-

Nate Bargatze to host Emmys: organizers

Nate Bargatze to host Emmys: organizers

-

US Fed Chair warns of 'tension' between employment, inflation goals

-

Trump touts trade talks, China calls out tariff 'blackmail'

Trump touts trade talks, China calls out tariff 'blackmail'

-

US judge says 'probable cause' to hold govt in contempt over deportations

-

US eliminates unit countering foreign disinformation

US eliminates unit countering foreign disinformation

-

Germany sees 'worrying' record dry spell in early 2025

-

Israel says 30 percent of Gaza turned into buffer zone

Israel says 30 percent of Gaza turned into buffer zone

-

TikTok tests letting users add informative 'Footnotes'

-

Global uncertainty will 'certainly' hit growth: World Bank president

Global uncertainty will 'certainly' hit growth: World Bank president

-

EU lists seven 'safe' countries of origin, tightening asylum rules

-

Chelsea fans must 'trust' the process despite blip, says Maresca

Chelsea fans must 'trust' the process despite blip, says Maresca

-

Rebel rival government in Sudan 'not the answer': UK

-

Prague zoo breeds near-extinct Brazilian mergansers

Prague zoo breeds near-extinct Brazilian mergansers

-

Macron to meet Rubio, Witkoff amid transatlantic tensions

-

WTO chief says 'very concerned' as tariffs cut into global trade

WTO chief says 'very concerned' as tariffs cut into global trade

-

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

-

Zverev joins Shelton in Munich ATP quarters

Zverev joins Shelton in Munich ATP quarters

-

The Trump adviser who wants to rewrite the global financial system

-

US senator travels to El Salvador over wrongly deported migrant

US senator travels to El Salvador over wrongly deported migrant

-

UN watchdog chief says Iran 'not far' from nuclear bomb

-

Trump says 'joke' Harvard should be stripped of funds

Trump says 'joke' Harvard should be stripped of funds

-

Macron vows punishment for French prison attackers

-

Canada central bank holds interest rate steady amid tariffs chaos

Canada central bank holds interest rate steady amid tariffs chaos

-

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

'Put it on': Dutch drive for bike helmets

-

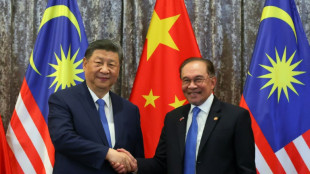

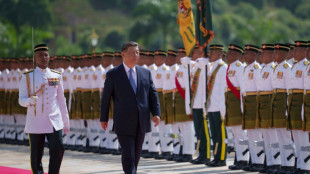

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

UK top court rules definition of 'woman' based on sex at birth

-

PSG keep Champions League bid alive, despite old ghosts reappearing

-

Stocks retreat as US hits Nvidia chip export to China

Stocks retreat as US hits Nvidia chip export to China

-

China's Xi meets Malaysian leaders in diplomatic charm offensive

-

Israel says no humanitarian aid will enter Gaza

Israel says no humanitarian aid will enter Gaza

-

Anxiety clouds Easter for West Bank Christians

-

Pocket watch found on Titanic victim to go on sale in UK

Pocket watch found on Titanic victim to go on sale in UK

-

UK top court rules definition of 'a woman' based on sex at birth

-

All Black Ioane to join Leinster on six-month 'sabbatical'

All Black Ioane to join Leinster on six-month 'sabbatical'

-

Barca suffer morale blow in Dortmund amid quadruple hunt

-

China tells Trump to 'stop threatening and blackmailing'

China tells Trump to 'stop threatening and blackmailing'

-

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

-

Automakers hold their breath on Trump's erratic US tariffs

Automakers hold their breath on Trump's erratic US tariffs

-

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

-

Troubled Red Bull search for path back to fast lane

Troubled Red Bull search for path back to fast lane

-

China's forecast-beating growth belies storm clouds ahead: analysts

Tax Day is Tomorrow: Extend Your 1040, 1120, or 1041 Deadline by Filing Form 4868 or 7004 with ExpressExtension

Individuals and many businesses must file tax forms or request an extension from the IRS by April 15, 2025.

