-

Britain's Azu storms to world indoor 60m gold

Britain's Azu storms to world indoor 60m gold

-

Heathrow closure could cost millions, disrupt flights for days

-

Israel defence minister threatens to annex parts of Gaza

Israel defence minister threatens to annex parts of Gaza

-

New IOC president Coventry can meet expectations: Bach

-

England Women's coach Jon Lewis sacked after Ashes drubbing

England Women's coach Jon Lewis sacked after Ashes drubbing

-

Israel supreme court freezes PM bid to sack intel chief

-

Turkey braces for more protests over Istanbul mayor's arrest

Turkey braces for more protests over Istanbul mayor's arrest

-

EU tariffs not a deterrent, says Chinese EV maker XPeng

-

Trump suggests Tesla vandals be jailed in El Salvador

Trump suggests Tesla vandals be jailed in El Salvador

-

Trump denies reports Musk to receive 'top secret' China briefing

-

Germany's huge spending package passes final hurdle in upper house

Germany's huge spending package passes final hurdle in upper house

-

Sudan army recaptures presidential palace from RSF

-

Turkey braces for day three of protests over Istanbul mayor's arrest

Turkey braces for day three of protests over Istanbul mayor's arrest

-

Russian central bank holds key rate at two-decade high

-

French actor Depardieu goes on trial on sexual assault charges

French actor Depardieu goes on trial on sexual assault charges

-

Israeli opposition appeals against intel chief sacking

-

French Olympic boss rules out new term after failed IOC bid

French Olympic boss rules out new term after failed IOC bid

-

Stock markets extend losses as Trump's tariffs hit global outlook

-

Japan panel drafts response plan for Mount Fuji eruption

Japan panel drafts response plan for Mount Fuji eruption

-

As euphoria of victory fades, IOC chief Coventry faces geopolitical reality

-

Namibia inaugurates its first woman president

Namibia inaugurates its first woman president

-

Eddie Jordan remembered as 'heart and soul of party' as Aston pay tribute

-

Nawaz smacks record-breaking maiden ton as Pakistan win 3rd NZ T20

Nawaz smacks record-breaking maiden ton as Pakistan win 3rd NZ T20

-

'Gobsmacked' Hamilton smashes Shanghai lap record for first Ferrari pole

-

Wood hits hat-trick as rampant New Zealand move to brink of World Cup

Wood hits hat-trick as rampant New Zealand move to brink of World Cup

-

Ferrari's Hamilton takes stunning pole for Chinese GP sprint

-

Markets skid into weekend as trade fears cast a pall

Markets skid into weekend as trade fears cast a pall

-

Mosquito-borne chikungunya kills two in France's La Reunion

-

Chapman blasts New Zealand to 204 in third Pakistan T20

Chapman blasts New Zealand to 204 in third Pakistan T20

-

Wood hat-trick as rampant New Zealand move to brink of World Cup

-

Court rules against K-pop group NewJeans in contract dispute

Court rules against K-pop group NewJeans in contract dispute

-

Sudan army says retakes presidential palace from RSF

-

Turkish clinics vie for UK medical tourists' custom in London

Turkish clinics vie for UK medical tourists' custom in London

-

Red Bull's Horner fondly recalls 'heart and soul of party' Eddie Jordan

-

London's Heathrow: Europe's biggest airport

London's Heathrow: Europe's biggest airport

-

Italy's Diaz dominates triple jump for opening world indoor gold

-

Butler triple-double leads Warriors over Raptors as Curry hurt

Butler triple-double leads Warriors over Raptors as Curry hurt

-

In Washington, glum residents struggle with Trump return

-

'People are afraid': NY migrant economy wilts under Trump policies

'People are afraid': NY migrant economy wilts under Trump policies

-

Norris quickest in China GP practice ahead of sprint qualifying

-

Ronen Bar: ex-Shin Bet chief who incurred right-wing wrath

Ronen Bar: ex-Shin Bet chief who incurred right-wing wrath

-

Khawaja lashes out at 'untrue' comments in growing availability row

-

Kluivert vows response after nightmare start to Indonesia reign

Kluivert vows response after nightmare start to Indonesia reign

-

London's Heathrow airport closed after fire causes major power cut

-

Taiwan's existential battle against Chinese spies

Taiwan's existential battle against Chinese spies

-

England eye eighth successive Women's Six Nations in World Cup build-up

-

Toulouse begin Top 14 life without Dupont at title rivals Bordeaux-Begles

Toulouse begin Top 14 life without Dupont at title rivals Bordeaux-Begles

-

Japan core inflation slows to 3% in Feburary

-

Trump's call for AI deregulation gets strong backing from Big Tech

Trump's call for AI deregulation gets strong backing from Big Tech

-

Vinicius fires stoppage time winner for Brazil

| NGG | -1.66% | 64.02 | $ | |

| CMSC | 0.13% | 23.15 | $ | |

| BTI | -0.49% | 40.87 | $ | |

| BP | -0.61% | 34.54 | $ | |

| SCS | -3.34% | 10.635 | $ | |

| RIO | -2% | 61.685 | $ | |

