-

Neighbours improvise first aid for wounded in besieged Sudan city

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

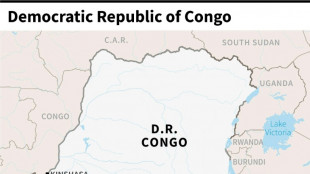

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

Man City close in on Champions League thanks to Everton late show

-

Bayern close in on Bundesliga title with Heidenheim thumping

-

Tunisia opposition figures get jail terms in mass trial

Tunisia opposition figures get jail terms in mass trial

-

Putin announces 'Easter truce' in Ukraine

The ACA 1095 Recipient Copy Deadline is Almost Here: TaxBandits Supports Employers and Tax Professionals with Seamless Distribution

With ACA reporting deadlines fast approaching, businesses must distribute recipient copies by March 3, 2025, and e-file by March 31, 2025-TaxBandits simplifies compliance with seamless e-filing, mailing, and secure online access.

ROCK HILL, SC / ACCESS Newswire / February 27, 2025 / As the 2025 ACA reporting deadlines approach, businesses must act swiftly to meet their compliance obligations under the Affordable Care Act (ACA). With less than a week left to distribute recipient copies before the March 3 deadline, time is running out. TaxBandits offers a reliable solution to meet this deadline and ensure ACA compliance efficiently.

Who Must Meet The ACA Reporting Requirements?

Employers, insurers, and service providers offering health coverage are required to accurately report coverage details to the IRS using Form 1095-B or Form 1095-C, as mandated under IRC Sections 6055 and 6056.

Applicable Large Employers (ALEs): Employers with 50 or more full-time equivalent employees must provide minimum essential coverage to their full-time employees and file Form 1095-C Online to report that information to the IRS. They must also provide copies of the forms to their employees. Form 1095-C requires employers to report ACA 1095 codes, which indicate the type of coverage offered and the employee's employment status.

Health Coverage Providers and Small Employers: Providers of self-funded coverage must file Form 1095-B and report the health coverage information to the IRS. These organizations must also distribute the forms to the individuals covered.

How TaxBandits Can Help

The deadline to e-file ACA 1095 forms with the IRS is March 31, 2025. However,the IRS requires ACA form copies to be furnished to employees and covered individuals by March 3, 2025. Failure to meet this deadline can result in costly penalties, making it essential for businesses to ensure timely distribution.

TaxBandits offers an easy and reliable e-filing solution to help employers and tax professionals meet these ACA reporting requirements. While e-filing their ACA forms to the IRS and/or state using TaxBandits, clients can choose any of the following options:

Postal Mailing Services - TaxBandits takes care of printing and mailing ACA forms directly to employees and covered individuals, ensuring timely and compliant distribution.

Secure Online Access - Employees can conveniently access their ACA forms through TaxBandits' secure online portal, reducing delays and eliminating the need for physical mailing. The recipients will have lifetime access to the forms.

Key TaxBandits Features

Beyond distribution, TaxBandits offers a comprehensive ACA reporting and e-filing solution designed to simplify compliance ahead of the ACA reporting deadline.

Federal and State E-Filing - With TaxBandits, clients can e-file their ACA forms with both the IRS and/or any required states.

Auto-Generation of 1094 Forms - TaxBandits simplifies the ACA filing process by allowing clients to attach the 1094-B/C forms easily and designate the authoritative transmittal.

Supports ACA Extensions - TaxBandits allows clients to easily request extensions to their e-filing deadline with Form 8809 and the recipient copy deadline with Form 15397, all in one place.

Built-In Error Checks - The system automatically identifies potential errors before submission, reducing IRS rejections.

Bulk Filing Support - Businesses, payroll providers, and tax professionals handling large ACA filings can easily upload all their data at once.

ACA Corrections - Clients can correct and resubmit Form 1095-B/C and 1094-C forms with ease and choose to distribute corrected recipient copies.

Team Management - TaxBandits enables clients to add their team members, delegate them roles, assign tasks, and monitor their progress efficiently.

Smart AI Assistance - BanditAI, the AI-powered chatbot, guides clients through every step of the filing process with instant responses.

World-Class Support Team - The dedicated support team is available to assist clients throughout the filing process via live chat, phone, and email.

Businesses needing to E-file 1095-C and 1095-B are encouraged to visit TaxBandits to get started and to watch the following video to learn how the filing process works: https://youtu.be/J21HXsS6z4Q

About TaxBandits

The 1099 and W-2 experts! TaxBandits is a SOC-2 Certified, IRS-authorized e-file provider of 1099 Form, Form W2, Form 940, Form 941, 1095-B, 1095-C, and W-9, serving businesses, service providers, and tax professionals of every shape and size.

TaxBandits provides another advantage for high-volume filers and software providers. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms and BOI reporting. Use the developer filing 1099 API to request W-9 and automate the filing efficiently.

About SPAN Enterprises

Based in Rock Hill, South Carolina, SPAN Enterprises has been developing industry-leading software solutions for IRS e-filing and business management tools for over a decade. The SPAN Enterprises portfolio of products includes TaxBandits, Tax990, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Caleb Flachman, Marketing Manager, at [email protected].

SOURCE: TaxBandits

View the original press release on ACCESS Newswire

P.Santos--AMWN