-

LIV Golf stars playing at Doral with Masters on their minds

LIV Golf stars playing at Doral with Masters on their minds

-

Trump unveils sweeping 'Liberation Day' tariffs

-

Most deadly 2024 hurricane names retired from use: UN agency

Most deadly 2024 hurricane names retired from use: UN agency

-

Boeing chief reports progress to Senate panel after 'serious missteps'

-

Is Musk's political career descending to Earth?

Is Musk's political career descending to Earth?

-

On Mexico-US border, Trump's 'Liberation Day' brings fears for future

-

Starbucks faces new hot spill lawsuit weeks after $50mn ruling

Starbucks faces new hot spill lawsuit weeks after $50mn ruling

-

Ally of Pope Francis elected France's top bishop

-

'Determined' Buttler leads Gujarat to IPL win over Bengaluru

'Determined' Buttler leads Gujarat to IPL win over Bengaluru

-

US judge dismisses corruption case against New York mayor

-

Left-wing party pulls ahead in Greenland municipal elections

Left-wing party pulls ahead in Greenland municipal elections

-

Blistering Buttler leads Gujarat to IPL win over Bengaluru

-

Tesla sales slump as pressure piles on Musk

Tesla sales slump as pressure piles on Musk

-

Amazon makes last-minute bid for TikTok: report

-

Canada Conservative leader warns Trump could break future trade deal

Canada Conservative leader warns Trump could break future trade deal

-

British band Muse cancels planned Istanbul gig

-

'I'll be back' vows Haaland after injury blow

'I'll be back' vows Haaland after injury blow

-

Trump to unveil 'Liberation Day' tariffs as world braces

-

New coach Edwards adamant England can win women's cricket World Cup

New coach Edwards adamant England can win women's cricket World Cup

-

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

-

US stocks advance ahead of looming Trump tariffs

US stocks advance ahead of looming Trump tariffs

-

Scramble for food aid in Myanmar city near quake epicentre

-

American Neilson Powless fools Visma to win Across Flanders

American Neilson Powless fools Visma to win Across Flanders

-

NATO chief says alliance with US 'there to stay'

-

Myanmar junta declares quake ceasefire as survivors plead for aid

Myanmar junta declares quake ceasefire as survivors plead for aid

-

American Neilson Powless fools Visma to win Around Flanders

-

Tesla first quarter sales sink amid anger over Musk politics

Tesla first quarter sales sink amid anger over Musk politics

-

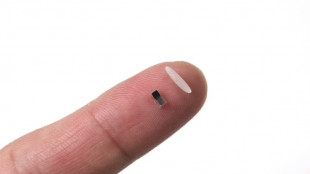

World's tiniest pacemaker is smaller than grain of rice

-

Judge dismisses corruption case against NY mayor

Judge dismisses corruption case against NY mayor

-

Nintendo to launch Switch 2 console on June 5

-

France Le Pen eyes 2027 vote, says swift appeal 'good news'

France Le Pen eyes 2027 vote, says swift appeal 'good news'

-

Postecoglou hopes Pochettino gets Spurs return wish

-

US, European stocks fall as looming Trump tariffs raise fears

US, European stocks fall as looming Trump tariffs raise fears

-

Nintendo says Switch 2 console to be launched on June 5

-

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

-

Le Pen ally denies planned rally a 'power play' against conviction

-

Letsile Tebogo says athletics saved him from life of crime

Letsile Tebogo says athletics saved him from life of crime

-

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

-

Israel says expanding Gaza offensive to seize 'large areas'

Israel says expanding Gaza offensive to seize 'large areas'

