-

Trump tariffs torch chances of meeting with China's Xi

Trump tariffs torch chances of meeting with China's Xi

-

X rival Bluesky adds blue checks for trusted accounts

-

China to launch new crewed mission into space this week

China to launch new crewed mission into space this week

-

Morocco volunteers on Sahara clean-up mission

-

Latin America fondly farewells its first pontiff

Latin America fondly farewells its first pontiff

-

'I wanted it to work': Ukrainians disappointed by Easter truce

-

Harvard sues Trump over US federal funding cuts

Harvard sues Trump over US federal funding cuts

-

'One isn't born a saint': School nuns remember Pope Francis as a boy

-

Battling Forest see off Spurs to boost Champions League hopes

Battling Forest see off Spurs to boost Champions League hopes

-

'I don't miss tennis' says Nadal

-

Biles 'not so sure' about competing at Los Angeles Olympics

Biles 'not so sure' about competing at Los Angeles Olympics

-

Gang-ravaged Haiti nearing 'point of no return', UN warns

-

US assets slump again as Trump sharpens attack on Fed chief

US assets slump again as Trump sharpens attack on Fed chief

-

Forest see off Spurs to boost Champions League hopes

-

Trump says Pope Francis 'loved the world,' will attend funeral

Trump says Pope Francis 'loved the world,' will attend funeral

-

Oscar voters required to view all films before casting ballots

-

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

-

Duplantis and Biles win Laureus World Sports Awards

-

US urges curb of Google's search dominance as AI looms

US urges curb of Google's search dominance as AI looms

-

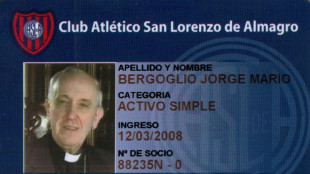

The Pope with 'two left feet' who loved the 'beautiful game'

-

With Pope Francis death, Trump loses top moral critic

With Pope Francis death, Trump loses top moral critic

-

Mourning Americans contrast Trump approach to late Pope Francis

-

Leeds and Burnley promoted to Premier League

Leeds and Burnley promoted to Premier League

-

Racist gunman jailed for life over US supermarket massacre

-

Trump backs Pentagon chief despite new Signal chat scandal

Trump backs Pentagon chief despite new Signal chat scandal

-

Macron vows to step up reconstruction in cyclone-hit Mayotte

-

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

-

Messi, San Lorenzo bid farewell to football fan Pope Francis

-

Leeds on brink of Premier League promotion after smashing Stoke

Leeds on brink of Premier League promotion after smashing Stoke

-

In Lourdes, Catholic pilgrims mourn the 'pope of the poor'

-

Korir wins men's Boston Marathon, Lokedi upstages Obiri

Korir wins men's Boston Marathon, Lokedi upstages Obiri

-

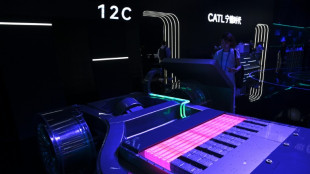

China's CATL launches new EV sodium battery

-

Korir wins Boston Marathon, Lokedi upstages Obiri

Korir wins Boston Marathon, Lokedi upstages Obiri

-

Francis, a pope for the internet age

-

Iraq's top Shiite cleric says Pope Francis sought peace

Iraq's top Shiite cleric says Pope Francis sought peace

-

Mourners flock to world's churches to grieve Pope Francis

-

Trump says Pope Francis 'loved the world'

Trump says Pope Francis 'loved the world'

-

Sri Lanka recalls Pope Francis' compassion on Easter bombing anniversary

-

Pope Francis inspired IOC president Bach to create refugee team

Pope Francis inspired IOC president Bach to create refugee team

-

Alexander-Arnold will be remembered for 'good things' at Liverpool: Van Dijk

-

US VP Vance meets Indian PM Modi for tough talks on trade

US VP Vance meets Indian PM Modi for tough talks on trade

-

Pentagon chief dismisses reports he shared military info with wife

-

15 potential successors to Pope Francis

15 potential successors to Pope Francis

-

The papabili - 15 potential successors to Pope Francis

-

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

-

Ostapenko stuns Sabalenka to win Stuttgart title

-

Argentina mourns loss of papal son

Argentina mourns loss of papal son

-

African leaders praise Pope Francis's 'legacy of compassion'

-

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

-

'The voice of god': Filipinos wrestle with death of Pope Francis

Stocks diverge in choppy trade after Fed decision

Wall Street stocks wobbled Thursday after the US Federal Reserve sought to calm fears over President Donald Trump's tariffs, while eurozone equities slumped.

