-

Thomas ends long wait with playoff win over Novak

Thomas ends long wait with playoff win over Novak

-

Thunder rumble to record win over Grizzlies, Celtics top Magic in NBA playoff openers

-

Linesman hit by projectile as Saint-Etienne edge toward safety

Linesman hit by projectile as Saint-Etienne edge toward safety

-

Mallia guides Toulouse to Top 14 win over Stade Francais

-

Israel cancels visas for French lawmakers

Israel cancels visas for French lawmakers

-

Russia and Ukraine trade blame over Easter truce, as Trump predicts 'deal'

-

Valverde stunner saves Real Madrid title hopes against Bilbao

Valverde stunner saves Real Madrid title hopes against Bilbao

-

Ligue 1 derby interrupted after assistant referee hit by projectile

-

Leclerc bags Ferrari first podium of the year

Leclerc bags Ferrari first podium of the year

-

Afro-Brazilian carnival celebrates cultural kinship in Lagos

-

Ligue 1 derby halted after assistant referee hit by projectile

Ligue 1 derby halted after assistant referee hit by projectile

-

Thunder rumble with record win over Memphis in playoff opener

-

Leverkusen held at Pauli to put Bayern on cusp of title

Leverkusen held at Pauli to put Bayern on cusp of title

-

Israel says Gaza medics' killing a 'mistake,' to dismiss commander

-

Piastri power rules in Saudi as Max pays the penalty

Piastri power rules in Saudi as Max pays the penalty

-

Leaders Inter level with Napoli after falling to late Orsolini stunner at Bologna

