-

German police earn their stripes with zebra-loaded van stop

German police earn their stripes with zebra-loaded van stop

-

'Bloodbath': Spooked Republicans warn Trump over US tariffs

-

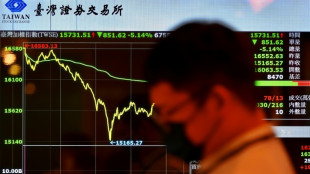

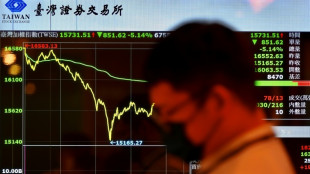

Trump vows huge new China tariffs as markets nosedive

Trump vows huge new China tariffs as markets nosedive

-

Belgian prince loses legal quest for social security

-

Facing Trump's trade war, EU seeks to quell divisions

Facing Trump's trade war, EU seeks to quell divisions

-

France detains alleged Romanian royal wanted in home country

-

Van Dijk reveals 'progress' in talks over new Liverpool contract

Van Dijk reveals 'progress' in talks over new Liverpool contract

-

Starmer unveils support for tariff-hit auto sector

-

Clem Burke, drummer for Blondie, dies at 70

Clem Burke, drummer for Blondie, dies at 70

-

Dortmund defender Schlotterbeck ruled out for season with injury

-

Arteta says Arsenal can upset Real Madrid on 'biggest night' of career

Arteta says Arsenal can upset Real Madrid on 'biggest night' of career

-

Bayern will not 'change goals' despite injury woes, says Kompany

-

Inter captain Martinez fined 5,000 euros for blasphemy

Inter captain Martinez fined 5,000 euros for blasphemy

-

Netanyahu to plead with Trump for tariff break

-

Arsenal's Saka says injury break 'really good' mentally

Arsenal's Saka says injury break 'really good' mentally

-

EU funding of NGOs 'too opaque', auditors find amid political storm

-

La Liga appeal decision allowing Barcelona's Olmo to play again

La Liga appeal decision allowing Barcelona's Olmo to play again

-

JPMorgan Chase CEO warns tariffs will slow growth

-

World sport-starved Moscow cheers Ovechkin NHL record

World sport-starved Moscow cheers Ovechkin NHL record

-

Stocks sink again as Trump holds firm on tariffs

-

Trump warns against 'stupid' panic as markets plummet

Trump warns against 'stupid' panic as markets plummet

-

Thousands of Afghans depart Pakistan under repatriation pressure

-

Macron rejects any Hamas role in post-war Gaza

Macron rejects any Hamas role in post-war Gaza

-

Boeing settles to avoid civil trial over Ethiopian Airlines crash

-

EU split on targeting US tech over Trump tariffs

EU split on targeting US tech over Trump tariffs

-

Russia, accused of stalling, wants answers before truce

-

German climate activist faces expulsion from Austria after ban

German climate activist faces expulsion from Austria after ban

-

Southampton sack manager Juric after Premier League relegation

-

Fowler hits the target as Matildas down South Korea

Fowler hits the target as Matildas down South Korea

-

Brook named new England white-ball cricket captain

-

Honda executive resigns over 'inappropriate conduct'

Honda executive resigns over 'inappropriate conduct'

