-

French court hands Le Pen five-year election ban

French court hands Le Pen five-year election ban

-

Probe accuses ex J-pop star Nakai of sexual assault

-

Japan leads hefty global stock market losses on tariff woes

Japan leads hefty global stock market losses on tariff woes

-

Saka 'ready to go' after long injury lay-off: Arteta

-

Ingebrigtsen Sr, on trial for abusing Olympic champion, says he was 'overly protective'

Ingebrigtsen Sr, on trial for abusing Olympic champion, says he was 'overly protective'

-

Tourists and locals enjoy 'ephemeral' Tokyo cherry blossoms

-

Khamenei warns of 'strong' response if Iran attacked

Khamenei warns of 'strong' response if Iran attacked

-

France fines Apple 150 million euros over privacy feature

-

UK PM urges nations to smash migrant smuggling gangs 'once and for all'

UK PM urges nations to smash migrant smuggling gangs 'once and for all'

-

Thai authorities probe collapse at quake-hit construction site

-

France's Le Pen convicted in fake jobs trial

France's Le Pen convicted in fake jobs trial

-

Chinese tech giant Huawei says profits fell 28% last year

-

Trump says confident of TikTok deal before deadline

Trump says confident of TikTok deal before deadline

-

Myanmar declares week of mourning as hopes fade for quake survivors

-

Japan's Nikkei leads hefty market losses, gold hits record

Japan's Nikkei leads hefty market losses, gold hits record

-

Tears in Taiwan for relatives hit by Myanmar quake

-

Venezuela says US revoked transnational oil, gas company licenses

Venezuela says US revoked transnational oil, gas company licenses

-

'Devastated': Relatives await news from Bangkok building collapse

-

Arsenal, Tottenham to play pre-season North London derby in Hong Kong

Arsenal, Tottenham to play pre-season North London derby in Hong Kong

-

Japan's Nikkei leads hefty equity market losses; gold hits record

-

Israel's Netanyahu picks new security chief, defying legal challenge

Israel's Netanyahu picks new security chief, defying legal challenge

-

Trump says US tariffs to hit 'all countries'

-

Prayers and tears for Eid in quake-hit Mandalay

Prayers and tears for Eid in quake-hit Mandalay

-

After flops, movie industry targets fresh start at CinemaCon

-

Tsunoda targets podium finish in Japan after 'unreal' Red Bull move

Tsunoda targets podium finish in Japan after 'unreal' Red Bull move

-

French chefs await new Michelin guide

-

UK imposes travel permit on Europeans from Wednesday

UK imposes travel permit on Europeans from Wednesday

-

At his academy, Romanian legend Hagi shapes future champions

-

Referee's lunch break saved Miami winner Mensik from early exit

Referee's lunch break saved Miami winner Mensik from early exit

-

Djokovic refuses to discuss eye ailment after shock Miami loss

-

Mitchell magic as Cavs bag 60th win, Pistons and T'Wolves brawl

Mitchell magic as Cavs bag 60th win, Pistons and T'Wolves brawl

-

Mensik shocks Djokovic to win Miami Open

-

Duterte lawyer: 'compelling' grounds to throw case out

Duterte lawyer: 'compelling' grounds to throw case out

-

What happens on Trump's 'Liberation Day' and beyond?

-

Clock ticks on Trump's reciprocal tariffs as countries seek reprieve

Clock ticks on Trump's reciprocal tariffs as countries seek reprieve

-

Japan-Australia flagship hydrogen project stumbles

-

Musk deploys wealth in bid to swing Wisconsin court vote

Musk deploys wealth in bid to swing Wisconsin court vote

-

Mensik upsets Djokovic to win Miami Open

-

China manufacturing activity grows at highest rate in a year

China manufacturing activity grows at highest rate in a year

-

'Waited for death': Ex-detainees recount horrors of Sudan's RSF prisons

-

Japan's Nikkei leads big losses in Asian markets as gold hits record

Japan's Nikkei leads big losses in Asian markets as gold hits record

-

Rescue hopes fading three days after deadly Myanmar quake

-

'Basketbrawl' as seven ejected in Pistons-Wolves clash

'Basketbrawl' as seven ejected in Pistons-Wolves clash

-

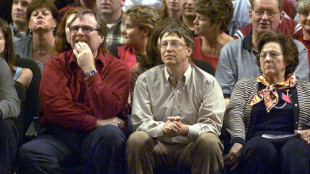

Four men loom large in Microsoft history

-

Computer pioneer Microsoft turns 50 in the age of AI

Computer pioneer Microsoft turns 50 in the age of AI

-

Trump calls out both Putin and Zelensky over ceasefire talks

-

Kim Hyo-joo tops Vu in playoff to win LPGA Ford Championship

Kim Hyo-joo tops Vu in playoff to win LPGA Ford Championship

-

Economy and especially Trump: Canadians' thoughts on campaigns

-

Liberal PM Carney takes lead four weeks before Canada vote

Liberal PM Carney takes lead four weeks before Canada vote

-

SpaceX to launch private astronauts on first crewed polar orbit

Australia to end stimulus but holds rates despite inflation surge

Australia's central bank moved to end multi-billion-dollar pandemic stimulus Tuesday, but kept interest rates at a record low despite rising inflation.

As the economy shows signs of recovery from the Covid-19 crisis, the Reserve Bank of Australia said it would wind up its unprecedented Aus$350 billion (US$250 billion) bond-buying programme on February 10.

But it did not fully slam the breaks on stimulus, holding off on an interest rate rise for now.

Borrowing will remain unchanged at 0.1 percent "until actual inflation is sustainably within the two to three percent target range", bank chief Philip Lowe said Tuesday.

The bond-buying programme, which was launched in late 2020, saw the RBA pour Aus$4 billion into government bonds each week to prop up the stalled economy during the pandemic.

In deciding to end the scheme, Lowe cited Australia's strong employment figures and other domestic indicators.

He also noted that monetary policy by other central banks was moving away from quantitative easing as inflation surges globally.

Canada's central bank was the first to end its programme in October, while the US Federal Reserve began tapering its own in November.

Over the 12 months to the December 2021 quarter, Australia's consumer inflation rose 3.5 percent with home buyers leading the jump.

But Lowe signalled the inflation spike may be short-lived as the "supply-side problems" that have plagued Australia during the pandemic -- from empty supermarket shelves to vital medical supplies -- are resolved.

With a federal election looming, the RBA is expected to hold off on any interest rate rise until later this year at the earliest.

P.Silva--AMWN