| AZN | -1.35% | 75.5 | $ | |

| GSK | -0.37% | 39.265 | $ | |

| CMSD | 0.69% | 23.32 | $ | |

| RBGPF | -1.05% | 65.74 | $ | |

| RYCEF | -3% | 10.35 | $ | |

| RELX | -0.22% | 49.78 | $ | |

| VOD | 0.61% | 9.76 | $ | |

| BCE | -1.05% | 22.78 | $ | |

| JRI | -0.46% | 12.99 | $ | |

| BCC | -2.55% | 97.93 | $ |

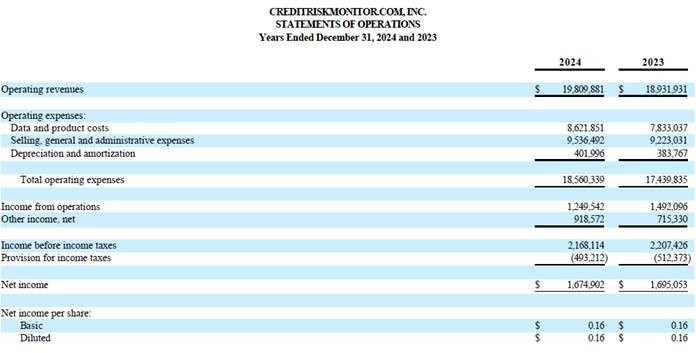

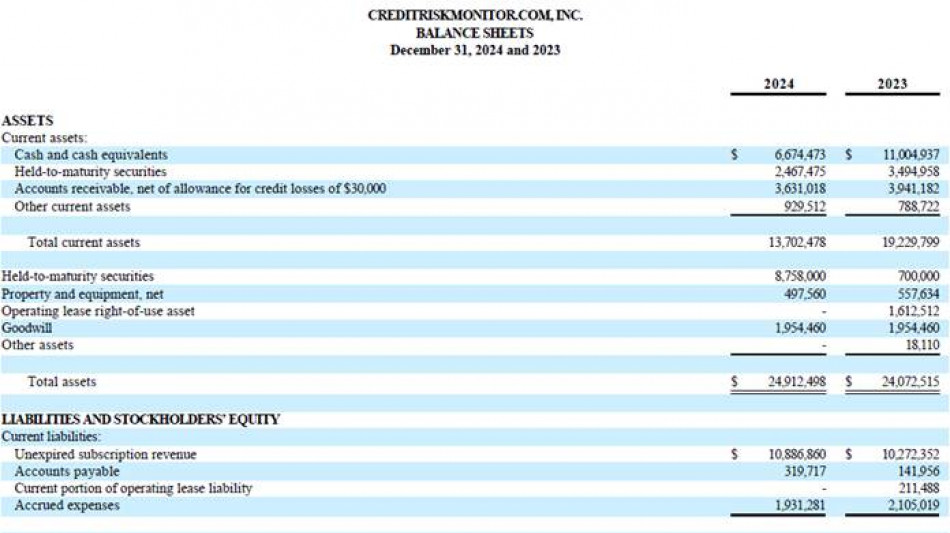

CreditRiskMonitor Announces 2024 Results

VALLEY COTTAGE, NY / ACCESS Newswire / March 20, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported revenues of $19.8 million, an increase of approximately $878 thousand or 5%, for the year ended December 31, 2024, as compared to 2023. The Company reported operating income of approximately $1.25 million, a decrease of approximately $243 thousand for 2024 as compared to 2023. The decrease in operating income was primarily due to increased data and product costs associated with higher employee expenses and third-party content costs. The Company reported net income of approximately $1.67 million, a decrease of approximately $20 thousand for 2024 as compared to 2023.

Mike Flum, CEO, said, "We remain committed to achieving higher efficiency for our teams, knowing it will require increased investment in technical human capital and systems. We continue refining our management team with an emphasis on improved performance and accountability. While we still expect to show lower profitability in the short-to-medium term due to this higher spending on data, technology, and skilled employees, the results of these investments will set up the Company for profitable growth in the long term.

To that end, we are happy to welcome Shyarsh Desai as our new Chief Operating Officer effective March 19, 2025. Shyarsh brings a wealth of experience in the risk, credit, and technology spaces from his time as the Chief Executive Officer at SMYYTH + CARIXA, a credit-to-cash company, and Credit2B, an AI-innovator in B2B credit decision automation, until its sale to Billtrust, where he served as Group President. He has also held management positions at Navex, Dun & Bradstreet, and IBM. We are excited to have Shyarsh on the team and help us drive for greater efficiency, performance, and accountability at CreditRiskMonitor.com.

On the customer satisfaction front, the Company surveyed clients between late 2024 and early 2025 to baseline our Net Promoter Score ("NPS"), Product Quality, and Customer Support. We achieved high marks in all categories including an excellent-level 77 for NPS as well as 4.6 out of 5 for both Product Quality and Customer Service. We are immensely proud of these results and applaud our teams for developing products and experiences that garner this much positive feedback.

On the product front, we are seeing mounting interest in our CreditRiskMonitor® and SupplyChainMonitor™ products due to increased bankruptcies and recessionary risks. The U.S. bankruptcy rates in the first quarter are higher in 2025 versus 2024, and 2024's full-year level was the highest since 2010. If these trends continue, we expect to see improved growth rates like those experienced during the Great Recession and the COVID-19 pandemic; however, there is a risk that this correction could negatively impact our clients enough to offset this growth. SupplyChainMonitor™ should also benefit from turmoil in global trade and supplier relationships caused by the unfolding tariff escalation as businesses search for alternative suppliers with less geopolitical exposure.

We are working to expand our worldwide coverage using novel scoring methods and expanded data partnerships. The Company is also increasing the functionality of our Confidential Financial Statements Solution to process more document types and support foreign languages so our customers can receive more scores on their private company counterparties. Our use of AI continues to evolve within financial risk scoring, data acquisition, data processing, quality assurance, and products. We are exploring ways to leverage AI for improved customer experience and workflow optimization by getting quality information to customers in easy-to-digest formats. Our over twenty-five-year commitment to maintaining high-quality data has been prescient as these AI systems directly reflect the quality of the input data. While these investments can be costly and involve iteration to get right, we believe these AI systems will make significant contributions to our operations.

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor™. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide.

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® scores, the well-known Altman Z"-score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately $3 trillion.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

[email protected]

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire

M.Fischer--AMWN