-

Intercommunal violence kills dozens in central Nigeria

Intercommunal violence kills dozens in central Nigeria

-

Nigerian, S. African music saw 'extraordinary growth' in 2024: Spotify

-

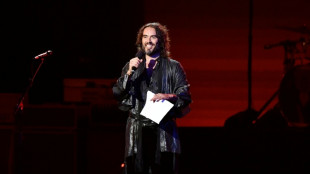

Russell Brand: From Hollywood star to rape suspect

Russell Brand: From Hollywood star to rape suspect

-

France soccer star Mbappe unveiled in London... in waxwork form

-

Trump goads China as global trade war escalates

Trump goads China as global trade war escalates

-

Israel expands Gaza ground offensive, hits Hamas in Lebanon

-

TikTok faces new US deadline to ditch Chinese owner

TikTok faces new US deadline to ditch Chinese owner

-

US Fed Chair warns tariffs will likely raise inflation, cool growth

-

Mbappe among three Real Madrid players fined for 'indecent conduct'

Mbappe among three Real Madrid players fined for 'indecent conduct'

-

How can the EU respond to Trump tariffs?

-

Canada loses jobs for first time in 3 years as US tariffs bite

Canada loses jobs for first time in 3 years as US tariffs bite

-

Real Madrid and Barcelona respect each other, says Ancelotti

-

Nations divided ahead of decisive week for shipping emissions

Nations divided ahead of decisive week for shipping emissions

-

Trump goads China after Beijing retaliates in global trade war

-

Arteta urges Arsenal to enjoy "beautiful" run-in despite injury woes

Arteta urges Arsenal to enjoy "beautiful" run-in despite injury woes

-

London mayor gets new powers to revive capital's ailing nightlife

-

Italy's ski star Brignone takes on 'new challenge' after serious leg injury

Italy's ski star Brignone takes on 'new challenge' after serious leg injury

-

Amorim in a 'rush' to succeed at Man Utd

-

PSG coach Luis Enrique targets unbeaten season

PSG coach Luis Enrique targets unbeaten season

-

Duterte victims seeking 'truth and justice': lawyer

-

US job growth strong in March but Trump tariff impact still to come

US job growth strong in March but Trump tariff impact still to come

-

UK comedian and actor Russell Brand charged with rape

-

Stocks, oil slump as China retaliates and Trump digs in heels

Stocks, oil slump as China retaliates and Trump digs in heels

-

Postecoglou 'falling out of love' with football due to VAR

-

EU hails 'new era' in relations with Central Asia

EU hails 'new era' in relations with Central Asia

-

US hiring beats expectations in March as tariff uncertainty brews

-

'Unique' De Bruyne one of the greats, says Guardiola

'Unique' De Bruyne one of the greats, says Guardiola

-

Automakers shift gears after Trump tariffs

-

Where things stand in the US-China trade war

Where things stand in the US-China trade war

-

De Bruyne to leave Man City at end of the season

-

Youthful Matildas provide spark in friendly win over South Korea

Youthful Matildas provide spark in friendly win over South Korea

-

Stocks, oil extend rout as China retaliates over Trump tariffs

-

De Bruyne says he will leave Man City at end of season

De Bruyne says he will leave Man City at end of season

-

UK spy agency MI5 reveals fruity secrets in new show

-

Leverkusen's Wirtz to return 'next week', says Alonso

Leverkusen's Wirtz to return 'next week', says Alonso

-

England bowler Stone to miss most of India Test series

-

Taiwan earmarks $2.7 bn to help industries hit by US tariffs

Taiwan earmarks $2.7 bn to help industries hit by US tariffs

-

Rat earns world record for sniffing landmines in Cambodia

-

Elton John says new album 'freshest' since 1970s

Elton John says new album 'freshest' since 1970s

-

EU announces 'new era' in relations with Central Asia

-

Greece nixes Acropolis shoot for 'Poor Things' director

Greece nixes Acropolis shoot for 'Poor Things' director

-

'Historic moment': South Koreans react to Yoon's dismissal

-

Israel kills Hamas commander in Lebanon strike

Israel kills Hamas commander in Lebanon strike

-

Trump unveils first $5 million 'gold card' visa

-

Crashes, fires as Piastri fastest in chaotic second Japan GP practice

Crashes, fires as Piastri fastest in chaotic second Japan GP practice

-

India and Bangladesh leaders meet for first time since revolution

