-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

Newsmax shares surge more than 2,000% in days after IPO

-

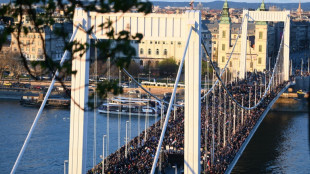

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

Former captain Edwards named new England women's cricket coach

-

Haaland ruled out for up to seven weeks: Man City boss Guardiola

-

UK Supreme Court opens car loans hearing as banks risk huge bill

UK Supreme Court opens car loans hearing as banks risk huge bill

-

Haaland ruled out for up to seven weeks: Guardiola

-

Trophies are what count: Barca's Flick before Atletico cup clash

Trophies are what count: Barca's Flick before Atletico cup clash

-

Trump signs executive order targeting ticket scalping

-

Eurozone inflation eases in March as tariff threat looms

Eurozone inflation eases in March as tariff threat looms

-

Howe targets 'game-changing' Champions League return for Newcastle

Gaming Realms PLC Announces Share Buyback Programme

Launch of Share Buyback Programme

LONDON, UNITED KINGDOM / ACCESS Newswire / March 31, 2025 / Gaming Realms plc (AIM:GMR), the developer and licensor of mobile-focused gaming content, announces the commencement of a share buyback programme to purchase ordinary shares of 0.1 pence each in the capital of the Company ("Ordinary Shares") up to a maximum aggregate consideration of £6 million (the "Share Buyback Programme").

As referenced in the Company's final results for the year ended 31 December 2024, announced today, the Company is debt free and has a strong cash position of approximately £13.5 million. The Share Buyback Programme reflects the Company's directors' continued confidence in its future prospects.

The Company remains committed to continuing to invest in the business to deliver organic growth and returning surplus cash to shareholders.

Details of the Share Buyback Programme

Gaming Realms has given irrevocable and non-discretionary instruction to Peel Hunt LLP ("Peel Hunt") and Investec Bank Plc ("Investec") (together the Brokers) to conduct the Share Buyback Programme on its behalf, which will commence today and will end no later than 31 August 2025 or, if earlier, the conclusion of the Company's annual general meeting ("AGM") to be held in May 2025 unless the requisite authority is renewed at the AGM in May 2025. The Brokers will act as "riskless" or "matched" principals for the purposes of the Share Buyback Programme, within certain parameters, and will make their trading decisions concerning the purchases of Ordinary Shares independently of the Company.

Ordinary Shares purchased under the Share Buyback Programme will take place in open market transactions and in accordance with the general authority to purchase Ordinary Shares granted to the directors of the Company (the "Directors") by its shareholders at the Company's AGM in 2024 (the "2024 Authority", or as subsequently granted to the Directors at its AGM in 2025). The maximum number of Ordinary Shares which the Company is authorised to purchase under the 2024 Authority is 29,477,644. The Share Buyback Programme will be conducted in accordance with Article 5(1) of Regulation (EU) 596/2014, as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended) ("UK MAR") and the provisions of Commission Delegated Regulation (EU) 2016/1052, as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended), which deal with buyback programmes.

The maximum price (excluding any expenses) which may be paid for each Ordinary Share shall not be more than the higher of (i) an amount equal to 105 per cent. of the average of the middle market quotations for an Ordinary Share, as derived from the AIM Appendix to the London Stock Exchange Daily Official List, for the five business days immediately preceding the day on which the Ordinary Share is contracted to be purchased, and (ii) an amount equal to the higher of the price of the last independent trade of an Ordinary Share and the highest current independent bid for an Ordinary Share as derived from the trading venues on which the purchase is carried out.

Gaming Realms will announce any purchase of its Ordinary Shares under the Share Buyback Programme no later than 7.30 a.m. on the business day following the calendar day on which the purchase occurred. The Company will cancel any Shares purchased or hold them in treasury to meet obligations arising from share option programmes.

The Company will make further regulatory announcements in respect of any repurchases of its Ordinary Shares as required by UK MAR and the AIM Rules. The Company is satisfied that it is not currently in a closed period, nor is it in possession of any inside information which has not previously been disclosed via Regulatory Information Service.

For further information, please contact:

Gaming Realms Plc | 0845 123 3773 |

Peel Hunt - NOMAD and Joint Corporate Broker | 020 7418 8900 |

George Sellar | |

Investec - Joint Corporate Broker | 020 7597 4000 |

Ben Farrow | |

Yellow Jersey | 07747 788 221 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Gaming Realms PLC

View the original press release on ACCESS Newswire

B.Finley--AMWN