-

Toppmoeller has ascendant Frankfurt challenging their limits

Toppmoeller has ascendant Frankfurt challenging their limits

-

Cambodia's Chinese casino city bets big on Beijing

-

Vespa love affair: Indonesians turn vintage scooters electric

Vespa love affair: Indonesians turn vintage scooters electric

-

Europe seeks to break its US tech addiction

-

Long-abandoned Welsh mine revived as gold prices soar

Long-abandoned Welsh mine revived as gold prices soar

-

UK's top court to rule on how to define a 'woman'

-

WHO countries reach landmark agreement on tackling future pandemics

WHO countries reach landmark agreement on tackling future pandemics

-

Stocks struggle again as Nvidia chip curb warning pops calm

-

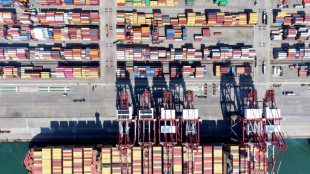

China's economy beats forecasts ahead of Trump's 'Liberation Day'

China's economy beats forecasts ahead of Trump's 'Liberation Day'

-

China's economy beat forecasts in first quarter ahead of Trump's 'Liberation Day'

-

Trump orders critical minerals probe that may bring new tariffs

Trump orders critical minerals probe that may bring new tariffs

-

Onana faces date with destiny as Man Utd chase Lyon win

-

Lessons in horror with Cambodia's Khmer Rouge tribunal

Lessons in horror with Cambodia's Khmer Rouge tribunal

-

Pandemic agreement: key points

-

Paramilitaries declare rival government as Sudan war hits two-year mark

Paramilitaries declare rival government as Sudan war hits two-year mark

-

Landmark agreement reached at WHO over tackling future pandemics

-

'La bolita,' Cuban lottery offering hope in tough times

'La bolita,' Cuban lottery offering hope in tough times

-

'Toxic beauty': Rise of 'looksmaxxing' influencers

-

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

-

Supplement Manufacturing Partner, Inc. Issues Recall on Dorado Nutrition Brand Spermidine Supplement 10mg Vegetable Capsules (Spermidine 3HCL) Due To Undeclared Wheat Allergen

