-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

As India's Bollywood shifts, stars and snappers click

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Djokovic eyes more Slam glory as Swiatek returns under doping cloud

-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

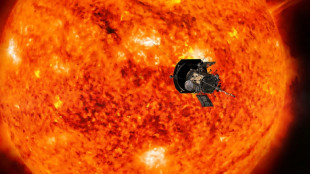

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Alibaba seeks dual-primary listing in Hong Kong

E-commerce giant Alibaba said Tuesday it will seek a primary listing in Hong Kong, potentially giving access to China's vast pool of investors, as mainland officials indicate a long-running crackdown on the tech sector could be coming to an end.

The move also comes as Chinese tech companies traded in New York grow increasingly worried about a regulatory drive by US authorities amid simmering tensions between the superpowers.

While Alibaba has a secondary listing in Hong Kong, that does not allow it to join a popular Stock Connect programme that links to bourses in Shanghai and Shenzhen.

The primary listing, which is expected to take place before the end of the year, would open that door.

News of the plan sent shares in Alibaba soaring more than five percent Tuesday, boosting other tech firms and helping drag the broader Hang Seng Index higher.

The Hangzhou-based group is one of a number of tech behemoths ensnared in a wide-ranging regulatory crackdown on alleged anti-competitive practices since late 2020.

The campaign has been driven by fears in Beijing that massive internet companies control too much data and have expanded too quickly.

But officials appear to be taking a lighter touch as they grapple with a slowing economy. And in May, Premier Li Keqiang urged support for tech companies to list both domestically and abroad.

But there is still a strict regulatory environment: President Xi Jinping last month called for stronger oversight and better security in the financial tech arena.

CEO and group chairman Daniel Zhang said on Tuesday the primary listing aimed to foster "a wider and more diversified investor base to share in Alibaba’s growth and future, especially from China and other markets in Asia".

"Hong Kong is also the launch pad for Alibaba’s globalisation strategy, and we are fully confident in China’s economy and future."

Alibaba said on Tuesday it had an average daily trading volume of $3.2 billion in the United States in the first six months of the year, while its Hong Kong secondary listing saw around $700 million.

Hong Kong's Stock Connect programme allows firms to take advantage of liquidity from mainland China for easier financing and higher valuations, but to qualify they must conduct a majority of their annual trading in the Chinese finance hub.

Alibaba is among a category of "innovative" Chinese firms with weighted voting rights or variable interest entities that would be eligible for dual-primary listing in Hong Kong, following a rule change by the bourse in January.

Analyst Willer Chen, at Forsyth Barr Asia, told Bloomberg that the move would be "massive" for Alibaba, adding that inclusion in Stock Connect could lead to a "more diversified investor base".

Beijing has opposed an attempt by US regulators to inspect the audit papers of Chinese firms listed there, and Alibaba is among 250 companies that face potential removal if no deal is reached.

Domestically, Alibaba is still reeling from the tech crackdown as well as China's slowing economy caused by the fallout from strict Covid curbs.

The company was hit with a record $2.75 billion fine for alleged unfair practices last year, and a planned 2020 IPO by Alibaba's financial arm Ant Group -- which would have been the world's largest public offering at the time -- was cancelled at the last minute.

Alibaba has lost around two-thirds of its value since a 2020 peak, according to Bloomberg, and in May the firm reported that profit fell 59 percent in the last fiscal year.

P.Stevenson--AMWN