-

Israel expands ground offensive in Gaza

Israel expands ground offensive in Gaza

-

Families of Duterte drug war victims demand probe into online threats

-

Stocks extend global rout after Trump's shock tariff blitz

Stocks extend global rout after Trump's shock tariff blitz

-

Kolkata's Iyer more bothered about impact than price tag

| CMSD | -0.71% | 22.51 | $ | |

| CMSC | -0.74% | 22.097 | $ | |

| SCS | -2.79% | 10.448 | $ | |

| GSK | -6.44% | 36.65 | $ | |

| BCC | -1.28% | 93.435 | $ | |

| RIO | -7.8% | 54.2 | $ | |

| BCE | 0.79% | 22.84 | $ | |

| NGG | -4.72% | 66.26 | $ | |

| BTI | -4.76% | 40.015 | $ | |

| RBGPF | 1.48% | 69.02 | $ | |

| AZN | -7.49% | 68.77 | $ | |

| RYCEF | -15.57% | 8.48 | $ | |

| BP | -10.34% | 28.403 | $ | |

| JRI | -7.01% | 11.98 | $ | |

| RELX | -5.43% | 48.79 | $ | |

| VOD | -10.04% | 8.515 | $ |

TechPrecision Corporation Reports FY 2025 Second Quarter Financial Results

Revenue increased 8% year-over-year, Customer confidence remains high

Management to host conference call at 4:30 p.m. ET on Tuesday, January 21, 2025

WESTMINSTER, MA / ACCESS Newswire / January 21, 2025 / TechPrecision Corporation (NASDAQ:TPCS) ("TechPrecision" or "the Company"), a custom manufacturer of precision, large-scale fabrication components and precision, large-scale machined metal structural components. The components that we manufacture are customer designed. We sell to customers in two main industry sections: defense and precision industrial markets, today reported financial results for the second quarter ended September 30, 2024.

We will have a conference call on Tuesday January 21, 2025 at 4:30 P.M. to discuss our financial results for the quarter ended September 30, 2024.

"Second quarter consolidated revenue was $8.9 million or 12% higher when compared to $8.0 million in the fiscal 2024 second quarter, bolstered by a favorable project mix at both Ranor and Stadco. Stadco operating loss of $0.8 million resulted from unexpected higher manufacturing costs on one-off projects, legacy pricing problems on core business, machine breakdowns in the quarter that disrupted expected throughput, and under-absorbed overhead costs. Customer confidence remains high as our backlog was $48.6 million at September 30, 2024," stated Alexander Shen, TechPrecision's Chief Executive Officer. "We expect to deliver our backlog over the course of the next one to three fiscal years with gross margin expansion."

The following summary compares the three and six months ended September 30, 2024 to the same prior year period:

Consolidated Financial Results - Fiscal 2025 Three Months Ended September 30, 2024

Revenue was $8.9 million, or 12% higher on a favorable project mix at both Ranor and Stadco.

Cost of revenue was $7.9 million, or 14% higher, due primarily to higher production costs at Stadco.

Gross profit was $1.0 million, or 2% lower when compared to the same period a year ago.

SG&A totaled $1.5 million or 8% lower due primarily to reduced spending on outside advisory services.

Operating loss was $0.5 million compared with $0.6 million in the same period a year ago.

Interest expense decreased by $38,000 due primarily to a decrease in borrowings under the revolver loan.

Net loss was $0.6 million, as the Company maintained a full valuation on its deferred tax assets.

Consolidated Financial Results - Fiscal 2025 Six Months Ended September 30, 2024

Revenue was $16.9 million, or 10% higher on a favorable project mix at both Ranor and Stadco.

Cost of revenue was $15.7 million, or 15% higher, due primarily to higher production costs at Stadco.

Gross profit was $1.3 million, or 28% lower, primarily the result of delayed repair and maintenance, higher production costs and under-absorbed overhead at Stadco.

SG&A totaled $3.1 million or 6% higher, due to a change in fair value on the Votaw termination fee.

Operating loss was $1.8 million, an increase of $0.6 million due primarily to losses at Stadco.

Interest expense increased by 1% due to higher borrowing under the revolver loan.

Net loss was $2.1 million, as the Company maintained a full valuation on its deferred tax assets.

