-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

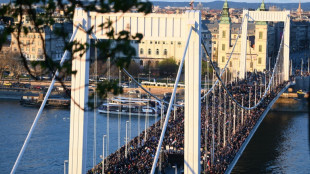

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

Japan leads hefty global stock market losses on tariff fears

Global stock markets were a sea of red Monday and investors fled to gold ahead of a wave of US tariffs this week that have fuelled recession fears.

Tokyo plunged more than four percent, leading losses across global stock markets as uncertainty over President Donald Trump's latest tariff announcements due on his "Liberation Day" on Wednesday eroded sentiment.

Adding to fears, Trump said Sunday that tariffs would include "all countries", not just those with the largest trade imbalances with the United States.

"Trump continues to be the key reason why markets are having a bad day," said AJ Bell investment director Russ Mould.

"He has now threatened to target all countries importing goods into the US with tariffs, further clouding economic prospects around the world," he added.

Automakers were hit particularly hard in the wake of Trump's announcement that he would also impose 25 percent duties on imports of all vehicles and parts.

In Europe, Porsche, Volkswagen and Stellantis, which owns several brands including Jeep, Peugeot and Fiat, all dropped around three percent.

Toyota, the world's biggest carmaker, plunged over three percent, along with Nissan and Mazda.

"Within the Asia-Pacific region, the car levies will hit Japan and South Korea the hardest," Moody's Analytics economists wrote.

"Such a sizeable tariff hike will undermine confidence, hit production and reduce orders. Given the long and complex supply chains in car manufacturing, the impact will ripple through these countries' economies."

Gold, seen as a safe haven asset in times of uncertainty, hit a record high over $3,100 an ounce.

Yields fell on government bonds, including those of the United States, "reflecting ongoing safe-haven trading due to concerns about US trade policy," said Briefing.com analyst Patrick O'Hare.

Data released Friday that showed the Federal Reserve's preferred gauge of inflation rose more than expected last month, which further dented hopes for interest rate cuts, was also still weighing on sentiment.

"There has been a growing expectation that inflation would fall back sharply this year... instead, many are concerned that tariffs are already having an inflationary impact," said Trade Nation analyst David Morrison.

In company news, shares in CK Hutchison shed 3.1 percent in Hong Kong following reports billionaire Li Ka-shing might delay signing a multi-billion-dollar deal to offload ports operations, including those in the Panama Canal.

His firm has faced criticism from China since it agreed to offload the business to a US-led consortium after pressure from Trump.

Beijing confirmed on Friday antitrust regulators will review the deal, likely preventing the parties from signing it as planned on Wednesday.

Shares in Zensho Holdings, which owns several Japanese restaurant franchises, plunged 3.9 percent in Tokyo after its beef bowl chain Sukiya said it would temporarily shut nearly all of its roughly 2,000 branches after a rat was found in a miso soup and a bug in another meal.

- Key figures around 1430 GMT -

Tokyo - Nikkei 225: DOWN 4.1 percent at 35,617.56 points (close)

New York - Dow: DOWN 0.8 percent at 41,268.01

New York - S&P 500: DOWN 1.1 percent at 5,520.94

New York - Nasdaq Composite: DOWN 1.7 percent at 17,036.19

London - FTSE 100: DOWN 1.2 percent at 8,551.55

Paris - CAC 40: DOWN 1.5 percent at 7,795.64

Frankfurt - DAX: DOWN 1.5 percent at 22,116.74

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 23,119.58 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,335.75 (close)

Euro/dollar: DOWN at $1.0818 from $1.0838 on Friday

Pound/dollar: DOWN at $1.2937 from $1.2947

Dollar/yen: DOWN at 149.52 yen from 149.72 yen

Euro/pound: DOWN at 83.63 pence from 83.68 pence

West Texas Intermediate: UP 0.7 percent at $69.83 per barrel

Brent North Sea Crude: UP 0.6 percent at $73.19 per barrel

burs-rl/rlp

A.Jones--AMWN