-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

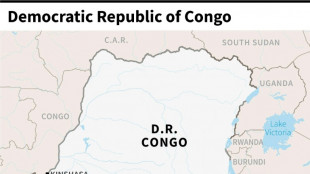

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

Key Business Tax Deadlines Approaching: ExpressExtension Helps Tax Professionals File Extensions with Ease

With March 17 tax deadlines approaching, ExpressExtension offers a secure IRS-authorized solution for filing business tax extensions with Forms 7004, 4868, 8868, and 8809.

ROCK HILL, SC / ACCESS Newswire / February 13, 2025 / With the January 31 deadline for Forms 1099 and W-2 behind them, tax professionals now turn their attention to the next set of critical business tax deadlines. Among the most significant are Form 1120-S, Form 1065, 1042, and 1042-S, all due on March 17, 2025.

For businesses and tax professionals who need more time to prepare returns, the IRS allows an extension request using Form 7004, postponing the filing deadline. However, this extension applies only to the return itself - any taxes owed must still be paid by the original deadline.

ExpressExtension, an IRS-authorized e-file provider, simplifies the extension filing process, providing a secure and efficient solution for businesses and tax professionals.

ExpressExtension - A Comprehensive Solution for Tax Extension Filing

ExpressExtension supports the following tax extension forms for the 2024 tax year.

Form 7004

This form is used to request a 6-month automatic extension for business tax returns, including Form 1120-S (S corporations) & Form 1065 (partnerships). With a deadline coming up for S corporations and partnerships on March 17, 2025, tax professionals can file Form 7004 to extend the filing deadline to September 15, 2025.

Form 4868

Filing Form 4868 provides an automatic extension for individual income tax returns, including Form 1040 & 1040-NR. Individuals can extend their federal filing deadline from April 15 to October 15, giving them additional time to prepare and submit their returns.

Form 8809

This form is used to request an extension for filing information returns, including Form 1099-series, W-2, 1042-S, and 5498. Filing 8809 grants an automatic 30-day extension for reporting payments made to foreign individuals and entities.

Form 8868

Form 8868 grants an extension for tax-exempt organizations filing 990 series returns, including Form 990, 990-EZ, and 990-PF. Filing 8868 allows nonprofits and tax-exempt organizations more time to gather the required financial information before filing.

PRO Features Tailored Exclusively for Tax Professionals

ExpressExtension offers exclusive features designed specifically for tax professionals, making the extension filing process simpler and more efficient.

Intuitive Dashboard for Seamless Management

The ExpressExtension dashboard provides a centralized hub for tax professionals to efficiently manage extensions, track filing statuses, and access past filings. With real-time updates and a user-friendly interface, tax professionals can stay organized and ensure every extension request is processed accurately.

Secure Bulk Upload Options

ExpressExtension offers a quick and efficient way to add client business details manually or add all the required clients at once with the provided bulk upload templates.

The Express Guarantee-Refunds for Duplicate Filings

ExpressExtension offers the Express Guarantee for Forms 7004 and 4868. Under this guarantee, clients can receive a full refund of the payment if the IRS rejects these forms due to duplicate filing. If the extension forms are rejected for other reasons, tax pros can fix errors and retransmit the returns at no additional cost.

Volume-Based Pricing

Tax professionals can choose to pay per extension or purchase credits in advance at discounted volume-based rates.

World-Class Customer Support

ExpressExtension provides reliable customer support via phone, email, and live chat, ensuring tax professionals receive assistance whenever needed.

AI Assistance At Every Step

ExpressExtension's AI-powered chatbot provides instant answers to common questions, guiding tax professionals through the extension filing process.

Visit ExpressExtension.com and start e-filing Form 7004, 4868, 8868, & 8809 at an affordable price.

About ExpressExtension

ExpressExtension is the one-stop solution for IRS Tax Extensions. As an IRS-authorized, SOC 2 Certified e-file provider, ExpressExtension has been helping businesses, tax professionals, individuals, and non-profit organizations obtain IRS extensions for over a decade. Supported forms include Form 7004, 4868, 8868, and 8809.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN has been developing industry-leading software tools for e-filing and business management tools for over a decade.

The SPAN Enterprises Portfolio of products includes TaxBandits, Tax 990, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

For any media inquiries, please reach out to Caleb Flachman, Marketing Manager at [email protected].

SOURCE: ExpressExtension

View the original press release on ACCESS Newswire

A.Malone--AMWN