ROCK HILL, SC / ACCESS Newswire / April 14, 2025 / Tomorrow, April 15, 2025, marks the IRS deadline for filing key federal tax returns, including Form 1040 (Individual Income Tax Return), 1120 (U.S. Corporation Income Tax Return), 1041 (U.S. Income Tax Return for Estates and Trusts), and others. To avoid late filing penalties and remain in good standing with the IRS, individuals and businesses must either file their returns or submit an official extension request by midnight on April 15, 2025.

For those who need additional time to complete their filings, the IRS allows taxpayers to file an extension request. ExpressExtension provides a quick and reliable way to electronically submit these extension forms before the deadline.

Extension Filing Options for Those Who Need More Time

Individuals and sole proprietors who are not ready to submit Form 1040 can file Form 4868 to receive an automatic 6-month extension.

C-Corporations and LLCs taxed as corporations can file Form 7004 to extend the deadline for Form 1120 by an additional 6 months.

Trusts and estates required to file Form 1041 can also use Form 7004 to obtain an automatic 5½-month extension.

To be valid, these extension forms must be submitted by midnight on April 15. Filing online through ExpressExtension helps ensure that requests are submitted securely and on time.

State Tax Extension Deadline

In many states, the tax extension deadlines coincide with the federal deadline of April 15. Businesses and individuals are advised to verify their specific state requirements to ensure they meet both federal and state deadlines. To learn more about each state's tax extension filing deadline, click here.

ExpressExtension: A Trusted Platform for IRS Tax Extension E-Filing

ExpressExtension is an IRS-authorized e-file provider offering a reliable and secure solution for filing last-minute tax extension requests. Designed for individuals, businesses, and tax professionals, the platform simplifies the process of filing Forms 7004 and 4868-helping users complete and transmit their extensions in just minutes. ExpressExtension incorporates advanced features that support accuracy, compliance, and ease of use.

Key features include:

Efficient Filing Process: A streamlined interface enables fast and accurate submission of IRS extension forms.

Copy Prior Return: Users can duplicate previously filed extensions to save time and reduce data entry.

Expert Support: A dedicated U.S.-based support team is available via live chat, phone, and email.

AI Assistance: An intelligent chatbot provides real-time help throughout the filing process.

ExpressGuarantee: Guaranteed IRS Approval or Money Back

To provide peace of mind during filing, ExpressExtension offers the ExpressGuarantee-a unique assurance for both individual and business filers. If the IRS rejects Form 4868 or 7004 due to a duplicate submission, ExpressExtension will issue a full refund of the filing fee. For all other rejections, users can make necessary corrections and re-transmit the form at no additional cost.

Advanced Tools for Tax Professionals and High-Volume Filers

ExpressExtension offers exclusive pro features tailored to meet the needs of tax professionals and high-volume filers:

Bulk Filing Made Easy: Tax professionals and accounting firms can save time by filing multiple extension requests simultaneously.

Flexible Data Import: Customizable Excel templates make it simple to upload large volumes of client data with minimal effort.

Client Management Dashboard: The centralized dashboard allows tax professionals to manage an unlimited number of clients in an organized manner.

Volume-Based Savings: ExpressExtension offers volume-based pricing options that enable high-volume filers to save more as they file more forms.

To file an extension Form 4868 or 7004, businesses and individuals are encouraged to visit ExpressExtension.com.

About ExpressExtension

ExpressExtension is the one-stop solution for IRS Tax Extensions. As an IRS-authorized, SOC 2 Certified e-file provider, ExpressExtension has been helping businesses, individuals, and non-profit organizations to obtain IRS extensions for over a decade. Supported forms include Form 7004, 4868, 8868, and 8809.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN has been developing industry-leading software solutions for e-filing and business management tools for over a decade.

The SPAN Enterprises Portfolio of products includes TaxBandits, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Caleb Flachman, Marketing Manager, at [email protected].

SOURCE: Span Enterprises

View the original press release on ACCESS Newswire

H.E.Young--AMWN