-

Trump claims China's Xi called him on tariffs

Trump claims China's Xi called him on tariffs

-

Lyon request French league discard result of Saint-Etienne match

-

Guardiola says Man City must show 'spirit' to get back on top

Guardiola says Man City must show 'spirit' to get back on top

-

US envoy meets Putin in Russia for Ukraine ceasefire talks

-

Hope, apprehension and politics: Cardinals search for new pope

Hope, apprehension and politics: Cardinals search for new pope

-

TikTok videos exploit trade war to sell fake luxury goods

-

Russian general killed by car bomb near Moscow

Russian general killed by car bomb near Moscow

-

Clasico Copa final offers Mbappe, Real Madrid redemption

-

Sister Genevieve, French nun who broke protocol to see pope's body

Sister Genevieve, French nun who broke protocol to see pope's body

-

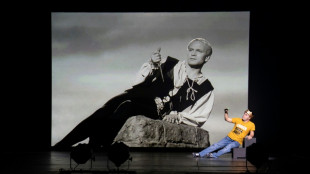

Actors with Down syndrome tear down barriers in London show

-

Nepal marks 10 years since devastating 2015 quake

Nepal marks 10 years since devastating 2015 quake

-

Stock markets rise on hopes of easing trade tensions

-

Russia holds key rate at two-decade high despite slowdown fears

Russia holds key rate at two-decade high despite slowdown fears

-

Badosa pulls out of Madrid Open with injury

-

Don't make 'disappointing' retreat on climate, COP30 CEO urges EU

Don't make 'disappointing' retreat on climate, COP30 CEO urges EU

-

Bayer says legal woes could force it to pull weedkiller

-

China's top leaders pledge economic support as trade war rages

China's top leaders pledge economic support as trade war rages

-

S. Korea's former president claims his bribery indictment 'unjust'

-

Huge crowds pack Vatican ahead of Pope's funeral

Huge crowds pack Vatican ahead of Pope's funeral

-

China says wind and solar energy capacity exceeds thermal for first time

-

Arms maker Saab posts record sales as Europe rearms

Arms maker Saab posts record sales as Europe rearms

-

Howe 'not 100 percent' on Newcastle return after pneumonia

-

Liverpool have 'big responsibility' to win title at Anfield: Slot

Liverpool have 'big responsibility' to win title at Anfield: Slot

-

East Timor PM says Francis left legacy of reconciliation, tackled abuse

-

Asian and European stocks rise in wake of Wall Street rally

Asian and European stocks rise in wake of Wall Street rally

-

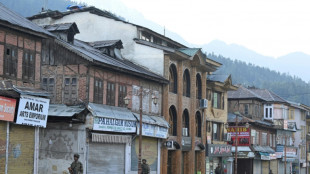

Cameras and automatic rifles: how the Kashmir attack took place

-

Huge crowds at Vatican ahead of Pope's funeral

Huge crowds at Vatican ahead of Pope's funeral

-

Thunder rally from 29 down after Morant hurt to stun Grizzlies

-

Indian and Pakistani troops exchange fire in Kashmir

Indian and Pakistani troops exchange fire in Kashmir

-

Australia's PM condemns heckling at Anzac Day services

-

Kenya failing to tackle record-high femicides, activists say

Kenya failing to tackle record-high femicides, activists say

-

'White flag': Pope leaves bitter legacy in Ukraine

-

Whitecaps outfight Miami to get advantage in Concacaf semi

Whitecaps outfight Miami to get advantage in Concacaf semi

-

Kane hopes to 'silence' the doubters as Bayern title looms

-

Barcelona out to prove Clasico superiority in Copa del Rey final

Barcelona out to prove Clasico superiority in Copa del Rey final

-

India and Pakistan urged to have 'maximum restraint' after Kashmir attack

-

Montemurro eyes Arsenal scalp as Lyon close on Champions League final

Montemurro eyes Arsenal scalp as Lyon close on Champions League final

-

Marseille get their passports out to prepare Champions League return

-

Asia stocks rise in wake of Wall Street rally

Asia stocks rise in wake of Wall Street rally

-

Remains of 5,000-year-old noblewoman found in Peru dig

-

Iraq farmers turn to groundwater to boost desert yield

Iraq farmers turn to groundwater to boost desert yield

-

Nepal's long road to quake resilience

-

Russia's Lavrov says 'ready to reach a deal' on Ukraine

Russia's Lavrov says 'ready to reach a deal' on Ukraine

-

Tradition stokes pollution at Myanmar 'slash and burn' festival

-

Vatican braces for huge crowds ahead of Pope's funeral

Vatican braces for huge crowds ahead of Pope's funeral

-

Knicks outlast Pistons to grab lead in NBA playoff series

-

'Blood and kin': Mongolians reflect on Pope Francis's legacy

'Blood and kin': Mongolians reflect on Pope Francis's legacy

-

Titans take QB Ward, Jags trade up for two-way star Hunter

-

China's Liu, South Korea's Ryu share storm-hit LPGA Chevron lead

China's Liu, South Korea's Ryu share storm-hit LPGA Chevron lead

-

Liverpool braced for Premier League title party

Kidoz Inc. : 2024 Record Adjusted EBITDA of USD $1,134,503 (CAD $1,554,963) and Revenue of USD $14,004,527 (CAD $19,194,773)

