-

Aston Martin to sell stake in Formula One team

Aston Martin to sell stake in Formula One team

-

Three talking points ahead of clay-court season

-

French court hands Le Pen five-year election ban

French court hands Le Pen five-year election ban

-

Probe accuses ex J-pop star Nakai of sexual assault

-

Japan leads hefty global stock market losses on tariff woes

Japan leads hefty global stock market losses on tariff woes

-

Saka 'ready to go' after long injury lay-off: Arteta

-

Ingebrigtsen Sr, on trial for abusing Olympic champion, says he was 'overly protective'

Ingebrigtsen Sr, on trial for abusing Olympic champion, says he was 'overly protective'

-

Tourists and locals enjoy 'ephemeral' Tokyo cherry blossoms

-

Khamenei warns of 'strong' response if Iran attacked

Khamenei warns of 'strong' response if Iran attacked

-

France fines Apple 150 million euros over privacy feature

-

UK PM urges nations to smash migrant smuggling gangs 'once and for all'

UK PM urges nations to smash migrant smuggling gangs 'once and for all'

-

Thai authorities probe collapse at quake-hit construction site

-

France's Le Pen convicted in fake jobs trial

France's Le Pen convicted in fake jobs trial

-

Chinese tech giant Huawei says profits fell 28% last year

-

Trump says confident of TikTok deal before deadline

Trump says confident of TikTok deal before deadline

-

Myanmar declares week of mourning as hopes fade for quake survivors

-

Japan's Nikkei leads hefty market losses, gold hits record

Japan's Nikkei leads hefty market losses, gold hits record

-

Tears in Taiwan for relatives hit by Myanmar quake

-

Venezuela says US revoked transnational oil, gas company licenses

Venezuela says US revoked transnational oil, gas company licenses

-

'Devastated': Relatives await news from Bangkok building collapse

-

Arsenal, Tottenham to play pre-season North London derby in Hong Kong

Arsenal, Tottenham to play pre-season North London derby in Hong Kong

-

Japan's Nikkei leads hefty equity market losses; gold hits record

-

Israel's Netanyahu picks new security chief, defying legal challenge

Israel's Netanyahu picks new security chief, defying legal challenge

-

Trump says US tariffs to hit 'all countries'

-

Prayers and tears for Eid in quake-hit Mandalay

Prayers and tears for Eid in quake-hit Mandalay

-

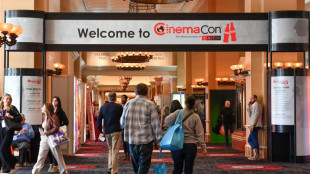

After flops, movie industry targets fresh start at CinemaCon

-

Tsunoda targets podium finish in Japan after 'unreal' Red Bull move

Tsunoda targets podium finish in Japan after 'unreal' Red Bull move

-

French chefs await new Michelin guide

-

UK imposes travel permit on Europeans from Wednesday

UK imposes travel permit on Europeans from Wednesday

-

At his academy, Romanian legend Hagi shapes future champions

-

Referee's lunch break saved Miami winner Mensik from early exit

Referee's lunch break saved Miami winner Mensik from early exit

-

Djokovic refuses to discuss eye ailment after shock Miami loss

-

Mitchell magic as Cavs bag 60th win, Pistons and T'Wolves brawl

Mitchell magic as Cavs bag 60th win, Pistons and T'Wolves brawl

-

Mensik shocks Djokovic to win Miami Open

-

Duterte lawyer: 'compelling' grounds to throw case out

Duterte lawyer: 'compelling' grounds to throw case out

-

What happens on Trump's 'Liberation Day' and beyond?