Financial Position

On September 30, 2024, the Company had approximately $132,000 in cash and cash equivalents, a $6,000 decrease since March 31, 2024. Working capital was negative $1.5 million on September 30, 2024 and debt totaled $7.2 million. Working capital was negative $2.9 million and total debt was $7.6 million on March 31, 2024.

Conference Call

The Company will hold a conference call at 4:30 p.m. Eastern (U.S.) time on Tuesday, January 21, 2025. To participate in the live conference call, please dial 1-888-506-0062 five to 10 minutes prior to the scheduled conference call time. International callers should dial 1-973-528-0011. When prompted, reference TechPrecision and enter code 801510.

A replay will be available until February 4, 2025. To access the replay, dial 1-877-481-4010 or 1-919-882-2331. When prompted, enter Conference Passcode 51915.

The call will also be available over the Internet and accessible at:

https://www.webcaster4.com/Webcast/Page/2198/51915.

About TechPrecision Corporation

TechPrecision Corporation, through its wholly owned subsidiaries, Ranor, Inc. and Stadco, The manufacturing operations of our Ranor subsidiary are situated on approximately 65 acres in North Central Massachusetts. Leveraging our 145,000 square foot facilities, Ranor provides a full range of custom solutions to transform material into precision finished welded components and precision finished machined components up to 100 tons: manufacturing engineering, materials management and traceability, high-precision heavy fabrication (in-house fabrication operations include cutting, press and roll forming, welding, heat treating, assembly, blasting and painting), heavy high-precision machining (in-house machining operations include CNC programming, finishing, and assembly), QC inspection including portable CMM, NonDestructive Testing, and final packaging.

All manufacturing at Ranor is performed in accordance with customer requirements. Ranor is an ISO 9001:2015 certificate holder. Ranor is a US defense-centric company with over 95% of its revenue in the defense sector. Ranor is registered and compliant with ITAR.

The manufacturing operations of our Stadco subsidiary are situated in an industrial self-contained multi-building complex comprised of approximately 183,000 square feet under roof in Los Angeles, California. Stadco manufactures large mission-critical components on several high-profile military aircraft, military helicopter, and military space programs. Stadco has been a critical supplier to a blue-chip customer base that includes some of the largest OEMs and prime contractors in the defense and aerospace industries. Stadco also manufactures tooling, molds, fixtures, jigs and dies used in the production of defense-centric aircraft components.

Our Stadco subsidiary, similar to Ranor, provides a full range of custom solutions: manufacturing engineering, materials management and traceability, high-precision fabrication (in-house fabrication operations include waterjet cutting, press forming, welding, and assembly) and high-precision machining (in-house machining operations include CNC programming, finishing, and assembly), QC inspection including both fixed and portable CMM NonDestructive Testing, and final packaging. In addition, Stadco features a large electron beam welding cell, and two NonDestructive Testing work cells, a unique mission-critical technology set.

All manufacturing at Stadco is performed in accordance with customer requirements. Stadco is an AS 9100 D and ISO 9001:2015 certificate holder and a NADCAP NonDestructive Testing certificate holder. Stadco is a US defense-centric company with over 60% of its revenue in the defense sector. Stadco is registered and compliant with ITAR.

To learn more about the Company, please visit the corporate website at http://www.techprecision.com. Information on the Company's website or any other website does not constitute a part of this press release.

Safe Harbor Statement

This release contains certain "forward-looking statements" relating to the business of the Company and its subsidiary companies. All statements other than statements of current or historical fact contained in this press release, including statements that express our intentions, plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "predict," "project," "prospects," "will," "should," "would" and similar expressions, as they relate to us, are intended to identify forward-looking statements. These statements are based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from: our reliance on individual purchase orders, rather than long-term contracts, to generate revenue; our ability to balance the composition of our revenues and effectively control operating expenses; external factors that may be outside our control, including health emergencies, like epidemics or pandemics, the conflicts in Eastern Europe and the Middle East, price inflation, interest rate increases and supply chain inefficiencies; the availability of appropriate financing facilities impacting our operations, financial condition and/or liquidity; our ability to receive contract awards through competitive bidding processes; our ability to maintain standards to enable us to manufacture products to exacting specifications; our ability to enter new markets for our services; our reliance on a small number of customers for a significant percentage of our business; competitive pressures in the markets we serve; changes in the availability or cost of raw materials and energy for our production facilities; restrictions in our ability to operate our business due to our outstanding indebtedness; government regulations and requirements; pricing and business development difficulties; changes in government spending on national defense; our ability to make acquisitions and successfully integrate those acquisitions with our business; our failure to maintain effective internal controls over financial reporting; general industry and market conditions and growth rates; and other risks discussed in the Company's periodic reports that are filed with the Securities and Exchange Commission and available on its website (www.sec.gov). Any forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this press release, except as required by applicable law. Investors should evaluate any statements made by us in light of these important factors.

