-

Toppmoeller has ascendant Frankfurt challenging their limits

Toppmoeller has ascendant Frankfurt challenging their limits

-

Cambodia's Chinese casino city bets big on Beijing

-

Vespa love affair: Indonesians turn vintage scooters electric

Vespa love affair: Indonesians turn vintage scooters electric

-

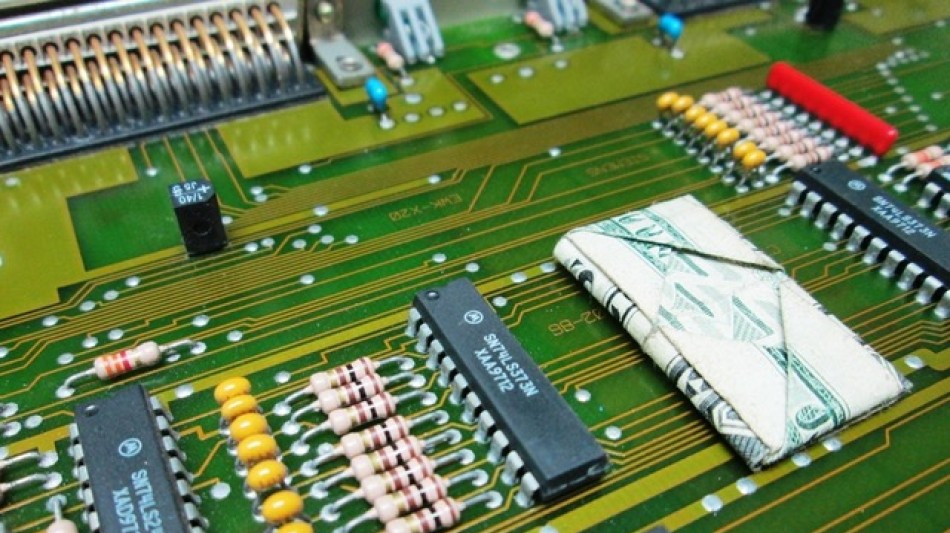

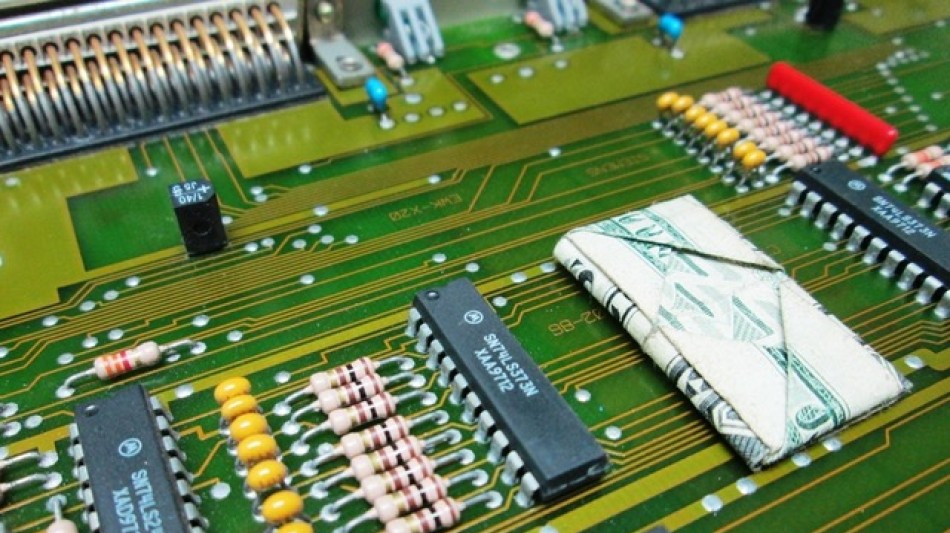

Europe seeks to break its US tech addiction

-

Long-abandoned Welsh mine revived as gold prices soar

Long-abandoned Welsh mine revived as gold prices soar

-

UK's top court to rule on how to define a 'woman'

-

WHO countries reach landmark agreement on tackling future pandemics

WHO countries reach landmark agreement on tackling future pandemics

-

Stocks struggle again as Nvidia chip curb warning pops calm

-

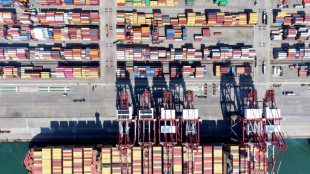

China's economy beats forecasts ahead of Trump's 'Liberation Day'