-

Stocks, oil prices sink further as Trump stands firm over tariffs

-

'Alarming' microplastic pollution in Europe's great rivers

'Alarming' microplastic pollution in Europe's great rivers

-

Spurs boss Postecoglou glad of Johnson revival ahead of Europa quarter-final

-

Major garment producer Bangladesh says US buyers halting orders

Major garment producer Bangladesh says US buyers halting orders

-

Former Wales fly-half Biggar to retire at end of rugby season

-

African players in Europe: Iwobi ends goal drought to help sink Reds

African players in Europe: Iwobi ends goal drought to help sink Reds

-

The worst market crashes since 1929

-

Japan emperor visits World War II battleground Iwo Jima

Japan emperor visits World War II battleground Iwo Jima

-

'Everyone is losing money': Hong Kong investors rattled by market rout

-

China vows to stay 'safe and promising land' for foreign investment

China vows to stay 'safe and promising land' for foreign investment

-

Stocks savaged as China retaliation to Trump tariffs fans trade war

-

Unification Church appeals Japan's decision to revoke legal status

Unification Church appeals Japan's decision to revoke legal status

-

Belgian prince seeks social security on top of allowance

-

European airlines hit turbulence over Western Sahara flights

European airlines hit turbulence over Western Sahara flights

-

Boeing faces new civil trial over 2019 Ethiopian Airlines crash

-

'Fear and anxiety': Bangkok residents seek quake-proof homes

'Fear and anxiety': Bangkok residents seek quake-proof homes

-

Injuries threaten to derail Bayern's home final dreams against Inter

-

Real Madrid vulnerability evident ahead of Arsenal clash

Real Madrid vulnerability evident ahead of Arsenal clash

-

Texans warily eye impact of Trump's tariffs on their beloved trucks

| RBGPF | 1.48% | 69.02 | $ | |

| RYCEF | -1.85% | 8.1 | $ | |

| CMSC | -0.22% | 22.24 | $ | |

| RIO | -0.59% | 54.35 | $ | |

| BTI | -1.27% | 39.36 | $ | |

| GSK | -5.96% | 34.475 | $ | |

| RELX | -5.87% | 45.49 | $ | |

| VOD | -1.98% | 8.335 | $ | |

| AZN | -5.22% | 65.065 | $ | |

| SCS | -2.52% | 10.32 | $ | |

| BCE | -3.65% | 21.91 | $ | |

| BP | -4.24% | 27.225 | $ | |

| JRI | -5.84% | 11.3 | $ | |

| BCC | -2.92% | 92.73 | $ | |

| NGG | -4.39% | 63.155 | $ | |

| CMSD | -1.33% | 22.53 | $ |

Stocks, oil prices sink further as Trump stands firm over tariffs

Stock markets and oil prices collapsed further on a black Monday for markets as US President Donald Trump stood firm over his tariffs despite recession fears.

Trading floors across Asia and Europe were overcome by waves of further selling after last week's sharp losses.

Hong Kong's drop of 13.2 percent Monday was its worst in nearly three decades.

Trillions of dollars have been wiped off combined stock market valuations in recent sessions.

Taipei stocks suffered their worst fall on record Monday, tanking 9.7 percent, while Frankfurt dived as much as 10 percent and Tokyo closed down by almost eight percent.

Hong Kong's loss was exaggerated as the index had been closed Friday for a public holiday.

Wall Street futures suffered another drubbing, while bitcoin tumbled.

The dollar was steadier after sharp losses last week.

"The carnage in global equity markets has continued," noted Thomas Mathews, Asia Pacific head of markets at Capital Economics.

He said Trump could still pare back his tariffs.

"But, if he doesn't, equities could get a lot sicker yet."

A 10-percent "baseline" tariff on imports from around the world took effect Saturday.

However, a slew of countries will be hit by higher duties from Wednesday, with levies of 34 percent for Chinese goods and 20 percent for EU products.

Countries mostly have been scrambling to blunt the new US tariffs without retaliating, but Beijing is responding in kind, escalating the trade war between the world's two biggest economies.

Beijing announced last week its own 34-percent tariff on US goods, which will come into effect on Thursday.

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

Wall Street's three main indices dived almost six percent Friday.

- No sector spared -

Monday's savage selling was across the board, with no sector spared.

Tech firms, carmakers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba tanked 18 percent and rival JD.com shed 15.5 percent, while Japanese tech investment giant SoftBank dived more than 12 percent and Sony gave up 10 percent.

Hong Kong's 13-percent drop marked its worst day since 1997 during the Asian financial crisis.

Shanghai shed more than seven percent, with China's state-backed fund Central Huijin Investment vowing to help ensure "stable operations" of the market.

Singapore plunged nearly eight percent, while Seoul gave up more than five percent, triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Sydney, Wellington, Manila and Mumbai were also deep in the red, while London and Paris both dropped nearly four percent in midday deals.

Milan and Madrid each shed more than four percent, with all sectors also affected across Europe.

Concerns about future energy demand saw oil prices sink about three percent, having dropped some seven percent Friday.

Both main contracts are now sitting at their lowest levels since 2021.

The Kremlin said it was monitoring the plummeting price of oil -- on which Russia's economy is highly dependent.

- Key figures around 1045 GMT -

London - FTSE 100: DOWN 3.4 percent at 7,779.08 points

Paris - CAC 40: DOWN 3.9 percent at 6,987.91

Frankfurt - DAX: DOWN 3.7 percent at 19,881.07

Tokyo - Nikkei 225: DOWN 7.8 percent at 31,136.58 (close)

Hong Kong - Hang Seng Index: DOWN 13.2 percent at 19,828.30 (close)

Shanghai - Composite: DOWN 7.3 percent at 3,096.58 (close)

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

West Texas Intermediate: DOWN 2.7 percent at $60.27 per barrel

Brent North Sea Crude: DOWN 2.6 percent at $63.85 per barrel

Euro/dollar: UP at $1.0972 from $1.0962 on Friday

Pound/dollar: DOWN at $1.2849 from $1.2893

Dollar/yen: DOWN at 146.45 yen from 146.98 yen

Euro/pound: UP at 85.37 pence from 85.01 pence

burs-bcp/ajb/rl

X.Karnes--AMWN