Company Contact: | Investor Relations Contact: |

Richard Roomberg | Hayden IR |

Chief Financial Officer | Brett Maas |

TechPrecision Corporation | Phone: 646-536-7331 |

Phone: 978-883-5108 | Email: [email protected] |

Email: [email protected] | Website: www.haydenir.com |

Website: www.TechPrecision.com |

TECHPRECISION CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) | ||||

September 30, | March 31, | |||

( in thousands, except per share data) | 2024 | 2024 | ||

ASSETS | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 132 | $ | 138 |

Accounts receivable, net | 2,387 | 2,371 | ||

Contract assets | 9,545 | 8,527 | ||

Raw materials | 1,802 | 1,827 | ||

Work-in-process | 1,558 | 1,423 | ||

Other current assets | 459 | 564 | ||

Total current assets | 15,883 | 14,850 | ||

Property, plant and equipment, net | 14,380 | 14,798 | ||

Right of use asset, net | 4,627 | 4,977 | ||

Other noncurrent assets | 122 | 122 | ||

Total assets | $ | 35,012 | $ | 34,747 |

LIABILITIES AND STOCKHOLDERS' EQUITY: | ||||

Current liabilities: | ||||

Accounts payable | $ | 3,149 | $ | 1,408 |

Accrued expenses | 3,936 | 4,263 | ||

Contract liabilities | 2,517 | 3,788 | ||

Current portion of long-term lease liability | 753 | 736 | ||

Current portion of long-term debt, net | 7,055 | 7,559 | ||

Total current liabilities | 17,410 | 17,754 | ||

Long-term lease liability | 4,028 | 4,408 | ||

Other noncurrent liability | 4,690 | 4,782 | ||

Total liabilities | 26,128 | 26,944 | ||

Stockholders' Equity: | ||||

Common stock - par value $0.0001 per share, 50,000,000 shares authorized; Shares issued and outstanding September 30, 2024 - 9,619,232 and 9,609,232, respectively; Shares issued and outstanding March 31, 2024 - 8,777,432. | 1 | 1 | ||

Additional paid in capital | 18,343 | 15,201 | ||

Accumulated deficit | (9,460 | ) | (7,399 | ) |

Total stockholders' equity | 8,884 | 7,803 | ||

Total liabilities and stockholders' equity | $ | 35,012 | $ | 34,747 |

TECHPRECISION CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Three Months Ended September 30, | Six Months Ended September 30, | |||||||||||

(in thousands, except per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||

Revenue | $ | 8,946 | $ | 7,970 | $ | 16,932 | $ | 15,341 | ||||

Cost of revenue | 7,932 | 6,935 | 15,679 | 13,612 | ||||||||

Gross profit | 1,014 | 1,035 | 1,253 | 1,729 | ||||||||

Selling, general and administrative | 1,502 | 1,632 | 3,082 | 2,906 | ||||||||

Loss from operations | (488 | ) | (597 | ) | (1,829 | ) | (1,177 | ) | ||||

Other income | - | 41 | 13 | 41 | ||||||||

Interest expense | (113 | ) | (149 | ) | (245 | ) | (243 | ) | ||||

Total other (expense) income | (113 | ) | (108 | ) | (232 | ) | (202 | ) | ||||

Loss before income taxes | (601 | ) | (705 | ) | (2,061 | ) | (1,379 | ) | ||||

Income tax benefit | - | (177 | ) | - | (323 | ) | ||||||

Net loss | $ | (601 | ) | $ | (528 | ) | $ | (2,061 | ) | $ | (1,056 | ) |

Net loss per share - basic and diluted | $ | (0.06 | ) | $ | (0.06 | ) | $ | (0.22 | ) | $ | (0.12 | ) |

