-

Etzebeth returns to Sharks lineup after concussion absence

Etzebeth returns to Sharks lineup after concussion absence

-

Gaza rescuers say 40 mostly displaced people killed in Israeli strikes

-

N.Ireland designer Jonathan Anderson takes helm at Dior Men

N.Ireland designer Jonathan Anderson takes helm at Dior Men

-

Turkish central bank raises interest rate to 46 percent

-

Trump's tariff storm a threat to dollar's dominance?

Trump's tariff storm a threat to dollar's dominance?

-

Bayern forced to watch on as home final dream 'shattered'

-

Trump clashes with Fed chief Powell over interest rates

Trump clashes with Fed chief Powell over interest rates

-

UK mulls impact of landmark gender ruling

-

'Help us,' says wife of Gaza medic missing since ambulance attack

'Help us,' says wife of Gaza medic missing since ambulance attack

-

Stocks diverge as ECB rate cut looms, Trump tussles with Fed

-

UN nuclear chief says Iran, US running out of time to secure deal

UN nuclear chief says Iran, US running out of time to secure deal

-

Somalia air strikes, combat kill dozens of jihadists: govt

-

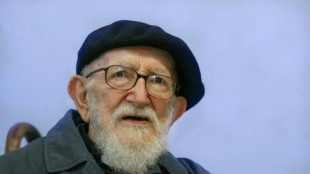

Book claims Vatican knew French charity icon accused of abuse from 1950s

Book claims Vatican knew French charity icon accused of abuse from 1950s

-

Afrobeats star Davido sees Nigeria's star rising

-

Van Dijk signs new Liverpool contract

Van Dijk signs new Liverpool contract

-

Gaza rescuers say 37 people killed in Israeli strikes, most of them displaced

-

Strongest 'hints' yet of life detected on distant planet

Strongest 'hints' yet of life detected on distant planet

-

EU hopes Trump tariffs can nudge Mercosur deal past finish line

-

Nvidia CEO in Beijing as US tech curbs, trade war threaten sales

Nvidia CEO in Beijing as US tech curbs, trade war threaten sales

-

Sexton moves into coaching role with Ireland and Lions

-

Italy's Meloni in Washington seeking EU tariff deal from Trump

Italy's Meloni in Washington seeking EU tariff deal from Trump

-

UN nuclear chief in Tehran ahead of fresh Iran-US talks

-

Silent killing fields 50 years on from Khmer Rouge atrocities

Silent killing fields 50 years on from Khmer Rouge atrocities

-

Ancelotti exposed as Real Madrid struggle to accommodate Mbappe

-

Rubio in Paris to meet Macron on Ukraine war

Rubio in Paris to meet Macron on Ukraine war

-

Asian markets boosted as 'Big Progress' made in Japan tariff talks

-

Philippine film legend Nora Aunor dies aged 71

Philippine film legend Nora Aunor dies aged 71

-

Taiwan's TSMC net profit soars as US tariff threat looms

-

Cartel recruitment at heart of Mexico's missing persons crisis

Cartel recruitment at heart of Mexico's missing persons crisis

-

Macron to hold Ukraine war talks with Rubio, Witkoff in Paris

-

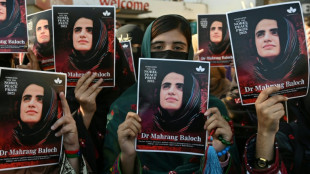

Mahrang Baloch, a child of the resistance for Pakistan's ethnic minority

Mahrang Baloch, a child of the resistance for Pakistan's ethnic minority

-

Myanmar junta says to free nearly 5,000 prisoners in amnesty

-

Taiwan's TSMC says net profit rose 60.3% in first quarter

Taiwan's TSMC says net profit rose 60.3% in first quarter

-

Hermes to hike US prices to offset tariff impact

-

Sri Lanka's women-run hotel breaks down barriers

Sri Lanka's women-run hotel breaks down barriers

-

Sweden turns up Eurovision heat with wacky sauna song

-

Sweden goes into Eurovision as punters' favourite

Sweden goes into Eurovision as punters' favourite

-

Spanish youth keep vibrant Holy Week processions alive

-

Eurovision promises glitz -- and controversy over Israel

Eurovision promises glitz -- and controversy over Israel

-

Italy's Meloni heads to White House seeking EU tariff deal

-

F1 on Jeddah's streets - talking points ahead of the Saudi Arabian GP

F1 on Jeddah's streets - talking points ahead of the Saudi Arabian GP

-

Changing face of war puts Denmark on drone offensive

-

Anger as China club plays hours after striker Boupendza's death

Anger as China club plays hours after striker Boupendza's death

-

Heat scorch Bulls to advance, Mavericks upset Kings

-

Chinese investment sparks rise of Mandarin in Cambodia

Chinese investment sparks rise of Mandarin in Cambodia

-

Unease grows over Trump tariffs despite 'progress' in Japan trade talks

-

Nigerian mixed-faith families sense danger as violence flares