-

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

-

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

-

UK drawing up new action plan to tackle rising TB

-

Nigerian president sacks board of state oil company

Nigerian president sacks board of state oil company

-

Barca never had financial room to register Olmo: La Liga

-

Spain prosecutors to appeal ruling overturning Alves' rape conviction

Spain prosecutors to appeal ruling overturning Alves' rape conviction

-

Heathrow 'warned about power supply' days before shutdown

-

Epstein accuser Virginia Giuffre 'stable' after car crash

Epstein accuser Virginia Giuffre 'stable' after car crash

-

Myanmar quake survivors plead for more help

-

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

-

Maresca non-committal over Sancho's future at Chelsea

Healthy Extracts Reports Record 2024 Financial Results, Driving First-Ever Positive Adj. EBITDA of $0.02 Per Share

Net Revenue up 25%, with Strong Subscription-Based Recurring Revenue Growth Helping to Drive Positive Cash Flow and First-Ever Positive Adjusted EBITDA

Outlook for Accelerating Net Revenue Growth in 2025, Projected up 29%+

LAS VEGAS, NEVADA / ACCESS Newswire / April 1, 2025 / Healthy Extracts Inc. (OTCQB:HYEX), an innovative platform for acquiring, developing, patenting, marketing and distributing plant-based nutraceuticals, reported results for the year ended December 31, 2024. All comparisons are to the year-ago period unless otherwise noted.

2024 Financial Highlights

Net revenue increased 25% to a record $3.1 million, driven by product line and distribution channel expansion as well as growth in subscription-based recurring revenue.

Gross profit increased 18% to $1.9 million or 61.4% of net revenue, compared to $1.6 million or 65.2% of net revenue.

Operating expenses decreased 46% to $2.1 million.

Net loss decreased to $841,000 or $(0.28) per basic and diluted share from a net loss of $2.5 million or $(0.85) per basic and diluted share in 2023.

Adjusted EBITDA totaled $61,000 or $0.02 per share, turning positive from an adjusted EBITDA loss of $456,000 or $(0.16) per share in 2023 (see definition of adjusted EBITDA, a non-GAAP term, and its reconciliation to GAAP, below).

Generated positive operating cash flow of $282,000 versus negative cash flow in 2023.

Direct-to-consumer subscription-based customers increased 72% year-over-year and Amazon "Subscribe & Save" customers increased 77% year-over-year. In addition to the benefits of recurring revenue, subscriptions help the company enhance customer communications, improve customer retention and extend customer lifetime value.

2024 Operational Highlights

Record Amazon sales were reflected in the company's top three category ranking, with this due to the company's highly optimized sales and marketing strategies.

Officially launched LONGEVITY Anti-Aging™, a new proprietary formulation designed to support skin vitality, arterial flexibility, and cellular and joint health.

Advanced the development of several new products across new categories that are planned for launch in 2025 and expected to benefit from the company's growing customer base.

In July 2024, the company transitioned its customer communications program and product promotions from "buy-two-get-one-free" to a direct-to-consumer subscription-based model. As a result, during the second half of 2024, the company reduced its customer churn rate from 5% to under 3%, dramatically below the nutritional supplement industry average.

Management Commentary

"Our record-breaking revenue in 2024, which drove positive operating cash flow and first-ever positive adjusted EBITDA, reflects Healthy Extract's strong performance across direct-to-consumer channels and growing momentum with our retail partners," commented Healthy Extracts president, Duke Pitts.

"Our record Amazon sales raised us to a top three ranking in our category, with this success attributed to our well-tuned marketing efforts. The top line growth was also driven by our growing subscription sales, broadened distribution channels, and new product offerings.

"After years of research and development, we will soon introduce several new products across new product categories. These new products will enable us to cross promote to our existing sales channels for the first time in our history and drive a substantial increase in revenue in 2025.

"Four new products are currently set to launch before the end of the second quarter, with this followed by additional releases later in the year. We expect these new products to have a very meaningful impact on our revenue growth and profitability.

"The near-term lineup includes a groundbreaking, on-the-go hydration solution, an easy-to-consume sugar blocker, and a convenient gel pack for gut health and anti-aging. However, perhaps most exciting of all is a revolutionary heart health formulation that will provide a long-needed solution to the more than 40 million statin users in the U.S. We plan to cross-promote across these product categories, thereby driving even greater sales.