Weighted average shares outstanding - basic and diluted | 9,568,660 | 8,720,603 | 9,279,967 | 8,667,298 | ||||||||

TECHPRECISION CORPORATION

REVENUE, COST OF REVENUE, GROSS PROFIT BY SEGMENT

Three Months Ended September 30, 2024 and 2023

September 30, 2024 | September 30, 2023 | Changes | |||||||||||||||

Percent of | Percent of | ||||||||||||||||

Amount | Revenue | Amount | Revenue | Amount | Percent | ||||||||||||

Revenue | |||||||||||||||||

Ranor | $ | 4,790 | 54 | % | $ | 4,495 | 56 | % | $ | 295 | 7 | % | |||||

Stadco | 4,223 | 47 | % | 3,606 | 45 | % | 617 | 17 | % | ||||||||

Intersegment elimination | (67 | ) | (1 | )% | (131 | ) | (1 | )% | 64 | 49 | % | ||||||

Consolidated Revenue | $ | 8,946 | 100 | % | $ | 7,970 | 100 | % | $ | 976 | 12 | % | |||||

Cost of revenue | |||||||||||||||||

Ranor | $ | 3,272 | 37 | % | $ | 3,451 | 43 | % | $ | (179 | ) | (5 | )% | ||||

Stadco | 4,727 | 53 | % | 3,615 | 45 | % | 1,112 | 31 | % | ||||||||

Intersegment elimination | (67 | ) | (1 | )% | (131 | ) | (1 | )% | 64 | 49 | % | ||||||

Consolidated Cost of revenue | $ | 7,932 | 89 | % | $ | 6,935 | 87 | % | $ | 997 | 14 | % | |||||

Gross profit (loss) | |||||||||||||||||

Ranor | $ | 1,518 | 17 | % | $ | 1,044 | 13 | % | $ | 474 | 45 | % | |||||

Stadco | (504 | ) | (6 | )% | (9 | ) | - | % | (495 | ) | nm% | ||||||

Consolidated Gross profit | $ | 1,014 | 11 | % | $ | 1,035 | 13 | % | $ | (21 | ) | (2 | )% | ||||

Six Months Ended September 30, 2024 and 2023

September 30, 2024 | September 30, 2023 | Changes | |||||||||||||||

Percent of | Percent of | ||||||||||||||||

Amount | Revenue | Amount | Revenue | Amount | Percent | ||||||||||||

Revenue | |||||||||||||||||

Ranor | $ | 9,172 | 54 | % | $ | 8,995 | 59 | % | $ | 177 | 2 | % | |||||

Stadco | 7,827 | 46 | % | 6,573 | 43 | % | 1,254 | 19 | % | ||||||||

Intersegment elimination | (67 | ) | - | % | (227 | ) | (2 | )% | 160 | 70 | % | ||||||

Consolidated Revenue | $ | 16,932 | 100 | % | $ | 15,341 | 100 | % | $ | 1,591 | 10 | % | |||||

Cost of revenue | |||||||||||||||||

Ranor | $ | 6,417 | 38 | % | $ | 6,670 | 44 | % | $ | (253 | ) | (4 | )% | ||||

Stadco | 9,329 | 55 | % | 7,169 | 47 | % | 2,160 | 30 | % | ||||||||

Intersegment elimination | (67 | ) | - | % | (227 | ) | (2 | )% | 160 | 70 | % | ||||||

Consolidated Cost of revenue | $ | 15,679 | 93 | % | $ | 13,612 | 89 | % | $ | 2,067 | 15 | % | |||||

Gross profit (loss) | |||||||||||||||||

Ranor | $ | 2,755 | 16 | % | $ | 2,325 | 15 | % | $ | 430 | 18 | % | |||||

Stadco | (1,502 | ) | (9 | )% | (596 | ) | (4 | )% | (906 | ) | (152 | )% | |||||

Consolidated Gross profit | $ | 1,253 | 7 | % | $ | 1,729 | 11 | % | $ | (476 | ) | (28 | )% | ||||

TECHPRECISION CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Six Months Ended September 30, | ||||||

(in thousands, except per share data) | 2024 | 2023 | ||||

CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||

Net loss | $ | (2,061 | ) | $ | (1,056 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||