-

David rediscovers teeth as Chevalier loses some in nervy Lille win

David rediscovers teeth as Chevalier loses some in nervy Lille win

-

Piastri wins Saudi Arabian Grand Prix, Verstappen second

-

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

-

Guirassy helps Dortmund past Gladbach, putting top-four in sight

-

Alexander-Arnold lauds 'special' Liverpool moments

Alexander-Arnold lauds 'special' Liverpool moments

-

Pina strikes twice as Barca rout Chelsea in Champions League semi

-

Rohit, Suryakumar on song as Mumbai hammer Chennai in IPL

Rohit, Suryakumar on song as Mumbai hammer Chennai in IPL

-

Dortmund beat Gladbach to keep top-four hopes alive

-

Leicester relegated from the Premier League as Liverpool close in on title

Leicester relegated from the Premier League as Liverpool close in on title

-

Alexander-Arnold fires Liverpool to brink of title, Leicester relegated

-

Maresca leaves celebrations to players after Chelsea sink Fulham

Maresca leaves celebrations to players after Chelsea sink Fulham

-

Trump eyes gutting US diplomacy in Africa, cutting soft power: draft plan

-

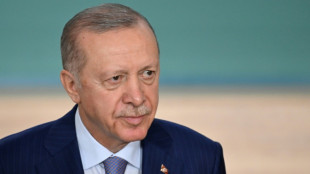

Turkey bans elective C-sections at private medical centres

Turkey bans elective C-sections at private medical centres

-

Lebanon army says 3 troops killed in munitions blast in south

-

N.America moviegoers embrace 'Sinners' on Easter weekend

N.America moviegoers embrace 'Sinners' on Easter weekend

-

Man Utd 'lack a lot' admits Amorim after Wolves loss

-

Arteta hopes Arsenal star Saka will be fit to face PSG

Arteta hopes Arsenal star Saka will be fit to face PSG

-

Ukrainian troops celebrate Easter as blasts punctuate Putin's truce

-

Rune defeats Alcaraz to win Barcelona Open

Rune defeats Alcaraz to win Barcelona Open

-

Outsider Skjelmose in Amstel Gold heist ahead of Pogacar and Evenepoel

-

Arsenal make Liverpool wait for title party, Chelsea beat Fulham

Arsenal make Liverpool wait for title party, Chelsea beat Fulham

-

Trump slams 'weak' judges as deportation row intensifies

-

Arsenal stroll makes Liverpool wait for title as Ipswich face relegation

Arsenal stroll makes Liverpool wait for title as Ipswich face relegation

-

Sabalenka to face Ostapenko in Stuttgart final

-

Kohli, Padikkal guide Bengaluru to revenge win over Punjab

Kohli, Padikkal guide Bengaluru to revenge win over Punjab

-

US aid cuts strain response to health crises worldwide: WHO

-

Birthday boy Zverev roars back to form with Munich win

Birthday boy Zverev roars back to form with Munich win

-

Ostapenko eases past Alexandrova into Stuttgart final

-

Zimbabwe on top in first Test after Bangladesh out for 191

Zimbabwe on top in first Test after Bangladesh out for 191

-

De Bruyne 'surprised' over Man City exit

-

Frail Pope Francis takes to popemobile to greet Easter crowd

Frail Pope Francis takes to popemobile to greet Easter crowd

-

Lewandowski injury confirmed in blow to Barca quadruple bid

-

Russia and Ukraine accuse each other of breaching Easter truce

Russia and Ukraine accuse each other of breaching Easter truce

-

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

Asian stocks rise on trade optimism, but US policy uncertainty lingers

Lingering hopes that Donald Trump's planned tariff blitz next week will not be as painful as feared helped lift Asian markets Wednesday, though uncertainty about the president's policies and the US economy tempered optimism.

With the White House's "Liberation Day" on April 2 approaching, investors have been bracing for a wave of sweeping levies on imports amid warnings of crippled global trade, recession and a fresh spike in inflation.

But suggestions from Trump and others in Washington that the measures could be more targeted, with some countries hit harder than others, have provided a sliver of hope that the worst-case scenario can be avoided.

The president told Newsmax that "I don’t want to have too many exceptions" but added: "I'll probably be more lenient than reciprocal, because if I was reciprocal, that would be very tough for people".

Signs of a less severe approach helped Wall Street record two successive days of gains, paring hefty losses suffered in recent weeks fuelled by fears that the hardball US policies would hit companies' bottom lines.

And after a mixed day Monday, Asia followed suit.

Hong Kong pushed higher a day after tanking more than two percent on profit-taking and selling in the tech sector, while Tokyo, Sydney, Shanghai, Seoul, Singapore and Wellington also advanced.

Jakarta jumped almost three percent after a hefty sell-off this year fuelled by worries over the Indonesian economy. However, the country's rupiah remained stuck around its lowest levels since the Asian financial crisis at the end of the last century.

Taipei and Manila edged down.

But while there is some hope over tariffs, Americans' fears about the economic outlook indicated the United States could be in for a bumpy ride.

The Conference Board's closely watched gauge of consumer confidence dived to its lowest level since 2021 -- during the pandemic -- as concerns grow over higher prices.

Meanwhile, another reading on expectations for the next six months hit a 12-year low.

The figures come as the Federal Reserve re-evaluates its monetary policy in light of Trump's tariffs agenda, with some analysts warning it might have to hold off any interest rate cuts this year.

At the end of a volatile first quarter, Charu Chanana, chief investment strategist at Saxo, said it had "challenged conventional thinking".

"While rate cut hopes dominated headlines early in the year, markets moved on quickly as economic resilience, sector rotation, geopolitical shifts, and regional divergences took centre stage," she wrote in a commentary.

"Trade policy returned to focus as the US election narrative picked up. Even without concrete tariffs, the potential for disruption hit sentiment across global sectors."

There was little major reaction to news that Russia and Ukraine had agreed to halt military strikes in the Black Sea and on energy sites following talks brokered by Washington.

The Kremlin said the deal could come into force only after the lifting of restrictions on its agriculture sector.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 37,890.15 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 23,391.53

Shanghai - Composite: UP 0.1 percent at 3,371.91

Euro/dollar: UP at $1.0794 from $1.0791 on Tuesday

Pound/dollar: UP at $1.2944 from $1.2943

Dollar/yen: UP at 150.14 yen from 149.90 yen

Euro/pound: UP at 83.40 pence from 83.37 pence

West Texas Intermediate: UP 0.4 percent at $69.25 per barrel

Brent North Sea Crude: UP 0.3 percent at $73.24 per barrel

New York - Dow: FLAT at 42,587.50 (close)

London - FTSE 100: UP 0.3 percent at 8,663.80 (close)

M.A.Colin--AMWN