Meanwhile, continued geopolitical tensions, particularly concerning Gaza and Yemen, saw oil prices jump and gold set a new record high.

Wall Street stocks opened lower, giving up some of the gains it made on Wednesday after Fed boss Jerome Powell suggested that any increase to consumer prices caused by tariffs would likely be short-lived, even as the central bank slashed its growth outlook and hiked inflation expectations.

Fed experts reaffirmed their expectations of two rate cuts even while indicating they expected higher rates this year.

But Wall Street's main indices bounced higher during morning trading, with US existing home sales beating expectations.

"It has been a choppy 24 hours for equity markets," said Chris Beauchamp, chief market analyst at online trading platform IG.

"For the moment it looks like bargain hunting continues to underpin Wall Street’s rebound, at least in the short term."

The short term ended in early afternoon trading after the White House vowed to impose "big tariffs" on April 2 when US President Donald Trump is to unveil reciprocal levies in a major escalation of his trade war.

The major eurozone markets of Frankfurt, Milan and Paris gave up around one percent or more after European Central Bank chief Christine Lagarde warned a trade war between the United States and Europe could shave half a percentage point off eurozone growth and push up inflation.

Lingering tariff fears and geopolitical developments helped safe-haven gold to another record above $3,057.49 an ounce.

The price of copper reached a five-month high above $10,000 a tonne as US companies stock up on the metal targeted by Trump's tariffs.

Oil prices jumped amid a fresh upsurge in Gaza hostilities and worries about Iran-backed Huthi rebels.

"The prospect of an extended US campaign against the Huthis combines with Israel’s renewed Gaza offensive to put oil squarely back in the spotlight," said IG's Beauchamp.

In other central bank action the Bank of England and Sweden's Riksbank held interest rates steady Thursday, as did the Bank of Japan on Wednesday.

Meanwhile, the Swiss central bank cut its rates on Thursday, citing "high uncertainty" in the global economy.

Nevertheless, the main markets focus was on the United States, the world's biggest economy.

"Great uncertainty remains over the direction of travel for the US economy, with business activity likely to remain subdued until we see greater clarity over the trade relationships and potential pricing for US imports and exports," noted Joshua Mahony, analyst at Scope Markets.

Trump's painful duties on imports into the United States and threats of further tariffs have stoked recession fears.

Some observers have warned also that the president's pledges to slash tax, regulation and immigration will reignite inflation could force the Fed to hike rates rather than cutting further.

The Fed on Wednesday said "uncertainty around the economic outlook has increased", cutting its forecast for US growth this year to 1.7 percent from 2.1 percent estimated in December.

It tipped core inflation to hit 2.8 percent as opposed to the 2.5 percent previously seen, but Fed Chair Jerome Powell said the increase would be "transitory".

- Key figures around 1630 GMT -

New York - Dow: UP 0.2 percent at 42,040.54 points

New York - S&P: DOWN 0.1 percent 5,669.70

New York - Nasdaq: DOWN 0.2 percent at 17,712.76

London - FTSE 100: DOWN less than 0.1 percent at 8,701.99 (close)

Paris - CAC 40: DOWN 1.0 percent at 8,701.99 (close)

Frankfurt - DAX: DOWN 1.2 percent at 22,999.15 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 24,219.95 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,408.95 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.0851 from $1.0903 on Wednesday

Pound/dollar: DOWN at $1.2966 from $1.3002

Dollar/yen: DOWN at 148.79 yen from 148.71 yen

Euro/pound: DOWN at 83.69 pence from 83.82 pence

West Texas Intermediate: UP 1.5 percent at $67.93 per barrel

Brent North Sea Crude: UP 1.5 percent at $71.83 per barrel

burs-rl/yad

Y.Aukaiv--AMWN