Depreciation and amortization | 1,391 | 1,128 | ||||

Amortization of debt issue costs | 38 | 37 | ||||

Change in fair value of stock acquisition termination fee | 419 | - | ||||

Stock-based compensation | 18 | 9 | ||||

Change in contract loss provision | 223 | (43 | ) | |||

Deferred income taxes | - | (323 | ) | |||

Gain on disposal of fixed assets | - | (40 | ) | |||

Changes in operating assets and liabilities: | ||||||

Accounts receivable | (16 | ) | (684 | ) | ||

Contract assets | (1,018 | ) | 851 | |||

Work-in-process and raw materials | (110 | ) | (379 | ) | ||

Other current assets | 105 | (117 | ) | |||

Accounts payable | 1,741 | (617 | ) | |||

Accrued expenses | 208 | (84 | ) | |||

Contract liabilities | (1,271 | ) | 847 | |||

Other noncurrent liabilities | (92 | ) | 1,729 | |||

Net cash (used in) provided by operating activities | (425 | ) | 1,258 | |||

CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||

Proceeds from insurance claim on fixed assets | --- | 62 | ||||

Purchases of property, plant, and equipment | (1,622 | ) | (2,659 | ) | ||

Reimbursements for purchases of property, plant and equipment | 1,000 | - | ||||

Net cash used in investing activities | (622 | ) | (2,597 | ) | ||

CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||

Proceeds from private placement | 1,801 | --- | ||||

Private placement fees | (213 | ) | --- | |||

Debt issue costs | (48 | ) | - | |||

Revolver loan borrowings | 6,746 | 6,710 | ||||

Revolver loan payments | (6,931 | ) | (5,460 | ) | ||

Payments of principal for leases | (5 | ) | (11 | ) | ||

Repayments of long-term debt | (309 | ) | (296 | ) | ||

Net cash provided by financing activities | 1,041 | 943 | ||||

Net decrease in cash and cash equivalents | (6 | ) | (396 | ) | ||

Cash and cash equivalents, beginning of period | 138 | 534 | ||||

Cash and cash equivalents, end of period | $ | 132 | $ | 138 | ||

SUPPLEMENTAL DISCLOSURES OF CASH FLOWS INFORMATION: | ||||||

Cash paid for interest; net of amounts capitalized | $ | 207 | $ | 201 | ||

EBITDA Non-GAAP Financial Measure

To complement our condensed consolidated statements of operations and condensed consolidated statements of cash flows, we use EBITDA, a non-GAAP financial measure. Net loss is the financial measure calculated and presented in accordance with U.S. GAAP that is most directly comparable to EBITDA. We believe EBITDA provides our board of directors, management, and investors with a helpful measure for comparing our operating performance with the performance of other companies that have different financing and capital structures or tax rates. We also believe that EBITDA is a measure frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry, and is a measure contained in our debt covenants. However, while we consider EBITDA to be an important measure of operating performance, EBITDA and other non-GAAP financial measures have limitations, and investors should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP.

We define EBITDA as net loss plus interest, income taxes, depreciation, and amortization. Net loss was $601 and $528 for the three months ended September 30, 2024 and 2023, and $2,061 and $1,056 for the six months ended September 30, 2024 and 2023. EBITDA, a non-GAAP financial measure, was negative for the six months ended September 30, 2024 and 2023. The following table provides a reconciliation of EBITDA to net income (loss), the most directly comparable U.S. GAAP measure reported in our condensed consolidated financial statements for the three and six months ended:

Three Months ended September 30, | Six Months ended September 30, | ||||||||||||||||||

(dollars in thousands) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||

Net loss | $ | (601 | ) | $ | (528 | ) | $ | (73 | ) | $ | (2,061 | ) | $ | (1,056 | ) | $ | (1,005 | ) | |

Income tax (benefit) expense | --- | (177 | ) | 177 | --- | (323 | ) | 323 | |||||||||||

Interest expense (1) | 113 | 149 | (35 | ) | 245 | 243 | 2 | ||||||||||||

Depreciation and amortization | 697 | 568 | 128 | 1,391 | 1,128 | 263 | |||||||||||||

EBITDA | $ | 209 | $ | 12 | $ | 197 | $ | (425 | ) | $ | (8 | ) | $ | (417 | ) | ||||

(1) Includes amortization of debt issue costs.

SOURCE: TechPrecision Corporation

View the original press release on ACCESS Newswire

P.Stevenson--AMWN