-

Frail Pope Francis takes to popemobile to greet Easter crowd

Frail Pope Francis takes to popemobile to greet Easter crowd

-

Lewandowski injury confirmed in blow to Barca quadruple bid

-

Russia and Ukraine accuse each other of breaching Easter truce

Russia and Ukraine accuse each other of breaching Easter truce

-

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

-

Ukrainians voice scepticism on Easter truce

Ukrainians voice scepticism on Easter truce

-

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

-

Sri Lanka police probe photo of Buddha tooth relic

Sri Lanka police probe photo of Buddha tooth relic

-

Home hero Wu wows Shanghai crowds by charging to China Open win

-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

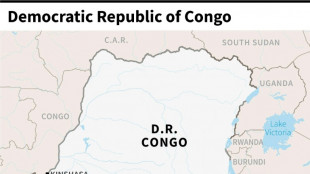

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Stock markets fall over US inflation, tariff fears

Stock markets fell on Friday as a closely-watched US inflation reading heated up, adding to concerns over the fallout from an incoming wave of tariffs by President Donald Trump.

Shares in automakers fell further as they brace for 25-percent levies due to kick in early next week along with a raft of "reciprocal" tariffs tailored to different countries.

The market mood has soured over fears that Trump's tactics will trigger tit-for-tat tariffs that would rekindle inflation, which could put the brakes on interest rate cuts and spark a recession.

"Investors remain nervous over the economic repercussions from President Trump's tariff threats, just days before he unleashes his 'reciprocal tariffs' (on April 2)," said David Morrison, senior market analyst at financial services provider Trade Nation.

Wall Street opened in the red after official data showed the Federal Reserve's preferred inflation measure, the personal consumption expenditures (PCE) price index, remained unchanged last month at 2.5 percent.

But another key figure, core inflation, which strips out volatile food and energy costs, rose more than expected at 2.8 percent in February on an annual basis, up from 2.6 percent the month before.

A tit-for-tat trade war and a reignition of inflation that could force the Fed and other central banks to rethink plans to cut interest rates.

"The (PCE) report isn't devastating, but given the current economic uncertainty and market volatility, investors were looking for reassurance in this report -- not something to fan the flames," said Bret Kenwell, US investment analyst at eToro trading platform.

In Spain, data showed inflation eased to 2.3 percent in March as rainy weather boosted hydro power production and drove down electricity prices. Consumer prices rises remained unchanged in France at 0.8 percent.

Paris and Frankfurt stocks dropped, with automakers Volkswagen, Renault and Stellantis, whose brands include Jeep, Peugeot and Fiat, faring particularly badly.

General Motors and Ford had more limited losses on Wall Street.

London bucked the trend, with the FTSE 100 index rising as data showed that the UK economy expanded more than intially estimated last year and retail sales rose.

Tokyo's stock market sank 1.8 percent as the world's biggest carmaker Toyota fell, along with Honda, Nissan and Mazda.

Seoul was off 1.9 percent as Hyundai gave up 2.6 percent.

Uncertainty over Trump's plans and long-term intentions has led investors to rush into safe havens such as gold, which hit a new record high of $3,085.96 an ounce on Friday.

Governments around the world have hit out at Trump's latest tariffs, with Canadian Prime Minister Mark Carney saying the "old relationship" of deep economic, security and military ties with Washington "is over".

Tariff worries also saw Hong Kong and Shanghai stock markets fall.

Bangkok was in the red when trading was suspended as the Thai capital was shaken by a powerful earthquake in neighbouring Myanmar.

Investors also kept tabs on Beijing, where Chinese leader Xi Jinping met leading business leaders pledging the country's door would "open wider and wider".

He also warned the world trading system was facing "severe challenges".

- Key figures around 1340 GMT -

New York - Dow: DOWN 0.2 percent at 42,216,50 points

New York - S&P 500: DOWN 0.2 percent at 5,683.38

New York - Nasdaq: DOWN 0.4 percent at 17,741.10

London - FTSE 100: UP 0.1 percent at 8,673.30

Paris - CAC 40: DOWN 0.5 percent at 7,949.83

Frankfurt - DAX: DOWN 0.4 percent at 22,593.76

Tokyo - Nikkei 225: DOWN 1.8 percent at 37,120.33 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 23,426.60 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,351.31 (close)

Euro/dollar: UP at $1.0803 from $1.0796 on Thursday

Pound/dollar: UP at $1.2957 from $1.2947

Dollar/yen: DOWN at 150.62 yen from 151.04 yen

Euro/pound: UP at 83.40 pence from 83.38 pence

West Texas Intermediate: DOWN 0.3 percent at $69.73 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $73.04 per barrel

Ch.Kahalev--AMWN