be covered by the government, under 100,000 Swiss francs" per customer, said a 40-year-old personal trainer, who declined to give his name.

"Someone will buy the bank anyway."

The bank's international activities, rather than its Swiss domestic banking branch, are the greater source of worry, he added.

Share prices nosedived after Ammar Al Khudairy, chairman of Credit Suisse's main shareholder Saudi National Bank, said it would "absolutely not" up its stake.

Another customer stepping outside into the spring sunshine said he thought the bank would stay afloat because it is one of the 30 "global systemically important banks" deemed too big to fail.

"I'm not worried. These are systemically important banks. They can't go bankrupt," said a restaurant manager, who is a professional customer at Credit Suisse and also did not want to be named.

For customers, the 33-year-old added, "there are bigger problems to worry about."

- 'Snowball effect' -

Inside the branch's atrium, there was no air of panic as customers formed queues at various desks.

Footage of Roger Federer played on repeat on bank's electronic screens. The Swiss tennis legend has long been a brand ambassador with Credit Suisse.

Global markets have been rattled by the collapse of tech sector lenders Silicon Valley Bank and Signature.

"It's a snowball effect," said a Geneva-based independent asset manager, who cycled up to the branch and seemed unsurprised that Credit Suisse was in trouble.

"I worked 15 years for them, but nearly 35 years ago," he said, declining to be named. "It was another era. Quite different. There were more people, more counters, a better dynamic."

Credit Suisse wanted to get rid of small customers, he said, including his wealth management portfolio which didn't have enough clients.

"That was fine by us as the service was lamentable," he said

Antolin Coll, 79, who worked for Credit Suisse for 22 years, said he was confident the bank would survive.

"I still have my money there and I always monitor it," the former manager said.

"I'm not afraid about that, because there have been previous cases and it always worked out."

He sold his Credit Suisse shares when they were very high, he said.

"If you have your account in a savings account, leave it alone until things settle down," he said, warning those with stocks however to "watch out".

Credit Suisse shares recovered slightly in afternoon trading Wednesday to close down 24 percent at 1.70 Swiss francs each.

A.Mahlangu--AMWN