-

Clock ticks on Trump's reciprocal tariffs as countries seek reprieve

Clock ticks on Trump's reciprocal tariffs as countries seek reprieve

-

Japan-Australia flagship hydrogen project stumbles

-

Musk deploys wealth in bid to swing Wisconsin court vote

Musk deploys wealth in bid to swing Wisconsin court vote

-

Mensik upsets Djokovic to win Miami Open

-

China manufacturing activity grows at highest rate in a year

China manufacturing activity grows at highest rate in a year

-

'Waited for death': Ex-detainees recount horrors of Sudan's RSF prisons

-

Japan's Nikkei leads big losses in Asian markets as gold hits record

Japan's Nikkei leads big losses in Asian markets as gold hits record

-

Rescue hopes fading three days after deadly Myanmar quake

-

'Basketbrawl' as seven ejected in Pistons-Wolves clash

'Basketbrawl' as seven ejected in Pistons-Wolves clash

-

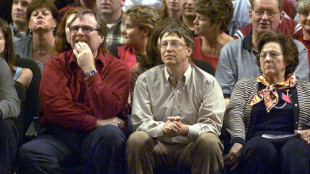

Four men loom large in Microsoft history

-

Computer pioneer Microsoft turns 50 in the age of AI

Computer pioneer Microsoft turns 50 in the age of AI

-

Trump calls out both Putin and Zelensky over ceasefire talks

-

Kim Hyo-joo tops Vu in playoff to win LPGA Ford Championship

Kim Hyo-joo tops Vu in playoff to win LPGA Ford Championship

-

Economy and especially Trump: Canadians' thoughts on campaigns

Asian markets rise as traders buoyed by another Wall St rally

Asian markets rose in limited trade Tuesday following another strong lead from Wall Street fuelled by a rebound in tech firms, while comments from Federal Reserve officials eased concerns that it will embark on an aggressive phase of policy tightening.

US equities rallied for a second day with plenty of support coming from Apple's blowout earnings report last week, while the current reporting season has proved fruitful despite concerns about inflation and central banks withdrawing financial support.

The Wall Street surge came at the end of a volatile month characterised by speculation over the Fed's plans to get a grip on runaway prices, with fears that its new hawkish tilt could see it hike borrowing costs as much as seven times this year with a 50 basis point move in March.

Comments from some leading figures at the bank at the weekend added to expectations the policy board would go hard and fast, though some were out on Monday trying to play down such a move.

Atlanta Fed boss Raphael Bostic said he was not in favour of such a big hike next month, having told the Financial Times at the weekend that his colleagues had not ruled it out.

Meanwhile, Kansas City Fed President Esther George said it was in "no one’s interest to try to upset the economy with unexpected adjustments", and the head of the San Francisco arm, Mary Daly, added that measures "have to be gradual and not disruptive".

The Nasdaq soared more than three percent, paring losses for January to nine percent, having at one point been down almost 15 percent during the month, while The S&P 500 and Dow also chalked up healthy gains.

And the positive energy continued in Asia, with Tokyo, Sydney and Wellington all up.

However, business was thin owing to the Chinese New Year break that saw Hong Kong, Shanghai, Singapore, Seoul, Taipei, Manila and Jakarta closed.

There was also hope that the rally could indicate markets are finding a bottom after the recent sell-off.

"The back to back consecutive rise in US stocks has got some thinking whether the trough has passed," said National Australia Bank's Tapas Strickland.

"Despite the talk of higher rates, earnings so far have been much better than expected. Whether we have passed the trough is uncertain, but certainly for some value is re-emerging."

And Solita Marcelli, at UBS Global Wealth Management, said in a commentary: "Investors should not lose sight of the fact that the economy remains strong, which should limit downside from current levels."

Traders are now awaiting policy decisions by the Bank of England and European Central Bank this week, while US jobs creation data due Friday could provide a fresh look at the world's top economy in light of inflation and rate hike expectations.

Oil prices extended their recent rally on demand optimism and the Russia-Ukraine standoff that is fanning worries over a possible hit to supplies. OPEC and other major producers' decision not to boost output by more than current levels was also a factor, analysts added.

"January has been a great month for oil prices and $100... might not be too far away as expectations are high that supply will not come close to catching up with demand as OPEC+ will deliver gradual production increase targets that they will fall short of reaching," said OANDA's Edward Moya.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.7 percent at 27,194.66 (break)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1226 from $1.1235 late Monday

Pound/dollar: DOWN at $1.3441 from $1.3445

Euro/pound: DOWN at 83.52 pence from 83.54 pence

Dollar/yen: DOWN at 115.10 yen from 115.13 yen

West Texas Intermediate: UP 0.1 percent at $88.27 per barrel

Brent North Sea crude: UP 0.1 percent at $89.37 per barrel

New York - Dow: UP 1.2 percent at 35,131.86 (close)

London - FTSE 100: FLAT at 7,464.37 (close)

M.Thompson--AMWN