China's economy beats forecasts ahead of Trump's 'Liberation Day'

-

China's economy beat forecasts in first quarter ahead of Trump's 'Liberation Day'

-

Trump orders critical minerals probe that may bring new tariffs

Trump orders critical minerals probe that may bring new tariffs

-

Onana faces date with destiny as Man Utd chase Lyon win

-

Lessons in horror with Cambodia's Khmer Rouge tribunal

Lessons in horror with Cambodia's Khmer Rouge tribunal

-

Pandemic agreement: key points

-

Paramilitaries declare rival government as Sudan war hits two-year mark

Paramilitaries declare rival government as Sudan war hits two-year mark

-

Landmark agreement reached at WHO over tackling future pandemics

-

'La bolita,' Cuban lottery offering hope in tough times

'La bolita,' Cuban lottery offering hope in tough times

-

'Toxic beauty': Rise of 'looksmaxxing' influencers

-

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

-

Supplement Manufacturing Partner, Inc. Issues Recall on Dorado Nutrition Brand Spermidine Supplement 10mg Vegetable Capsules (Spermidine 3HCL) Due To Undeclared Wheat Allergen

-

Trump signs order aimed at lowering drug prices

Trump signs order aimed at lowering drug prices

-

Paramilitaries declare rival government as Sudan war enters third year

-

Nvidia expects $5.5 bn hit as US targets chips sent to China

Nvidia expects $5.5 bn hit as US targets chips sent to China

-

Emery targets 'next step' for Aston Villa after Champions League heroics

-

'Gap too big' for Dortmund after first leg, says Guirassy

'Gap too big' for Dortmund after first leg, says Guirassy

-

Maradona's daughter says doctors could have prevented his death

-

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

-

'We thought the tie was over': Dembele admits PSG switched off against Villa

-

Wine consumption falls heavily into the red

Wine consumption falls heavily into the red

-

Barca through to Champions League semis despite Guirassy hat-trick

-

Global stocks mixed amid lingering unease over trade war

Global stocks mixed amid lingering unease over trade war

-

PSG survive Aston Villa scare to reach Champions League semis

-

Pandemic treaty talks fight late hurdles

Pandemic treaty talks fight late hurdles

-

Trump resurrects ghost of US military bases in Panama

-

Family seeks homicide charges against owners of collapsed Dominican nightclub

Family seeks homicide charges against owners of collapsed Dominican nightclub

-

Sudan paramilitary chief declares rival government two years into war

-

Boeing faces fresh crisis with US-China trade war

Boeing faces fresh crisis with US-China trade war

-

Trump eyes slashing State Department by 50 percent: US media

-

Canada offers automakers tariff relief, Honda denies weighing move

Canada offers automakers tariff relief, Honda denies weighing move

-

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

-

French Ligue 1 clubs vote to break TV deal with DAZN

French Ligue 1 clubs vote to break TV deal with DAZN

-

Peru court sentences ex-president Humala to 15 years for graft

-

Sumy buries mother and daughter victims of Russian double strike

Sumy buries mother and daughter victims of Russian double strike

-

Trump says ball in China's court on tariffs

-

Kane urges Bayern to hit the mark against Inter in Champions League

Kane urges Bayern to hit the mark against Inter in Champions League

-

Trump ramps up conflict against defiant Harvard

-

Arteta feeding Arsenal stars 'opposite' of comeback message

Arteta feeding Arsenal stars 'opposite' of comeback message

-

France's Macron honours craftspeople who rebuilt Notre Dame

-

Watkins left on Villa bench for PSG return

Watkins left on Villa bench for PSG return

-

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

GameSquare Holdings Reports 2024 Full Year Results

Proforma revenue of $102 million, aligned with multi-year strategic plan to rapidly scale business

Fourth quarter adjusted EBITDA loss of $4.3 million, impacted by $2.8 million from FaZe Media

GameSquare expects 2025 revenue of over $100 million, with positive cash flow and adjusted EBITDA supported by a higher gross margin and lower operating expenses

FRISCO, TX / ACCESS Newswire / April 15, 2025 / GameSquare Holdings, Inc. (NASDAQ:GAME), ("GameSquare", or the "Company"), today announced financial results for the twelve-months ended December 31, 2024.