"We believe our focused commitment to customer retention, product excellence, innovation, and strategic engagement continues to differentiate our brands from the competition. We have successfully leveraged our expertise to drive sales in key channels such as Amazon, where each new product launch presents the opportunity to drive millions in additional annual sales.

"We began the new year with solid cash flow, manageable debt, and a highly favorable capitalization structure. This strengthens our ability to pursue certain opportunistic M&A opportunities, as well as positions us for another year of record growth and increase in shareholder value."

2025 Outlook

For full year 2025, the company expects to remain on track for net revenue at more than $4.0 million, up 29%+ over 2024. New product launches across new categories and formats that are scheduled for throughout the year are expected to continue driving growth momentum and greater profitability (excluding non-cash-based expenses). The company plans to drive future growth by reinvesting its profits into new product development and channel expansion.

Product Outlook

Healthy Extracts' BergaMet is planning to launch several new product introductions in April:

MYNUS sugar blocker, which is specially formulated to reduce up to 42% of the sugar impact from meals. The MYNUS on-the-go gel-packs will be made available under the company's exclusive U.S. and Canadian licensing and manufacturing agreement with Gelteq.

Hydrate EZ: on-the-go gel pack specially formulated to provide hydration, focus, recovery, and sleep benefits without the need for mixing.

Revolutionary heart health formulation targeting the more than 40 million statin users in the U.S.

Healthy Extracts' top brand ambassador and renowned fitness expert, Whitney Johns, is preparing to launch WHITNEY JOHNS™ NUTRITION on-the-go gel packs for gut health in the second quarter of 2025.

In the second half of the year, the company plans to launch COLLAGEN (anti-aging) in an on-the-go gel pack. These gel products will be based on Healthy Extracts' exclusive oral delivery system and proprietary formulations.

2024 Financial Summary

Net revenue in the full year of 2024 increased 25% to $3.1 million from $2.5 million in 2023, primarily due to product line and distribution channel expansion.

Gross profit increased to $1.9 million or 61.4% of net revenue from $1.6 million or 65.2% of net revenue in 2023. The decrease in gross margin was a result of a shift to lower margin products.

Operating expenses decreased 46% to $2.1 million as compared to $3.9 million in 2023.

Net loss totaled $841,000 or $(0.28) per basic and diluted share, as compared to a net loss of $2.5 million or $(0.85) per basic and diluted share in 2023. The improvement in net loss was primarily due to one-time costs associated with planned acquisitions, related public offering and uplist to major exchange that did not reoccur in 2024.

Adjusted EBITDA totaled $61,000 or $0.02 per share, turning positive from an adjusted EBITDA loss of $456,000 or $(0.16) per share in 2023.

About Healthy Extracts "Live Life Young Again"

Healthy Extracts Inc. is a platform for acquiring, developing, researching, patenting, marketing, and distributing plant-based nutraceuticals.

The company's subsidiaries, BergametNA™ and Ultimate Brain Nutrients™ (UBN), offer nutraceutical natural heart and brain health supplements. This includes the only heart health supplement distributed in North America containing Citrus Bergamot SuperFruit™. This superfruit has the highest known concentration of polyphenols and flavonoids.

UBN's KETONOMICS® proprietary formulations, which have been designed to enhance brain activity, focus, headache and cognitive behavior, provide many sales and intellectual property licensing opportunities.

For more information visit: healthyextractsinc.com, bergametna.com or tryubn.com.

