-

'Black day': French workers protest Michelin plans to close two plants

'Black day': French workers protest Michelin plans to close two plants

-

Manchester United fans in favour of leaving Old Trafford

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Kenya court jails Olympian Kiplagat's killers for 35 years

-

Dutch, French authorities raid Netflix offices in tax probe

Dutch, French authorities raid Netflix offices in tax probe

-

Barcelona to replace flood-hit Valencia for MotoGP finale

-

Spain unveils aid plan a week after catastrophic floods

Spain unveils aid plan a week after catastrophic floods

-

Neymar to miss two weeks' training in fresh setback: coach

-

Injured Djokovic gives up on ATP Finals title defence

Injured Djokovic gives up on ATP Finals title defence

-

Indonesia volcano erupts again after killing nine day earlier

-

Injured Djokovic to miss ATP Finals

Injured Djokovic to miss ATP Finals

-

South Korea fines Meta for illegal collection of user data

-

UK parliament to debate world's first 'smoke-free generation' bill

UK parliament to debate world's first 'smoke-free generation' bill

-

Stock markets rise, dollar pressured as US votes

-

'Incalculable' bill awaits Spain after historic floods

'Incalculable' bill awaits Spain after historic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Award-winning Cambodian reporter quits journalism after arrest

Award-winning Cambodian reporter quits journalism after arrest

-

Kenyan athletes' deaths expose mental health struggles

-

Start without a shot: PTSD sufferers welcome marathon effort

Start without a shot: PTSD sufferers welcome marathon effort

-

Norway speeds ahead of EU in race for fossil-free roads

-

Harris or Trump: America decides in knife-edge election

Harris or Trump: America decides in knife-edge election

-

Smog sickness: India's capital struggles as pollution surges

-

Most Asian markets rise as US heads to polls in toss-up vote

Most Asian markets rise as US heads to polls in toss-up vote

-

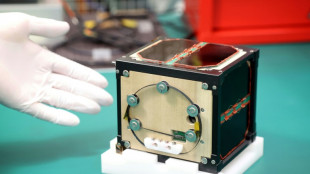

World's first wooden satellite launched into space

-

Myanmar junta chief visits key ally China

Myanmar junta chief visits key ally China

-

Nintendo lowers sales forecast as first-half profits plunge

-

Most Asian markets rise ahead of toss-up US election

Most Asian markets rise ahead of toss-up US election

-

Greenland seeks to capitalise on 'last-chance tourism'

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Greenland eyes tourism takeoff with new airport runway

-

Boeing union says approves contract, ending over 7-week strike

Boeing union says approves contract, ending over 7-week strike

-

Harris, Trump end historic campaigns with final pitch to voters

-

Cavs down Bucks to improve to 8-0, Thunder unbeaten in West

Cavs down Bucks to improve to 8-0, Thunder unbeaten in West

-

New Hampshire hamlet tied in first US Election day votes

-

Outsider Knight's Choice wins Melbourne Cup photo-finish thriller

Outsider Knight's Choice wins Melbourne Cup photo-finish thriller

-

Chiefs stay perfect with overtime win over Bucs

-

Uncertain Inter with questions to answer before Arsenal clash

Uncertain Inter with questions to answer before Arsenal clash

-

With Mbappe gone, misfiring PSG are under pressure in Champions League

-

China's premier 'fully confident' of hitting growth targets

China's premier 'fully confident' of hitting growth targets

-

North Korea fires short-range ballistic missile salvo ahead of US election

-

Taiwan couple charged with trying to influence elections for China

Taiwan couple charged with trying to influence elections for China

-

Indonesian President Prabowo to visit China this week

-

Critically endangered Sumatran elephant calf born in Indonesia

Critically endangered Sumatran elephant calf born in Indonesia

-

The marble 'living Buddhas' trapped by Myanmar's civil war

-

How East Germany's 'traffic light man' became a beloved icon

How East Germany's 'traffic light man' became a beloved icon

-

Japan expresses concern to China over Russia-North Korea ties

-

Asian markets swing ahead of toss-up US election

Asian markets swing ahead of toss-up US election

-

Palau polls open as pro-US president faces election test

-

'Panic buttons,' SWAT teams: US braces for election unrest

'Panic buttons,' SWAT teams: US braces for election unrest

-

Hundreds of UK police sacked for misconduct

Flutter eyes US listing switch in new post-Brexit blow

Online betting giant Flutter this week took the first step to switch its main listing from London to New York, in a fresh post-Brexit blow to the City finance district.

Flutter, which launched a secondary US listing on Monday, said its board "believes that the New York Stock Exchange is now the optimal location for Flutter's primary listing of its shares".

The firm, which is based in Dublin but currently has its main listing on the London Stock Exchange, will put the proposal to shareholders at the next annual general meeting on May 1, it said in a statement.

The City of London has sought to defend its status as a preeminent global finance hub after Britain's departure from the European Union in early 2021.

Yet Flutter's New York switch, which could become effective at the end of the second quarter or start of the third quarter, came as no surprise to analysts.

- 'Another body blow' -

"Another day, another body blow to London with Flutter confirming that it will shift its primary listing location from London to New York," noted Neil Shah, research director at Edison Group.

"That Flutter has upgraded its love affair with the US markets to a fully fledged relationship is no surprise given that its US operations are a significant part of its business and the soon-to-be primary source of its profits."

US online gambling has boomed after the country's Supreme Court in 2018 lifted a ban on sports betting.

"The US market... is deregulating and looks to offer greater growth potential than the UK and some European markets where the gambling regulations are becoming tighter, not looser," noted AJ Bell investment director Russ Mould.

Flutter's sales surged 38 percent in the United States last year, compared with a 24 percent increase across the group.

The secondary New York listing "is a pivotal moment... as we make Flutter more accessible to US-based investors and gain access to deeper capital markets", said chief executive Peter Jackson.

- 'Jilted partner' -

Flutter would become the latest corporate departure from the British capital, which has since Brexit faced fierce competition from the likes of Amsterdam, Frankfurt and New York.

British chip designer Arm, whose semiconductors power most of the world's smartphones and which is owned by Japan's SoftBank, launched a blockbuster initial public offering in New York in September.

Building materials giant CRH also switched its primary market listing to New York from London last year.

Soda ash producing giant WE Soda last year scrapped its plan to list in the British capital, while German travel firm TUI plans to end its London listing in favour of Frankfurt.

"London's role as jilted partner continues, with yet another company leaving its embrace on the promise of higher valuations and deeper pools of capital in the US," added Shah.

"That... follows a very worrying and very public trend of listed companies losing trust in the City, which must prompt the government to turbo-charge its listing reforms."

Britain's Financial Conduct Authority regulator has sought to reform rules in a bid to attract more IPOs.

The government has also launched its own reforms in an attempt to stimulate growth in the financial sector.

The City of London Corporation, which oversees the Square Mile finance district, conceded last week that London faced "a decrease in capital markets activity and assets under management" -- but insisted it remained "the top global financial centre" ahead of New York.

However, IPO volumes tumbled 36 percent in the United Kingdom and Ireland last year, according to a recent study from financial services giant EY. That compared with an overall eight percent decline globally.

F.Pedersen--AMWN