Justin Kenna, CEO of GameSquare, stated, "Since our founding in August 2020, the first phase of our multi-year strategic plan has focused on quickly building a diverse offering of media, agency, technology and esports assets to help global brands engage with hard-to-reach audiences at scale. Our 2024 financial results reflect the success of the differentiated platform we have created and our organic and M&A growth strategies. In less than four years, GameSquare has grown from just $0.5 million in revenue to $102 million in proforma revenue through our team's efforts to develop next-generation solutions and drive connections between the world's largest video game publishers, brands, and global gaming and esports communities."

"Our performance in 2024 reflects our near-term efforts to optimize our business model by divesting non-core assets, driving cross-selling opportunities, and integrating the March 2024 FaZe Clan acquisition. We also continued pursuing strategies to improve our balance sheet, reduce operating expenses, and invest in new products and services. The progress we made in 2024 supports the next phase of our strategic plan, focused on reaching positive adjusted EBITDA and cash flow in 2025," Mr. Kenna continued.

"While our markets were softer than expected in the 2024 fourth quarter, and profitability was reduced throughout the year by the impact of FaZe Media and a less profitable mix of revenue, 2025 is off to a solid start. Our order book for 2025 is strong despite recent economic uncertainty. This trend is supported by global gaming publishers and top-tier brands prioritizing engagement with GameSquare's core esports and youth audiences. As a result, we believe we are on track to grow sales organically and improve profitability and cash flow throughout 2025," concluded Mr. Kenna.

Twelve months ended December 31, 2024, compared to December 31, 2023

Revenue of $96.2 million, compared to $41.3 million

Gross profit of $15.3 million, compared to $10.1 million

Net loss attributable to GameSquare of $48.8 million, compared to a net loss of $31.3 million

Adjusted EBITDA loss of $16.0 million, compared to a loss of $11.1 million

Adjusted EBITDA loss was 16.6% of revenue, versus 26.8% of revenue last year

Proforma* results for the twelve months ended December 31, 2024, compared to December 31, 2023 (unless otherwise noted)

Revenue of $102.0 million, compared to $94.8 million

Gross profit of $15.6 million, compared to $13.9 million

Operating expenses of $39.3 million, or 38.6% of revenue, compared to $60.0 million or 63.4% of revenue last year

Adjusted EBITDA loss of $19.8 million, compared to a loss of $46.1 million last year

Adjusted EBITDA loss was 19.4% of revenue, versus 48.6% of revenue last year

* Proforma financial results includes a full year-to-date contribution of FaZe Clan in the 2024 period, and includes a full year-to-date contribution of Engine and FaZe Clan in the 2023 period.

2025 Annual Guidance

Annual proforma revenue in 2025 between $100 million to $105 million, which excludes $27 million of FaZe Media revenue that GameSquare divested on April 1, 2025

Organic revenue growth of 20% to 25% supported by sales to existing and new customers, and cross-selling opportunities

Annual gross margin of approximately 20% to 25% benefiting from a more profitable mix of revenue and the April 1, 2025, FaZe Media divestiture

GameSquare expects annual cash operating expenses in 2025 to improve by approximately $15 million from cash operating expenses in 2024 of $35 million, as a result the FaZe Media divestiture and recent actions to reduce full-year operating expenses by approximately 10%

EBITDA and cash flow to improve throughout 2025 with positive EBITDA and cash flow in the second half of 2025

Conference Call Details

Justin Kenna, CEO, Lou Schwartz, President, and Mike Munoz CFO are scheduled to host a conference call with the investment community. Analysts and interested investors can join the call via the details below:

Date: April 16, 2025

Time: 5:00 pm ET

Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=vc78St32

Corporate Contact

Lou Schwartz, President

Phone: (216) 464-6400

Email: [email protected]

Investor Relations

Andrew Berger

Phone: (216) 464-6400

Email: [email protected]

Media Relations

Chelsey Northern / The Untold

Phone: (254) 855-4028

Email: [email protected]

About GameSquare Holdings, Inc.

GameSquare's (NASDAQ: GAME) mission is to revolutionize the way brands and game publishers connect with hard-to-reach Gen Z, Gen Alpha, and Millennial audiences. Our next generation media, entertainment, and technology capabilities drive compelling outcomes for creators and maximize our brand partners' return on investment. Through our purpose-built platform, we provide award winning marketing and creative services, offer leading data and analytics solutions, and amplify awareness through FaZe Clan Esports, one of the most prominent and influential gaming organizations in the world. With one of the largest gaming media networks in North America, as verified by Comscore, we are reshaping the landscape of digital media and immersive entertainment. GameSquare's largest investors are Dallas Cowboys owner Jerry Jones and the Goff family.