Forward-Looking Statements and Safe Harbor Notice

All statements other than statements of historical facts included in this press release are "forward-looking statements" (as defined in the Private Securities Litigation Reform Act of 1995). Such forward-looking statements include our expectations and those statements that use forward-looking words such as "projected," "expect," "possibility" and "anticipate." The achievement or success of the matters covered by such forward-looking statements involve significant risks, uncertainties and assumptions. Actual results could differ materially from current projections or implied results. Investors should read the risk factors set forth in the Company's Annual Report on Form 10-K filed with the SEC on April 1, 2024, and future periodic reports filed with the SEC. All of the Company's forward-looking statements are expressly qualified by all such risk factors and other cautionary statements. The Company cautions that statements and assumptions made in this news release constitute forward-looking statements and make no guarantee of future performance. Forward-looking statements are based on estimates and opinions of management at the time statements are made. The information set forth herein speaks only as of the date hereof. The Company and its management undertake no obligation to revise these statements following the date of this news release.

Use of Non-GAAP Measures

This press release contains financial measures that are not recognized measures under accounting principles generally accepted in the United States of America ("GAAP"), which are EBITDA and adjusted EBITDA. EBITDA is defined for the purposes of this press release as net income before Income tax expense, Interest expense, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the gain or loss related to stock-based option/warrant expense, change in fair value of derivative, and offering costs.

Healthy Extracts' management believes that EBITDA and adjusted EBITDA are useful supplemental measures of our operating performance and provide our investors meaningful measures of overall corporate performance. EBITDA is also presented because management believes that it is frequently used by investment analysts, investors, and other interested parties as a measure of financial performance. Adjusted EBITDA is also presented because management believes that it provides our investors additional measures of our core business. However, non-GAAP measures do not have a standardized meaning prescribed by GAAP, and investors are cautioned that non-GAAP measures, such as EBITDA and adjusted EBITDA, should not be construed as an alternative to net income or loss or other income statement data (which are determined in accordance with GAAP) as an indicator of our performance or as a measure of liquidity and cash flows. Management's method of calculating EBITDA and adjusted EBITDA may differ materially from the method used by other companies and, accordingly, may not be comparable to similarly titled measures used by other companies. A reconciliation of EBITDA and adjusted EBITDA to net income, the most comparable GAAP measure, is included in the table below. See the table, Consolidated Statement of Operations, provided further below for the weighted average number of common shares used for the determination of adjusted EBITDA basic and diluted earnings per common share.

For the Twelve Months Ended | ||||||

December 31, | ||||||

2024 | 2023 | |||||

Net Income | $ | (840,671 | ) | $ | (2,472,931 | ) |

Income tax expense | - | - | ||||

Interest expense, net of interest income | 186,252 | 176,948 | ||||

Depreciation and amortization | (139 | ) | 2,195 | |||

EBITDA | (654,558 | ) | (2,293,788 | ) | ||

Stock-based option/warrant expense | 241,858 | 1,494,191 | ||||

Change in fair value of derivative | 471,270 | 52,140 | ||||

Offering costs | 2,657 | 291,955 | ||||

EBITDA adjustments | 715,785 | 1,838,286 | ||||

Adjusted EBITDA | $ | 61,227 | $ | (455,502 | ) | |

Adjusted EBITDA per common share - basic and diluted | $ | 0.02 | $ | (0.16 | ) | |

Food & Drug Administration Disclosure

The product and formulation featured in this release is not for use by or sale to persons under the age of 12. This product should be used only as directed on the label. Consult with a physician before use if you have a serious medical condition or use prescription medications. A doctor's advice should be sought before using this and any supplemental dietary product. These statements have not been evaluated by the FDA. This product is not intended to diagnose, treat, cure or prevent any disease.

BergametNA™, Ultimate Brain Nutrients™, UBN™, Citrus Bergamot SuperFruit™ and F4T® are registered trademarks of Healthy Extracts Inc.™

Company Contact

Duke Pitts, President

Healthy Extracts Inc.

Tel (720) 463-1004

Email contact

Investor Contact

CMA Investor Relations

Tel (949) 432-7554

Email contact

HEALTHY EXTRACTS INC.

CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE TWELVE MONTHS ENDING DECEMBER 31, 2024 AND 2023

(Audited)

FOR THE TWELVE | ||||||

2024 | 2023 | |||||

REVENUE | ||||||

Revenue | $ | 3,113,279 | $ | 2,485,866 | ||

Net revenue | 3,113,279 | 2,485,866 | ||||

COST OF REVENUE | ||||||

Cost of goods sold | 1,201,959 | 864,055 | ||||

Total cost of revenue | 1,201,959 | 864,055 | ||||

GROSS PROFIT | 1,911,320 | 1,621,810 | ||||

OPERATING EXPENSES | ||||||

General and administrative | 2,094,469 | 3,865,654 | ||||

Total operating expenses | 2,094,469 | 3,865,654 | ||||

OTHER INCOME (EXPENSE) | ||||||

Interest expense, net of interest income | (186,252 | ) | (176,948 | ) | ||

Change in fair value on derivative | (471,270 | ) | (52,140 | ) | ||

Total other income (expense) | (657,522 | ) | (229,088 | ) | ||

Net income/(loss) before income tax provision | (840,671 | ) | (2,472,931 | ) | ||

NET INCOME/(LOSS) | $ | (840,671 | ) | $ | (2,472,931 | ) |

Income/(Loss) per share - basic and diluted | $ | (0.28 | ) | $ | (0.85 | ) |

Weighted average number of shares outstanding - basic and diluted | 2,978,540 | 2,915,410 | ||||

HEALTHY EXTRACTS INC.

CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2024 AND DECEMBER 31, 2023

(Audited)

DECEMBER 31, | DECEMBER 31, | |||

2024 | 2023 | |||

ASSETS | ||||

CURRENT ASSETS | ||||

Cash | $ | 112,020 | $ | 19,441 |

Accounts receivable | 11,003 | 30,440 | ||

Deposit | 16,890 | - | ||

Inventory, net | 1,361,216 | 1,626,283 | ||

Offering costs | 149,274 | 151,931 | ||

Right of use asset, net | 8,984 | 71,583 | ||

Total current assets | 1,659,387 | 1,899,678 | ||

Fixed assets | 3,445 | 3,306 | ||

Patents/Trademarks | 521,881 | 521,881 | ||

Deposit | - | 16,890 | ||

Goodwill | 193,260 | 193,260 | ||

Total other assets | 718,586 | 735,336 | ||

TOTAL ASSETS | $ | 2,377,973 | $ | 2,635,014 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

LIABILITIES | ||||

Accounts payable | $ | 52,248 | $ | 116,842 |

Accrued liabilities | 248,609 | 215,069 | ||

Lease liabilities - current | 9,222 | 65,229 | ||

Lease liabilities - long-term | - | 9,222 | ||

Notes payable | 2,427 | 361,093 | ||

Notes payable - related party | 399,388 | 83,366 | ||

Convertible debt, net of discount | 530,860 | 608,601 | ||

Accrued interest payable | 67,770 | 64,386 | ||

Accrued interest payable - related party | 31,652 | 2,465 | ||

Derivative liabilities | 625,420 | 154,150 | ||

Total current and total liabilities | 1,967,596 | 1,680,424 | ||

STOCKHOLDERS' EQUITY | ||||

Preferred stock, $0.001 par value, 75,000,000 shares authorized, no shares issued and outstanding, respectively | - | - | ||

Common stock, $0.001 par value, 50,000,000 shares authorized, 2,989,406 shares issued and outstanding as of December 31, 2024, and 2,954,104 shares issued and outstanding as of December 31, 2023, respectively- | 354,532 | 354,492 | ||

Additional paid-in capital | 19,301,589 | 18,999,770 | ||

Treasury stock, at cost, 4,166 shares, respectively | (5,400 | ) | - | |

Accumulated deficit | (19,240,344 | ) | (18,399,673 | ) |

Total stockholders' equity | 410,377 | 954,590 | ||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 2,377,973 | $ | 2,635,014 |

SOURCE: HEALTHY EXTRACTS INC.

View the original press release on ACCESS Newswire

A.Jones--AMWN