VANCOUVER, BC / ACCESS Newswire / April 24, 2025 / Kidoz Inc. (TSXV:KIDZ) (the "Company"), mobile AdTech developer and owner of the market-leading Kidoz Contextual Ad Network ( www.kidoz.net ), the Kidoz Publisher SDK and Kidoz COPPA Shield, announced todayits audited financial results for the year ended December 31, 2024. All amounts are presented in United States dollars and are in accordance with United States Generally Accepted Accounting Principles.

Financial highlights from fiscal 2024 include:

Total Revenue of $14,004,527 an increase of 6% over fiscal 2023 Total Revenue of $13,326,824.

Sales and Marketing expenditure of $1,465,833, an increase of 16% from $1,268,218 in fiscal 2023.

Non-Capitalized R&D expenditures of $3,445,018, an increase of 15% from $2,999,079 in fiscal 2023.

Net income after tax of $353,140, compared to a net loss after tax ($2,012,056) in fiscal 2023.

Adjusted EBITDA of $1,134,503 compared to Adjusted EBITDA of ($891,166) in fiscal 2023.

Cash of $2,780,517 and working capital of $4,219,588 as at December 31, 2024, compared to cash of $1,469,224 and working capital of $3,220,646 as at December 31, 2023.

Free Cash Flow as at December 31, 2024, of $1,305,230 compared to Free Cash Flow of ($823,640) as at December 31, 2023.

"Record Company profits in 2024 marked a pivotal moment for Kidoz," said Jason Williams, CEO of Kidoz Inc. "Our investment in building a proprietary, privacy-first technology has positioned us as a key partner to the world's leading family brands. As digital safety shifts from a differentiator to an industry standard, we're well-positioned for continued growth driven by increasing demand for compliant, high-performance mobile solutions leading to greater profitability for Kidoz.

Kidoz has built the privacy defining platform that enables the delivery of safe media to children at scale. We are constantly improving our system to stay ahead of privacy regulations and work closely with the leading certifier to ensure that every aspect of our operation is private and always keeps our brand partners completely safe. With many data and privacy risks inherent in the child-directed media landscape, Kidoz provides brands with a trusted solution. As we are seeing age confirmation requirements increase through the adoption of age gates, Kidoz's importance in the media ecosystem increases as firms look for established solutions to implement safe media offerings."

The following tables present our unaudited consolidated quarterly results of operations for each of our last four quarters. This data has been derived from unaudited consolidated financial statements that have been prepared on the same basis as the annual audited consolidated financial statements and, in our opinion, include all normal recurring adjustments necessary for the fair presentation of such information. These unaudited quarterly results should be read in conjunction with our audited consolidated financial statements.

Three Months Ended | |||||||||||

December 31, 2024 | September 30 2024 | June 30 2024 | March 31 2024 | ||||||||

(Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||

Revenue | $ | 7,444,505 | $ | 2,287,776 | $ | 2,479,175 | $ | 1,793,071 | |||

Cost of sales | 3,277,093 | 1,079,212 | 1,233,994 | 836,674 | |||||||

Gross profit | 4,167,412 | 1,208,564 | 1,245,181 | 956,397 | |||||||

Operating expenses and other income / (expenses) | (1,983,399 | ) | (1,569,535 | ) | (1,586,313 | ) | (1,567,928 | ) | |||

Provision for doubtful receivables | (114,480 | ) | - | - | - | ||||||

Stock awareness program | - | - | - | - | |||||||

Depreciation and amortization | (45,377 | ) | (45,313 | ) | (45,437 | ) | (108,052 | ) | |||

Income (Loss) before income taxes | 2,024,156 | (406,284 | ) | (386,569 | ) | (719,583 | ) | ||||

Income tax (expense) recovery | (159,499 | ) | - | 919 | - | ||||||

Income (Loss) after tax | $ | 1,864,657 | (406,284 | ) | $ | (385,650 | ) | $ | (719,583 | ) | |

Basic and diluted Income (loss) per share | $ | 0.01 | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) |

Weighted average common shares, basic | 131,304,499 | 131,304,499 | 131,304,499 | 131,304,499 | |||||||

Weighted average common shares, diluted | 131,304,499 | 131,304,499 | 131,304,499 | 131,304,499 | |||||||

CAUTION REGARDING NON-GAAP FINANCIAL MEASURES

This press release refers to "Adjusted EBITDA" which is a non-GAAP financial measure that does not have a standardized meaning prescribed by GAAP. Adjusted EBITDA is not presented in accordance with, or as an alternative to, GAAP financial measures and may be different from non-GAAP measures used by other companies. These non-GAAP measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with generally accepted accounting principles in the United States of America ("GAAP"). We encourage investors to review the GAAP financial measures included in the last Quarterly Form 6-K, including our unaudited consolidated financial statements, to aid in their analysis and understanding of our performance and in making comparisons.