To learn more, visit www.gamesquare.com.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the Company's and FaZe Media's future performance, revenue, growth and profitability; and the Company's and FaZe Media's ability to execute their business plans. These forward-looking statements are provided only to provide information currently available to us and are not intended to serve as and must not be relied on by any investor as, a guarantee, assurance or definitive statement of fact or probability. Forward-looking statements are necessarily based upon a number of estimates and assumptions which include, but are not limited to: the Company's and FaZe Media's ability to grow their business and being able to execute on their business plans, the Company being able to complete and successfully integrate acquisitions, the Company being able to recognize and capitalize on opportunities and the Company continuing to attract qualified personnel to supports its development requirements. These assumptions, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: the Company's ability to achieve its objectives, the Company successfully executing its growth strategy, the ability of the Company to obtain future financings or complete offerings on acceptable terms, failure to leverage the Company's portfolio across entertainment and media platforms, dependence on the Company's key personnel and general business, economic, competitive, political and social uncertainties. These risk factors are not intended to represent a complete list of the factors that could affect the Company which are discussed in the Company's most recent MD&A. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. GameSquare assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

GameSquare Holdings, Inc.

Consolidated Balance Sheets

December 31, | December 31, | |||

Assets | ||||

Cash | $ | 12,094,950 | $ | 2,945,373 |

Restricted cash | 1,054,030 | 47,465 | ||

Accounts receivable, net | 21,330,847 | 16,459,684 | ||

Government remittances | 119,721 | 1,665,597 | ||

Contingent consideration, current | - | 207,673 | ||

Promissory note receivable, current | 379,405 | - | ||

Prepaid expenses and other current assets | 1,493,619 | 916,740 | ||

Total current assets | 36,472,572 | 22,242,532 | ||

Investment | 2,199,909 | 2,673,472 | ||

Contingent consideration, non-current | - | 293,445 | ||

Promissory note receivable | 9,212,785 | - | ||

Property and equipment, net | 303,950 | 2,464,633 | ||

Goodwill | 12,704,979 | 16,303,989 | ||

Intangible assets, net | 15,265,736 | 18,574,144 | ||

Right-of-use assets | 2,570,516 | 2,159,693 | ||

Total assets | $ | 78,730,447 | $ | 64,711,908 |

Liabilities and Shareholders' Equity | ||||

Accounts payable | $ | 27,349,372 | $ | 23,493,472 |

Accrued expenses and other current liabilities | 13,694,179 | 5,289,149 | ||

Players liability account | 47,535 | 47,465 | ||

Deferred revenue | 2,726,121 | 1,930,028 | ||

Current portion of operating lease liability | 748,916 | 367,487 | ||

Line of credit | 3,501,457 | 4,518,571 | ||

Convertible debt carried at fair value | 6,481,704 | - | ||

Warrant liability | 14,314 | 102,284 | ||

Arbitration reserve | 199,374 | 428,624 | ||

Total current liabilities | 54,762,972 | 36,177,080 | ||

Convertible debt carried at fair value | 9,908,784 | 8,176,928 | ||

Operating lease liability | 2,054,443 | 1,994,961 | ||

Total liabilities | 66,726,199 | 46,348,969 | ||

Commitments and contingencies (Note 14) | ||||

Preferred stock (no par value, unlimited shares authorized, zero shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively) | - | - | ||

Common stock (no par value, unlimited shares authorized, 32,635,995 and 12,989,128 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively) | - | - | ||

Additional paid-in capital | 119,441,634 | 91,915,169 | ||

Accumulated other comprehensive loss | (208,617 | ) | (132,081 | ) |

Non-controlling interest | 14,942,287 | - | ||

Accumulated deficit | (122,171,056 | ) | (73,420,149 | ) |

Total shareholders' equity | 12,004,248 | 18,362,939 | ||

Total liabilities and shareholders' equity | $ | 78,730,447 | $ | 64,711,908 |

GameSquare Holdings, Inc.