-

Trump signs order aimed at lowering drug prices

Trump signs order aimed at lowering drug prices

-

Paramilitaries declare rival government as Sudan war enters third year

-

Nvidia expects $5.5 bn hit as US targets chips sent to China

Nvidia expects $5.5 bn hit as US targets chips sent to China

-

Emery targets 'next step' for Aston Villa after Champions League heroics

-

'Gap too big' for Dortmund after first leg, says Guirassy

'Gap too big' for Dortmund after first leg, says Guirassy

-

Maradona's daughter says doctors could have prevented his death

-

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

-

'We thought the tie was over': Dembele admits PSG switched off against Villa

-

Wine consumption falls heavily into the red

Wine consumption falls heavily into the red

-

Barca through to Champions League semis despite Guirassy hat-trick

-

Global stocks mixed amid lingering unease over trade war

Global stocks mixed amid lingering unease over trade war

-

PSG survive Aston Villa scare to reach Champions League semis

-

Pandemic treaty talks fight late hurdles

Pandemic treaty talks fight late hurdles

-

Trump resurrects ghost of US military bases in Panama

-

Family seeks homicide charges against owners of collapsed Dominican nightclub

Family seeks homicide charges against owners of collapsed Dominican nightclub

-

Sudan paramilitary chief declares rival government two years into war

-

Boeing faces fresh crisis with US-China trade war

Boeing faces fresh crisis with US-China trade war

-

Trump eyes slashing State Department by 50 percent: US media

-

Canada offers automakers tariff relief, Honda denies weighing move

Canada offers automakers tariff relief, Honda denies weighing move

-

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

-

French Ligue 1 clubs vote to break TV deal with DAZN

French Ligue 1 clubs vote to break TV deal with DAZN

-

Peru court sentences ex-president Humala to 15 years for graft

-

Sumy buries mother and daughter victims of Russian double strike

Sumy buries mother and daughter victims of Russian double strike

-

Trump says ball in China's court on tariffs

-

Kane urges Bayern to hit the mark against Inter in Champions League

Kane urges Bayern to hit the mark against Inter in Champions League

-

Trump ramps up conflict against defiant Harvard

-

Arteta feeding Arsenal stars 'opposite' of comeback message

Arteta feeding Arsenal stars 'opposite' of comeback message

-

France's Macron honours craftspeople who rebuilt Notre Dame

-

Watkins left on Villa bench for PSG return

Watkins left on Villa bench for PSG return

-

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

KonaTel Reports Fiscal Year 2024 Results

Positioned for Growth in 2025; Focused on Higher Margin Product Mix

DALLAS, TX / ACCESS Newswire / April 15, 2025 / KonaTel, Inc. (OTCQB:KTEL) (www.konatel.com), a voice/data communications holding company, today announced financial results for the year ended December 31, 2024.

Full Fiscal Year 2024 Financial Highlights (2024 vs. 2023)

Revenues of $15.5 million compared to $18.2 million for the year ended December 31, 2023. The decrease in revenue was due to fewer activations within the Company's Mobile Services segment as a result of reduced government subsidized revenues due to the cancellation of the Affordable Connectivity Program (the "ACP").

Gross profit of $3.41 million compared to $3.37 million for the year ended December 31, 2023.

GAAP net income (loss) $4.5 million, or $0.10 per diluted share, compared to $(3.9) million, or $(0.09) per diluted share, in the year ended December 31, 2023, which includes IM Telecom 49% ownership sale.

Non-GAAP net income (loss) of $(3.3) million, or $(0.08) per diluted share, compared to non-GAAP net loss of $(2.9) million, or $(0.07) per diluted share, in the year ended December 31, 2023, which excludes IM Telecom 49% ownership sale.

Cash and cash equivalents of $1.7 million compared to $777,000 as of December 31, 2023.

Quarterly Financial Highlights (Q4 2024 vs. Q4 2023)

Revenue of $2.4 million, a decrease of 51.5% compared to $4.9 million. This decrease was directly related to the decline in government subsidized revenues within the Mobile Services segment.

Gross profit was $677,723 or 28.5% gross profit margin, compared to $333,540, or 6.8% gross profit margin. The increase in gross profit was directly related to a decrease in customer acquisition costs.

Total operating expenses were flat at $1.8 million, compared to $1.8 million.

GAAP net loss was $(1.1) million, or $(0.02) per diluted share compared to $(1.7) million, or $(0.04) per diluted share. The loss for the three months ended December 31, 2024, was impacted by reduced subsidized mobile activations in Q4-2024 triggering substantially lower customer acquisition costs (booked at time of sale) compared to increased activations in Q4-2023 triggering higher customer acquisition costs (booked at time of sale).

Non-GAAP net loss was $(620,728), or $(0.01) per diluted share, compared to Non-GAAP net loss of $(1.2) million, or $(0.03) per diluted share.

Sean McEwen, Chairman and CEO of KonaTel stated, "There is no doubt 2024 was a challenging year for our Company, our employees and our shareholders; however, we feel the worst is behind us as we stabilized the impact from the government's unwillingness to re-fund the ACP in 2024. That being said, we are prepared to take advantage of the ACP, if it returns, or an enhanced (more profitable) Lifeline program. In some ways, we are better positioned to expand our government subsidy business as we have grown our national Lifeline license from our original eleven (11) states to forty (40) states over the past twelve (12) months.

"It's also encouraging that in January, 2025, President Elect Trump, in a post on Truth Social announcing his nomination of FCC commissioner Olivia Trusty and reemphasizing his support for affordable Internet access, which was the foundation of the ACP created by President Trump in his first term, "[She] will work with our incredible new Chairman of the FCC, Brendan Carr, to cut regulations at a record pace, protect Free Speech, and ensure every American has access to affordable and fast Internet."