We use Adjusted EBITDA internally to evaluate our performance and make financial and operational decisions that are presented in a manner that adjusts from their equivalent GAAP measures or that supplement the information provided by our GAAP measures. Adjusted EBITDA is defined by us as EBITDA (net income (loss) plus depreciation expense, amortization expense, interest, stock-based compensation and impairment of goodwill), further adjusted to exclude certain non-cash expenses and other adjustments. We use Adjusted EBITDA because we believe it more clearly highlights business trends that may not otherwise be apparent when relying solely on GAAP financial measures, since Adjusted EBITDA eliminates from our results specific financial items that have less bearing on our core operating performance.

Our Adjusted EBITDA is reconciled as follows:

Twelve Months Ended December 31, 2024 | Twelve Months Ended December 31, 2023 | Three Months Ended December 31, 2024 | Three Months Ended December 31, 2023 | ||||||

Net Income (loss) | $ | 353,140 | $ | (2,012,056 | ) | $ | 1,934,806 | $ | 328,309 |

Less: | |||||||||

Depreciation and amortization | 244,179 | 558,740 | 45,377 | 139,945 | |||||

Interest and other income | (643 | ) | (1,049 | ) | (4 | ) | (6 | ) | |

Stock awareness program | - | 74,112 | - | 18,371 | |||||

Stock-based compensation | 379,247 | 515,116 | 101,899 | 130,928 | |||||

Gain on derivative liability - warrants | - | (51 | ) | - | - | ||||

Income tax (recovery) expense | 158,580 | (25,978 | ) | 89,114 | (25,978 | ) | |||

Adjusted EBITDA | $ | 1,134,503 | $ | (891,166 | ) | $ | 2,171,192 | $ | 591,569 |

For full details of the Company's operations, please refer to the Securities and Exchange Commission website at www.sec.gov or the Kidoz Inc. corporate website at https://investor.kidoz.net or on the https://www.sedarplus.ca website.

About Kidoz Inc.

Kidoz Inc. (TSXV:KIDZ) ( www.kidoz.net ) is a global AdTech software company and the developer of the Kidoz Safe Ad Network, delivering privacy-first, high-performance mobile advertising for children, teens, and families, whose mission is to keep children safe in the complex digital advertising ecosystem. Through its proprietary Kidoz SDK, Privacy Shield, and advanced contextual targeting tools, Kidoz enables safe, compliant ad experiences that adhere to COPPA, GDPR-K, and global standards, without using location or personally identifiable information data tracking commonly used in digital advertising.

The Kidoz platform helps app developers monetize their apps with safe and relevant ads, while uniting brands and families in a compliant mobile ecosystem. Google-certified and Apple-approved, the Kidoz network reaches hundreds of millions of users monthly, and is trusted by leading brands including Mattel, LEGO, Disney, and Kraft. Kidoz offers both managed and programmatic media solutions, including SSP, DSP, and Ad Exchange capabilities and provides a platform for mobile app publishers to monetize their active users through display, rich media, and video ads. Trusted by top brands and developers, Kidoz runs campaigns in over 60 countries and generates the majority of its revenue from AdTech advertising.

The Company also operates Prado, its wholly owned over-13 division. For brands, Prado enables scaled access with high quality inventory and audience engagement across teens, families, and general audiences.

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements. Certain information included in this press release (as well as information included in oral statements or other written statements made or to be made by the company) contains statements that are forward-looking, such as statements relating to anticipated future success of the company. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of the company. For a description of additional risks and uncertainties, please refer to the company's filings with the Securities and Exchange Commission. Specifically, readers should read the Company's Annual Report on Form 20-F, filed with the SEC and the Annual Financial Statements and Management Discussion & Analysis filed on SEDAR on April 24, 2025, and the prospectus filed under Rule 424(b) of the Securities Act on March 9, 2005 and the SB2 filed July 17, 2007, and the TSX Venture Exchange Listing Application for Common Shares filed on June 29, 2015 on SEDAR, for a more thorough discussion of the Company's financial position and results of operations, together with a detailed discussion of the risk factors involved in an investment in Kidoz Inc.

For more information contact:

Henry Bromley

CFO|

[email protected]

(888) 374-2163

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Kidoz Inc.

View the original press release on ACCESS Newswire

L.Davis--AMWN