Consolidated Statements of Operations and Comprehensive Loss

Three months ended December 31, | Year ended December 31, | |||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Revenue | $ | 23,469,686 | $ | 15,649,970 | $ | 96,198,101 | $ | 41,303,381 | ||||

Cost of revenue | 21,066,042 | 12,127,151 | 80,924,985 | 31,201,859 | ||||||||

Gross profit | 2,403,644 | 3,522,819 | 15,273,116 | 10,101,522 | ||||||||

Operating expenses: | ||||||||||||

General and administrative | 6,840,523 | 1,982,320 | 25,074,294 | 13,587,575 | ||||||||

Selling and marketing | 2,274,496 | 2,358,839 | 9,131,270 | 6,305,939 | ||||||||

Research and development | 876,847 | 1,966,570 | 3,247,774 | 3,067,361 | ||||||||

Depreciation and amortization | 723,467 | 593,406 | 3,237,349 | 1,889,075 | ||||||||

Restructuring charges | 827,888 | 158,836 | 1,334,717 | 545,456 | ||||||||

Impairment expense | 12,548,476 | 7,024,000 | 12,548,476 | 7,024,000 | ||||||||

Other operating expenses | 3,474,486 | 878,105 | 6,849,846 | 3,065,021 | ||||||||

Total operating expenses | 27,566,183 | 14,962,076 | 61,423,726 | 35,484,427 | ||||||||

Loss from continuing operations | (25,162,539 | ) | (11,439,257 | ) | (46,150,610 | ) | (25,382,905 | ) | ||||

Other income (expense), net: | ||||||||||||

Interest expense | 110,531 | (318,028 | ) | (570,960 | ) | (672,589 | ) | |||||

Loss on debt extinguishment | - | (2,204,737 | ) | (1,032,070 | ) | (2,204,737 | ) | |||||

Change in fair value of convertible debt carried at fair value | 201,390 | (2,782 | ) | 559,212 | 538,354 | |||||||

Change in fair value of investment | (473,563 | ) | (515,277 | ) | (473,563 | ) | (515,277 | ) | ||||

Change in fair value of warrant liability | 5,067 | (875,337 | ) | 84,449 | 968,757 | |||||||

Arbitration settlement reserve | (22,958 | ) | 89,251 | 229,250 | 1,041,129 | |||||||

Other income (expense), net | (4,138,044 | ) | 85,844 | (8,204,066 | ) | (103,463 | ) | |||||

Total other income (expense), net | (4,317,577 | ) | (3,741,066 | ) | (9,407,748 | ) | (947,826 | ) | ||||

Loss from continuing operations before income taxes | (29,480,116 | ) | (15,180,323 | ) | (55,558,358 | ) | (26,330,731 | ) | ||||

Income tax benefit | - | 38,600 | - | 55,096 | ||||||||

Net loss from continuing operations | (29,480,116 | ) | (15,141,723 | ) | (55,558,358 | ) | (26,275,635 | ) | ||||

Net income (loss) from discontinued operations | (100,000 | ) | (2,659,548 | ) | 1,249,738 | (5,006,792 | ) | |||||

Net loss | (29,580,116 | ) | (17,801,271 | ) | (54,308,620 | ) | (31,282,427 | ) | ||||

Net loss attributable to non-controlling interest | 3,188,180 | - | 5,557,713 | - | ||||||||

Net loss attributable to attributable to GameSquare Holdings, Inc. | $ | (26,391,936 | ) | $ | (17,801,271 | ) | $ | (48,750,907 | ) | $ | (31,282,427 | ) |

Comprehensive loss, net of tax: | ||||||||||||

Net loss | $ | (29,580,116 | ) | $ | (17,801,271 | ) | $ | (54,308,620 | ) | $ | (31,282,427 | ) |

Change in foreign currency translation adjustment | (449,723 | ) | 36,285 | (76,536 | ) | 136,972 | ||||||

Comprehensive loss | (30,029,839 | ) | (17,764,986 | ) | (54,385,156 | ) | (31,145,455 | ) | ||||

Comprehensive income attributable to non-controlling interest | 3,188,180 | - | 5,557,713 | - | ||||||||

Comprehensive loss | $ | (26,841,659 | ) | $ | (17,764,986 | ) | $ | (48,827,443 | ) | $ | (31,145,455 | ) |

Income (loss) per common share attributable to GameSquare Holdings, Inc. - basic and assuming dilution: | ||||||||||||

From continuing operations | $ | (0.81 | ) | $ | (1.17 | ) | $ | (1.79 | ) | $ | (2.36 | ) |

From discontinued operations | (0.00 | ) | (0.21 | ) | 0.04 | (0.45 | ) | |||||

Loss per common share attributable to GameSquare Holdings, Inc. - basic and assuming dilution | $ | (0.81 | ) | $ | (1.38 | ) | $ | (1.75 | ) | $ | (2.81 | ) |

Weighted average common shares outstanding - basic and diluted | 32,423,558 | 12,927,204 | 27,897,987 | 11,119,900 | ||||||||

Management's use of Non-GAAP Measures

This release contains certain financial performance measures, including "EBITDA" and "Adjusted EBITDA," that are not recognized under accounting principles generally accepted in the United States of America ("GAAP") and do not have a standardized meaning prescribed by GAAP. As a result, these measures may not be comparable to similar measures presented by other companies. For a reconciliation of these measures to the most directly comparable financial information presented in the Financial Statements in accordance with GAAP, see the section entitled "Reconciliation of Non-GAAP Measures" below.

