-

Security 'breakdown' allows armed men into Melbourne's MCG

Security 'breakdown' allows armed men into Melbourne's MCG

-

Norris fastest in Japan GP first practice, Tsunoda sixth on Red Bull debut

-

Albon says Thailand taking bid for F1 race 'very seriously'

Albon says Thailand taking bid for F1 race 'very seriously'

-

'It's gone': conservation science in Thailand's burning forest

-

Protest as quake-hit Myanmar junta chief joins Bangkok summit

Protest as quake-hit Myanmar junta chief joins Bangkok summit

-

EU leaders push for influence at Central Asia summit

-

Asian stocks extend global rout after Trump's shock tariff blitz

Asian stocks extend global rout after Trump's shock tariff blitz

-

Lewandowski, Mbappe duel fuelling tight La Liga title race

-

South Korea court upholds President Yoon's impeachment, strips him of office

South Korea court upholds President Yoon's impeachment, strips him of office

-

Liverpool march towards title as Man City face Man Utd

-

Finland's colossal bomb shelters a model for jittery Europe

Finland's colossal bomb shelters a model for jittery Europe

-

Athletes frustrated as France mulls Muslim headscarf ban in sport

-

Korda downs Kupcho to stay alive at LPGA Match Play

Korda downs Kupcho to stay alive at LPGA Match Play

-

German industry grapples with AI at trade fair

-

Irish school trains thatchers to save iconic roofs

Irish school trains thatchers to save iconic roofs

-

'Frightening': US restaurants, producers face tariff whiplash

-

Cuba looks to sun to solve its energy crisis

Cuba looks to sun to solve its energy crisis

-

Experts warn 'AI-written' paper is latest spin on climate change denial

-

PSG eye becoming France's first 'Invincibles'

PSG eye becoming France's first 'Invincibles'

-

Late birdie burst lifts Ryder to Texas Open lead

-

Five potential Grand National fairytale endings

Five potential Grand National fairytale endings

-

Trump purges national security team after meeting conspiracist

-

More work for McIlroy even with two wins before Masters

More work for McIlroy even with two wins before Masters

-

Trump hopeful of 'great' PGA-LIV golf merger

-

No.1 Scheffler goes for third Masters crown in four years

No.1 Scheffler goes for third Masters crown in four years

-

Where Trump's tariffs could hurt Americans' wallets

-

Trump says 'very close to a deal' on TikTok

Trump says 'very close to a deal' on TikTok

-

Trump tariffs on Mexico: the good, the bad, the unknown

-

Postecoglou denies taunting Spurs fans in Chelsea defeat

Postecoglou denies taunting Spurs fans in Chelsea defeat

-

Oscar-winning Palestinian director speaks at UN on Israeli settlements

-

With tariff war, Trump also reshapes how US treats allies

With tariff war, Trump also reshapes how US treats allies

-

Fernandez fires Chelsea into fourth as pressure mounts on Postecoglou

-

South Korea court to decide impeached president's fate

South Korea court to decide impeached president's fate

-

Penguin memes take flight after Trump tariffs remote island

-

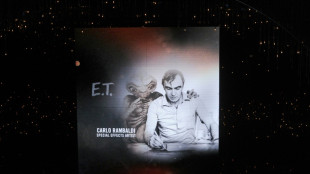

E.T., no home: Original model of movie alien doesn't sell at auction

E.T., no home: Original model of movie alien doesn't sell at auction

-

Italy's Brignone has surgery on broken leg with Winter Olympics looming

-

Trump defiant as tariffs send world markets into panic

Trump defiant as tariffs send world markets into panic

-

City officials vote to repair roof on home of MLB Rays

-

Rockets forward Brooks gets one-game NBA ban for technicals

Rockets forward Brooks gets one-game NBA ban for technicals

-

Pentagon watchdog to probe defense chief over Signal chat row

-

US tariffs could push up inflation, slow growth: Fed official

US tariffs could push up inflation, slow growth: Fed official

-

New Bruce Springsteen music set for June 27 release

-

Tom Cruise pays tribute to Val Kilmer

Tom Cruise pays tribute to Val Kilmer

-

Mexico president welcomes being left off Trump's tariffs list

-

Zuckerberg repeats Trump visits in bid to settle antitrust case

Zuckerberg repeats Trump visits in bid to settle antitrust case

-

US fencer disqualified for not facing transgender rival

-

'Everyone worried' by Trump tariffs in France's champagne region

'Everyone worried' by Trump tariffs in France's champagne region

-

Italy's Brignone suffers broken leg with Winter Olympics looming

-

Iyer blitz powers Kolkata to big IPL win over Hyderabad

Iyer blitz powers Kolkata to big IPL win over Hyderabad

-

Russian soprano Netrebko to return to London's Royal Opera House

$80 billion in Aramco shares moved to Saudi sovereign fund

Saudi Arabia has moved four percent of Aramco shares worth $80 billion in the world's biggest oil exporter to the kingdom's sovereign wealth fund, authorities said on Sunday.

Crown Prince Mohammed bin Salman, Saudi Arabia's de facto ruler, announced the move as part of efforts to recalibrate the oil-dominated economy.

The transfer is also the latest sign that Saudi Arabia wants to open up the oil giant and "crown jewel" of the Saudi economy, the Arab world's largest.

The "transfer of four percent of Aramco shares to the Public Investment Fund (PIF)... is part of the kingdom's long-term strategy to support the restructuring of its economy," the crown prince was quoted as saying by the official Saudi Press Agency.

Crown Prince Mohammed said he wants the investment fund to have one trillion dollars in assets by the end of 2025. The fund, the centrepiece of official moves to end economic reliance on oil, has less than half that amount before this deal.

"The shares will bolster the fund's strong financial position and high credit ratings in the medium term, as the PIF relies on the value of its assets and the returns on its assets under management for its funding strategy," he said.

The crown prince stressed that the Saudi state would remain the dominant Aramco shareholder with a 94 percent stake. Crown Prince Mohammed is also head of the PIF sovereign fund.

Aramco shares finished down by 0.6 percent in trading Sunday after the announcement. But experts said the share switch would strengthen the sovereign fund.

Mazen al-Sudairi, head of Research at Al Rajhi Capital, said it would "give the fund flexibility" if it wants to launch shares on the local or international market.

Ibrahim al-Ghitani, head of energy studies at the Future for Advanced Research and Studies think tank, predicted that it would a "preparatory step" toward an international sale of shares.

- 'Financial reform process' -

The crown prince said in April last year that Aramco was in talks to sell a one percent stake to a foreign energy giant.

"There is a discussion on the acquisition of one percent (of Aramco) by one of the world's leading energy companies, and this will be a very important deal to boost Aramco's sales in that country," the crown prince said at the time.

Aramco previously sold 1.7 percent of its shares on the Saudi bourse in December 2019, generating $29.4 billion in the world's biggest initial public offering.

It raised six billion dollars in Islamic bonds in June last year, so that it could pay dividends to the new shareholders.

But Aramco announced $30.4 billion in profits for the third quarter of 2021, a massive rise from $18.8 billion for the same quarter the previous year, as oil prices took off again.

In December, Aramco said it had signed a $15.5 billion lease agreement for its gas pipeline network with a consortium led by BlackRock Real Estate of the United States and Hassana Investment Company, a Saudi-state-backed investment management firm.

Aramco and its assets were once kept under a vice-like government control, long off-limits to outside investment.

But with the rise of Crown Prince Mohammed, who has been pushing his "Vision 2030" reform programme since 2016, the kingdom has shown readiness to cede some control.

M.Thompson--AMWN