-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Djokovic eyes more Slam glory as Swiatek returns under doping cloud

-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

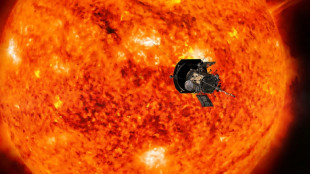

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

Battery X Metals Announces Closing of Non-Brokered Private Placement and Debt Settlement

Battery X Metals Announces Closing of Non-Brokered Private Placement and Debt Settlement

-

MGO Global Announces Closing of Upsized $6.0 Million Public Offering

Italian prosecutor says Meta owes more than 887 mn euros in VAT

A Milan prosecutor on Monday said that Meta, the parent company of Facebook and Instagram, owes more than 887 million euros in value added taxes on estimated revenue it generated in Italy between 2015 and 2021.

Signing up for Facebook and Instagram is theoretically free, but users must accept access to their usage data and personal information, which the prosecutor described as a "synallagmatic contract" in which each side has obligations towards the other.

In Meta's case, these transactions have "commercial purposes" that justify taxation, even if no actual money changes hands, Milan prosecutor Marcello Viola said in a statement.

The prosecutor said that he suspected the "legal representatives" of Meta's Ireland-based platform of failing to declare a total of four billion euros ($4.23bn) in income over the period to evade VAT.

It estimated the VAT due at 887.6 million euros. A judge now must decide whether to pursue the case.

Meta told AFP that "we strongly disagree with the idea that providing access to online platforms to users should be charged with VAT."

It said that the company has "cooperated fully with the authorities on our obligations under EU and local law and we will continue to do so. We take our tax obligations seriously and pay all tax required in each of the countries where we operate."

The prosecution noted that other Italian public authorities had also come to the conclusion that Meta's services were not free, including the competition watchdog in 2018, the administrative court of Lazio in 2020 and the Council of State in 2021.

P.Martin--AMWN