We believe EBITDA is a useful measure to assess the performance of the Company as it provides more meaningful operating results by excluding the effects of expenses that are not reflective of our underlying business performance and other one-time or non-recurring expenses. We define "EBITDA" as net income (loss) before (i) depreciation and amortization; (ii) income taxes; and (iii) interest expense.

Adjusted EBITDA

We believe Adjusted EBITDA is a useful measure to assess the performance of the Company as it provides more meaningful operating results by excluding the effects of expenses that are not reflective of our underlying business performance and other one-time or non-recurring expenses. We define "Adjusted EBITDA" as EBITDA adjusted to exclude extraordinary items, non-recurring items and other non-cash items, including, but not limited to (i) share based compensation expense, (ii) transaction costs related to merger and acquisition activities, (iii) arbitration settlement reserves and other non-recurring legal settlement expenses, (iv) restructuring costs, primarily comprised of employee severance resulting from integration of acquired businesses, (v) impairment of goodwill and intangible assets, (vi) gains and losses on extinguishment of debt, (vii) change in fair value of assets and liabilities adjusted to fair value on a quarterly basis, (viii) gains and losses from discontinued operations, and (ix) net income (loss) attributable to non-controlling interest.

Reconciliation of Non-GAAP Measures

A reconciliation of Adjusted EBITDA to the most directly comparable measure determined under US GAAP is set out below.

Three months ended December 31, | Year ended December 31, | |||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Net loss | $ | (29,580,116 | ) | $ | (17,801,271 | ) | $ | (54,308,620 | ) | $ | (31,282,427 | ) |

Interest expense | (110,531 | ) | 318,028 | 570,960 | 672,589 | |||||||

Income tax benefit | - | (38,600 | ) | - | (55,096 | ) | ||||||

Amortization and depreciation | 723,467 | 593,406 | 3,237,349 | 1,889,075 | ||||||||

Share-based payments | 850,762 | 447,338 | 2,139,246 | 1,735,630 | ||||||||

Transaction costs | 2,931,041 | 832,457 | 6,348,728 | 3,019,373 | ||||||||

Arbitration settlement reserve | 22,958 | (89,251 | ) | (229,250 | ) | (1,041,129 | ) | |||||

Restructuring costs | 827,888 | 158,836 | 1,334,717 | 545,456 | ||||||||

Legal settlement | - | (545 | ) | - | 186,560 | |||||||

Loss on extinguishment of debt | - | 2,204,737 | 1,032,070 | 2,204,737 | ||||||||

Change in fair value of contingent consideration | 543,445 | 45,648 | 501,118 | 45,648 | ||||||||

Change in fair value of investment | 473,563 | 515,277 | 473,563 | 515,277 | ||||||||

Change in fair value of warrant liability | (5,067 | ) | 875,337 | (84,449 | ) | (968,757 | ) | |||||

Change in fair value of convertible debt carried at fair value | (201,390 | ) | 2,782 | (559,212 | ) | (538,354 | ) | |||||

Gain on disposition of subsidiary | - | - | (3,009,891 | ) | - | |||||||

Loss on disposition of assets | 4,500,506 | (40,794 | ) | 8,264,980 | (40,794 | ) | ||||||

Impairment expense | 12,548,476 | 7,024,000 | 12,548,476 | 7,024,000 | ||||||||

Loss from discontinued operations | 100,000 | 2,659,548 | 1,760,153 | 5,006,792 | ||||||||

Net loss attributable to non-controlling interest | 3,188,180 | - | 5,557,713 | - | ||||||||

Net loss attributable to non-controlling interest (adjustment for NCI share of add backs to Adjusted EBITDA) | (1,119,096 | ) | - | (1,586,728 | ) | - | ||||||

Adjusted EBITDA | $ | (4,305,914 | ) | $ | (2,293,067 | ) | $ | (16,009,077 | ) | $ | (11,081,420 | ) |

SOURCE: GameSquare Holdings, Inc.

View the original press release on ACCESS Newswire

P.Stevenson--AMWN