McEwen added, "Additionally, we have paid down all our long-term debt accumulated during our ACP/Lifeline growth period. With a cash balance of 1,679,345 and net working capital of $2,006,701, we have been growing our hosted cloud service platform focusing on enhanced and new product offerings."

Hosted Cloud Service Platform Expansion

McEwen continued, "Throughout 2024, we dedicated additional resources to expand our SaaS ("Software as a Service") cloud platform to include a variety of enhanced and new wholesale services, ready for deployment in 2025. Our expansion efforts have already resulted in an increase in our monthly SMS service revenue from $20,000 to $110,000 over the last twelve (12) months. Customers are selecting our wholesale SMS service because of our robust API interface, flexibility within our cloud platform, and a streamlined process for enabling SMS short codes, critical for wholesale SMS distribution."

"In addition to our SMS expansion, we have added a new wholesale POTS ("plain old telephone service") service to our suite of cloud products. Our POTS service utilizes our wireless cellular infrastructure and offers unique features specifically designed to support the wholesale market, which includes telecommunications companies and national resellers with an existing POTS customer base. This allows us to grow at scale versus selling to individual retail customers."

"There are approximately 40 million traditional (i.e., "copper wire") POTS lines in the USA. Many lines are used for elevator phones, monitoring systems, fire alarms, and other equipment that require access to the national telephone network. After the FCC deregulated mandatory POTS support in 2019, carriers started to move their POTS customers to less expensive internet and wireless (cellular) data solutions. With the advent of more cost-effective POTS replacement services, like ours, carriers are getting more aggressive in moving their customers to a new internet/wireless based POTS solution."

McEwen concluded, "As of Q1-2025, we have already entered into wholesale agreements with a group of resellers who have over 35,000 existing POTS lines, which they plan to migrate. Our new wholesale POTS service provides a stable, sticky ("very low churn"), predictable recurring revenue line of business."

About KonaTel

KonaTel provides a variety of retail and wholesale telecommunications services including mobile voice/text/data service supported by national U.S. mobile networks, mobile numbers, SMS/MMS services, IoT mobile data service, and a range of hosted cloud services. KonaTel's subsidiary, Apeiron Systems (www.apeiron.io), is a global cloud communications service provider employing a dynamic "as a service" ("CPaaS/UCaaS/CCaaS/PaaS") platform. Apeiron provides voice, messaging, SD-WAN, and platform services using its national cloud network. All Apeiron's services can be accessed through legacy interfaces and rich communications APIs. KonaTel's other subsidiary, IM Telecom, dba "Infiniti Mobile" (www.infinitimobile.com), is an FCC authorized wireless Lifeline carrier with an FCC approved wireless Lifeline Compliance Plan, authorized to provide government subsidized cellular service to low-income American families. KonaTel is headquartered in Plano, Texas.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this press release. This press release should be considered in light of the disclosures contained in the filings of KonaTel and its "forward-looking statements" in such filings that are contained in the EDGAR Archives of the SEC at www.sec.gov.

Contacts

D. Sean McEwen

[email protected]

-- Tables Follow -

KonaTel, Inc.