Nigerian mixed-faith families sense danger as violence flares

-

Asian markets boosted by 'Big Progress' in Japan tariff talks

-

No room for sentiment as Hinault returns to site of world title glory

No room for sentiment as Hinault returns to site of world title glory

-

ECB ready to cut rates again as Trump tariffs shake eurozone

US stocks fall again as global rally fizzles

Wall Street stocks sank again Tuesday while US oil prices hit a multi-year low as worries about President Donald Trump's escalating trade wars erased rebound hopes following gains in Europe and Asia.

After trillions of dollars were wiped from the combined value of global equity markets since last week, share prices across the globe clawed back some ground as investors assessed the possibility of Washington tempering some of the levies.

Following winning sessions in Europe and Asia, US indices opened buoyantly as traders embraced talk of White House negotiations with Japan and South Korea in hopes that Trump's trade onslaught might be short-lived.

But investors grew edgy as the day progressed with no concrete progress and the White House confirmed plans for massive tariffs on China to go into effect overnight.

"Obviously investors are clamoring for clarity and there still isn't any," said Jack Ablin of Cresset Capital, who estimated that the market now sees a greater than 50 percent chance of a US recession.

The S&P 500 tumbled into the red in the early afternoon, with losses accelerating in the final 90 minutes of trading. The broad-based index finished down 1.6 percent at 4,982.77, its first close below 5,000 points in nearly a year.

Oil prices also tumbled on the weakening economic outlook. West Texas Intermediate, the US benchmark futures contract, finished under $60 a barrel for the first time since April 2021.

Stocks have been in free fall since Trump's "Liberation Day" event announcing tariffs on major US trading partners last Wednesday.

White House officials have signaled openness to dealmaking while blasting China for enacting sharp retaliatory tariffs in response to the new US levies.

Trump plans to impose another 50 percent duty on Chinese goods at midnight, bringing the additional rate on Chinese products to 104 percent.

European officials, meanwhile, plan tariffs of up to 25 percent on US goods in retaliation for levies on metals, but will spare bourbon to shield European wine and spirits from reprisals, according to a document seen by AFP.

The list proposes levies on goods including soybeans, poultry, rice, sweetcorn, fruit and nuts, wood, motorcycles, plastics, textiles, paintings, electrical equipment, make-up and other beauty products.

An EU spokesman said on Tuesday that the European Commission could present its planned countermeasures to the new levies "as early as next week".

- Rebound in Asia -

Earlier Tokyo's stock market closed up more than six percent -- recovering much of Monday's drop -- after Japanese Prime Minister Shigeru Ishiba held talks with Trump.

Hong Kong's stock market closed up by more than one percent, having plunged more than 13 percent on Monday, its biggest one-day retreat since 1997.

"After multiple punishing sessions, stock markets appear to have started their road to recovery," noted Russ Mould, investment director at the AJ Bell trading group.

He warned, however, that "it's dangerous to think a massive rally will definitely happen, given how Trump is unpredictable".

- Key figures around 2130 GMT -

New York - Dow: DOWN 0.8 percent at 37,645.59 (close)

New York - S&P 500: DOWN 1.6 percent at 4,982.77 (close)

New York - Nasdaq Composite: DOWN 2.2 percent at 15,267.91 (close)

London - FTSE 100: UP 2.7 percent at 7,910.53 (close)

Paris - CAC 40: UP 2.5 percent at 7,100.42 (close)

Frankfurt - DAX: UP 2.5 percent at 20,280.26 (close)

Tokyo - Nikkei 225: UP 6.0 percent at 33,012.58 (close)

Hong Kong - Hang Seng Index: UP 1.5 percent at 20,127.68 (close)

Shanghai - Composite: UP 1.6 percent at 3,145.55 (close)

Euro/dollar: UP at $1.0959 from $1.0912 on Monday

Pound/dollar: DOWN at $1.2766 from $1.2887

Dollar/yen: DOWN at 146.23 yen from 146.84 yen

Euro/pound: UP at 85.78 pence from 85.70 pence

West Texas Intermediate: DOWN 1.9 percent at $59.58 per barrel

Brent North Sea Crude: DOWN 2.2 percent at $62.82 per barrel

burs-jmb/dw

M.Fischer--AMWN