Consolidated Balance Sheets

December 31, 2024 | December 31, 2023 | |||

Assets | ||||

Current Assets | ||||

Cash and Cash Equivalents | $ | 1,679,345 | $ | 777,103 |

Accounts Receivable, Net | 1,533,015 | 1,496,799 | ||

Notes Receivable | 1,000,000 | - | ||

Inventory, Net | 163,063 | 1,229,770 | ||

Prepaid Expenses | 94,496 | 129,706 | ||

Other Current Assets | 112,170 | - | ||

Total Current Assets | 4,582,089 | 3,633,378 | ||

Property and Equipment, Net | 15,128 | 24,184 | ||

Other Assets | ||||

Intangible Assets, Net | 323,468 | 634,251 | ||

Right of Use Asset | 319,549 | 443,328 | ||

Other Assets | 74,328 | 74,543 | ||

Total Other Assets | 717,345 | 1,152,122 | ||

Total Assets | $ | 5,314,562 | $ | 4,809,684 |

Liabilities and Stockholders' Equity | ||||

Current Liabilities | ||||

Accounts Payable and Accrued Expenses | $ | 2,277,597 | $ | 3,709,691 |

Loans Payable, Net of Loan Fees | - | 3,655,171 | ||

Right of Use Operating Lease Obligation - Current | 113,740 | 127,716 | ||

Income Tax Payable | 184,051 | - | ||

Total Current Liabilities | 2,575,388 | 7,492,578 | ||

Long Term Liabilities | ||||

Right of Use Operating Lease Obligation - Long Term | 227,776 | 330,511 | ||

Total Long Term Liabilities | 227,776 | 330,511 | ||

Total Liabilities | 2,803,164 | 7,823,089 | ||

Commitments and Contingencies | ||||

Stockholders' Equity | ||||

Common stock, $.001 par value, 50,000,000 shares authorized, 43,503,658 outstanding and issued at December 31, 2024 and 43,145,720 outstanding and issued at December 31, 2023 | 43,504 | 43,146 | ||

Additional Paid In Capital | 10,215,767 | 9,182,140 | ||

Accumulated Deficit | (7,747,873 | ) | (12,238,691 | ) |

Total Stockholders' Equity | 2,511,398 | (3,013,405 | ) | |

Total Liabilities and Stockholders' Equity | $ | 5,314,562 | $ | 4,809,684 |

KonaTel, Inc.

Consolidated Statements of Operations

Years Ended December 31, | ||||||

2024 | 2023 | |||||

Revenue | $ | 15,503,251 | $ | 18,223,745 | ||

Cost of Revenue | 12,088,944 | 14,850,105 | ||||

Gross Profit | 3,414,307 | 3,373,640 | ||||

Operating Expenses | ||||||

Payroll and Related Expenses | 5,310,549 | 3,995,698 | ||||

Operating and Maintenance | 6,086 | 5,804 | ||||

Credit Loss | 1,448 | 215 | ||||

Professional and Other Expenses | 1,646,755 | 1,526,947 | ||||

Utilities and Facilities | 210,438 | 191,556 | ||||

Depreciation and Amortization | 9,056 | 12,352 | ||||

General and Administrative | 213,149 | 155,734 | ||||

Marketing and Advertising | 99,759 | 154,533 | ||||

Application Development Costs | 140,880 | 138,600 | ||||

Taxes and Insurance | 315,258 | 312,804 | ||||

Total Operating Expenses | 7,953,378 | 6,494,243 | ||||

Operating Loss | (4,539,071 | ) | (3,120,603 | ) | ||

Other Income and Expense | ||||||

Gain on Sale | 9,247,726 | - | ||||

Interest Expense | (104,737 | ) | (820,254 | ) | ||

Other Income/(Expense), net | 70,951 | 30 | ||||

Total Other Income and Expenses | 9,213,940 | (820,224 | ) | |||

Income Before Income Taxes | 4,674,869 | (3,940,827 | ) | |||

Income Tax Expense | 184,051 | - | ||||

Net Income (Loss) | $ | 4,490,818 | $ | (3,940,827 | ) | |

Loss per Share | ||||||

Basic | $ | 0.10 | $ | (0.09 | ) | |

Diluted | $ | 0.10 | $ | (0.09 | ) | |

Weighted Average Outstanding Shares | ||||||

Basic | 43,402,219 | 42,773,269 | ||||

Diluted | 43,526,417 | 42,773,269 | ||||

SOURCE: KonaTel

View the original press release on ACCESS Newswire

L.Davis--AMWN